JS Global Lifestyle (HKG:1691) Sheds HK$452m, Company Earnings and Investor Returns Have Been Trending Downwards for Past Three Years

JS Global Lifestyle (HKG:1691) Sheds HK$452m, Company Earnings and Investor Returns Have Been Trending Downwards for Past Three Years

As an investor, mistakes are inevitable. But you want to avoid the really big losses like the plague. So take a moment to sympathize with the long term shareholders of JS Global Lifestyle Company Limited (HKG:1691), who have seen the share price tank a massive 89% over a three year period. That'd be enough to cause even the strongest minds some disquiet. Shareholders have had an even rougher run lately, with the share price down 14% in the last 90 days. While a drop like that is definitely a body blow, money isn't as important as health and happiness.

作为投资者,犯错是不可避免的。但你想尽量避免像瘟疫一样的大损失。所以花点时间同情JS全球生活公司(HKG:1691)的长期股东,他们已经看到股价在三年内暴跌了89%。这足以让即使是最坚强的头脑也感到不安。 股东们最近的情况甚至更加糟糕,股价在过去90天内下跌了14%。虽然这样的下跌绝对会遭遇重创,但钱并没有健康和幸福重要。

If the past week is anything to go by, investor sentiment for JS Global Lifestyle isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

如果过去一周有什么可以表明的,投资者对JS全球生活的情绪并不乐观,所以我们来看看基本面与股价之间是否存在不匹配。

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

虽然有效市场假说仍然会被一些人教授,但已经证明市场是过度反应的动态系统,投资者并不总是理性的。考察市场情绪随时间变化的一种方法是查看公司股价与每股收益(EPS)之间的互动。

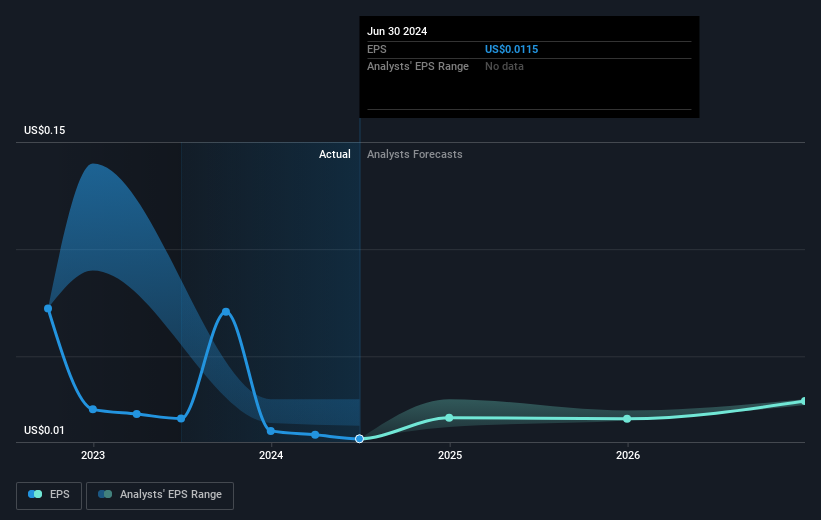

JS Global Lifestyle saw its EPS decline at a compound rate of 56% per year, over the last three years. This change in EPS is reasonably close to the 53% average annual decrease in the share price. So it seems like sentiment towards the stock hasn't changed all that much over time. In this case, it seems that the EPS is guiding the share price.

在过去三年中,JS全球生活的每股收益以复合年率下降了56%。每股收益的变化与股价平均年下降53%相当接近。因此,似乎对该股票的情绪在一段时间内并没有太大变化。在这种情况下,似乎每股收益正在引导股价。

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

您可以在下面的图像中查看每股收益随时间的变化(单击图表查看确切值)。

Dive deeper into JS Global Lifestyle's key metrics by checking this interactive graph of JS Global Lifestyle's earnings, revenue and cash flow.

通过查看JS全球生活的收益、营业收入和现金流的互动图表,深入了解其关键指标。

A Different Perspective

不同的视角

While the broader market gained around 25% in the last year, JS Global Lifestyle shareholders lost 8.9%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. However, the loss over the last year isn't as bad as the 12% per annum loss investors have suffered over the last half decade. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. It's always interesting to track share price performance over the longer term. But to understand JS Global Lifestyle better, we need to consider many other factors. Take risks, for example - JS Global Lifestyle has 2 warning signs we think you should be aware of.

虽然大盘在去年大约上涨了25%,但JS全球生活的股东损失了8.9%。然而,请记住,即使是最好的股票在十二个月内有时也会跑输大盘。然而,去年损失并不像投资者在过去五年中遭受的每年12%的损失那么糟糕。我们需要看到一些关键指标的持续改善,才能激起我们的热情。长期跟踪股价表现总是很有意思。但要更好地理解JS全球生活,我们需要考虑许多其他因素。拿风险来说,JS全球生活有两个警告信号,我们认为你应该关注。

We will like JS Global Lifestyle better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

如果我们看到一些大的内部购买,JS全球生活会更受欢迎。在我们等待的时候,查看这份免费的被低估股票名单(主要是小型股),这些股票最近有相当多的内部购买。

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

请注意,本文中引用的市场回报反映了目前在香港交易所交易的股票的市场加权平均回报。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对本文有反馈?对内容有疑虑?请直接与我们联系。或者,发送电子邮件至 editorial-team (at) simplywallst.com。

这篇来自Simply Wall St的文章是一般性的。我们根据历史数据和分析师预测提供评论,采用无偏见的方法,我们的文章并不旨在提供财务建议。它不构成对任何股票的买入或卖出建议,也未考虑到您的目标或财务状况。我们旨在为您提供以基本数据驱动的长期分析。请注意,我们的分析可能未考虑最新的价格敏感公司公告或定性材料。Simply Wall St在提到的任何股票中均没有持仓。

JS Global Lifestyle saw its EPS decline at a compound rate of 56% per year, over the last three years. This change in EPS is reasonably close to the 53% average annual decrease in the share price. So it seems like sentiment towards the stock hasn't changed all that much over time. In this case, it seems that the EPS is guiding the share price.

JS Global Lifestyle saw its EPS decline at a compound rate of 56% per year, over the last three years. This change in EPS is reasonably close to the 53% average annual decrease in the share price. So it seems like sentiment towards the stock hasn't changed all that much over time. In this case, it seems that the EPS is guiding the share price.