2024's Financial Frenzy: Did You Capitalize on Key Market Trends?

2024's Financial Frenzy: Did You Capitalize on Key Market Trends?

As 2024 draws to a close, the year has been marked by a succession of pivotal global events. Financial markets saw significant volatility, with various asset classes posting notable performances.

随着2024年即将结束,这一年被一系列重要的全球事件所标志。金融市场经历了显著的波动,各类资产的表现都相当突出。

The U.S. stock market, in its second bullish year, repeatedly shattered records. Nvidia claimed the crown, tech giants reigned supreme, and AI continued to fuel the market's ascent. Globally, interest rates took a downturn amidst ongoing geopolitical tensions, propelling gold to unprecedented heights. Meanwhile, the U.S. election ushered in the Trump 2.0 era, setting the stage for America's transformation into a crypto hub. Against this backdrop, Bitcoin surged past the pivotal $100,000 mark.

美国股市在连续第二年看好中屡创新高。英伟达夺得桂冠,科技巨头们统治市场,而人工智能继续推动市场的上涨。在全球范围内,利率因持续的地缘政治紧张局势而下滑,使黄金价格达到了前所未有的高点。与此同时,美国大选迎来了特朗普2.0时代,为美国转型为加密中心奠定了基础。在此背景下,比特币冲破了关键的100,000美元大关。

Join us as we revisit the unforgettable moments that defined this extraordinary year in finance!

加入我们,一起回顾那些定义金融界这一非凡一年难忘时刻!

1) Trump and Musk Triumph

1)特朗普和马斯克的胜利

The U.S. presidential election was the year's most impactful financial event. Trump won the election and swept Congress, becoming the first non-consecutive two-term president since 1892.

美国总统选举是今年最具影响力的金融事件。特朗普赢得了选举,并席卷国会,成为自1892年以来首位非连续两届总统。

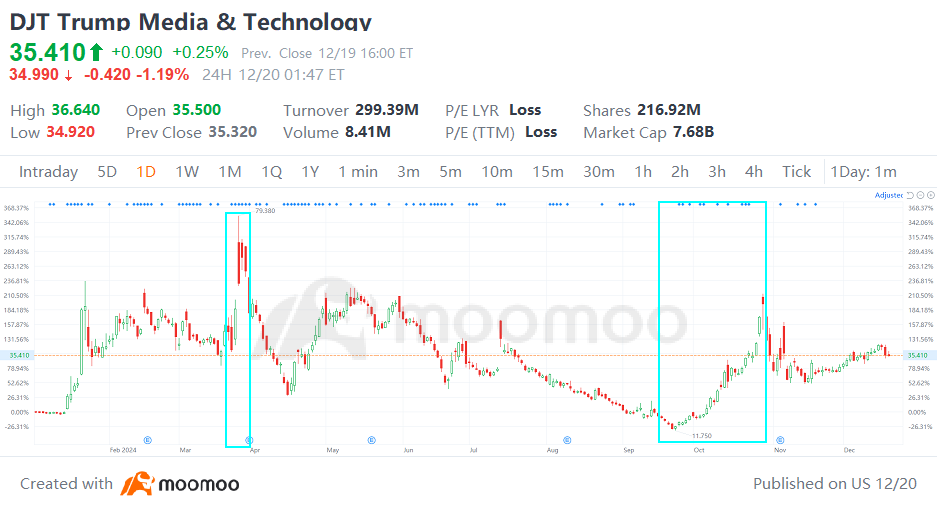

Shares of $Trump Media & Technology (DJT.US)$ have experienced significant volatility amid election developments. In March, after Donald Trump secured the Republican nomination, the DJT index surged over 50%. In July, following an attempted shooting at a weekend campaign rally, speculation of a Trump victory drove a more than 30% single-day surge when markets opened on Monday. As election day approached in October, Trump's betting odds surpassed those of Kamala Harris, pushing DJT up nearly 120% for the month.

股价经历了较大的波动,特别是在选举进展中。$特朗普媒体科技集团 (DJT.US)$ 在3月,唐纳德·特朗普获得共和党提名后,DJt指数暴涨超过50%。在7月,因周末竞选集会的枪击事件,市场对特朗普胜利的猜测在周一开盘时推动了超过30%的单日飙升。随着10月选举日的临近,特朗普的下注赔率超过了卡马拉·哈里斯,使DJt在这一个月内上涨了近120%。

Elon Musk, Tesla's founder and the world’s richest person, emerged as another winner in the election. Following the shooting incident, Musk backed Trump, donating over $250 million to his campaign. Trump praised Musk as a "super genius" and appointed him to head the "Department of Government Efficiency." Besides, Trump's initiatives to scrap electric vehicle incentives and strengthen autonomous driving policies are anticipated to favor $Tesla (TSLA.US)$, a frontrunner in full self-driving technology. Since the Nov. 5 election, Tesla shares have soared over 75%, hitting a peak of $488. During this period, Elon Musk's net worth has jumped by nearly $200 billion.

埃隆·马斯克,特斯拉的创始人以及全球首富,在选举中再次获胜。在枪击事件后,马斯克支持特朗普,为他的竞选捐款超过25000万。特朗普称赞马斯克为“超级天才”,并任命他负责“政府效率部”。此外,特朗普提议取消电动车激励措施并加强自动驾驶政策,这些都可能对领先的全自动驾驶技术有利。$特斯拉 (TSLA.US)$自11月5日的选举以来,特斯拉的股价飙升超过75%,达到488美元的高峰。在此期间,埃隆·马斯克的净资产增加了近2000亿。

2) Bitcoin's Soaring Rise

2)比特币的飙升

$Bitcoin (BTC.CC)$ has surged close to 130% since the start of 2024, surpassing silver and Saudi Aramco to become the world's seventh-largest asset, with its market cap briefly exceeding $2 trillion.

$比特币 (BTC.CC)$ 自2024年初以来,比特币的价格已经上涨了近130%,超越白银和沙特阿美,成为全球第七大资产,其市值一度超过2万亿。

The year 2024 is pivotal for Bitcoin, catalyzing a sustained bull market. In January, Bitcoin spot ETFs were approved. April brought the halving event, while September initiated an interest rate cut cycle. November saw Donald Trump winning the U.S. election and the introduction of Bitcoin spot ETF options. In December, Trump appointed crypto advocate Paul Atkins as SEC chair, propelling Bitcoin from $70,000 to over $100,000.

2024年对比特币来说至关重要,催化了持续的看涨市场。1月,比特币现货ETF获得批准。4月迎来了减半事件,而9月则开启了利率下调周期。11月,特朗普赢得美国总统选举,并引入比特币现货ETF期权。12月,特朗普任命加密货币倡导者保罗·阿特金斯为美国证监会主席,推动比特币从70,000美元上涨至超过100,000美元。

Increased investment opportunities, enhanced market liquidity, and a supportive regulatory environment have attracted substantial capital to Bitcoin. Within ten months of its debut, the Bitcoin ETF's assets surpassed $100 billion, reaching 82% of the U.S. gold ETF's size. Remarks by Federal Reserve Chair Jerome Powell in December, likening Bitcoin to digital gold, pushed the Bitcoin-to-gold ratio to a record high.

投资机会的增加、市场流动性的提高以及支持性的监管环境吸引了大量资本涌入比特币。在比特币ETF推出的十个月内,其资产超过了1000亿,达到了美国黄金ETF规模的82%。美联储主席杰罗姆·鲍威尔在12月的言论,将比特币比作数字黄金,使比特币与黄金的比率达到创纪录的高点。

3) The Forces Behind "Black Monday"

3) "黑色星期一"背后的力量

Global financial markets faced a turbulent "Black Monday" on August 5, as the $S&P 500 Index (.SPX.US)$ dropped 3% and the $CBOE Volatility S&P 500 Index (.VIX.US)$ spiked 180% at one point. Japan's $Nikkei 225 (.N225.JP)$ plunged over 12%, marking its largest single-day decline ever, while South Korea's $Korea Composite Index (.KOSPI.KR)$ Index fell more than 8%, triggering a trading halt.

全球金融市场在8月5日经历了动荡的 "黑色星期一",因为$标普500指数 (.SPX.US)$ 下跌了3%,而$标普500波动率指数 (.VIX.US)$ 一度暴涨180%。日本的$日经225 (.N225.JP)$ 暴跌超过12%,创下了有史以来最大的单日跌幅,而韩国的$韩国综合指数 (.KOSPI.KR)$ 指数下跌超过8%万亿,触发交易暂停。

The unwinding of yen carry trades fueled the market selloff, driven by hawkish signals from the Bank of Japan and mounting US recession fears. On July 31, Japan unexpectedly raised interest rates by 15 basis points, the first hike in 30 years, exceeding market expectations and causing a sharp yen appreciation. US non-farm payroll data for July, released on August 2, missed forecasts, heightening recession concerns and sending US Treasury yields down. Traders had exploited cheap yen loans to invest in higher-yield markets for carry trade gains. However, with the yen strengthening, US stocks declining, and Treasury yields falling, carry trade profits were squeezed, prompting a reversal.

日元套利交易的平仓加剧了市场的抛售,原因是日本银行释放出鹰派信号以及美国的衰退忧虑加剧。7月31日,日本意外地将利率提高了15个基点,这是30年来的首次加息,超出市场预期,导致日元急剧升值。8月2日发布的美国7月非农就业数据未达预期,加剧了衰退担忧,导致美国国债收益率下降。交易者曾利用便宜的日元贷款投资于更高收益的市场以获取套利交易收益。然而,随着日元升值,美国股票下跌以及国债收益率下降,套利交易利润受到挤压,促使了反转。

4) Nvidia's Ascendancy

4) 英伟达的崛起

$NVIDIA (NVDA.US)$ has cemented its lead in the AI industry, achieving over two years of rapid expansion and consistently exceeding Wall Street forecasts. The company’s stock has surged more than 160% so far this year.

$英伟达 (NVDA.US)$ 已巩固其在人工智能行业的领先地位,经历了超过两年的快速扩张,并持续超越华尔街的预期。该公司的股票在今年迄今已经上涨超过160%。

Nvidia’s ascent has been meteoric, swiftly claiming the crown as the king of the stock market. On February 22, the company unveiled its fiscal 2024 full-year results, highlighting explosive growth in its data center division. Revenue jumped 126% year-over-year, while net profit soared 581% from the prior year. The stock climbed more than 16% that day, adding $277 billion to its market value—a record single-day gain in U.S. stock market history. By the next day, Nvidia's market capitalization surpassed $2 trillion.

英伟达的崛起如日中天,迅速夺得了股票市场的王者地位。2月22日,该公司公布了2024财政年度的全年业绩,突显其数据中心部门的爆炸性增长。营业收入同比增长126%,而净利润则同比飙升581%。当天股票上涨超过16%,市场价值增加了2770亿——创下美国股市历史上单日最大涨幅。到第二天,英伟达的市值超过了2万亿。

On April 19, despite a 10% drop on "Black Friday," the company set the stage for further growth. The leap from $1 trillion to $2 trillion took just nine months, and within 103 days, by June 5, Nvidia surpassed the $3 trillion mark. By June 18, Nvidia had overtaken Microsoft and Apple to become the world’s largest publicly traded company, with a market cap of $3.33 trillion.

4月19日,尽管在“黑色星期五”上跌幅达10%,该公司仍为进一步增长奠定了基础。从1万亿到2万亿仅用了九个月,而在103天内,到6月5日,英伟达超越了3万亿大关。到6月18日,英伟达超越微软和苹果,成为全球市值最大的上市公司,市值达到3.33万亿。

5) Policy-Driven Rally in US-listed Chinese Stocks

5) 政策驱动的美国上市中国股票反弹

Ahead of China's National Day, Beijing unveiled significant economic stimulus measures, sparking a robust rebound in Chinese assets worldwide. Over ten trading sessions, the Nasdaq Golden Dragon China Index surged more than 38%, while the $Hang Seng TECH Index (800700.HK)$ soared over 40%. Among US-listed Chinese stocks, $KE Holdings (BEKE.US)$ and $Bilibili (BILI.US)$ jumped more than 70%, with $JD.com (JD.US)$, $PDD Holdings (PDD.US)$, and $Kanzhun (BZ.US)$ each rising over 50%. $TAL Education (TAL.US)$ and $Trip.com (TCOM.US)$ advanced more than 40%.

在中国国庆节前夕,北京公布了重大经济刺激措施,全球中国资产出现强劲反弹。在十多个交易日内,纳斯达克黄金龙中国指数上涨超过38%,而$恒生科技指数 (800700.HK)$ 上涨超过40%。在美国上市的中国股票中,$贝壳 (BEKE.US)$ 和$哔哩哔哩 (BILI.US)$ 涨幅超过70%,其中$京东 (JD.US)$, $拼多多 (PDD.US)$,以及 $BOSS直聘 (BZ.US)$ 每个都上涨超过50%。 $好未来 (TAL.US)$ 和$携程网 (TCOM.US)$ 上涨超过40%。

On Sept. 24, the People’s Bank of China initiated comprehensive monetary stimulus and real estate support, including interest rate cuts and reduced reserve requirements. Two days later, the Politburo unveiled fiscal spending plans to boost consumption, manage local government debt, and stabilize the property market. These actions, along with expected additional measures, have bolstered market expectations for economic expansion.

在9月24日,中国人民银行发起了全面货币刺激和房地产支持措施,包括降息和降低准备金要求。两天后,政治局公布了财政支出计划,以促进消费,管理地方政府债务,并稳定房地产市场。这些举措连同预期的其他措施,提高了市场对经济扩张的预期。

By Dec. 9, a Politburo meeting laid the groundwork for more proactive fiscal policies by 2025, marking the first mention since 2010 of a "moderately loose monetary policy." There was also an unusual focus on stabilizing the property and stock markets. Following this announcement, the $NASDAQ Golden Dragon China (.HXC.US)$ Index closed up 8.5%, marking its best single-day gain since late September.

到12月9日,政治局会议为到2025年更加积极的财政政策奠定了基础,这标志着自2010年以来首次提到"适度宽松的货币政策"。对此还异常关注于稳定房地产和股票市场。在这一公告后,$纳斯达克中国金龙指数 (.HXC.US)$ 指数上涨8.5%,创下自九月底以来最佳单日涨幅。

Source: Bloomberg, Yahoo Finance, Reuters, abc News

来源:彭博社、Yahoo财经、路透社、abc新闻

by moomoo News Olivia

由moomoo资讯Olivia提供