Looking At KULR Tech Gr's Recent Unusual Options Activity

Looking At KULR Tech Gr's Recent Unusual Options Activity

Investors with a lot of money to spend have taken a bullish stance on KULR Tech Gr (AMEX:KULR).

资金雄厚的投资者对KULR科技集团(美交所:KULR)持看好态度。

And retail traders should know.

零售交易者应该了解这一点。

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

我们今天注意到这一点,当交易出现在我们在Benzinga跟踪的公共可用期权历史记录中时。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with KULR, it often means somebody knows something is about to happen.

我们不知道这些是机构还是只是富有的个人。但当KULR发生这么大的事情时,通常意味着有人知道即将发生的事情。

So how do we know what these investors just did?

那么我们怎么知道这些投资者刚刚做了什么呢?

Today, Benzinga's options scanner spotted 14 uncommon options trades for KULR Tech Gr.

今天,Benzinga的期权扫描仪发现了14个KULR科技集团的非凡期权交易。

This isn't normal.

这并不正常。

The overall sentiment of these big-money traders is split between 50% bullish and 35%, bearish.

这些大资金交易者的整体情绪分为50%的看好和35%的看淡。

Out of all of the special options we uncovered, 6 are puts, for a total amount of $379,860, and 8 are calls, for a total amount of $318,170.

在我们发现的所有特殊期权中,有6个是看跌期权,总金额为$379,860,而8个是看涨期权,总金额为$318,170。

Expected Price Movements

预期价格变动

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $1.0 and $9.0 for KULR Tech Gr, spanning the last three months.

经过对交易量和未平仓合约的评估,显然主要市场参与者正集中在KULR科技公司的价格区间在$1.0到$9.0之间,持续了过去三个月。

Volume & Open Interest Trends

成交量和未平仓量趋势

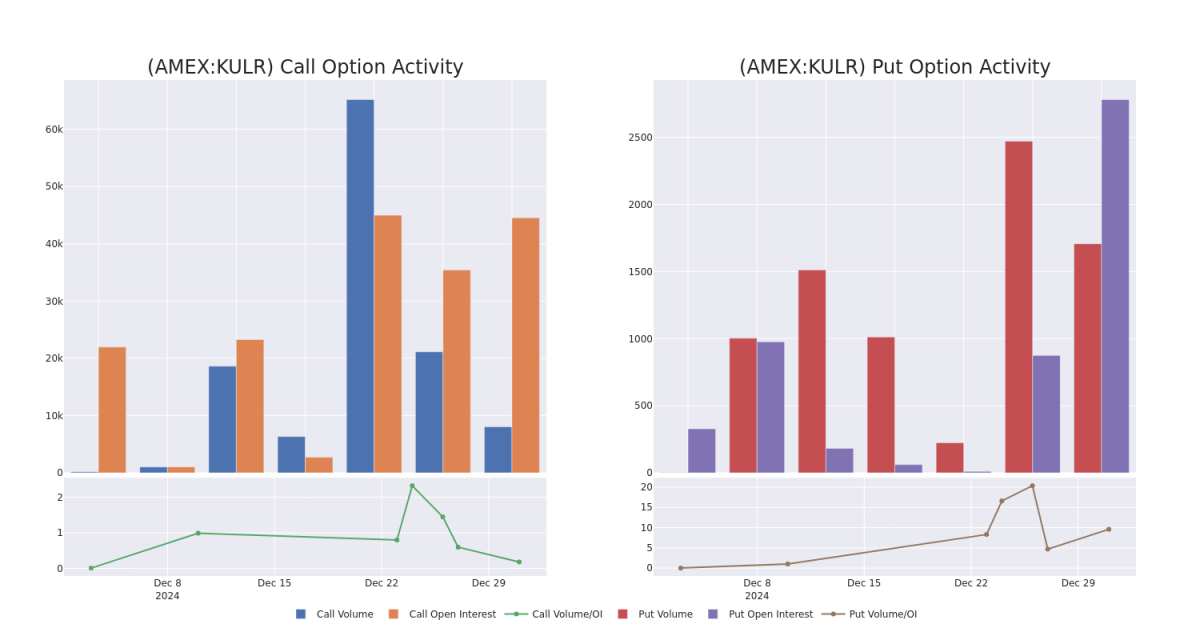

In today's trading context, the average open interest for options of KULR Tech Gr stands at 4301.27, with a total volume reaching 9,746.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in KULR Tech Gr, situated within the strike price corridor from $1.0 to $9.0, throughout the last 30 days.

在今天的交易环境中,KULR科技公司的期权平均未平仓合约为4301.27,成交量达到9,746.00。附带图表描绘了KULR科技公司在过去30天内,高价值交易的看涨和看跌期权的成交量及未平仓合约的发展。

KULR Tech Gr Option Volume And Open Interest Over Last 30 Days

KULR科技公司过去30天的期权成交量和未平仓合约

Biggest Options Spotted:

最大的期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| KULR | PUT | SWEEP | BULLISH | 01/15/27 | $6.1 | $5.8 | $5.8 | $7.50 | $136.7K | 110 | 486 |

| KULR | PUT | SWEEP | BULLISH | 07/18/25 | $5.3 | $5.2 | $5.2 | $7.50 | $65.0K | 381 | 130 |

| KULR | CALL | SWEEP | BEARISH | 01/17/25 | $0.25 | $0.2 | $0.2 | $5.00 | $64.3K | 13.2K | 5.5K |

| KULR | PUT | SWEEP | BULLISH | 01/15/27 | $6.1 | $5.9 | $5.9 | $7.50 | $49.5K | 110 | 168 |

| KULR | PUT | SWEEP | BULLISH | 01/15/27 | $6.1 | $5.9 | $5.9 | $7.50 | $49.5K | 110 | 84 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 行权价 | 总交易价格 | 未平仓合约 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| KULR | 看跌 | 扫单 | 看好 | 01/15/27 | $6.1 | $5.8 | $5.8 | $7.50 | $136.7K | 110 | 486 |

| KULR | 看跌 | 扫单 | 看好 | 07/18/25 | $5.3 | $5.2 | $5.2 | $7.50 | 65.0K美元 | 381 | 130 |

| KULR | 看涨 | 扫单 | 看淡 | 01/17/25 | $0.25 | $0.2 | $0.2 | $5.00 | $64.3K | 13.2K | 5.5K |

| KULR | 看跌 | 扫单 | 看好 | 01/15/27 | $6.1 | $5.9 | $5.9 | $7.50 | $49.5K | 110 | 168 |

| KULR | 看跌 | 扫单 | 看好 | 01/15/27 | $6.1 | $5.9 | $5.9 | $7.50 | $49.5K | 110 | 84 |

About KULR Tech Gr

关于KULR科技公司

KULR Technology Group Inc develops and commercializes high-performance thermal management technologies for electronics, batteries, and other components. The company is focused on targeting the following applications: electric vehicles and autonomous driving systems; artificial intelligence and Cloud computing; energy storage; and 5G communication technologies.

KULR科技集团公司开发并商业化高性能热管理技术,用于电子产品、电池和其他元件。该公司专注于以下应用:新能源汽车和自动驾驶系统;人工智能和云计算服务商;能源存储;以及5G通信技术。

In light of the recent options history for KULR Tech Gr, it's now appropriate to focus on the company itself. We aim to explore its current performance.

鉴于KULR科技集团近期的期权历史,现在是关注公司本身的适当时机。我们旨在探讨其目前的表现。

KULR Tech Gr's Current Market Status

KULR科技集团的当前市场状况

- Trading volume stands at 38,523,383, with KULR's price down by -21.01%, positioned at $3.27.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 101 days.

- 交易量为38,523,383,KULR的价格下跌了-21.01%,报$3.27。

- 相对强弱指数(RSI)因子显示该股票可能接近超买状态。

- 预计在101天内公布财报。

Expert Opinions on KULR Tech Gr

关于KULR科技集团的专家意见

A total of 1 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $5.0.

在过去30天里,共有1名专业分析师对这只股票进行了分析,设定了5.0美元的平均目标价。

Unusual Options Activity Detected: Smart Money on the Move

检测到期权异动:聪明资金正在行动

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* In a positive move, an analyst from Benchmark has upgraded their rating to Buy and adjusted the price target to $5.

Benzinga Edge的期权异动板块在市场发生之前发现潜在的市场动向。看看大资金在您最喜欢的股票上采取了什么头寸。单击此处以获取访问权限。* 在一个积极的举措中,Benchmark的分析师已将其评级上调至买入,并将目标价调整为5美元。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

与仅仅交易股票相比,期权是一种风险较高的资产,但它们具有更高的盈利潜力。严肃的期权交易者通过日常学习、逐步进出交易、关注多个因子以及密切关注市场来管理这种风险。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with KULR, it often means somebody knows something is about to happen.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with KULR, it often means somebody knows something is about to happen.