EQT Unusual Options Activity For December 30

EQT Unusual Options Activity For December 30

Financial giants have made a conspicuous bearish move on EQT. Our analysis of options history for EQT (NYSE:EQT) revealed 9 unusual trades.

金融巨头在EQT上做出了明显的看淡举动。我们对EQT(纽交所:EQT)的期权历史分析显示有9笔期权异动。

Delving into the details, we found 33% of traders were bullish, while 55% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $85,152, and 7 were calls, valued at $508,455.

深入分析后,我们发现33%的交易者看好,而55%表现出看淡的倾向。在我们发现的所有交易中,有2笔看跌期权,金额为$85,152,7笔看涨期权,金额为$508,455。

What's The Price Target?

价格目标是什么?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $42.0 and $50.0 for EQT, spanning the last three months.

通过评估成交量和未平仓合约,明显可以看出主要市场参与者在过去三个月内将EQT的价格区间主要集中在$42.0到$50.0之间。

Volume & Open Interest Development

成交量和持仓量的评估是期权交易中的一个关键步骤。这些指标揭示了阿里巴巴集团(Alibaba Gr Hldgs)特定执行价格期权的流动性和投资者兴趣。下面的数据可视化了在过去30天内,阿里巴巴集团(Alibaba Gr Hldgs)在执行价格在74.0美元到120.0美元区间内的看涨看跌期权中,成交量和持仓量的波动情况。

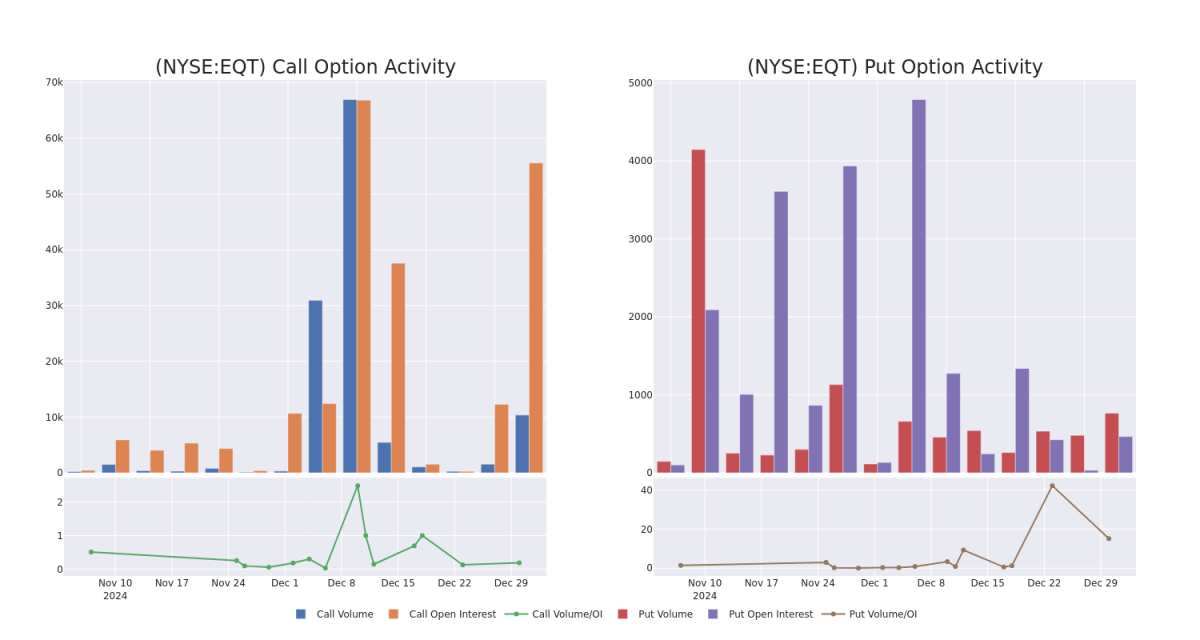

In terms of liquidity and interest, the mean open interest for EQT options trades today is 7005.88 with a total volume of 11,123.00.

在流动性和兴趣方面,今天EQT期权交易的平均未平仓合约为7005.88,总成交量为11,123.00。

In the following chart, we are able to follow the development of volume and open interest of call and put options for EQT's big money trades within a strike price range of $42.0 to $50.0 over the last 30 days.

在下图中,我们可以跟踪过去30天EQT大额交易的看涨期权和看跌期权的成交量及未平仓合约的发展,执行价格范围在$42.0到$50.0之间。

EQT Call and Put Volume: 30-Day Overview

EQT看涨期权和看跌期权成交量:30天概览

Biggest Options Spotted:

最大的期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| EQT | CALL | SWEEP | BEARISH | 06/20/25 | $3.2 | $3.15 | $3.15 | $50.00 | $174.1K | 11.1K | 1.0K |

| EQT | CALL | TRADE | BEARISH | 01/17/25 | $0.51 | $0.43 | $0.45 | $50.00 | $92.6K | 13.0K | 5.3K |

| EQT | CALL | SWEEP | BULLISH | 01/17/25 | $0.46 | $0.46 | $0.46 | $50.00 | $92.2K | 13.0K | 2.3K |

| EQT | CALL | SWEEP | BULLISH | 01/17/25 | $1.18 | $1.14 | $1.15 | $47.50 | $56.0K | 2 | 487 |

| EQT | PUT | SWEEP | BEARISH | 01/31/25 | $0.54 | $0.51 | $0.54 | $42.00 | $47.9K | 45 | 671 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 行权价 | 总交易价格 | 未平仓合约 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| EQT能源 | 看涨 | 扫单 | 看淡 | 06/20/25 | $3.2 | $3.15 | $3.15 | $50.00 | ¥174.1K | 11.1K | 1.0K |

| EQT能源 | 看涨 | 交易 | 看淡 | 01/17/25 | $0.51 | $0.43 | $0.45 | $50.00 | $92.6K | 13.0K | 5.3K |

| EQT能源 | 看涨 | 扫单 | 看好 | 01/17/25 | $0.46 | $0.46 | $0.46 | $50.00 | 92.2K美元 | 13.0K | 2.3K |

| EQT能源 | 看涨 | 扫单 | 看好 | 01/17/25 | $1.18 | $1.14 | $1.15 | $47.50 | $56.0K | 2 | 487 |

| EQT能源 | 看跌 | 扫单 | 看淡 | 01/31/25 | $0.54 | $0.51 | $0.54 | $42.00 | $47.9K | 45 | 671 |

About EQT

关于EQT

EQT Corp is an independent natural gas production company with operations focused in the Marcellus and Utica shale plays in the Appalachian Basin. At year-end 2023, EQT's proven reserves totaled 27.6 trillion cubic feet equivalent, with net production of 5.79 billion cubic feet equivalent per day. Natural gas accounted for 94% of production.

EQT能源是一家独立的天然气生产公司,主要在阿巴拉契亚盆地的马塞勒斯和尤蒂卡页岩区进行生产。到2023年年末,EQT的已探明储量总计为27.6万亿立方英尺,相当于每天净生产57.9亿立方英尺。天然气占生产总量的94%。

Having examined the options trading patterns of EQT, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在分析EQT的期权交易模式后,我们的注意力现在直接转向公司本身。这一转变使我们能够深入了解其当前的市场地位和表现。

Current Position of EQT

EQT的当前市场地位

- Currently trading with a volume of 4,936,372, the EQT's price is up by 4.56%, now at $46.34.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 43 days.

- 目前,EQT的成交量为4,936,372,价格上涨了4.56%,现报46.34美元。

- RSI读数表明该股票目前可能接近超买状态。

- 预计盈利发布将在43天后。

What The Experts Say On EQT

专家对EQT的看法

In the last month, 4 experts released ratings on this stock with an average target price of $51.75.

在过去一个月中,4位专家对这只股票发布了评级,平均目标价为51.75美元。

Unusual Options Activity Detected: Smart Money on the Move

检测到期权异动:聪明资金正在行动

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* An analyst from Citigroup has decided to maintain their Buy rating on EQT, which currently sits at a price target of $51. * An analyst from Bernstein downgraded its action to Market Perform with a price target of $50. * Showing optimism, an analyst from Mizuho upgrades its rating to Outperform with a revised price target of $57. * An analyst from RBC Capital downgraded its action to Sector Perform with a price target of $49.

Benzinga Edge的期权异动板块在潜在市场变动发生之前识别出市场动向。看看大资金在你最喜欢的股票上采取了什么仓位。点击此处获取访问权限。* 花旗集团的分析师决定维持对EQT的买入评级,目前目标价为51美元。* Bernstein的分析师将其评级下调至市场表现,目标价为50美元。* Mizuho的分析师表现出乐观,将其评级上调至跑赢大盘,修订后的目标价为57美元。* RBC Capital的分析师将其评级下调至板块表现,目标价为49美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest EQT options trades with real-time alerts from Benzinga Pro.

期权交易带来更高的风险和潜在收益。精明的交易者通过不断自我教育、调整策略、监控多个因子,以及密切关注市场动态来管理这些风险。通过Benzinga Pro提供的实时警报,及时了解最新的EQT期权交易信息。

In terms of liquidity and interest, the mean open interest for EQT options trades today is 7005.88 with a total volume of 11,123.00.

In terms of liquidity and interest, the mean open interest for EQT options trades today is 7005.88 with a total volume of 11,123.00.