Wall Street's Most Accurate Analysts Give Their Take On 3 Utilities Stocks With Over 4% Dividend Yields

Wall Street's Most Accurate Analysts Give Their Take On 3 Utilities Stocks With Over 4% Dividend Yields

华尔街最准的分析师对三只超过4%股息收益率的公用事业股票发表看法

During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

在市场动荡和不确定时期,许多投资者会选择高股息股票。这些公司通常具有高自由现金流,并以高股息回报股东。

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting Analyst Stock Ratings page. Traders can sort through Benzinga's extensive database of analyst ratings, including by analyst accuracy.

Benzinga读者可以通过访问分析师股票评级页面,查看他们最喜欢的股票的最新分析师观点。交易者可以浏览Benzinga广泛的分析师评级数据库,包括根据分析师准确性进行排序。

Below are the ratings of the most accurate analysts for three high-yielding stocks in the utilities sector.

以下是公用事业板块三个高股息股票最准确的分析师的评级。

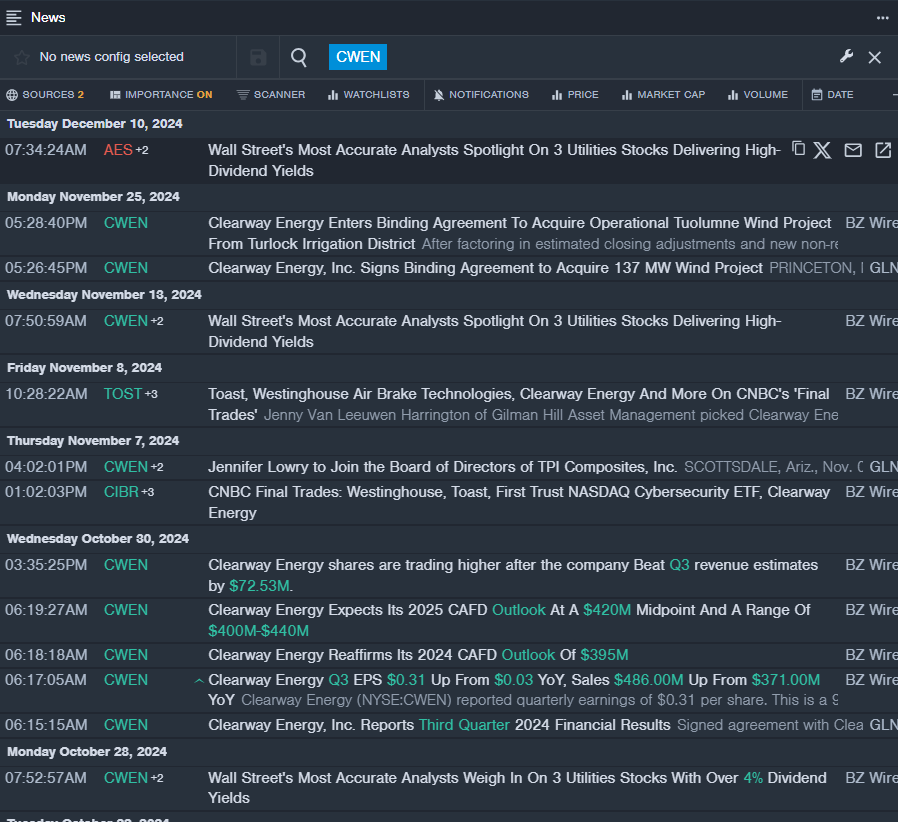

Clearway Energy, Inc. (NYSE:CWEN)

Clearway Energy, Inc. (纽交所:CWEN)

- Dividend Yield: 6.44%

- Jefferies analyst Julien Dumoulin-Smith initiated coverage on the stock with a Buy rating and a price target of $35 on Sept. 20. This analyst has an accuracy rate of 66%.

- Morgan Stanley analyst Robert Kad upgraded the stock from Equal-Weight to Overweight and increased the price target from $25 to $36 on July 31. This analyst has an accuracy rate of 77%.

- Recent News: On Nov. 25, Clearway Energy entered into binding agreement to acquire Operational Tuolumne Wind Project from Turlock Irrigation District.

- Benzinga Pro's real-time newsfeed alerted to latest CWEN news.

- 股息收益率:6.44%

- Jefferies的分析师Julien Dumoulin-Smith于9月20日对该股票进行覆盖,给予买入评级,目标价格为35美元。该分析师的准确率为66%。

- 摩根士丹利的分析师Robert Kad将该股票从等权评级上调至增持,并将目标价格从25美元上调至36美元,时间为7月31日。该分析师的准确率为77%。

- 最新资讯:11月25日,Clearway Energy与Turlock Irrigation District达成了收购Operational Tuolumne Wind Project的具有约束力的协议。

- Benzinga Pro的实时资讯提醒了最新的CWEN资讯。

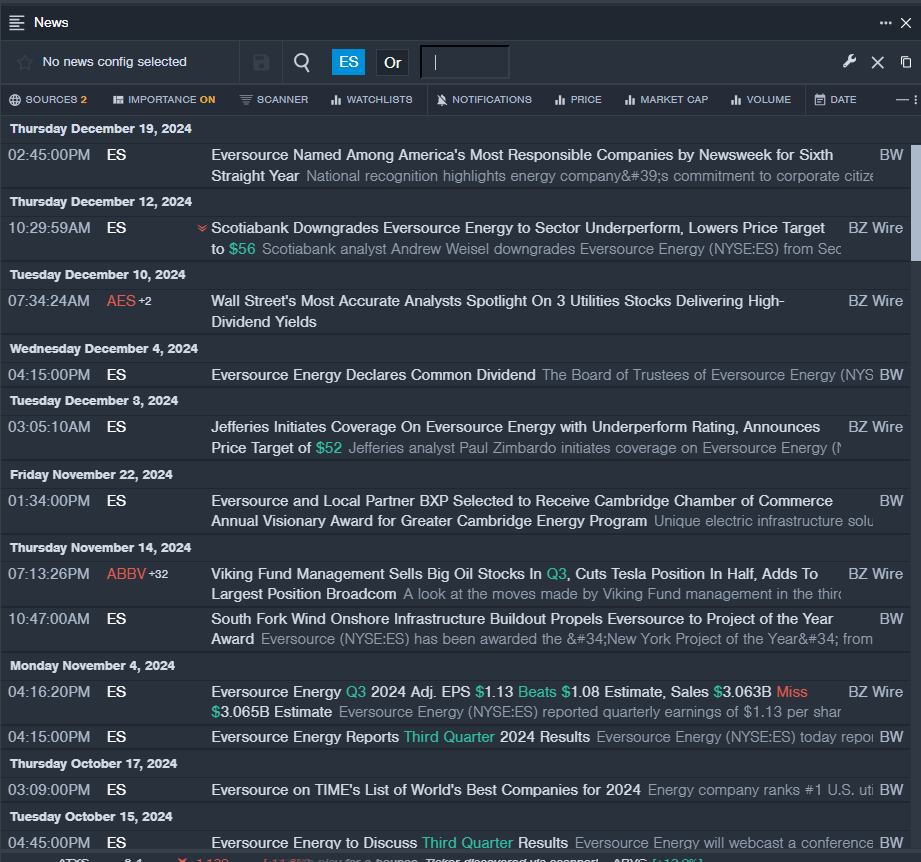

Eversource Energy (NYSE:ES)

eversource energy (纽交所: 英顺)

- Dividend Yield: 5.00%

- BMO Capital analyst James Thalacker maintained a Market Perform rating and cut the price target from $74 to $72 on Oct. 15. This analyst has an accuracy rate of 68%.

- Barclays analyst Eric Beaumont maintained an Equal-Weight rating and raised the price target from $69 to $72 on Oct. 15. This analyst has an accuracy rate of 71%.

- Recent News: On Nov. 4, Eversource Energy posted upbeat quarterly earnings.

- Benzinga Pro's real-time newsfeed alerted to latest ES news

- 股息收益率:5.00%

- BMO Capital的分析师James Thalacker维持市场表现评级,并将目标价从$74万亿下调至$72,时间为10月15日。该分析师的准确率为68%。

- 巴克莱银行的分析师Eric Beaumont维持等权评级,并将目标价从$69万亿上调至$72,时间为10月15日。该分析师的准确率为71%。

- 最新资讯:在11月4日,Eversource Energy发布了乐观的季度财报。

- Benzinga Pro的实时资讯提醒了最新的ES资讯。

Spire Inc. (NYSE:SR)

Spire股票(纽交所:SR)

- Dividend Yield: 4.71%

- Mizuho analyst Gabriel Moreen upgraded the stock from Neutral to Outperform and raised the price target from $65 to $76 on Dec. 20. This analyst has an accuracy rate of 77%.

- Janney Montgomery analyst Michael Gaugler initiated coverage on the stock with a Neutral rating and a price target of $73 on Dec. 17. This analyst has an accuracy rate of 74%.

- Recent News: On Nov. 20, Spire reported a loss for the fourth quarter.

- Benzinga Pro's charting tool helped identify the trend in SR stock.

- 股息收益率:4.71%

- 瑞穗的分析师加布里埃尔·莫林将该股评级从中立上调至跑赢大盘,并在12月20日将目标价从65美元提高至76美元。该分析师的准确率为77%。

- 詹尼·蒙哥马利的分析师迈克尔·高格勒在12月17日对该股进行了评级,给予中立评级,目标价为73美元。该分析师的准确率为74%。

- 最新资讯:在11月20日,Spire公布了第四季度的亏损。

- Benzinga Pro的图表工具帮助识别了SR股票的趋势。

Read More:

阅读更多:

- How To Earn $500 A Month From Qualcomm Stock

- 如何从高通股票中每月赚取500美元