A Closer Look at Rigetti Computing's Options Market Dynamics

A Closer Look at Rigetti Computing's Options Market Dynamics

High-rolling investors have positioned themselves bearish on Rigetti Computing (NASDAQ:RGTI), and it's important for retail traders to take note.\This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in RGTI often signals that someone has privileged information.

高风险投资者对Rigetti Computing (纳斯达克:RGTI)采取了看淡的立场,零售交易者需要注意。\这一活动通过Benzinga对公开期权数据的跟踪今天引起了我们的注意。这些投资者的身份尚不确定,但RGTI如此显著的变动通常意味着有人掌握了内部信息。

Today, Benzinga's options scanner spotted 17 options trades for Rigetti Computing. This is not a typical pattern.

今天,Benzinga的期权扫描器发现了17笔Rigetti Computing的期权交易。这不是一个典型的模式。

The sentiment among these major traders is split, with 23% bullish and 70% bearish. Among all the options we identified, there was one put, amounting to $27,700, and 16 calls, totaling $1,630,393.

这些主要交易者的情绪呈现分裂,23%看好,70%看淡。在我们识别的所有期权中,有一笔看跌期权,金额为$27,700,还有16笔看涨期权,总计$1,630,393。

What's The Price Target?

价格目标是什么?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $10.0 to $20.0 for Rigetti Computing over the last 3 months.

考虑到这些合约的成交量和未平仓合约数量,鲸鱼们似乎在过去3个月内瞄准了Rigetti Computing的价格区间在$10.0到$20.0之间。

Volume & Open Interest Development

成交量和持仓量的评估是期权交易中的一个关键步骤。这些指标揭示了阿里巴巴集团(Alibaba Gr Hldgs)特定执行价格期权的流动性和投资者兴趣。下面的数据可视化了在过去30天内,阿里巴巴集团(Alibaba Gr Hldgs)在执行价格在74.0美元到120.0美元区间内的看涨看跌期权中,成交量和持仓量的波动情况。

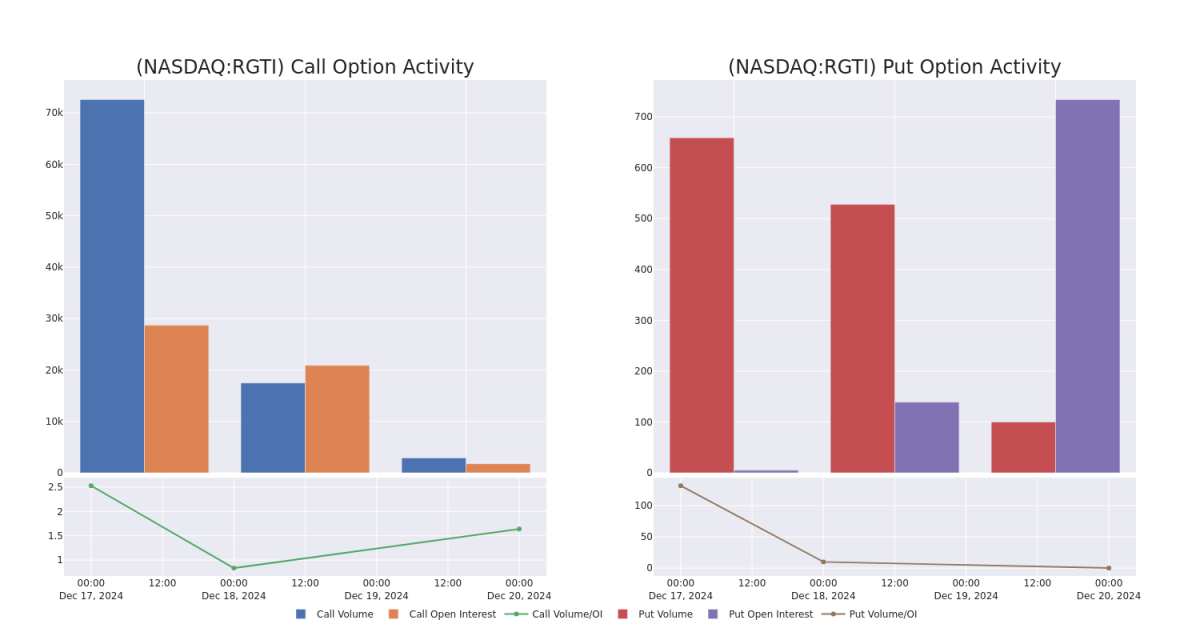

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Rigetti Computing's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Rigetti Computing's whale trades within a strike price range from $10.0 to $20.0 in the last 30 days.

观察成交量和未平仓合约数量在交易期权时是一个强有力的举措。这些数据可以帮助你跟踪Rigetti Computing在给定执行价格的期权的流动性和兴趣。以下,我们可以观察到在过去30天内,Rigetti Computing的鲸鱼交易在$10.0到$20.0的执行价格范围内的看涨和看跌期权的成交量和未平仓合约的演变。

Rigetti Computing Option Volume And Open Interest Over Last 30 Days

Rigetti Computing过去30天的期权成交量和未平仓合约

Significant Options Trades Detected:

检测到重大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| RGTI | CALL | SWEEP | BEARISH | 01/31/25 | $3.4 | $2.4 | $2.35 | $12.50 | $540.5K | 416 | 2.3K |

| RGTI | CALL | TRADE | NEUTRAL | 05/16/25 | $4.1 | $3.9 | $4.0 | $16.00 | $288.4K | 93 | 2.0K |

| RGTI | CALL | SWEEP | BEARISH | 01/17/25 | $2.1 | $2.0 | $2.0 | $13.00 | $120.0K | 4.9K | 859 |

| RGTI | CALL | SWEEP | BEARISH | 01/17/25 | $3.3 | $3.2 | $3.2 | $10.00 | $120.0K | 7.6K | 1.3K |

| RGTI | CALL | TRADE | BEARISH | 01/17/25 | $6.7 | $1.7 | $3.7 | $10.00 | $90.6K | 7.6K | 245 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 行权价 | 总交易价格 | 未平仓合约 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| RGTI | 看涨 | 扫单 | 看淡 | 01/31/25 | $3.4 | $2.4 | $2.35 | $12.50 | 54.05万美元 | 416 | 2.3K |

| RGTI | 看涨 | 交易 | 中立 | 05/16/25 | $4.1 | $3.9 | $4.0 | $16.00 | $288.4K | 93 | 2.0K |

| RGTI | 看涨 | 扫单 | 看淡 | 01/17/25 | $2.1 | $2.0 | $2.0 | $13.00 | 12万美金 | 4.9K | 859 |

| RGTI | 看涨 | 扫单 | 看淡 | 01/17/25 | $3.3 | $3.2 | $3.2 | $10.00 | 12万美金 | 7.6K | 1.3K |

| RGTI | 看涨 | 交易 | 看淡 | 01/17/25 | $6.7 | $1.7 | $3.7 | $10.00 | $90.6K | 7.6K | 245 |

About Rigetti Computing

关于Rigetti计算公司

Rigetti Computing Inc is engaged in the business of full-stack quantum computing. Its proprietary quantum-classical infrastructure provides ultra-low latency integration with public and private clouds for high-performance practical quantum computing. The company has developed the industry's first multi-chip quantum processor for scalable quantum computing systems. Geographically, it derives a majority of its revenue from the United States.

Rigetti计算公司从事全栈量子计算业务。其专有的量子-经典基础设施提供与公共和私有云的超低延迟集成,支持高性能的实用量子计算。该公司开发了行业首个多芯片量子处理器,用于可扩展的量子计算系统。在地理上,它的大部分营业收入来自美国。

Following our analysis of the options activities associated with Rigetti Computing, we pivot to a closer look at the company's own performance.

在对与Rigetti Computing相关的期权活动进行分析后,我们开始更深入地关注该公司的自身表现。

Present Market Standing of Rigetti Computing

Rigetti计算公司的当前市场地位

- With a volume of 89,179,572, the price of RGTI is up 24.69% at $11.68.

- RSI indicators hint that the underlying stock may be overbought.

- Next earnings are expected to be released in 80 days.

- RGTI的成交量为89,179,572,价格上涨了24.69%,目前为$11.68。

- RSI因子提示基准股可能被高估。

- 下一次财报预计将在80天内发布。

What The Experts Say On Rigetti Computing

专家对Rigetti Computing的看法

In the last month, 2 experts released ratings on this stock with an average target price of $8.0.

在过去一个月里,有2位专家对该股票发布了评级,平均目标价为$8.0。

Turn $1000 into $1270 in just 20 days?

在短短20天内将1000美元变成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* An analyst from Craig-Hallum downgraded its action to Buy with a price target of $12. * An analyst from B. Riley Securities persists with their Buy rating on Rigetti Computing, maintaining a target price of $4.

一位具有20年经验的期权交易员揭示了他的单行图表技巧,展示了何时该买入和卖出。复制他的交易,平均每20天获得27%的利润。点击此处获取访问权限。* Craig-Hallum的分析师已将其评级下调至买入,目标价为$12。* b. Riley Securities的分析师仍然维持对Rigetti Computing的买入评级,目标价为$4。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Rigetti Computing with Benzinga Pro for real-time alerts.

交易期权涉及更大的风险,但也提供了更高收益的潜力。精明的交易者通过持续的教育、战略性交易调整、利用各种因子和关注市场动态来减少这些风险。通过Benzinga Pro实时跟踪Rigetti Computing的最新期权交易,获取实时警报。

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $10.0 to $20.0 for Rigetti Computing over the last 3 months.

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $10.0 to $20.0 for Rigetti Computing over the last 3 months.