Looking At Accenture's Recent Unusual Options Activity

Looking At Accenture's Recent Unusual Options Activity

Financial giants have made a conspicuous bullish move on Accenture. Our analysis of options history for Accenture (NYSE:ACN) revealed 18 unusual trades.

金融巨头们对埃森哲采取了显著的看好举动。我们对埃森哲(纽交所:ACN)期权历史的分析揭示了18个异常交易。

Delving into the details, we found 44% of traders were bullish, while 38% showed bearish tendencies. Out of all the trades we spotted, 4 were puts, with a value of $127,780, and 14 were calls, valued at $962,800.

深入分析后,我们发现44%的交易者持看好态度,38%表现出看淡倾向。在我们发现的所有交易中,有4个看跌期权,价值127,780美元,和14个看涨期权,价值962,800美元。

What's The Price Target?

价格目标是什么?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $320.0 to $410.0 for Accenture over the last 3 months.

考虑到这些合约的成交量和未平仓合约,似乎大户在过去三个月内一直在针对埃森哲的目标价格区间为320.0美元到410.0美元。

Analyzing Volume & Open Interest

分析成交量和未平仓合约

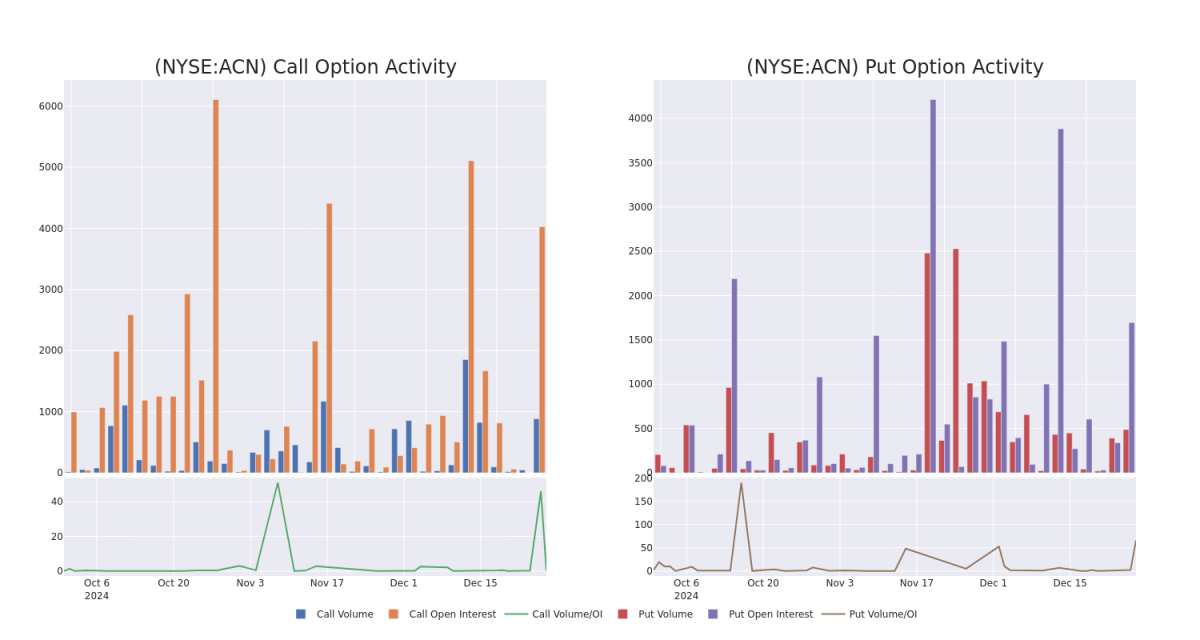

In today's trading context, the average open interest for options of Accenture stands at 381.53, with a total volume reaching 1,372.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Accenture, situated within the strike price corridor from $320.0 to $410.0, throughout the last 30 days.

在今天的交易背景下,埃森哲期权的平均未平仓合约量为381.53,总成交量达到1,372.00。随附的图表描绘了埃森哲高价值交易中看涨和看跌期权的成交量和未平仓合约的变化情况,位于320.0美元到410.0美元的行权价格区间,在过去30天内。

Accenture Option Activity Analysis: Last 30 Days

Accenture期权活动分析:过去30天

Noteworthy Options Activity:

值得注意的期权活动:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ACN | CALL | TRADE | BULLISH | 06/20/25 | $23.3 | $22.6 | $23.06 | $360.00 | $196.0K | 566 | 86 |

| ACN | CALL | TRADE | BEARISH | 06/20/25 | $49.3 | $48.1 | $48.58 | $320.00 | $194.3K | 181 | 40 |

| ACN | CALL | TRADE | BULLISH | 05/16/25 | $22.1 | $21.6 | $21.9 | $355.00 | $109.5K | 233 | 0 |

| ACN | CALL | TRADE | BEARISH | 09/19/25 | $18.3 | $17.4 | $17.49 | $390.00 | $76.9K | 117 | 106 |

| ACN | CALL | TRADE | BULLISH | 01/17/25 | $5.9 | $5.8 | $5.9 | $357.50 | $53.6K | 0 | 93 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 行权价 | 总交易价格 | 未平仓合约 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ACN | 看涨 | 交易 | 看好 | 06/20/25 | $23.3 | $22.6 | $23.06 | $360.00 | $196.0K | 566 | 86 |

| ACN | 看涨 | 交易 | 看淡 | 06/20/25 | $49.3 | $48.1 | $48.58 | $320.00 | 194.3K美元 | 181 | 40 |

| ACN | 看涨 | 交易 | 看好 | 05/16/25 | $22.1 | $21.6 | $21.9 | $355.00 | ¥109.5K | 233 | 0 |

| ACN | 看涨 | 交易 | 看淡 | 09/19/25 | $18.3 | $17.4 | $17.49 | $390.00 | 76.9K美元 | 117 | 106 |

| ACN | 看涨 | 交易 | 看好 | 01/17/25 | $5.9 | $5.8 | $5.9 | $357.50 | $53.6K | 0 | 93 |

About Accenture

关于埃森哲

Accenture is a leading global IT services firm that provides consulting, strategy, and technology and operational services. These services run the gamut from aiding enterprises with digital transformation to procurement services to software system integration. The company provides its IT offerings to a variety of sectors, including communications, media and technology, financial services, health and public services, consumer products, and resources. Accenture employs just under 500,000 people throughout 200 cities in 51 countries.

埃森哲是一家领先的全球IT服务公司,提供咨询、战略、科技和运营服务。这些服务涵盖了从帮助企业进行数字化转型到采购服务再到软件系统集成的方方面面。该公司向多个行业提供其IT产品,包括通信-半导体、媒体与科技、金融服务、健康与公共服务、消费产品以及资源。埃森哲在51个国家的200个城市中雇佣了近50万人。

In light of the recent options history for Accenture, it's now appropriate to focus on the company itself. We aim to explore its current performance.

鉴于近期埃森哲的期权历史,现在适合关注公司本身。我们旨在探索其当前的表现。

Current Position of Accenture

埃森哲的当前位置

- Currently trading with a volume of 515,604, the ACN's price is down by -1.08%, now at $356.54.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 83 days.

- 当前成交量为515,604,ACN的价格下跌了-1.08%,现在为$356.54。

- RSI读数表明该股票目前在超买和超卖之间保持中立。

- 预计在83天后发布财报。

Expert Opinions on Accenture

关于Accenture的专家意见

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $413.2.

在过去30天内,总共有5位专业分析师对该股票进行了评估,设定了平均目标价为413.2美元。

Turn $1000 into $1270 in just 20 days?

在短短20天内将1000美元变成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* In a positive move, an analyst from Goldman Sachs has upgraded their rating to Buy and adjusted the price target to $420. * An analyst from Baird has revised its rating downward to Neutral, adjusting the price target to $370. * Maintaining their stance, an analyst from UBS continues to hold a Buy rating for Accenture, targeting a price of $455. * Consistent in their evaluation, an analyst from BMO Capital keeps a Market Perform rating on Accenture with a target price of $425. * An analyst from JP Morgan persists with their Overweight rating on Accenture, maintaining a target price of $396.

一位从业20年的期权专业交易员揭示了他的一行图表技术,显示了何时买入和卖出。复制他的交易,这些交易在每20天的平均利润为27%。点击此处获取访问权限。* 在积极的举措中,来自高盛的分析师已将其评级提高至买入,并调整目标价至420美元。* 来自贝尔德的分析师已将其评级下调至中立,调整目标价至370美元。* 坚持他们的立场,来自瑞士银行的分析师继续持有埃森哲的买入评级,目标价为455美元。* 在评估上保持一致,来自BMO资本的分析师对埃森哲保持市场表现评级,目标价为425美元。* 来自摩根大通的分析师坚持对埃森哲的增持评级,目标价保持396美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Accenture options trades with real-time alerts from Benzinga Pro.

期权交易带来了更高的风险和潜在的回报。聪明的交易者通过不断自我教育、调整策略、监控多个因子并密切关注市场动态来管理这些风险。通过Benzinga Pro的实时提醒,获取最新的埃森哲期权交易信息。

In today's trading context, the average open interest for options of Accenture stands at 381.53, with a total volume reaching 1,372.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Accenture, situated within the strike price corridor from $320.0 to $410.0, throughout the last 30 days.

In today's trading context, the average open interest for options of Accenture stands at 381.53, with a total volume reaching 1,372.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Accenture, situated within the strike price corridor from $320.0 to $410.0, throughout the last 30 days.