Markets Weekly Update (December 20) : U.S. Economy Expands by 3.1% in Q3 2024, Surpassing Previous Estimates

Markets Weekly Update (December 20) : U.S. Economy Expands by 3.1% in Q3 2024, Surpassing Previous Estimates

Welcome to the Markets Weekly Update, the column committed to delivering essential investing insights for the week and key events that could move markets in the week ahead.

欢迎来到市场每周更新,本栏目致力于提供本周的重要投资见解以及可能在未来一周影响市场的关键事件。

Macro Matters

宏观问题

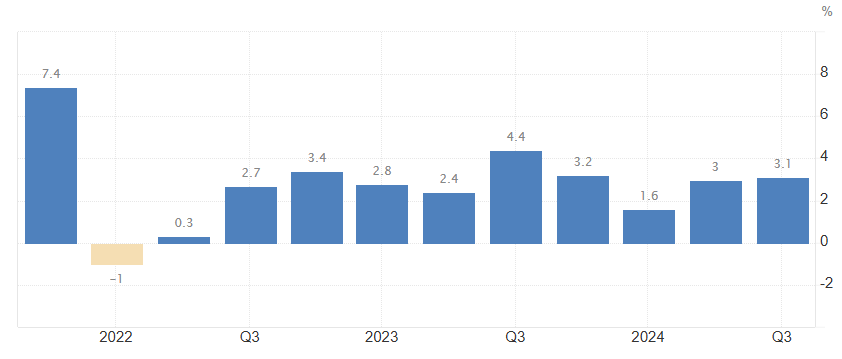

U.S. Economy Expands by 3.1% in Q3 2024, Surpassing Previous Estimates

美国经济在2024年第三季度增长了3.1%,超过了之前的预期

The US economy expanded an annualized 3.1% in the third quarter of 2024, higher than 2.8% in the second estimate and above 3% in Q2. It is the biggest growth rate so far this year. Personal spending increased at the fastest pace since Q1 2023 (3.7% vs 3.5% in the second estimate). It was boosted by a 5.6% surge in consumption of goods (vs 5.6% in the second estimate) and a robust spending on services (2.8% vs 2.6%). Also, fixed investment rose more than anticipated (2.1% vs 1.7%). Investment in equipment soared (10.8% vs 10.6%) while structures (-5% vs -4.7%) and residential investment (-4.3% vs -5%) declined. Government consumption growth was also revised higher to 5.1% (vs 5%). In addition, the contribution of net trade was less negative (-0.43 pp vs -0.57 pp in the second estimate), with both exports (9.6% vs 7.5%) and imports (10.7% vs 10.2%) revised higher. On the other hand, private inventories dragged 0.22 pp from the growth, compared to a 0.11 pp drop in the second estimate.

美国经济在2024年第三季度年化增长了3.1%,高于第二次估算的2.8%以及第二季度的3%。这是今年迄今为止最大的增长率。个人消费支出增幅达到自2023年第一季度以来的最快速度(3.7% vs 2.5%在第二次估算中)。这受到商品消费增长5.6%(与第二次估算的5.6%一致)以及对服务的强劲支出(2.8% vs 2.6%)的推动。此外,固定投资的增长超过预期(2.1% vs 1.7%)。设备投资猛增(10.8% vs 10.6%),而结构投资(-5% vs -4.7%)和住宅投资(-4.3% vs -5%)则出现下降。政府消费增长也被上调至5.1%(vs 5%)。此外,净贸易的贡献减少幅度也较小(-0.43百分比点 vs -0.57百分比点在第二次估算中),出口(9.6% vs 7.5%)和进口(10.7% vs 10.2%)均被上调。另一方面,私人库存对增长的影响减少了0.22百分比点,而第二次估算中下降0.11百分比点。

Federal Reserve Cuts Federal Funds Rate, Forecasts Slower Reductions Amid Rising Inflation Concerns

美联储下调联邦基金利率,预计在通货膨胀担忧加剧的情况下将放慢降息步伐

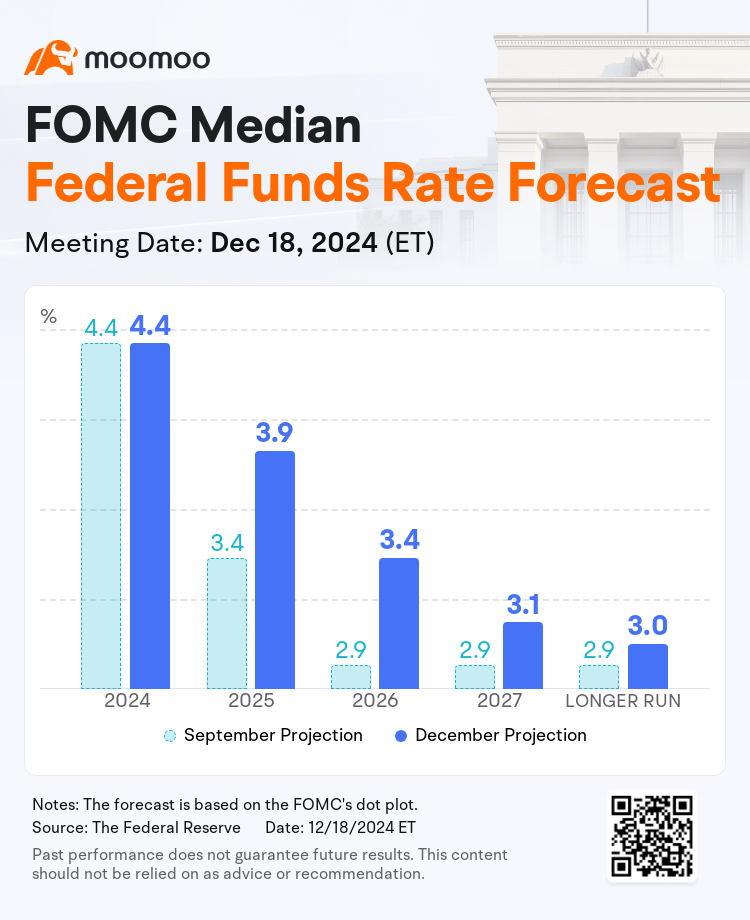

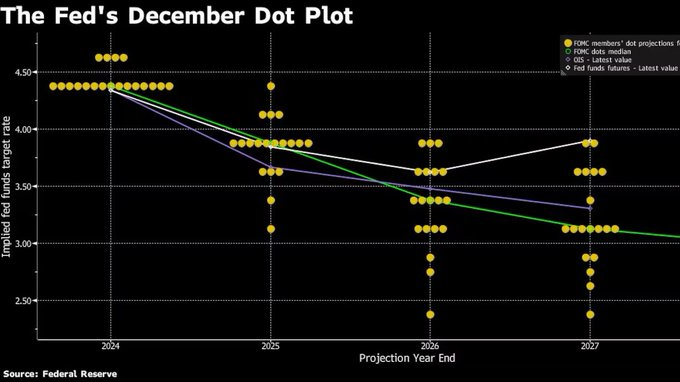

The Federal Open Market Committee lowered the target federal funds rate by 25 basis points and forecast a slower pace of reductions next year as policymakers raised their inflation outlook.

联邦公开市场委员会将目标联邦基金利率下调25个基点,并预计明年降息步伐将放缓,因为政策制定者上调了通货膨胀前景。

The target rate was lowered to a range of 4.25%-4.5% Wednesday, the Federal Reserve said in a statement Wednesday at the end of policymakers' two-day meeting. While the previous decision to lower rates was unanimous, this time around, Federal Reserve Bank of Cleveland Beth M. Hammack voted against the move, preferring instead to hold the benchmark borrowing cost steady at 4.5% to 4.75%.

美联储在周三的声明中表示,目标利率下调至4.25%-4.5%的区间,这是在政策制定者为期两天的会议结束时宣布的。虽然上一次降息的决定是全体一致的,但这次克利夫兰联邦储备银行的贝丝·哈马克投票反对这一举措,宁愿将基准借贷成本维持在4.5%至4.75%之间。

Japan Experiences Sharp Inflation Increase in November 2024, Reaching Highest Rate Since Last Year

日本在2024年11月经历了急剧的通胀增长,达到去年以来的最高水平

The annual inflation rate in Japan climbed to 2.9% in November 2024 from 2.3% in the prior month, marking the highest reading since October 2023. Food prices rose at the steepest pace in eight months (4.8% vs 3.5% in October), with fresh vegetables and fresh food contributing the most to the upturn. Meantime, electricity prices (9.9% vs 4.0%) and gas prices (5.6% vs 3.5%) sharply accelerated with the absence of energy subsidies since May. Additional upward pressure also came from housing (0.9% vs 0.8%), clothing (2.9% vs 2.8%), transport (0.9% vs 0.5%), furniture and household utensils (3.7% vs 4.4%), healthcare (1.6% vs 1.7%), recreation (4.5% vs 4.3%), and miscellaneous items (1.1% vs 1.1%). In contrast, prices fell further for communication (-3.0% vs -3.5%) and education (-1.0% vs -1.0%). The core inflation rate rose to a 3-month high of 2.7% in November, up from 2.3% in October and surpassing estimates of 2.6%. Monthly, the CPI increased by 0.6%, the highest figure in 13 months.

日本的年通胀率在2024年11月上升至2.9%,相比上个月的2.3%有所增加,这是自2023年10月以来的最高水平。食品价格以八个月以来最快的速度上涨(4.8% vs 10月的3.5%),新鲜蔬菜和新鲜食品是上涨的主要贡献者。同时,电力价格(9.9% vs 4.0%)和燃气价格(5.6% vs 3.5%)在5月取消能源补贴后急剧上升。住房(0.9% vs 0.8%)、品牌服饰(2.9% vs 2.8%)、交通(0.9% vs 0.5%)、家具(3.7% vs 4.4%)和家庭用品、医疗保健(1.6% vs 1.7%)、休闲(4.5% vs 4.3%)及其他商品(1.1% vs 1.1%)等也带来了额外的上涨压力。相反,通信(-3.0% vs -3.5%)和教育(-1.0% vs -1.0%)的价格进一步下降。核心通胀率在11月份上升至3个月以来的最高点2.7%,高于10月份的2.3%并超过了2.6%的预期。每月,CPI增长了0.6%,为13个月以来的最高水平。

Smart Money Flow

智能资金流动

Federal Reserve officials expect only two quarter point rate reductions for 2025.

联邦储备官员预计2025年仅会有两个四分之一的基点降息。

The long run neutral rate is raised to 3%.

长期的中立利率提高至3%。

Gold Prices Dip Amid Hawkish Federal Reserve Outlook and Challenges in Future Demand

在鹰派的联邦储备前景和未来需求挑战的影响下,黄金价格下跌。

Gold hovered around $2,600 per ounce on Friday, poised for a weekly decline under the influence of a hawkish Federal Reserve. The Fed indicated only two potential rate cuts next year, reflecting a cautious approach to monetary easing. Strong US GDP data and increased consumer spending further supported a slower easing pace. This environment has dampened gold demand, as reduced monetary easing lessens the appeal of non-yielding assets like bullion. Moreover, gold's near-term outlook faces added pressure from declining physical demand in India, where a significant drop in December gold imports is expected.

在鹰派的联邦储备影响下,黄金价格在周五徘徊在每盎司2600美元左右,面临每周的下降。美联储预计明年仅会有两次可能的降息,反映出对货币宽松的谨慎态度。强劲的美国GDP数据显示和消费者支出的增加进一步支持了更慢的宽松步伐。这种环境抑制了黄金需求,因为减少的货币宽松降低了像金条这样的无收益资产的吸引力。此外,由于预计印度12月份黄金进口大幅下降,黄金的短期前景面临来自实物需求减少的额外压力。

Bitcoin Eyes $200,000 Milestone by 2025 Amidst Robust Growth and Favorable Market Conditions

比特币在强劲的增长和有利的市场环境下,瞄准2025年20万美元的里程碑。

Bitcoin has seen a historic rally in 2024, with its price soaring over 150% and breaking the $100,000 mark. Supported by significant events such as the approval of Bitcoin spot ETFs, rate-cut cycles, and favorable regulatory changes, Bitcoin is now being targeted for a $200,000 valuation by 2025. Amidst this bullish backdrop, the cryptocurrency market anticipates further gains, potentially capping the year with a 'Santa Rally'.

比特币在2024年经历了历史性的反弹,价格飙升超过150%,突破了10万美元大关。在比特币现货ETF获得批准、降息周期及有利的监管变化等重大事件的支持下,比特币现在的目标是到2025年达到20万美元的估值。在这个看好的背景下,数字货币市场预计将继续上涨,有可能以“圣诞反弹”结束这一年。

Top Corporate News

头条公司新闻

Micron Falls Most in Four Years on Sluggish Sales Outlook

美光科技因销售前景疲软大幅下跌,达到四年来的最大跌幅

Shares of Micron Technology experienced their largest drop in over four years following the release of disappointing Q1 FY2025 earnings on Wednesday. Both the company’s revenue and EPS guidance for the next quarter fell significantly short of expectations, leading to a decline in share price. The weak outlook can be attributed to three main factors: a slowdown in demand for data center SSDs, slower-than-expected inventory absorption in consumer markets like PCs and smartphones, and an industry-wide oversupply of NAND memory. On a positive note, Micron made significant strides in improving its inventory levels, and its adjusted operating income surpassed Wall Street's forecasts.

美光科技在周三发布了令人失望的2025财年第一季度财报后,其股价经历了四年多以来的最大跌幅。该公司的营业收入和每股收益指引都大幅低于预期,导致股价下挫。疲软的前景主要归因于三个因素:数据中心SSD需求放缓、消费市场如个人电脑和智能手机的库存消化低于预期,以及整个行业的NAND闪存供应过剩。好消息是,美光在改善库存水平方面取得了显著进展,其调整后的运营收入超过了华尔街的预期。

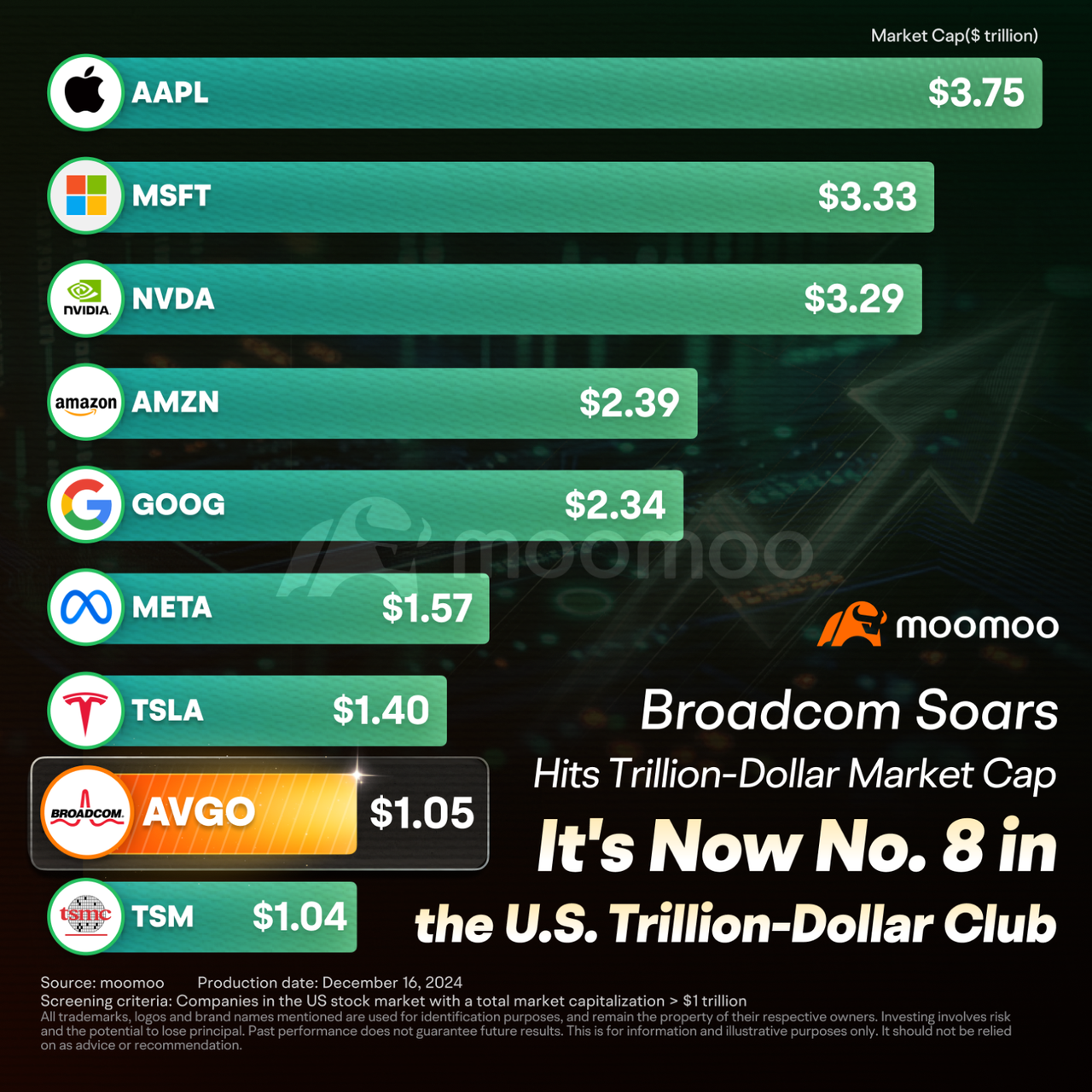

Broadcom Hits $1 Trillion Market Cap, Ranks 8th Globally

博通市值达到1万亿,全球排名第八

On December 13th, Broadcom's stock price surged by over 24%, closing at $224.8 per share. The company's market capitalization surpassed the $1 trillion mark for the first time, making it the 12th company globally and the 9th in the United States to achieve a market value of $1 trillion. It also became the third semiconductor company to break the $1 trillion market cap barrier, following NVIDIA and TSMC.

在12月13日,博通的股价上涨超过24%,收于每股224.8美元。该公司的市值首次突破1万亿美元大关,成为全球第12家、美国第9家公司实现市值1万亿美元。它也是继英伟达和台积电之后,第三家突破1万亿美元市值的半导体公司。

Broadcom's ASIC leadership positions it well for future AI competition. The company is developing custom AI chips with three major clients (Google, Meta, ByteDance) and working on next-gen AIXPUs with two others. It aims to convert these into revenue-generating customers by 2027, expanding its market.

博通在ASIC领域的领导地位使其在未来的人工智能竞争中具备优势。该公司正在与三大客户(谷歌、Meta、字节跳动)开发定制的人工智能芯片,并与另外两家客户合作研发下一代AIXPU。它的目标是在2027年前将这些客户转化为产生收入的客户,从而扩大市场。

Disclaimer: This presentation is for informational and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors’ financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information having regard to your relevant personal circumstances before making any investment decisions. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal.

免责声明:本演示材料仅供信息和教育用途,并不构成对任何特定投资或投资策略的推荐或认可。本内容提供的投资信息具有一般性,仅供参考,可能不适用于所有投资者。信息提供时未考虑个人投资者的财务能力、财务状况、投资目标、投资时间框架或风险承受能力。在做出任何投资决定之前,您应考虑根据自己相关的个人情况,该信息的适当性。过去的投资表现并不表明或保证未来的成功。收益会有所不同,所有投资都存在风险,包括本金损失。

Moomoo is a financial information and trading app offered by Moomoo Technologies Inc. In the U.S., investment products and services on Moomoo are offered by Moomoo Financial Inc., Member FINRA/SIPC.

moomoo是由moomoo科技公司提供的金融信息和交易应用。在美国,moomoo提供的投资产品和服务由moomoo金融公司提供,成员为FINRA/SIPC。