Is Cogent Biosciences (NASDAQ:COGT) In A Good Position To Invest In Growth?

Is Cogent Biosciences (NASDAQ:COGT) In A Good Position To Invest In Growth?

Just because a business does not make any money, does not mean that the stock will go down. For example, although software-as-a-service business Salesforce.com lost money for years while it grew recurring revenue, if you held shares since 2005, you'd have done very well indeed. But the harsh reality is that very many loss making companies burn through all their cash and go bankrupt.

仅仅因为一家企业没有赚钱,并不意味着股票会下跌。例如,尽管软件即服务公司Salesforce.com在增长持续营收的过程中亏损多年,但如果你从2005年开始持有股份,实际上你会做得很好。但严酷的现实是,很多亏损的公司会耗尽所有现金并破产。

So should Cogent Biosciences (NASDAQ:COGT) shareholders be worried about its cash burn? For the purposes of this article, cash burn is the annual rate at which an unprofitable company spends cash to fund its growth; its negative free cash flow. First, we'll determine its cash runway by comparing its cash burn with its cash reserves.

那么,Cogent Biosciences (纳斯达克:COGT) 的股东应该担心其现金消耗吗?在本文中,现金消耗是指一家亏损公司为资助其增长而支出的年现金流量;即其负自由现金流。首先,我们将通过将其现金消耗与现金储备进行比较来判断其现金储备情况。

When Might Cogent Biosciences Run Out Of Money?

Cogent Biosciences 何时可能会耗尽资金?

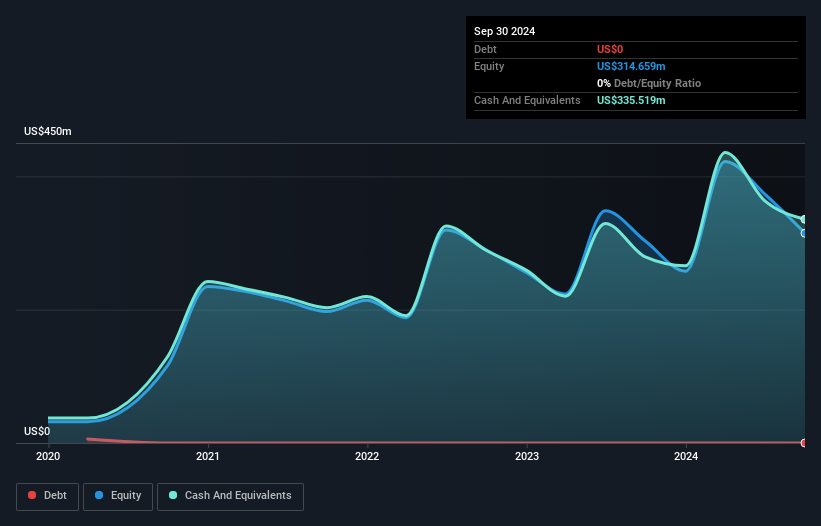

A cash runway is defined as the length of time it would take a company to run out of money if it kept spending at its current rate of cash burn. As at September 2024, Cogent Biosciences had cash of US$336m and no debt. In the last year, its cash burn was US$192m. So it had a cash runway of approximately 21 months from September 2024. While that cash runway isn't too concerning, sensible holders would be peering into the distance, and considering what happens if the company runs out of cash. The image below shows how its cash balance has been changing over the last few years.

现金储备被定义为公司在保持当前现金消耗率的情况下,耗尽资金所需的时间。到2024年9月,Cogent Biosciences 拥有33600万美元的现金且没有债务。在过去一年中,其现金消耗为19200万美元。因此,它从2024年9月起大约有21个月的现金储备。虽然这个现金储备并不太令人担忧,但明智的持有者应该审慎考虑,如果公司耗尽现金会发生什么。下图显示了过去几年中其现金余额的变化情况。

How Is Cogent Biosciences' Cash Burn Changing Over Time?

Cogent Biosciences 的现金消耗随时间变化的情况如何?

Because Cogent Biosciences isn't currently generating revenue, we consider it an early-stage business. So while we can't look to sales to understand growth, we can look at how the cash burn is changing to understand how expenditure is trending over time. Over the last year its cash burn actually increased by 34%, which suggests that management are increasing investment in future growth, but not too quickly. However, the company's true cash runway will therefore be shorter than suggested above, if spending continues to increase. While the past is always worth studying, it is the future that matters most of all. So you might want to take a peek at how much the company is expected to grow in the next few years.

由于 Cogent Biosciences 目前未产生营业收入,我们将其视为一家早期阶段的业务。因此,虽然我们不能通过销售来了解增长情况,但我们可以观察现金消耗的变化,以了解支出随时间的趋势。在过去一年中,其现金消耗实际上增加了34%,这表明管理层正在增加对未来增长的投资,但并没有过快。然而,如果支出持续增加,该公司的实际现金储备将比上述所述的要短。因此,尽管过去值得研究,未来才是最重要的。所以你可能想看看该公司预计在未来几年内的增长情况。

How Hard Would It Be For Cogent Biosciences To Raise More Cash For Growth?

Cogent Biosciences要筹集更多资金以支持增长有多难?

While Cogent Biosciences does have a solid cash runway, its cash burn trajectory may have some shareholders thinking ahead to when the company may need to raise more cash. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. Commonly, a business will sell new shares in itself to raise cash and drive growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

虽然Cogent Biosciences有稳定的现金流,但其现金消耗趋势可能会让一些股东考虑公司何时需要筹集更多现金。一般来说,上市公司可以通过发行股票或增加债务来筹集新资金。通常,一家公司会出售新发行的股票以筹集现金并推动增长。通过将公司的现金消耗与其市值进行比较,我们可以洞察如果公司需要筹集足够现金来覆盖另一年的现金消耗,股东将会被稀释多少。

Cogent Biosciences has a market capitalisation of US$905m and burnt through US$192m last year, which is 21% of the company's market value. That's fairly notable cash burn, so if the company had to sell shares to cover the cost of another year's operations, shareholders would suffer some costly dilution.

Cogent Biosciences的市值为90500万美元,去年消耗了19200万美元,约占公司市值的21%。这相当显著的现金消耗,因此如果公司不得不出售股票来支付另一年的运作成本,股东将面临一定的成本稀释。

How Risky Is Cogent Biosciences' Cash Burn Situation?

Cogent Biosciences的现金消耗情况有多风险?

On this analysis of Cogent Biosciences' cash burn, we think its cash runway was reassuring, while its increasing cash burn has us a bit worried. Even though we don't think it has a problem with its cash burn, the analysis we've done in this article does suggest that shareholders should give some careful thought to the potential cost of raising more money in the future. On another note, we conducted an in-depth investigation of the company, and identified 3 warning signs for Cogent Biosciences (1 is potentially serious!) that you should be aware of before investing here.

在对Cogent Biosciences的现金消耗分析中,我们认为其现金流令人放心,而其不断增加的现金消耗让我们有些担忧。尽管我们认为它的现金消耗没有问题,但我们在本文中的分析确实表明,股东应该认真考虑未来筹集更多资金的潜在成本。此外,我们还对公司进行了深入调查,发现了Cogent Biosciences的3个警示信号(其中1个是潜在的严重问题!),在这里投资之前你应该注意这一点。

Of course Cogent Biosciences may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

当然,Cogent Biosciences可能不是最佳的买入股票。所以你可能希望查看这份提供高股本回报的公司免费合集,或者这份内部人士持股比例高的股票清单。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对本文有反馈?对内容有疑虑?请直接与我们联系。或者,发送电子邮件至 editorial-team (at) simplywallst.com。

这篇来自Simply Wall St的文章是一般性的。我们根据历史数据和分析师预测提供评论,采用无偏见的方法,我们的文章并不旨在提供财务建议。它不构成对任何股票的买入或卖出建议,也未考虑到您的目标或财务状况。我们旨在为您提供以基本数据驱动的长期分析。请注意,我们的分析可能未考虑最新的价格敏感公司公告或定性材料。Simply Wall St在提到的任何股票中均没有持仓。

Because Cogent Biosciences isn't currently generating revenue, we consider it an early-stage business. So while we can't look to sales to understand growth, we can look at how the cash burn is changing to understand how expenditure is trending over time. Over the last year its cash burn actually increased by 34%, which suggests that management are increasing investment in future growth, but not too quickly. However, the company's true cash runway will therefore be shorter than suggested above, if spending continues to increase. While the past is always worth studying, it is the future that matters most of all. So you might want to take a peek at how much the company is expected to grow in the next few years.

Because Cogent Biosciences isn't currently generating revenue, we consider it an early-stage business. So while we can't look to sales to understand growth, we can look at how the cash burn is changing to understand how expenditure is trending over time. Over the last year its cash burn actually increased by 34%, which suggests that management are increasing investment in future growth, but not too quickly. However, the company's true cash runway will therefore be shorter than suggested above, if spending continues to increase. While the past is always worth studying, it is the future that matters most of all. So you might want to take a peek at how much the company is expected to grow in the next few years.