When Will Natera, Inc. (NASDAQ:NTRA) Breakeven?

When Will Natera, Inc. (NASDAQ:NTRA) Breakeven?

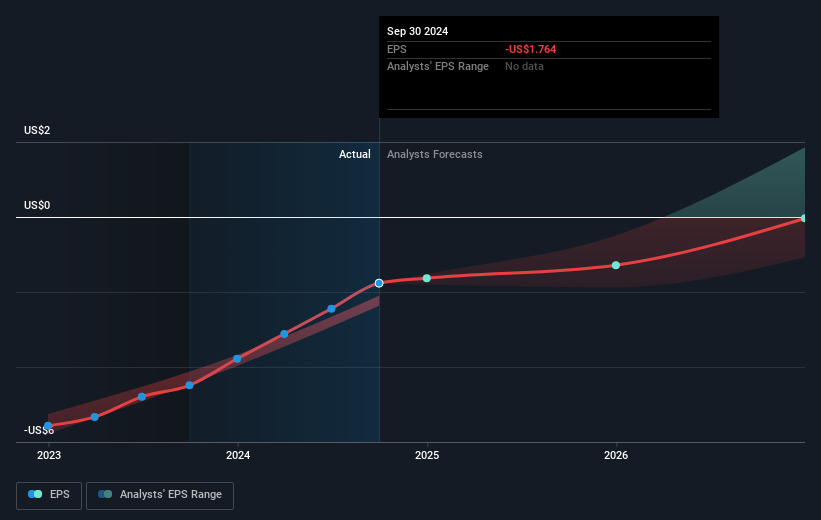

Natera, Inc. (NASDAQ:NTRA) is possibly approaching a major achievement in its business, so we would like to shine some light on the company. Natera, Inc., a diagnostics company, develops and commercializes molecular testing services worldwide. The US$21b market-cap company's loss lessened since it announced a US$435m loss in the full financial year, compared to the latest trailing-twelve-month loss of US$215m, as it approaches breakeven. Many investors are wondering about the rate at which Natera will turn a profit, with the big question being "when will the company breakeven?" In this article, we will touch on the expectations for the company's growth and when analysts expect it to become profitable.

Natera, Inc.(纳斯达克:NTRA)可能即将实现其业务的重大成就,因此我们希望对该公司进行一些介绍。Natera, Inc.是一家诊断公司,开发并在全球范围内商业化分子检测服务。该市值210亿美元的公司的亏损自宣布在完整财年中亏损43500万美元以来有所减少,而最新的过去十二个月的亏损为21500万美元,正接近盈亏平衡。许多投资者对Natera实现盈利的速度感到好奇,最大的疑问是“公司何时能够实现盈亏平衡?”在这篇文章中,我们将讨论公司增长的预期以及分析师预计它何时能实现盈利。

Consensus from 19 of the American Biotechs analysts is that Natera is on the verge of breakeven. They expect the company to post a final loss in 2025, before turning a profit of US$15m in 2026. Therefore, the company is expected to breakeven roughly 2 years from today. What rate will the company have to grow year-on-year in order to breakeven on this date? Using a line of best fit, we calculated an average annual growth rate of 70%, which is extremely buoyant. Should the business grow at a slower rate, it will become profitable at a later date than expected.

来自19位美国生物技术分析师的共识是,Natera即将实现盈亏平衡。他们预计公司将在2025年公布最终亏损,然后在2026年实现1500万美元的盈利。因此,该公司预计将在大约两年后达到盈亏平衡。公司需要每年以什么速度增长,才能在这个日期达到盈亏平衡?通过最佳拟合线,我们计算出的平均年增长率为70%,这非常乐观。如果业务以较慢的速度增长,它将比预期的更晚实现盈利。

Underlying developments driving Natera's growth isn't the focus of this broad overview, though, take into account that typically biotechs, depending on the stage of product development, have irregular periods of cash flow. This means, large upcoming growth rates are not abnormal as the company is beginning to reap the benefits of earlier investments.

驱动Natera增长的潜在发展的重点并不是这一广泛的概述,尽管需要考虑的是,通常生物技术公司根据产品开发阶段的不同,其现金流的波动期是不规律的。这意味着,由于公司开始收获早期投资的成果,大幅增长率并不罕见。

Before we wrap up, there's one issue worth mentioning. Natera currently has a relatively high level of debt. Generally, the rule of thumb is debt shouldn't exceed 40% of your equity, which in Natera's case is 42%. A higher level of debt requires more stringent capital management which increases the risk around investing in the loss-making company.

在结束之前,有一个问题值得提及。Natera目前的债务水平相对较高。一般来说,债务水平不应超过股本的40%,而在Natera的情况中为42%。更高的债务水平需要更严格的资本管理,这增加了投资于该亏损公司的风险。

Next Steps:

下一步:

There are too many aspects of Natera to cover in one brief article, but the key fundamentals for the company can all be found in one place – Natera's company page on Simply Wall St. We've also put together a list of relevant aspects you should further research:

Natera 有太多方面无法在一篇简短的文章中涵盖,但公司的关键基本面都可以在一个地方找到——Natera 在 Simply Wall St. 的公司页面。我们还整理了一份相关方面的清单,您应该进一步研究:

- Valuation: What is Natera worth today? Has the future growth potential already been factored into the price? The intrinsic value infographic in our free research report helps visualize whether Natera is currently mispriced by the market.

- Management Team: An experienced management team on the helm increases our confidence in the business – take a look at who sits on Natera's board and the CEO's background.

- Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

- 估值:Natera今天的价值是多少?未来的增长潜力已经被市场反映在价格中了吗?我们免费的研究报告中的内在价值信息图帮助可视化Natera目前是否被市场定价错误。

- 管理团队:一个经验丰富的管理团队在掌舵时增强了我们对业务的信恳智能——看看 Natera 董事会的成员和 CEO 的背景。

- 其他高表现股票:是否还有其他股票提供更好的前景和经过验证的业绩?在这里查看我们这些优秀股票的免费列表。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对本文有反馈?对内容有疑虑?请直接与我们联系。或者,发送电子邮件至 editorial-team (at) simplywallst.com。

这篇来自Simply Wall St的文章是一般性的。我们根据历史数据和分析师预测提供评论,采用无偏见的方法,我们的文章并不旨在提供财务建议。它不构成对任何股票的买入或卖出建议,也未考虑到您的目标或财务状况。我们旨在为您提供以基本数据驱动的长期分析。请注意,我们的分析可能未考虑最新的价格敏感公司公告或定性材料。Simply Wall St在提到的任何股票中均没有持仓。

Before we wrap up, there's one issue worth mentioning. Natera currently has a relatively high level of debt. Generally, the rule of thumb is debt shouldn't exceed 40% of your equity, which in Natera's case is 42%. A higher level of debt requires more stringent capital management which increases the risk around investing in the loss-making company.

Before we wrap up, there's one issue worth mentioning. Natera currently has a relatively high level of debt. Generally, the rule of thumb is debt shouldn't exceed 40% of your equity, which in Natera's case is 42%. A higher level of debt requires more stringent capital management which increases the risk around investing in the loss-making company.