Smart Money Is Betting Big In DIS Options

Smart Money Is Betting Big In DIS Options

Financial giants have made a conspicuous bullish move on Walt Disney. Our analysis of options history for Walt Disney (NYSE:DIS) revealed 10 unusual trades.

金融巨头们对华特迪士尼采取了显著的看好举动。我们对华特迪士尼(纽交所:DIS)期权历史的分析显示出10笔期权异动。

Delving into the details, we found 50% of traders were bullish, while 20% showed bearish tendencies. Out of all the trades we spotted, 4 were puts, with a value of $162,899, and 6 were calls, valued at $492,203.

深入细节后,我们发现50%的交易者看好,而20%则表现出看淡的倾向。在我们发现的所有交易中,有4笔是看跌期权,价值162,899美元,6笔是看涨期权,价值492,203美元。

Predicted Price Range

预测价格区间

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $55.0 to $140.0 for Walt Disney over the last 3 months.

考虑到这些合约的成交量和未平仓合约,似乎鲸鱼们在过去三个月内一直在针对华特迪士尼的价格区间为55.0美元至140.0美元。

Volume & Open Interest Trends

成交量和未平仓量趋势

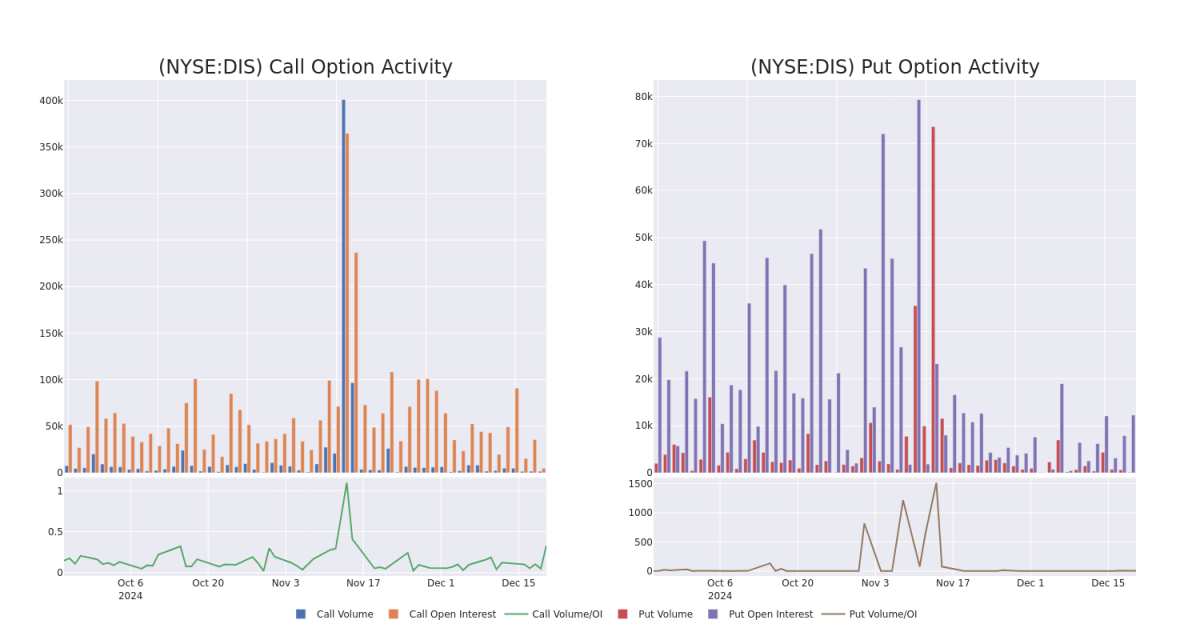

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Walt Disney's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Walt Disney's significant trades, within a strike price range of $55.0 to $140.0, over the past month.

分析成交量和未平仓合约提供了股票研究的关键洞察。这些信息对于评估华特迪士尼在某些履约价格的流动性和兴趣水平至关重要。以下,我们展示了过去一个月中,华特迪士尼重大交易中看涨期权和看跌期权的成交量和未平仓合约趋势快照,履约价格范围为55.0美元至140.0美元。

Walt Disney Option Volume And Open Interest Over Last 30 Days

迪士尼期权的成交量和持仓量过去30天的情况

Biggest Options Spotted:

最大的期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DIS | CALL | SWEEP | BULLISH | 06/20/25 | $10.8 | $10.5 | $10.85 | $110.00 | $216.9K | 4.2K | 218 |

| DIS | CALL | SWEEP | BULLISH | 06/20/25 | $10.9 | $10.55 | $10.82 | $110.00 | $108.1K | 4.2K | 838 |

| DIS | CALL | SWEEP | NEUTRAL | 12/20/24 | $57.25 | $54.6 | $55.78 | $55.00 | $55.8K | 10 | 10 |

| DIS | PUT | TRADE | BULLISH | 01/17/25 | $5.75 | $5.1 | $5.3 | $115.00 | $53.0K | 5.7K | 100 |

| DIS | CALL | SWEEP | BEARISH | 01/10/25 | $2.0 | $1.93 | $1.93 | $113.00 | $52.3K | 98 | 546 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 行权价 | 总交易价格 | 未平仓合约 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 迪士尼 | 看涨 | 扫单 | 看好 | 06/20/25 | $10.8 | $10.5 | $10.85 | $110.00 | $216.9K | 4.2K | 218 |

| 迪士尼 | 看涨 | 扫单 | 看好 | 06/20/25 | $10.9 | $10.55 | $10.82 | $110.00 | $108.1K | 4.2K | 838 |

| 迪士尼 | 看涨 | 扫单 | 中立 | 12/20/24 | $57.25 | $54.6 | $55.78 | $55.00 | 55800美元 | 10 | 10 |

| 迪士尼 | 看跌 | 交易 | 看好 | 01/17/25 | $5.75 | $5.1 | $5.3 | $115.00 | 53000美元 | 5.7K | 100 |

| 迪士尼 | 看涨 | 扫单 | 看淡 | 01/10/25 | $2.0 | $1.93 | $1.93 | $113.00 | $52.3K | 98 | 546 |

About Walt Disney

关于迪士尼

Disney operates in three global business segments: entertainment, sports, and experiences. Entertainment and experiences both benefit from the firm's ownership of iconic franchises and characters. Entertainment includes the ABC broadcast network, several cable television networks, and the Disney+ and Hulu streaming services. Within the segment, Disney also engages in movie and television production and distribution, with content licensed to movie theaters, other content providers, or, increasingly, kept in-house for use on Disney's own streaming platform and television networks. The sports segment houses ESPN and the ESPN+ streaming service. Experiences contains Disney's theme parks and vacation destinations, and also benefits from merchandise licensing.

迪士尼在三个全球业务板块中运营:娱乐、体育和体验。娱乐和体验都受益于公司对标志性特许经营和角色的拥有。娱乐包括ABC广播网络、多个有线电视网络,以及Disney+和Hulu流媒体概念。在该板块内,迪士尼还从事电影和电视的制作和发行,将内容授权给电影院、其他内容提供商,或越来越多地保持在内部,用于迪士尼自己的流媒体平台和电视网络。体育板块包含ESPN和ESPN+流媒体概念。体验包含迪士尼的主题公园和度假目的地,并且也受益于商品授权。

After a thorough review of the options trading surrounding Walt Disney, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

在对迪士尼相关的期权交易进行了全面审查后,我们开始更详细地研究该公司。这包括对其当前市场状态和表现的评估。

Present Market Standing of Walt Disney

迪士尼目前市场地位

- With a trading volume of 2,968,688, the price of DIS is up by 0.01%, reaching $111.38.

- Current RSI values indicate that the stock is may be approaching oversold.

- Next earnings report is scheduled for 47 days from now.

- DIS的成交量为2,968,688,价格上涨了0.01%,达到$111.38。

- 当前RSI值显示该股票可能接近超卖状态。

- 下一次财报预计在47天后公布。

What The Experts Say On Walt Disney

专家对华特迪士尼的看法

A total of 2 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $127.5.

在过去30天内,共有2位专业分析师对这只股票发表了看法,设定的平均目标价为127.5美元。

Unusual Options Activity Detected: Smart Money on the Move

检测到期权异动:聪明资金正在行动

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* An analyst from Jefferies has revised its rating downward to Hold, adjusting the price target to $120. * An analyst from Rosenblatt persists with their Buy rating on Walt Disney, maintaining a target price of $135.

Benzinga Edge的期权异动板块在潜在市场波动发生之前发现机会。查看大资金在您最喜欢的股票上采取了哪些仓位。点击这里获取访问权限。* 一位来自Jefferies的分析师已将其评级下调至持有,将目标价调整至120美元。* 一位来自Rosenblatt的分析师继续对迪士尼给予买入评级,维持目标价135美元。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Walt Disney with Benzinga Pro for real-time alerts.

交易期权涉及更高的风险,但也提供了更高利润的潜力。精明的交易者通过持续的教育、战略交易调整、利用各种因子和关注市场动态来缓解这些风险。通过Benzinga Pro实时关注迪士尼的最新期权交易提示。

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Walt Disney's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Walt Disney's significant trades, within a strike price range of $55.0 to $140.0, over the past month.

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Walt Disney's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Walt Disney's significant trades, within a strike price range of $55.0 to $140.0, over the past month.