Market Whales and Their Recent Bets on IONQ Options

Market Whales and Their Recent Bets on IONQ Options

Financial giants have made a conspicuous bullish move on IonQ. Our analysis of options history for IonQ (NYSE:IONQ) revealed 40 unusual trades.

金融巨头对IonQ做出了明显的看好举动。我们对IonQ(纽交所:IONQ)的期权历史分析显示,有40笔飞凡交易。

Delving into the details, we found 42% of traders were bullish, while 35% showed bearish tendencies. Out of all the trades we spotted, 5 were puts, with a value of $225,930, and 35 were calls, valued at $4,686,955.

深入分析发现,42%的交易者持看好态度,而35%表现出看淡倾向。在我们发现的所有交易中,有5笔是看跌看跌,价值为225,930美元,35笔是看涨,价值为4,686,955美元。

What's The Price Target?

价格目标是什么?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $25.0 and $65.0 for IonQ, spanning the last three months.

在评估了交易量和未平仓合约后,明显可以看出主要市场推动者关注IonQ的价格区间在25.0美元到65.0美元之间,持续了过去三个月。

Analyzing Volume & Open Interest

分析成交量和未平仓合约

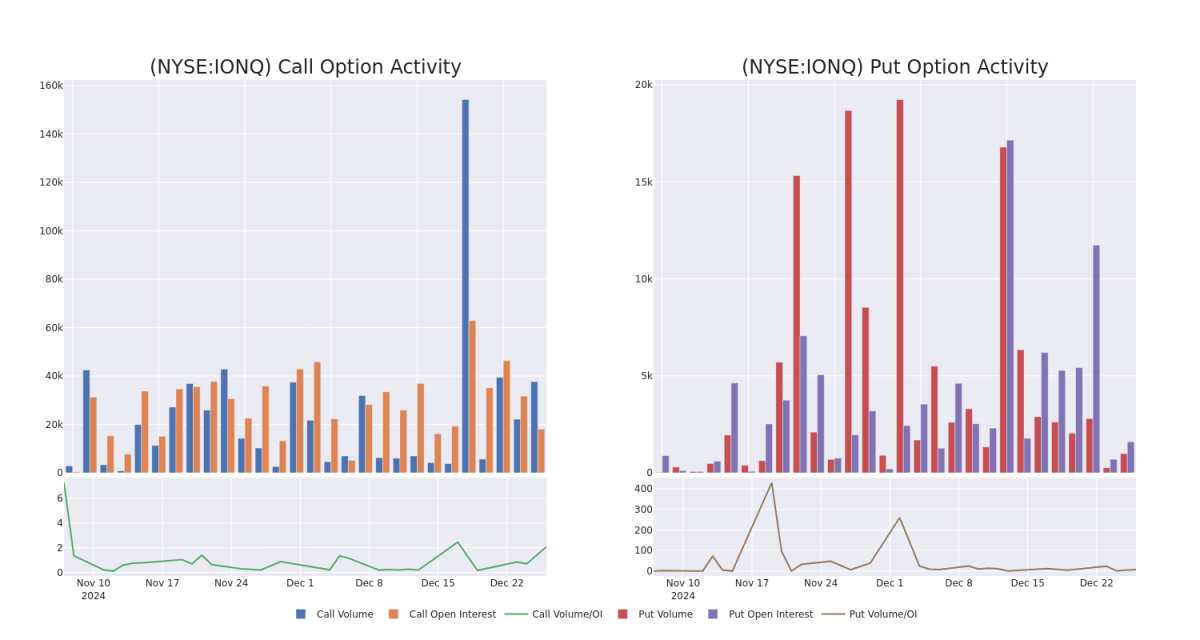

In today's trading context, the average open interest for options of IonQ stands at 1094.17, with a total volume reaching 38,651.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in IonQ, situated within the strike price corridor from $25.0 to $65.0, throughout the last 30 days.

在今天的交易背景下,IonQ期权的平均未平仓合约为1094.17,总成交量达到38,651.00。附图描绘了IonQ中高价值交易的看涨和看跌期权的成交量和未平仓合约的进展,位于25.0美元到65.0美元的行权价区间,覆盖了过去30天。

IonQ 30-Day Option Volume & Interest Snapshot

IonQ 30天期权成交量及兴趣快照

Significant Options Trades Detected:

检测到重大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| IONQ | CALL | TRADE | BEARISH | 04/17/25 | $8.5 | $8.1 | $8.1 | $65.00 | $810.0K | 678 | 4.2K |

| IONQ | CALL | SWEEP | BULLISH | 01/03/25 | $10.4 | $10.2 | $10.4 | $35.00 | $208.0K | 183 | 1.1K |

| IONQ | CALL | SWEEP | NEUTRAL | 01/03/25 | $10.4 | $10.15 | $10.4 | $35.00 | $208.0K | 183 | 900 |

| IONQ | CALL | SWEEP | BULLISH | 01/03/25 | $10.4 | $10.05 | $10.38 | $35.00 | $207.8K | 183 | 700 |

| IONQ | CALL | SWEEP | NEUTRAL | 01/03/25 | $10.4 | $10.05 | $10.38 | $35.00 | $207.6K | 183 | 300 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 行权价 | 总交易价格 | 未平仓合约 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| IONQ | 看涨 | 交易 | 看淡 | 04/17/25 | $8.5 | $8.1 | $8.1 | $65.00 | 81万美元 | 678 | 4.2K |

| IONQ | 看涨 | 扫单 | 看好 | 01/03/25 | $10.4 | $10.2 | $10.4 | $35.00 | 208.0K美元 | 183 | 1.1千 |

| IONQ | 看涨 | 扫单 | 中立 | 01/03/25 | $10.4 | $10.15 | $10.4 | $35.00 | 208.0K美元 | 183 | 900 |

| IONQ | 看涨 | 扫单 | 看好 | 01/03/25 | $10.4 | $10.05 | $10.38 | $35.00 | $207.8K | 183 | 700 |

| IONQ | 看涨 | 扫单 | 中立 | 01/03/25 | $10.4 | $10.05 | $10.38 | $35.00 | 207.6K美元 | 183 | 300 |

About IonQ

关于IonQ

IonQ Inc sells access to several quantum computers of various qubit capacities and is in the process of researching and developing technologies for quantum computers with increasing computational capabilities. The company currently makes access to its quantum computers available via cloud platforms and also to select customers via its own cloud service. This cloud-based approach enables the broad availability of quantum-computing-as-a-service (QCaaS). The company derives its revenue from its quantum-computing-as-a-service arrangements, consulting services related to co-developing algorithms on company's quantum computing systems, and contracts associated with the design, development, and construction of specialized quantum computing systems together with related services.

IonQ公司销售多种量子计算机的访问权限,具有不同的量子比特容量,并正在研究和开发计算能力不断增强的量子计算机技术。该公司目前通过云平台提供量子计算机的访问权限,同时也通过自己的云服务向部分客户提供。这种基于云的方式使量子计算即服务(QCaaS)广泛可用。该公司的营业收入来自于量子计算即服务的安排、与在公司量子计算系统上共同开发算法相关的咨询服务,以及与专门量子计算系统的设计、开发和施工及相关服务的合同。

Following our analysis of the options activities associated with IonQ, we pivot to a closer look at the company's own performance.

在我们对IonQ相关的期权活动进行分析后,我们转向更仔细地审视公司的自身表现。

Present Market Standing of IonQ

IonQ的当前市场地位

- Currently trading with a volume of 11,841,948, the IONQ's price is up by 4.31%, now at $46.5.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 62 days.

- 当前成交量为11,841,948,IONQ的价格上涨了4.31%,现为46.5美元。

- RSI读数表明该股票目前可能接近超买状态。

- 预计盈利发布将在62天后进行。

What Analysts Are Saying About IonQ

分析师对IonQ的看法

In the last month, 2 experts released ratings on this stock with an average target price of $47.5.

在过去一个月中,2位专家对该股票发布了评级,平均目标价为$47.5。

Turn $1000 into $1270 in just 20 days?

在短短20天内将1000美元变成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* An analyst from DA Davidson has revised its rating downward to Buy, adjusting the price target to $50. * An analyst from Craig-Hallum persists with their Buy rating on IonQ, maintaining a target price of $45.

一位拥有20年经验的期权交易员透露了他的单线图技巧,这显示了何时买入和卖出。复制他的交易,这些交易每20天平均盈利27%。点击这里获取访问权限。* DA Davidson的分析师将其评级下调至买入,并将目标价调整至50美元。* Craig-Hallum的分析师继续对IonQ维持买入评级,保持目标价45美元。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

与仅仅交易股票相比,期权是一种风险较高的资产,但它们具有更高的盈利潜力。严肃的期权交易者通过日常学习、逐步进出交易、关注多个因子以及密切关注市场来管理这种风险。

In today's trading context, the average open interest for options of IonQ stands at 1094.17, with a total volume reaching 38,651.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in IonQ, situated within the strike price corridor from $25.0 to $65.0, throughout the last 30 days.

In today's trading context, the average open interest for options of IonQ stands at 1094.17, with a total volume reaching 38,651.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in IonQ, situated within the strike price corridor from $25.0 to $65.0, throughout the last 30 days.