Check Out These 5 Nasdaq-Listed Multibaggers — One Made Investors 17.56x Richer This Year: Here's What To Expect In 2025

Check Out These 5 Nasdaq-Listed Multibaggers — One Made Investors 17.56x Richer This Year: Here's What To Expect In 2025

Several Nasdaq-listed companies have delivered remarkable returns in 2024, with one standout performer making investors significantly wealthier.

几家纳斯达克上市公司在2024年实现了可观的回报,其中一家表现出色的公司使投资者变得更加富有。

What Happened: According to Benzinga Pro, several Nasdaq-listed companies have delivered impressive returns in 2024. Quantum Computing Inc. (NASDAQ:QUBT) tops the list with a staggering 1,756.12% increase. It recently signed a significant contract with NASA's Goddard Space Flight Center for advanced imaging and data processing. Despite this surge, analysts from Ascendiant Capital have set a price target of $8.5, suggesting a potential downside of 51.02%.

发生了什么:根据Benzinga Pro的数据,几家纳斯达克上市公司在2024年实现了可观的回报。量子计算公司(纳斯达克股票代码:QUBT)以惊人的1,756.12%的涨幅位居榜首。它最近与美国宇航局戈达德太空飞行中心签署了一份关于高级成像和数据处理的重要合同。尽管价格飙升,但Ascendiant Capital的分析师仍将目标股价设定为8.5美元,这表明潜在的下行空间为51.02%。

MicroStrategy Inc. (NASDAQ:MSTR) saw a 450.14% rise, driven by its strategic Bitcoin (CRYPTO: BTC) acquisitions, which have significantly increased its asset-backed value. According to bitcointreasuries.net, the company now holds 444,262 BTCs, valued at over $41.74 billion. Analysts from Bernstein, TD Cowen, and Barclays have set an average price target of $546.67, indicating a 64.51% potential upside.

微策略公司(纳斯达克股票代码:MSTR)上涨了450.14%,这得益于其对比特币(加密货币:BTC)的战略收购,这大大增加了其资产支持价值。根据bitcointreasuries.net的数据,该公司现在持有444,262张比特币,价值超过417.4亿美元。伯恩斯坦、道明考恩和巴克莱银行的分析师将平均目标股价设定为546.67美元,表明潜在上涨空间为64.51%。

Palantir Technologies Inc. (NASDAQ:PLTR) achieved a 356.39% gain, bolstered by strong government revenue and a substantial contract extension with the U.S. Army, potentially worth $618.9 million over four years. However, the average analyst price target of $64.67 implies a 19.20% downside.

Palantir Technologies Inc.(纳斯达克股票代码:PLTR)实现了356.39%的涨幅,这得益于强劲的政府收入和与美国陆军的大量延期合同,四年内可能价值6.189亿美元。但是,分析师的平均目标股价为64.67美元,这意味着下跌19.20%。

NVIDIA Corp (NASDAQ:NVDA) experienced a 183.42% increase, fueled by robust growth in its AI and data center sectors. The company's commitment to expanding production capacity underscores confidence in continued revenue growth. Analysts from DA Davidson, Phillip Securities, and Truist Securities suggest a 10.53% upside with an average price target of $154.67.

英伟达公司(纳斯达克股票代码:NVDA)增长了183.42%,这得益于其人工智能和数据中心领域的强劲增长。该公司对扩大产能的承诺凸显了人们对持续收入增长的信心。来自戴维森、辉利普证券和信托证券的分析师表示,上涨幅度为10.53%,平均目标股价为154.67美元。

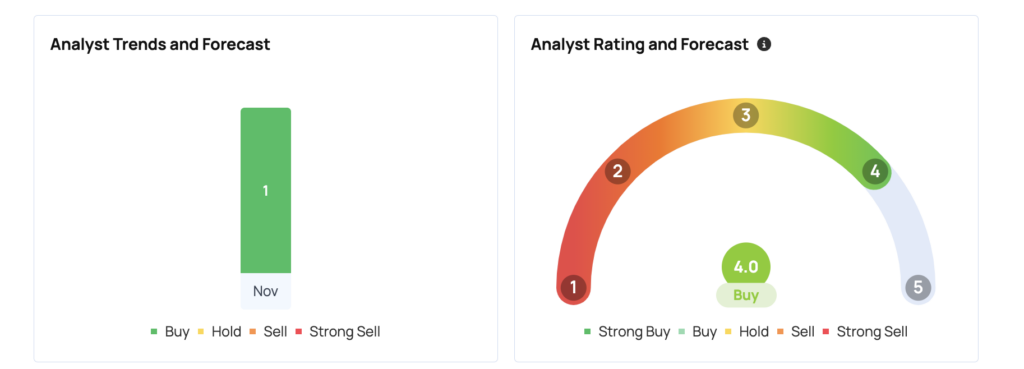

Powell Industries Inc. (NASDAQ:POWL) reported a 162.45% rise, supported by favorable analyst ratings and a consensus price target of $312, reflecting optimism in its market performance. The most recent analyst rating for Powell Industries came from Roth MKM on December 11, setting a price target of $312, which implies a 33.6% upside potential for the stock.

鲍威尔工业公司(纳斯达克股票代码:POWL)报告上涨162.45%,这得益于良好的分析师评级和312美元的共识目标股价,这反映了对其市场表现的乐观情绪。鲍威尔工业公司的最新分析师评级来自Roth mKM,将目标股价定为312美元,这意味着该股的上涨潜力为33.6%。

Multibagger stocks are equities that yield exceptional returns, often doubling or more in value within a year. These stocks are prized by investors for their potential to significantly grow wealth over a relatively short period. The term was first coined by Peter Lynch in his book "One Up on Wall Street."

Multibagger股票是具有丰厚回报的股票,其价值通常在一年内翻一番或更多。这些股票因其在相对较短的时间内显著增加财富的潜力而受到投资者的青睐。这个词最初是彼得·林奇在他的《华尔街One Up》一书中创造的。

- Celebrities Like Ellen DeGeneres, David Beckham And Simon Cowell Have Turned England's Idyllic Cotswolds

- 艾伦·德杰尼勒斯、大卫·贝克汉姆和西蒙·考威尔等名人已经变成了英格兰田园诗般的科茨沃尔德

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

免责声明:该内容部分是在Benzinga Neuro的帮助下制作的,并由Benzinga编辑审查和发布。

Image via Shutterstock

图片来自 Shutterstock