Decoding GameStop's Options Activity: What's the Big Picture?

Decoding GameStop's Options Activity: What's the Big Picture?

Investors with a lot of money to spend have taken a bearish stance on GameStop (NYSE:GME).

持有大量资金的投资者对游戏驿站(纽交所:GME)采取了看淡的态度。

And retail traders should know.

零售交易者应该了解这一点。

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

我们今天注意到这一点,当交易出现在我们在Benzinga跟踪的公共可用期权历史记录中时。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with GME, it often means somebody knows something is about to happen.

无论这些是机构还是仅仅是富裕的个人,我们都不知道。但当游戏驿站发生如此重大的事情时,通常意味着有人知道即将发生的事情。

So how do we know what these investors just did?

那么我们怎么知道这些投资者刚刚做了什么呢?

Today, Benzinga's options scanner spotted 33 uncommon options trades for GameStop.

今天,Benzinga的期权扫描仪发现了33笔不寻常的游戏驿站期权交易。

This isn't normal.

这并不正常。

The overall sentiment of these big-money traders is split between 18% bullish and 54%, bearish.

这些大资金交易者的整体情绪在18%看好和54%看淡之间分裂。

Out of all of the special options we uncovered, 13 are puts, for a total amount of $625,725, and 20 are calls, for a total amount of $1,054,347.

在我们发现的所有特殊期权中,有13个是看跌期权,总金额为625,725美元,20个是看涨期权,总金额为1,054,347美元。

Expected Price Movements

预期价格变动

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $20.0 and $125.0 for GameStop, spanning the last three months.

在评估成交量和未平仓合约后,很明显主要市场动向者专注于游戏驿站的价格区间在20.0美元到125.0美元之间,覆盖了过去三个月。

Volume & Open Interest Development

成交量和持仓量的评估是期权交易中的一个关键步骤。这些指标揭示了阿里巴巴集团(Alibaba Gr Hldgs)特定执行价格期权的流动性和投资者兴趣。下面的数据可视化了在过去30天内,阿里巴巴集团(Alibaba Gr Hldgs)在执行价格在74.0美元到120.0美元区间内的看涨看跌期权中,成交量和持仓量的波动情况。

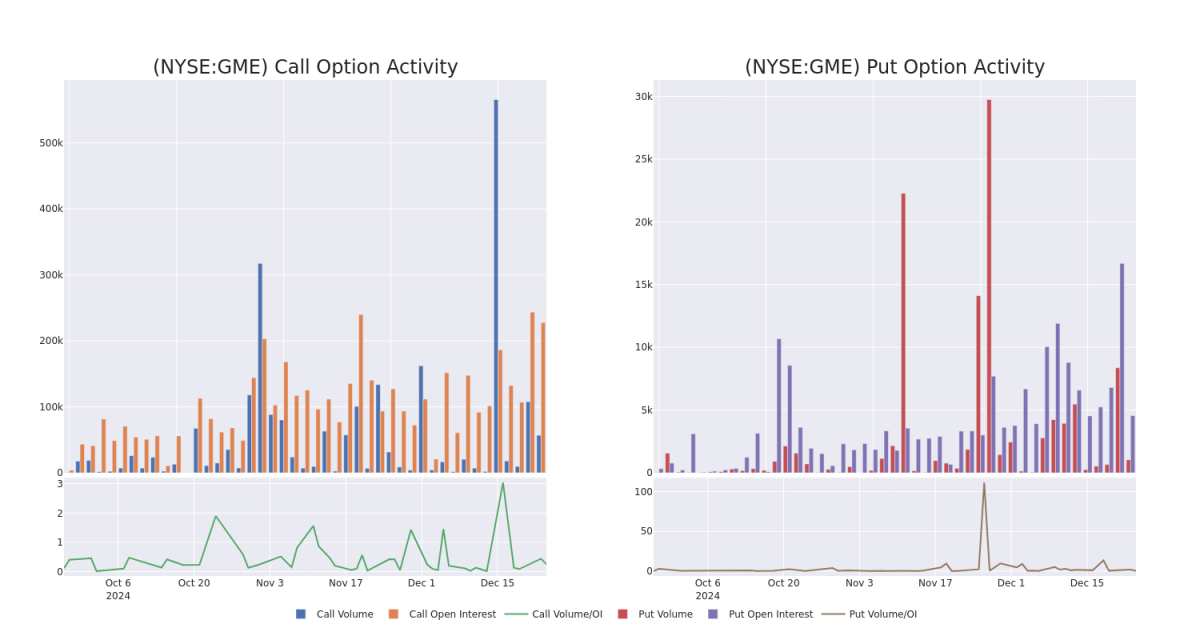

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

观察成交量和未平仓合约是进行股票尽职调查的一个有见地的方法。

This data can help you track the liquidity and interest for GameStop's options for a given strike price.

这些数据可以帮助你跟踪游戏驿站在特定行权价格下的流动性和兴趣。

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of GameStop's whale activity within a strike price range from $20.0 to $125.0 in the last 30 days.

下面,我们可以观察到在过去30天内,对所有游戏驿站的鲸鱼活动在行权价格区间从20.0美元到125.0美元的看涨和看跌期权的成交量和未平仓合约的演变。

GameStop Option Volume And Open Interest Over Last 30 Days

GameStop近30天期权成交量和持仓量

Significant Options Trades Detected:

检测到重大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GME | CALL | SWEEP | BEARISH | 01/17/25 | $7.25 | $7.15 | $7.15 | $25.00 | $143.0K | 25.5K | 209 |

| GME | CALL | TRADE | NEUTRAL | 02/21/25 | $6.05 | $5.85 | $5.94 | $30.00 | $118.8K | 2.9K | 200 |

| GME | CALL | TRADE | BEARISH | 01/16/26 | $5.1 | $5.0 | $5.0 | $125.00 | $97.5K | 15.7K | 211 |

| GME | CALL | TRADE | BEARISH | 01/17/25 | $6.85 | $6.65 | $6.65 | $25.00 | $73.1K | 25.5K | 1.4K |

| GME | CALL | SWEEP | BEARISH | 01/17/25 | $0.4 | $0.36 | $0.37 | $125.00 | $68.8K | 130.6K | 22.1K |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 行权价 | 总交易价格 | 未平仓合约 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GME | 看涨 | 扫单 | 看淡 | 01/17/25 | $7.25 | $7.15 | $7.15 | $25.00 | 143,000美元 | 25.5K | 209 |

| GME | 看涨 | 交易 | 中立 | 02/21/25 | $6.05 | $5.85 | $5.94 | $30.00 | $118.8K | 2.9K | 200 |

| GME | 看涨 | 交易 | 看淡 | 01/16/26 | $5.1 | $5.0 | $5.0 | $125.00 | 97.5K美元 | 15.7K | 211 |

| GME | 看涨 | 交易 | 看淡 | 01/17/25 | $6.85 | $6.65 | $6.65 | $25.00 | 73.1K美元 | 25.5K | 1.4K |

| GME | 看涨 | 扫单 | 看淡 | 01/17/25 | $0.4 | $0.36 | $0.37 | $125.00 | $68.8K | 130.6K | 22.1K |

About GameStop

关于游戏驿站

GameStop Corp is a U.S. multichannel video game, consumer electronics, and services retailer. The company operates across Europe, Canada, Australia, and the United States. GameStop sells new and second-hand video game hardware, physical and digital video game software, and video game accessories, mainly through GameStop, EB Games, and Micromania stores and international e-commerce sites. The majority of sales are from the United States.

游戏驿站CORP是一家美国多渠道视频游戏、消费电子-半导体和服务零售商。该公司在欧洲、加拿大、澳洲和美国运营。游戏驿站主要通过游戏驿站、Eb Games和Micromania商店以及国际电子商务网站销售新旧视频游戏硬件、实体和数字视频游戏软件,以及视频游戏配件。销售大部分来自美国。

After a thorough review of the options trading surrounding GameStop, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

在对围绕游戏驿站的期权交易进行全面审查后,我们开始更详细地检查该公司。这包括对其当前市场状况和表现的评估。

Present Market Standing of GameStop

游戏驿站的当前市场表现

- Currently trading with a volume of 5,093,848, the GME's price is up by 0.68%, now at $31.11.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 91 days.

- 目前成交量为5,093,848,游戏驿站的价格上涨了0.68%,现为31.11美元。

- RSI读数表明该股票目前可能接近超买状态。

- 预计收益发布将在91天内进行。

Turn $1000 into $1270 in just 20 days?

在短短20天内将1000美元变成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

一位拥有20年经验的期权交易员揭示了他的单行图表技巧,帮助判断何时买入和卖出。复制他的交易,这些交易每20天平均获得27%的利润。点击这里获取访问权限。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

与仅仅交易股票相比,期权是一种风险较高的资产,但它们具有更高的盈利潜力。严肃的期权交易者通过日常学习、逐步进出交易、关注多个因子以及密切关注市场来管理这种风险。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with GME, it often means somebody knows something is about to happen.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with GME, it often means somebody knows something is about to happen.