Spotlight on JPMorgan Chase: Analyzing the Surge in Options Activity

Spotlight on JPMorgan Chase: Analyzing the Surge in Options Activity

Whales with a lot of money to spend have taken a noticeably bearish stance on JPMorgan Chase.

手握大量资金的鲸鱼们在摩根大通上采取了明显的看淡态度。

Looking at options history for JPMorgan Chase (NYSE:JPM) we detected 8 trades.

查看摩根大通(纽交所:JPM)的期权历史,我们发现了8笔交易。

If we consider the specifics of each trade, it is accurate to state that 12% of the investors opened trades with bullish expectations and 87% with bearish.

如果我们考虑每笔交易的具体情况,可以准确地说,12%的投资者是以看好的预期进行交易的,而87%则是以看淡的预期进行交易的。

From the overall spotted trades, 2 are puts, for a total amount of $97,315 and 6, calls, for a total amount of $348,620.

从发现的交易整体来看,有2笔是看跌期权,总金额为$97,315,6笔是看涨期权,总金额为$348,620。

Expected Price Movements

预期价格变动

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $200.0 to $260.0 for JPMorgan Chase during the past quarter.

分析这些合约的成交量和未平仓合约,似乎大型投资者在过去一个季度内关注摩根大通的价格区间为$200.0到$260.0。

Insights into Volume & Open Interest

成交量和持仓量分析

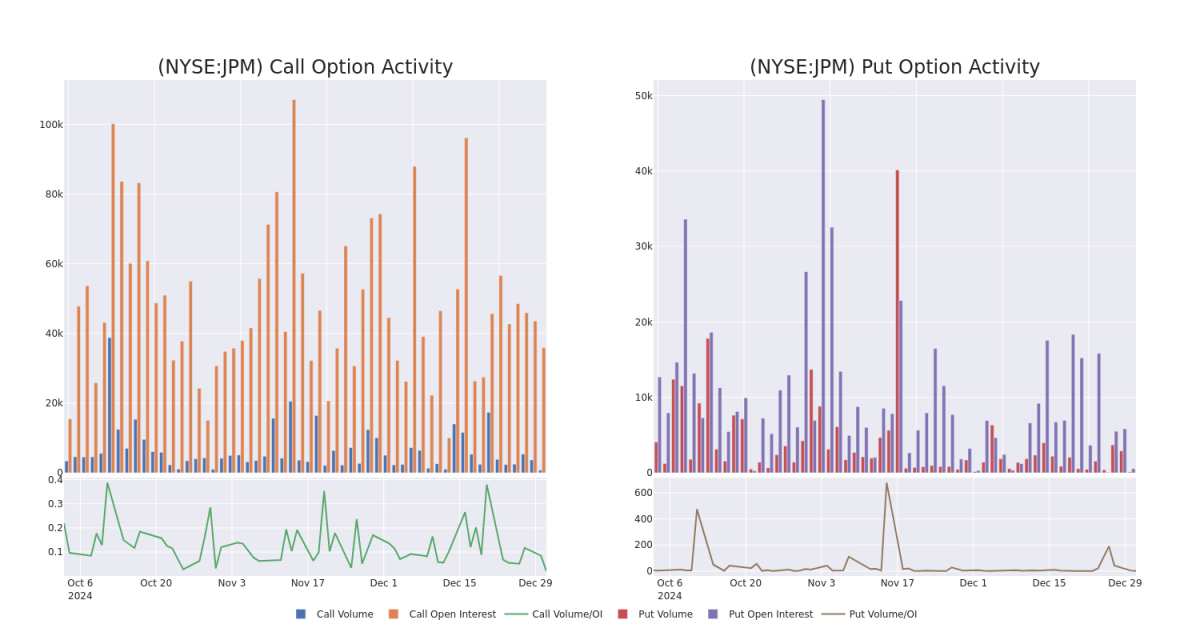

In today's trading context, the average open interest for options of JPMorgan Chase stands at 5213.71, with a total volume reaching 878.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in JPMorgan Chase, situated within the strike price corridor from $200.0 to $260.0, throughout the last 30 days.

在今天的交易环境中,摩根大通期权的平均未平仓合约为5213.71,总成交量达到878.00。附图描绘了摩根大通看涨期权和看跌期权的成交量及未平仓合约的进展,位于$200.0到$260.0的行权价区间内,覆盖过去30天的高价值交易。

JPMorgan Chase Call and Put Volume: 30-Day Overview

JP摩根大通看涨和看跌期权成交量:30天概览

Significant Options Trades Detected:

检测到重大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| JPM | CALL | SWEEP | BEARISH | 06/20/25 | $8.15 | $8.0 | $8.0 | $260.00 | $84.0K | 1.1K | 105 |

| JPM | CALL | TRADE | BULLISH | 01/15/27 | $27.8 | $26.55 | $27.8 | $260.00 | $77.8K | 1.2K | 28 |

| JPM | CALL | SWEEP | BEARISH | 01/17/25 | $2.01 | $1.88 | $1.88 | $250.00 | $75.4K | 14.9K | 402 |

| JPM | CALL | SWEEP | BEARISH | 01/17/25 | $5.8 | $5.65 | $5.65 | $240.00 | $56.5K | 11.4K | 203 |

| JPM | PUT | SWEEP | BEARISH | 03/21/25 | $11.85 | $11.75 | $11.83 | $245.00 | $49.7K | 547 | 42 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 行权价 | 总交易价格 | 未平仓合约 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 摩根大通 | 看涨 | 扫单 | 看淡 | 06/20/25 | $8.15 | $8.0 | $8.0 | $260.00 | $84.0K | 1.1千 | 105 |

| 摩根大通 | 看涨 | 交易 | 看好 | 01/15/27 | $27.8 | $26.55 | $27.8 | $260.00 | $77.8K | 1.2K | 28 |

| 摩根大通 | 看涨 | 扫单 | 看淡 | 01/17/25 | $2.01 | $1.88 | $1.88 | $250.00 | 75,400美元 | 14.9K | 402 |

| 摩根大通 | 看涨 | 扫单 | 看淡 | 01/17/25 | $5.8 | $5.65 | $5.65 | $240.00 | $56.5K | 11.4K | 203 |

| 摩根大通 | 看跌 | 扫单 | 看淡 | 03/21/25 | $11.85 | $11.75 | $11.83 | $245.00 | 49.7千美元 | 547 | 42 |

About JPMorgan Chase

关于摩根大通

JPMorgan Chase is one of the largest and most complex financial institutions in the United States, with nearly $4.1 trillion in assets. It is organized into four major segments--consumer and community banking, corporate and investment banking, commercial banking, and asset and wealth management. JPMorgan operates, and is subject to regulation, in multiple countries.

摩根大通是美国最大且最复杂的金融机构之一,资产接近4.1万亿。它分为四个主要板块——消费与社区银行、公司与投资银行、商业银行以及资产与财富管理。摩根大通在多个国家运营,并受到监管。

Following our analysis of the options activities associated with JPMorgan Chase, we pivot to a closer look at the company's own performance.

在分析了与摩根大通相关的期权活动后,我们转向更仔细地审视公司的自身表现。

Present Market Standing of JPMorgan Chase

JP摩根大通的现在市场状况

- With a trading volume of 346,133, the price of JPM is up by 0.74%, reaching $241.09.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 15 days from now.

- 在成交量为346,133的情况下,JPm的价格上涨了0.74%,达到了$241.09。

- 当前的相对强弱指标(RSI)值表明,该股票目前在超买和超卖之间处于中立状态。

- 下一个财报将于15天后发布。

Expert Opinions on JPMorgan Chase

摩根大通看好专家意见:

2 market experts have recently issued ratings for this stock, with a consensus target price of $264.5.

两位市场专家最近对这只股票发布了评级,市场一致目标价为264.5美元。

Turn $1000 into $1270 in just 20 days?

在短短20天内将1000美元变成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* An analyst from Piper Sandler has decided to maintain their Overweight rating on JPMorgan Chase, which currently sits at a price target of $275. * An analyst from Keefe, Bruyette & Woods has decided to maintain their Market Perform rating on JPMorgan Chase, which currently sits at a price target of $254.

一位有20年经验的期权交易员透露了他的单行图表技巧,显示何时买入和卖出。复制他的交易,平均每20天获利27%。点击这里获取访问权限。* 派杰投资的分析师决定维持对摩根大通的增持评级,当前目标价为275美元。* Keefe, Bruyette & Woods的分析师决定维持对摩根大通的市场表现评级,当前目标价为254美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest JPMorgan Chase options trades with real-time alerts from Benzinga Pro.

期权交易具有更高的风险和潜在的回报。精明的交易者通过不断学习、调整策略、监控多个因子和密切关注市场动态来管理这些风险。通过Benzinga Pro的实时提醒,随时了解最新的摩根大通期权交易。

From the overall spotted trades, 2 are puts, for a total amount of $97,315 and 6, calls, for a total amount of $348,620.

From the overall spotted trades, 2 are puts, for a total amount of $97,315 and 6, calls, for a total amount of $348,620.