Price Over Earnings Overview: Adient

Price Over Earnings Overview: Adient

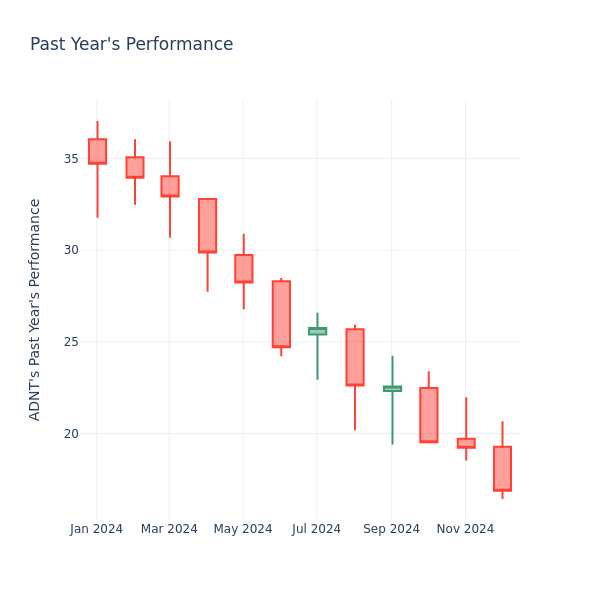

In the current market session, Adient Inc. (NYSE:ADNT) price is at $16.88, after a 0.18% spike. However, over the past month, the stock decreased by 12.27%, and in the past year, by 54.25%. Shareholders might be interested in knowing whether the stock is undervalued, even if the company is performing up to par in the current session.

在当前市场交易中,Adient Inc.(纽交所:ADNT)的价格为16.88美元,上涨了0.18%。然而,在过去一个月,该股票下跌了12.27%,而在过去一年中,下跌了54.25%。股东可能会对该股票是否被低估感兴趣,即使公司在当前交易中表现良好。

Adient P/E Ratio Analysis in Relation to Industry Peers

Adient市盈率分析与行业同行的关系

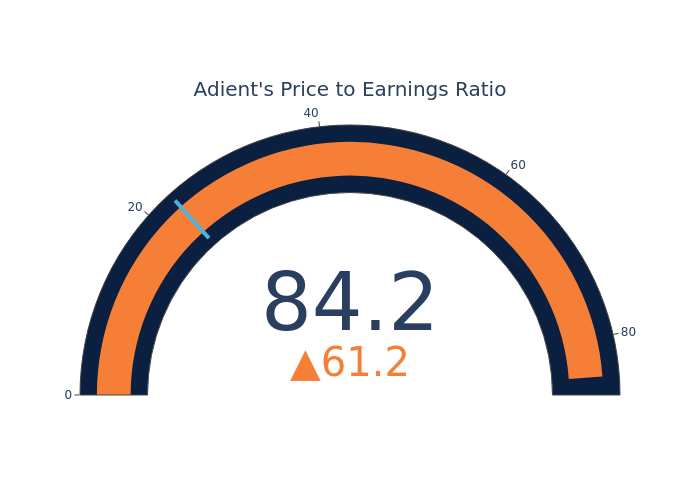

The P/E ratio measures the current share price to the company's EPS. It is used by long-term investors to analyze the company's current performance against it's past earnings, historical data and aggregate market data for the industry or the indices, such as S&P 500. A higher P/E indicates that investors expect the company to perform better in the future, and the stock is probably overvalued, but not necessarily. It also could indicate that investors are willing to pay a higher share price currently, because they expect the company to perform better in the upcoming quarters. This leads investors to also remain optimistic about rising dividends in the future.

市盈率衡量的是当前股价与公司每股收益的关系。长期投资者使用这个指标来分析公司当前的表现与过去的收益、历史数据以及行业或指数(如S&P 500)的整体市场数据的对比。更高的市盈率表明投资者预期公司未来表现会更好,因此股票可能被高估,但不一定。它也可能表明投资者愿意当前支付更高的股价,因为他们期望公司在即将到来的几个季度内表现更好。这使得投资者对未来分红派息的增加也保持乐观。

Compared to the aggregate P/E ratio of 22.98 in the Automobile Components industry, Adient Inc. has a higher P/E ratio of 84.25. Shareholders might be inclined to think that Adient Inc. might perform better than its industry group. It's also possible that the stock is overvalued.

与汽车元件行业22.98的整体市盈率相比,Adient Inc.的市盈率为84.25,偏高。股东可能倾向于认为Adient Inc.的表现可能优于其行业组。但也可能该股票被高估。

In summary, while the price-to-earnings ratio is a valuable tool for investors to evaluate a company's market performance, it should be used with caution. A low P/E ratio can be an indication of undervaluation, but it can also suggest weak growth prospects or financial instability. Moreover, the P/E ratio is just one of many metrics that investors should consider when making investment decisions, and it should be evaluated alongside other financial ratios, industry trends, and qualitative factors. By taking a comprehensive approach to analyzing a company's financial health, investors can make well-informed decisions that are more likely to lead to successful outcomes.

总之,虽然市盈率是投资者评估公司市场表现的有价值工具,但使用时应谨慎。低市盈率可能是被低估的迹象,但也可能表明增长前景疲软或财务不稳定。此外,市盈率只是投资者在做出投资决策时应考虑的众多指标之一,还应与其他财务比率、行业趋势和定性因素结合考虑。通过全面分析公司的财务健康状况,投资者可以做出更明智的决策,更有可能获得成功的结果。

In summary, while the price-to-earnings ratio is a valuable tool for investors to evaluate a company's market performance, it should be used with caution. A low P/E ratio can be an indication of undervaluation, but it can also suggest weak growth prospects or financial instability. Moreover, the P/E ratio is just one of many metrics that investors should consider when making investment decisions, and it should be evaluated alongside other financial ratios, industry trends, and qualitative factors. By taking a comprehensive approach to analyzing a company's financial health, investors can make well-informed decisions that are more likely to lead to successful outcomes.

In summary, while the price-to-earnings ratio is a valuable tool for investors to evaluate a company's market performance, it should be used with caution. A low P/E ratio can be an indication of undervaluation, but it can also suggest weak growth prospects or financial instability. Moreover, the P/E ratio is just one of many metrics that investors should consider when making investment decisions, and it should be evaluated alongside other financial ratios, industry trends, and qualitative factors. By taking a comprehensive approach to analyzing a company's financial health, investors can make well-informed decisions that are more likely to lead to successful outcomes.