Here's Why Knowles (NYSE:KN) Can Manage Its Debt Responsibly

Here's Why Knowles (NYSE:KN) Can Manage Its Debt Responsibly

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies Knowles Corporation (NYSE:KN) makes use of debt. But the more important question is: how much risk is that debt creating?

沃伦·巴菲特曾 famously 说过,‘波动性与风险并不完全相同。’ 因此,当您考虑任何给定股票的风险时,考虑债务可能是显而易见的,因为过多的债务可能会使公司陷入困境。 正如许多其他公司一样,Knowles Corporation (纽交所:KN) 也使用债务。但更重要的问题是:这些债务创造了多少风险?

What Risk Does Debt Bring?

债务带来了什么风险?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

债务可以帮助企业,直到企业在偿还债务时遇到麻烦,无论是通过新资本还是自由现金流。如果情况真的很糟糕,贷方可能会控制公司。虽然这并不常见,但我们常常看到负债公司因贷方迫使他们以折价筹集资金而永久性稀释股东权益。当然,许多公司利用债务来资助增长,而没有任何负面影响。当我们考虑一家公司的债务使用时,首先会将现金和债务放在一起考虑。

What Is Knowles's Net Debt?

Knowles的净债务是多少?

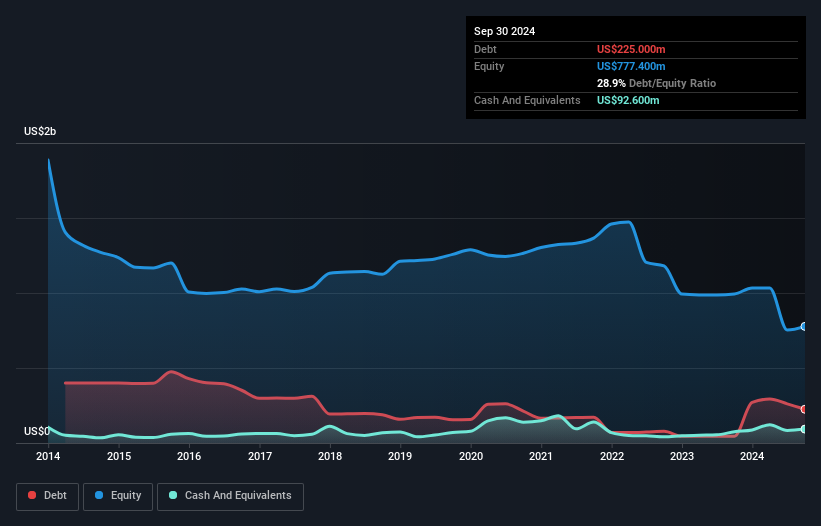

The image below, which you can click on for greater detail, shows that at September 2024 Knowles had debt of US$225.0m, up from US$45.0m in one year. However, it also had US$92.6m in cash, and so its net debt is US$132.4m.

下图(您可以点击以获取更多详细信息)显示,截至2024年9月,Knowles的债务为22500万美金,比一年前的4500万美金有所上升。然而,它还有9260万美金的现金,因此其净债务为13240万美金。

How Strong Is Knowles' Balance Sheet?

Knowles的资产负债表有多强?

Zooming in on the latest balance sheet data, we can see that Knowles had liabilities of US$185.9m due within 12 months and liabilities of US$208.0m due beyond that. On the other hand, it had cash of US$92.6m and US$105.7m worth of receivables due within a year. So its liabilities total US$195.6m more than the combination of its cash and short-term receivables.

深入看看最新的资产负债表数据,我们可以看到Knowles的负债为18590万美元,预计在12个月内到期,超过该期限的负债为20800万美元。另一方面,它有9260万美元的现金和价值10570万美元的应收账款将在一年内到期。因此,它的负债总额超过其现金和短期应收账款的总和19560万美元。

Given Knowles has a market capitalization of US$1.71b, it's hard to believe these liabilities pose much threat. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward.

考虑到Knowles的市值为17.1亿美元,很难相信这些负债会造成很大威胁。但负债确实足够多,我们一定会建议股东继续关注资产负债表。

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

我们通过看净债务与息税折旧及摊销前利润(EBITDA)的比率,以及计算其息税前利润(EBIT)如何轻松地覆盖利息费用(利息覆盖)来衡量一家公司相对于其获利能力的债务负担。这样,我们既考虑了债务的绝对量,也考虑了其支付的利率。

Looking at its net debt to EBITDA of 1.1 and interest cover of 3.8 times, it seems to us that Knowles is probably using debt in a pretty reasonable way. So we'd recommend keeping a close eye on the impact financing costs are having on the business. Unfortunately, Knowles saw its EBIT slide 3.0% in the last twelve months. If earnings continue on that decline then managing that debt will be difficult like delivering hot soup on a unicycle. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Knowles's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

查看其净债务与EBITDA的比率为1.1,利息覆盖比率为3.8倍,我们认为Knowles可能以相当合理的方式使用债务。因此,我们建议密切关注融资成本对业务的影响。不幸的是,Knowles在过去12个月中EBIT下降了3.0%。如果收益继续下降,那么管理债务将会变得如同在独轮车上端热汤一样困难。分析债务时,资产负债表显然是需要关注的重点。但未来的收益,尤其是,将决定Knowles未来维持健康资产负债表的能力。因此,如果您想了解专业人士的看法,您或许会发现这篇关于分析师利润预测的免费报告非常有趣。

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we always check how much of that EBIT is translated into free cash flow. Over the last three years, Knowles actually produced more free cash flow than EBIT. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

但我们最终的考虑也很重要,因为一家公司不能用纸面利润来还债;它需要冷硬的现金。因此,我们总是检查EBIT中有多少转化为自由现金流。在过去三年中,Knowles实际上产生的自由现金流超过了EBIT。这种强劲的现金流生成让我们感到如同看到一只穿着大黄蜂服装的小狗一样温暖。

Our View

我们的观点

The good news is that Knowles's demonstrated ability to convert EBIT to free cash flow delights us like a fluffy puppy does a toddler. But, on a more sombre note, we are a little concerned by its interest cover. Looking at all the aforementioned factors together, it strikes us that Knowles can handle its debt fairly comfortably. Of course, while this leverage can enhance returns on equity, it does bring more risk, so it's worth keeping an eye on this one. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. For instance, we've identified 1 warning sign for Knowles that you should be aware of.

好消息是Knowles表现出的将EBIT转化为自由现金流的能力让我们如同小狗让幼儿感到愉悦。但从更严肃的角度来看,我们对它的利息覆盖率有些担忧。综合考虑所有上述因素,我们认为Knowles可以相对轻松地处理其债务。当然,虽然这种杠杆可以提升股本回报,但也带来了更多风险,因此值得关注。当分析债务水平时,资产负债表显然是开始的地方。然而,并非所有投资风险都存在于资产负债表中,远非如此。例如,我们已经识别出Knowles应该注意的1个警告信号。

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对本文有反馈?对内容有疑虑?请直接与我们联系。或者,发送电子邮件至 editorial-team (at) simplywallst.com。

这篇来自Simply Wall St的文章是一般性的。我们根据历史数据和分析师预测提供评论,采用无偏见的方法,我们的文章并不旨在提供财务建议。它不构成对任何股票的买入或卖出建议,也未考虑到您的目标或财务状况。我们旨在为您提供以基本数据驱动的长期分析。请注意,我们的分析可能未考虑最新的价格敏感公司公告或定性材料。Simply Wall St在提到的任何股票中均没有持仓。

Zooming in on the latest balance sheet data, we can see that Knowles had liabilities of US$185.9m due within 12 months and liabilities of US$208.0m due beyond that. On the other hand, it had cash of US$92.6m and US$105.7m worth of receivables due within a year. So its liabilities total US$195.6m more than the combination of its cash and short-term receivables.

Zooming in on the latest balance sheet data, we can see that Knowles had liabilities of US$185.9m due within 12 months and liabilities of US$208.0m due beyond that. On the other hand, it had cash of US$92.6m and US$105.7m worth of receivables due within a year. So its liabilities total US$195.6m more than the combination of its cash and short-term receivables.