Behind the Scenes of Qualcomm's Latest Options Trends

Behind the Scenes of Qualcomm's Latest Options Trends

Whales with a lot of money to spend have taken a noticeably bearish stance on Qualcomm.

有大量资金的鲸鱼对高通采取了明显的看淡态度。

Looking at options history for Qualcomm (NASDAQ:QCOM) we detected 10 trades.

查看高通(纳斯达克:QCOM)的期权历史,我们检测到10笔交易。

If we consider the specifics of each trade, it is accurate to state that 20% of the investors opened trades with bullish expectations and 50% with bearish.

如果我们考虑每笔交易的具体情况,可以准确地说,20%的投资者以看涨的预期开盘交易,50%以看跌的预期开盘。

From the overall spotted trades, 3 are puts, for a total amount of $103,238 and 7, calls, for a total amount of $449,504.

从整体发现的交易中,3笔为看跌期权,总金额为$103,238,7笔为看涨期权,总金额为$449,504。

Projected Price Targets

预计价格目标

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $105.0 to $200.0 for Qualcomm over the last 3 months.

考虑到这些合约的成交量和未平仓合约,看来鲸鱼在过去3个月内一直在高通上锁定从$105.0到$200.0的价格区间。

Insights into Volume & Open Interest

成交量和持仓量分析

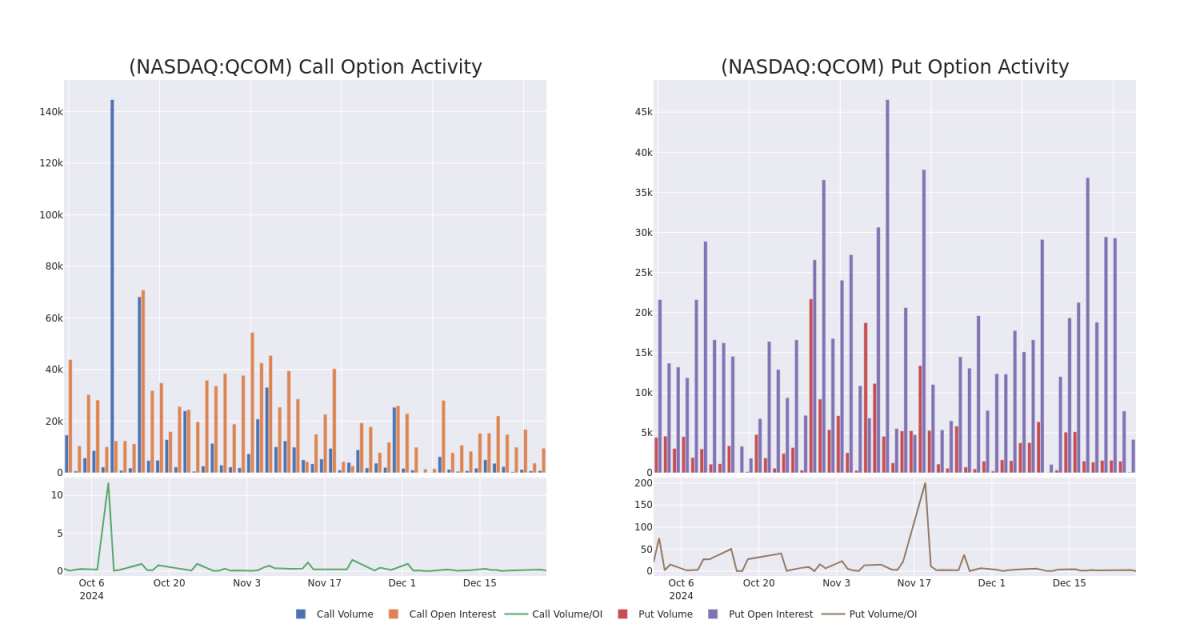

In terms of liquidity and interest, the mean open interest for Qualcomm options trades today is 1371.1 with a total volume of 892.00.

在流动性和兴趣方面,今天高通期权交易的平均未平仓合约为1371.1,总成交量为892.00。

In the following chart, we are able to follow the development of volume and open interest of call and put options for Qualcomm's big money trades within a strike price range of $105.0 to $200.0 over the last 30 days.

在下图中,我们能够跟踪过去30天内高通在105.0美元到200.0美元的行使价格区间内看涨和看跌期权的大额交易的成交量和未平仓合约的发展。

Qualcomm Option Activity Analysis: Last 30 Days

高通期权活动分析:过去30天

Biggest Options Spotted:

最大的期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| QCOM | CALL | TRADE | BEARISH | 01/17/25 | $6.0 | $5.5 | $5.5 | $155.00 | $194.1K | 5.5K | 371 |

| QCOM | CALL | SWEEP | NEUTRAL | 01/15/27 | $55.0 | $49.95 | $52.79 | $125.00 | $52.7K | 49 | 10 |

| QCOM | PUT | SWEEP | BEARISH | 02/21/25 | $13.35 | $13.3 | $13.35 | $165.00 | $52.0K | 2.5K | 52 |

| QCOM | CALL | TRADE | BEARISH | 01/17/25 | $52.55 | $51.5 | $51.5 | $105.00 | $51.5K | 1.2K | 10 |

| QCOM | CALL | TRADE | BEARISH | 01/31/25 | $1.18 | $1.1 | $1.1 | $175.00 | $44.0K | 76 | 402 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 行权价 | 总交易价格 | 未平仓合约 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| QCOM | 看涨 | 交易 | 看淡 | 01/17/25 | $6.0 | $5.5 | $5.5 | $155.00 | $194.1K | 5.5K | 371 |

| QCOM | 看涨 | 扫单 | 中立 | 01/15/27 | $55.0 | $49.95 | $52.79 | $125.00 | $52.7K | 49 | 10 |

| QCOM | 看跌 | 扫单 | 看淡 | 02/21/25 | $13.35 | $13.3 | $13.35 | $165.00 | $52.0K | 2.5K | 52 |

| QCOM | 看涨 | 交易 | 看淡 | 01/17/25 | $52.55 | $51.5 | $51.5 | $105.00 | 51500美元 | 1.2K | 10 |

| QCOM | 看涨 | 交易 | 看淡 | 01/31/25 | $1.18 | $1.1 | $1.1 | $175.00 | $44.0K | 76 | 402 |

About Qualcomm

关于高通

Qualcomm develops and licenses wireless technology and designs chips for smartphones. The company's key patents revolve around CDMA and OFDMA technologies, which are standards in wireless communications that are the backbone of all 3G, 4G, and 5G networks. Qualcomm's IP is licensed by virtually all wireless device makers. The firm is also the world's largest wireless chip vendor, supplying nearly every premier handset maker with leading-edge processors. Qualcomm also sells RF-front end modules into smartphones, as well as chips into automotive and Internet of Things markets.

高通开发和授权无线技术,并为智能手机设计芯片。公司的关键专利围绕CDMA和OFDMA技术,这些都是无线通信的标准,是所有3G、4G和5G网络的支柱。几乎所有无线设备制造商都获得了高通的知识产权许可。该公司还是全球最大的无线芯片供应商,为几乎所有顶级手机制造商提供尖端处理器。高通还向智能手机销售射频前端模块,以及向汽车和物联网市场销售芯片。

Following our analysis of the options activities associated with Qualcomm, we pivot to a closer look at the company's own performance.

在分析了与高通相关的期权活动后,我们开始关注该公司的自身表现。

Qualcomm's Current Market Status

高通的当前市场状况

- With a volume of 1,611,809, the price of QCOM is down -1.23% at $156.58.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 33 days.

- QCOM的成交量为1,611,809,价格下跌1.23%,现为156.58美元。

- 相对强弱指数因子暗示底层股票目前在超买和超卖之间处于中立状态。

- 下一次财报预计将在33天后发布。

Professional Analyst Ratings for Qualcomm

高通的专业分析师评级

Over the past month, 1 industry analysts have shared their insights on this stock, proposing an average target price of $180.0.

在过去一个月里,1位行业分析师分享了他们对该股票的见解,提出平均目标价为180.0美元。

Unusual Options Activity Detected: Smart Money on the Move

检测到期权异动:聪明资金正在行动

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* Reflecting concerns, an analyst from Melius Research lowers its rating to Hold with a new price target of $180.

Benzinga Edge的期权异动版块在市场动向发生之前发现潜在的市场驱动因素。看看大资金在你喜爱的股票上采取了哪些头寸。点击这里获取访问权限。* 反映出担忧,Melius Research的一位分析师将其评级下调至持有,并设定新的目标价为180美元。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Qualcomm with Benzinga Pro for real-time alerts.

交易期权涉及更大的风险,但也提供了更高利润的潜力。精明的交易者通过持续教育、战略交易调整、利用各种因子,并保持对市场动态的敏锐洞察来减轻这些风险。通过Benzinga Pro跟进高通的最新期权交易,获取实时警报。

From the overall spotted trades, 3 are puts, for a total amount of $103,238 and 7, calls, for a total amount of $449,504.

From the overall spotted trades, 3 are puts, for a total amount of $103,238 and 7, calls, for a total amount of $449,504.