Sam Altman-Backed Nuclear Power Startup Oklo Receives Outperform Rating From Wedbush Amid 'AI Revolution' Buzz

Sam Altman-Backed Nuclear Power Startup Oklo Receives Outperform Rating From Wedbush Amid 'AI Revolution' Buzz

OpenAI CEO Sam Altman-backed nuclear power startup Oklo Inc. (NASDAQ:OKLO) received an outperform rating from Wedbush Securities, marking another milestone in its push to power the artificial intelligence revolution through advanced nuclear technology.

OpenAI首席执行官萨姆·阿尔特曼支持的核能初创公司Oklo Inc. (纳斯达克:OKLO)获得了Wedbush证券公司的超越市场评级,这标志着其通过先进核科技推动人工智能革命的又一重要里程碑。

What Happened: Wedbush analyst Dan Ives set a $26 price target for Oklo, citing the company's strategic position to capitalize on surging energy demands from data centers. "With the AI revolution underway, the industry will need roughly a tenfold increase in computing power by 2030," Ives wrote in his Thursday note, according to Investor's Business Daily.

发生了什么:Wedbush分析师丹·艾夫斯为Oklo设定了26美元的目标价格,指出该公司处于战略位置,可以利用数据中心日益增长的能源需求。艾夫斯在他周四的报告中写道:“随着人工智能革命的展开,到2030年,行业将需要大约十倍的计算能力。”,消息来源于《投资者商业日报》。

The rating follows Oklo's Wednesday announcement of an agreement to supply up to 12 gigawatts of nuclear power to Switch, an AI provider and data center operator, through 2044. The company plans to develop, construct, and operate powerhouses across the United States, with its first Aurora reactor expected to be operational by 2027.

该评级跟随Oklo在周三宣布与Switch达成协议,为其提供最多12吉瓦的核电,Switch是一家人工智能提供商和数据中心运营商,协议有效期至2044年。该公司计划在美国开发、建设和运营发电厂,其首个Aurora反应堆预计将在2027年投入使用。

Why It Matters: Oklo's shares have surged approximately 100% in 2024, despite a 9% December decline. The stock's momentum aligns with broader nuclear energy sector gains, sparked by Constellation Energy Corp.'s (NASDAQ:CEG) September deal to power Microsoft Corp.'s (NASDAQ:MSFT) data centers.

重要性:尽管在12月份下降了9%,但Oklo的股票在2024年仍激增了约100%。该股票的动量与更广泛的核能行业板块的增长相一致,这一增长是由恒星能源公司(纳斯达克:CEG)在9月与微软公司(纳斯达克:MSFT)的数据中心的交易推动的。

According to McKinsey & Co., data center energy demand is projected to grow from 4% to 11-12% of total U.S. energy consumption by 2030. This surge has attracted major tech companies, with Amazon.com Inc. (NASDAQ:AMZN), Alphabet Inc. (NASDAQ:GOOGL) (NASDAQ:GOOG), and Oracle Corp. (NYSE:ORCL) all investing in small modular reactor technology.

根据麦肯锡公司,数据中心的能源需求预计到2030年将从美国总能源消费的4%增长到11-12%。这一激增吸引了许多大型科技公司,亚马逊公司(纳斯达克:AMZN)、Alphabet Inc. (纳斯达克:GOOGL) (纳斯达克:GOOG)和甲骨文公司(纽交所:ORCL)都在小型模块化反应堆技术上进行了投资。

While Oklo forecasts a full-year operating loss of $40-50 million, its customer pipeline has grown significantly, reaching approximately 2,100 megawatts by the third quarter of 2024.

尽管Oklo预计全年的运营损失为4000-5000万,但其客户管道显著增长,到2024年第三季度达到约2100兆瓦。

Price Action: Oklo stock closed at $22.02 on Monday, up 2.32% for the day. In after-hours trading, the stock dipped to $22.00. Year to date, Oklo shares have surged by 107.74%, according to data from Benzinga Pro.

价格走势:Oklo的股票在周一收于22.02美元,当天上涨了2.32%。在盘后交易中,股票回落至22.00美元。今年以来,根据Benzinga Pro的数据,Oklo的股票上涨了107.74%。

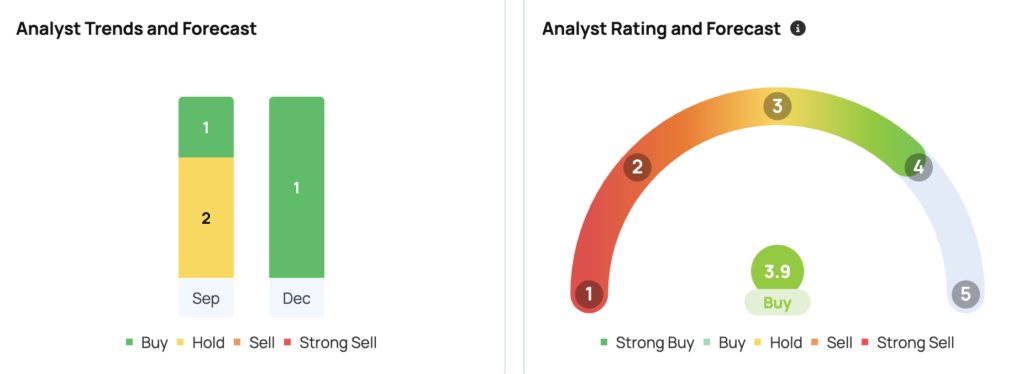

Oklo has a consensus price target of $15.33 from 4 analysts, with a high of $26 and a low of $10. The most recent ratings from Wedbush, Citigroup, and B. Riley Securities imply a downside of 30.30% from the average target.

Oklo的共识目标价格为15.33美元,来自4位分析师,最高为26美元,最低为10美元。Wedbush、花旗集团和b. Riley证券公司最近的评级暗示从平均目标价格来看,可能下跌30.30%。

- Tesla Shorts, Gordon Johnson, And James Chanos Express Skepticism On Robotaxi Potential Amid Usage Data Debate: The 'Promise' Worth Much More Than Reality

- 特斯拉做空者戈登·约翰逊和詹姆斯·查诺斯对机器人出租车的潜力表示怀疑,原因是使用数据的争议:这些"承诺"远远超过了现实。

Image Via Shutterstock

图片来自Shutterstock。

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

免责声明:本内容部分使用人工智能工具生成,并经Benzinga编辑审核发布。