Market Whales and Their Recent Bets on QUBT Options

Market Whales and Their Recent Bets on QUBT Options

Investors with a lot of money to spend have taken a bullish stance on Quantum Computing (NASDAQ:QUBT).

资金雄厚的投资者对量子计算概念(纳斯达克:QUBT)持看好的态度。

And retail traders should know.

零售交易者应该了解这一点。

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

我们今天注意到这一点,当交易出现在我们在Benzinga跟踪的公共可用期权历史记录中时。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with QUBT, it often means somebody knows something is about to happen.

无论这些是机构还是只是富有的个人,我们并不知道。但当QUBT发生如此大的事情时,这通常意味着有人知道即将发生的事情。

So how do we know what these investors just did?

那么我们怎么知道这些投资者刚刚做了什么呢?

Today, Benzinga's options scanner spotted 19 uncommon options trades for Quantum Computing.

今天,Benzinga的期权扫描器发现了19笔不寻常的量子计算概念期权交易。

This isn't normal.

这并不正常。

The overall sentiment of these big-money traders is split between 42% bullish and 31%, bearish.

这些资金雄厚的交易者的整体情绪在42%看好和31%看淡之间分裂。

Out of all of the special options we uncovered, 9 are puts, for a total amount of $455,775, and 10 are calls, for a total amount of $688,739.

在我们发现的所有特殊期权中,有9个是看跌期权,总金额为455,775美元,10个是看涨期权,总金额为688,739美元。

Expected Price Movements

预期价格变动

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $12.5 to $25.0 for Quantum Computing over the recent three months.

根据交易活动,重大投资者似乎正瞄准量子计算在最近三个月的价格区间,从12.5美元到25.0美元。

Analyzing Volume & Open Interest

分析成交量和未平仓合约

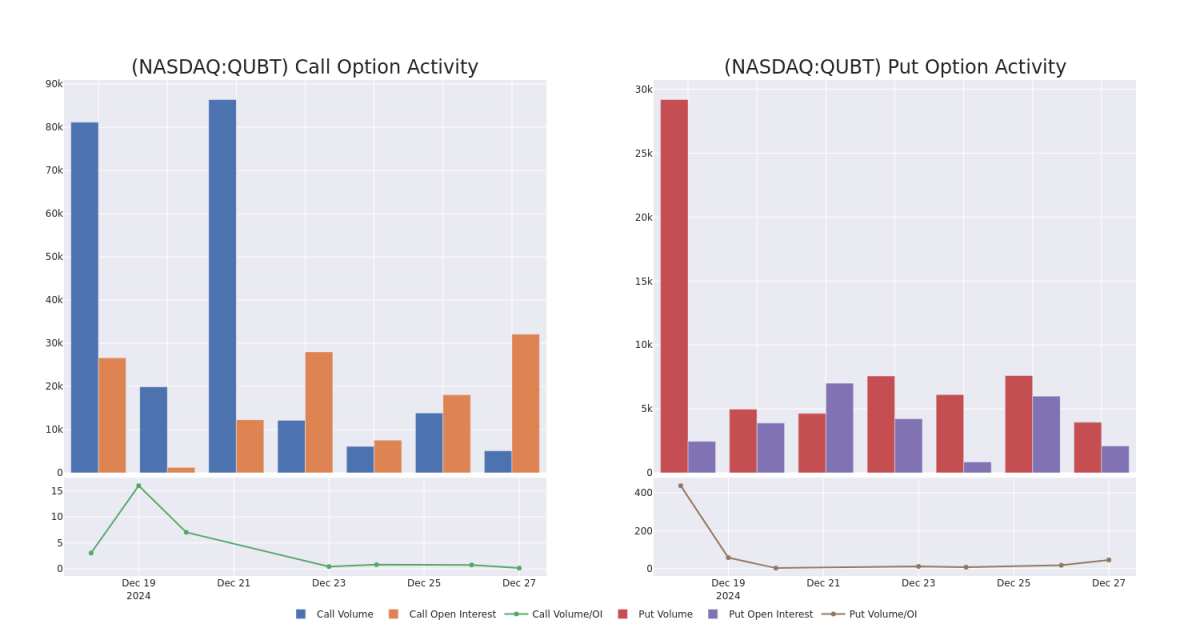

In terms of liquidity and interest, the mean open interest for Quantum Computing options trades today is 2280.4 with a total volume of 9,055.00.

就流动性和兴趣而言,今天量子计算期权交易的平均未平仓合约为2280.4,总成交量为9,055.00。

In the following chart, we are able to follow the development of volume and open interest of call and put options for Quantum Computing's big money trades within a strike price range of $12.5 to $25.0 over the last 30 days.

在下面的图表中,我们能够跟踪量子计算在过去30天内看涨和看跌期权的大额交易的成交量和未平仓合约的发展,行权价格范围为12.5美元到25.0美元。

Quantum Computing Option Activity Analysis: Last 30 Days

量子计算期权活动分析:过去30天

Noteworthy Options Activity:

值得注意的期权活动:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| QUBT | CALL | SWEEP | BULLISH | 01/24/25 | $4.5 | $4.4 | $4.5 | $20.00 | $137.0K | 876 | 308 |

| QUBT | CALL | SWEEP | BULLISH | 01/17/25 | $3.7 | $3.5 | $3.7 | $18.00 | $111.0K | 1.7K | 527 |

| QUBT | CALL | SWEEP | BULLISH | 01/10/25 | $3.2 | $2.95 | $3.2 | $18.00 | $96.0K | 372 | 489 |

| QUBT | PUT | TRADE | BULLISH | 01/17/25 | $5.6 | $5.4 | $5.45 | $20.00 | $92.6K | 1.5K | 823 |

| QUBT | PUT | SWEEP | BULLISH | 01/17/25 | $5.6 | $5.5 | $5.5 | $20.00 | $82.6K | 1.5K | 1.1K |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 行权价 | 总交易价格 | 未平仓合约 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| QUBT | 看涨 | 扫单 | 看好 | 01/24/25 | $4.5 | $4.4 | $4.5 | $20.00 | $137.0K | 876 | 308 |

| QUBT | 看涨 | 扫单 | 看好 | 01/17/25 | $3.7 | $3.5 | $3.7 | $18.00 | 111.0K美元 | 1.7K | 527 |

| QUBT | 看涨 | 扫单 | 看好 | 01/10/25 | $3.2 | $2.95 | $3.2 | $18.00 | 96.0K美元 | 372 | 489 |

| QUBT | 看跌 | 交易 | 看好 | 01/17/25 | $5.6 | $5.4 | $5.45 | $20.00 | $92.6K | 1.5K | 823 |

| QUBT | 看跌 | 扫单 | 看好 | 01/17/25 | $5.6 | $5.5 | $5.5 | $20.00 | $82.6K | 1.5K | 1.1千 |

About Quantum Computing

关于量子计算概念

Quantum Computing Inc is an American company utilizing non-linear quantum optics (optical devices whose output due to quantum effects is exponentially, not linearly, related to inputs) to deliver quantum products for high-performance computing applications. QCi's products are designed to operate at room temperature and use low power at an affordable cost. The Company's portfolio of core technology and products offer new capabilities in the areas of high-performance computing, artificial intelligence, cyber security as well as remote sensing applications.

量子计算公司是一家美国公司,利用非线性量子光学(由于量子效应其输出与输入呈指数关系而非线性关系的光学设备)提供高性能计算应用的量子产品。量子计算公司的产品旨在在常温下运行,并以一种经济实惠的方式使用低功耗。公司的核心技术和产品组合在高性能计算、人工智能、网络安全以及遥感应用领域提供了新的能力。

In light of the recent options history for Quantum Computing, it's now appropriate to focus on the company itself. We aim to explore its current performance.

考虑到最近的量子计算概念期权历史,现在应该关注公司本身。我们旨在探讨其当前表现。

Present Market Standing of Quantum Computing

量子计算的当前市场状况

- With a volume of 33,862,378, the price of QUBT is down -4.95% at $18.29.

- RSI indicators hint that the underlying stock may be overbought.

- Next earnings are expected to be released in 94 days.

- QUBt的成交量为33,862,378,价格下跌了-4.95%,当前为$18.29。

- RSI因子提示基准股可能被高估。

- 下一次财报预计将在94天后发布。

Turn $1000 into $1270 in just 20 days?

在短短20天内将1000美元变成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

一位拥有20年经验的期权交易员揭示了他的单行图表技巧,帮助判断何时买入和卖出。复制他的交易,这些交易每20天平均获得27%的利润。点击这里获取访问权限。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Quantum Computing with Benzinga Pro for real-time alerts.

交易期权涉及更大的风险,但也提供了更高利润的潜力。精明的交易者通过持续教育、战略性交易调整、利用各种因子以及关注市场动态来降低这些风险。通过Benzinga Pro跟踪最新的量子计算概念期权交易,获取实时警报。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with QUBT, it often means somebody knows something is about to happen.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with QUBT, it often means somebody knows something is about to happen.