What the Options Market Tells Us About Shopify

What the Options Market Tells Us About Shopify

Whales with a lot of money to spend have taken a noticeably bearish stance on Shopify.

拥有大量资金的投资者对Shopify采取了明显的看淡态度。

Looking at options history for Shopify (NYSE:SHOP) we detected 14 trades.

查看Shopify(纽交所:SHOP)的期权历史,我们检测到14笔交易。

If we consider the specifics of each trade, it is accurate to state that 28% of the investors opened trades with bullish expectations and 42% with bearish.

如果我们考虑每笔交易的具体情况,可以准确地说,28%的投资者以看好的预期打开了交易,42%则是以看淡的预期。

From the overall spotted trades, 5 are puts, for a total amount of $179,950 and 9, calls, for a total amount of $707,111.

在所有发现的交易中,有5笔是看跌期权,总金额为179,950美元,9笔是看涨期权,总金额为707,111美元。

What's The Price Target?

价格目标是什么?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $55.0 and $120.0 for Shopify, spanning the last three months.

经过评估交易量和未平仓合约后,显而易见,主要市场推动者正专注于shopify在55.0美元和120.0美元之间的价格区间,跨越过去三个月。

Analyzing Volume & Open Interest

分析成交量和未平仓合约

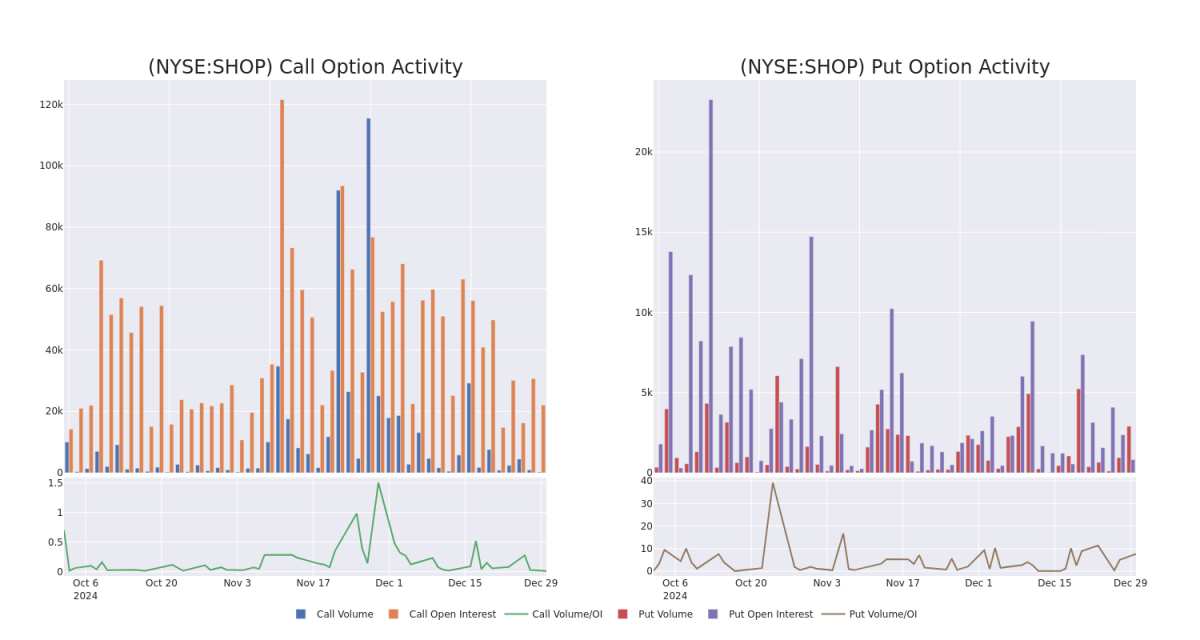

In today's trading context, the average open interest for options of Shopify stands at 2545.89, with a total volume reaching 3,152.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Shopify, situated within the strike price corridor from $55.0 to $120.0, throughout the last 30 days.

在今天的交易环境中,Shopify的期权平均未平仓合约为2545.89,总成交量达到3,152.00。附图描绘了过去30天中,在执行价格区间为55.0到120.0之间,Shopify高价值交易的看涨和看跌期权成交量及未平仓合约的变化。

Shopify 30-Day Option Volume & Interest Snapshot

Shopify 30天期权成交量和持仓量简介

Significant Options Trades Detected:

检测到重大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SHOP | CALL | TRADE | NEUTRAL | 03/21/25 | $37.35 | $36.55 | $37.0 | $70.00 | $366.3K | 1.6K | 0 |

| SHOP | CALL | TRADE | NEUTRAL | 09/19/25 | $19.95 | $18.05 | $19.09 | $105.00 | $74.4K | 199 | 42 |

| SHOP | CALL | TRADE | BEARISH | 03/21/25 | $9.45 | $9.4 | $9.4 | $110.00 | $47.0K | 1.1K | 79 |

| SHOP | CALL | SWEEP | BULLISH | 01/17/25 | $45.6 | $44.9 | $45.6 | $60.00 | $45.6K | 3.4K | 20 |

| SHOP | PUT | SWEEP | BEARISH | 01/03/25 | $1.75 | $1.66 | $1.74 | $105.00 | $43.7K | 379 | 572 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 行权价 | 总交易价格 | 未平仓合约 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Shopify | 看涨 | 交易 | 中立 | 03/21/25 | $37.35 | $36.55 | $37.0 | $70.00 | $366.3K | 1.6K | 0 |

| Shopify | 看涨 | 交易 | 中立 | 09/19/25 | $19.95 | $18.05 | $19.09 | $105.00 | 74.4K美元 | 199 | 42 |

| Shopify | 看涨 | 交易 | 看淡 | 03/21/25 | $9.45 | $9.4 | $9.4 | $110.00 | $47.0K | 1.1千 | 79 |

| Shopify | 看涨 | 扫单 | 看好 | 01/17/25 | $45.6 | $44.9 | $45.6 | $60.00 | $45.6K | 3.4K | 20 |

| Shopify | 看跌 | 扫单 | 看淡 | 01/03/25 | $1.75 | $1.66 | $1.74 | $105.00 | $43.7K | 379 | 572 |

About Shopify

关于shopify

Shopify offers an e-commerce platform primarily to small and medium-size businesses. The firm has two segments. The subscription solutions segment allows Shopify merchants to conduct e-commerce on a variety of platforms, including the company's website, physical stores, pop-up stores, kiosks, social networks (Facebook), and Amazon. The merchant solutions segment offers add-on products for the platform that facilitate e-commerce and include Shopify Payments, Shopify Shipping, and Shopify Capital.

Shopify主要为中小型企业提供电子商务平台。该公司有两个业务部分。订阅解决方案部分允许Shopify商户在多种平台上进行电子商务,包括公司的官方网站、实体店、快闪店、售货亭、社交网络(Facebook)和亚马逊。商户解决方案部分提供增值产品,以促进电子商务,包括Shopify支付、Shopify运送和Shopify资本。

Following our analysis of the options activities associated with Shopify, we pivot to a closer look at the company's own performance.

在对与Shopify相关的期权活动进行分析后,我们转向更仔细地观察该公司的自身表现。

Shopify's Current Market Status

Shopify当前市场状态

- Currently trading with a volume of 1,963,164, the SHOP's price is down by -1.43%, now at $106.63.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 43 days.

- 目前成交量为1,963,164,SHOP的价格下跌了1.43%,现在为106.63美元。

- RSI读数表明该股票目前在超买和超卖之间保持中立。

- 预计盈利发布将在43天后。

Expert Opinions on Shopify

关于Shopify的专家意见

Over the past month, 3 industry analysts have shared their insights on this stock, proposing an average target price of $126.66666666666667.

在过去一个月里,3位行业分析师分享了他们对这只股票的见解,提出了平均目标价为126.67美元。

Unusual Options Activity Detected: Smart Money on the Move

检测到期权异动:聪明资金正在行动

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* Reflecting concerns, an analyst from JMP Securities lowers its rating to Market Outperform with a new price target of $120.* An analyst from JMP Securities downgraded its action to Market Outperform with a price target of $120. * In a positive move, an analyst from Loop Capital has upgraded their rating to Buy and adjusted the price target to $140.

Benzinga Edge的期权异动板块在潜在市场动向发生之前就发现它们。查看大资金在你喜爱的股票上采取了什么仓位。点击这里获取访问权限。* 反映出顾虑,JMP证券的一位分析师将其评级下调至市场表现优于市场,并调整新的目标价为120美元。* JMP证券的一位分析师将其评级下调至市场表现优于市场,目标价为120美元。* 在一个积极的举动中,Loop Capital的一位分析师已将其评级上调至买入,并将目标价调整至140美元。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

与仅仅交易股票相比,期权是一种风险较高的资产,但它们具有更高的盈利潜力。严肃的期权交易者通过日常学习、逐步进出交易、关注多个因子以及密切关注市场来管理这种风险。

From the overall spotted trades, 5 are puts, for a total amount of $179,950 and 9, calls, for a total amount of $707,111.

From the overall spotted trades, 5 are puts, for a total amount of $179,950 and 9, calls, for a total amount of $707,111.