Decoding Bristol-Myers Squibb's Options Activity: What's the Big Picture?

Decoding Bristol-Myers Squibb's Options Activity: What's the Big Picture?

Financial giants have made a conspicuous bullish move on Bristol-Myers Squibb. Our analysis of options history for Bristol-Myers Squibb (NYSE:BMY) revealed 10 unusual trades.

金融巨头们在施贵宝上做出了显著的看好举动。我们对施贵宝(纽交所:BMY)的期权历史分析显示了10笔异常交易。

Delving into the details, we found 50% of traders were bullish, while 50% showed bearish tendencies. Out of all the trades we spotted, 4 were puts, with a value of $239,888, and 6 were calls, valued at $312,412.

深入分析后,我们发现50%的交易者看好,而50%则表现出看淡的倾向。在我们发现的所有交易中,有4笔为看跌,价值为239,888美元,6笔为看涨,价值为312,412美元。

What's The Price Target?

价格目标是什么?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $43.0 to $75.0 for Bristol-Myers Squibb during the past quarter.

分析这些合约的成交量和未平仓合约,似乎大玩家们在过去一个季度内关注施贵宝的价格区间为43.0美元至75.0美元。

Analyzing Volume & Open Interest

分析成交量和未平仓合约

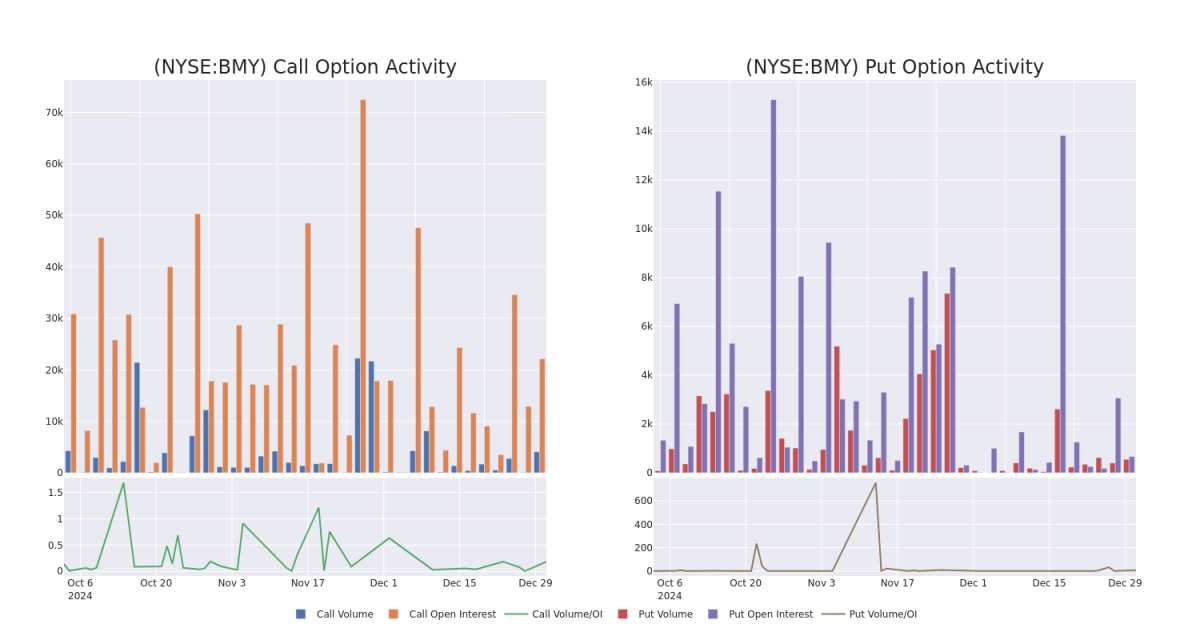

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

观察成交量和未平仓合约是进行股票尽职调查的一个有见地的方法。

This data can help you track the liquidity and interest for Bristol-Myers Squibb's options for a given strike price.

这些数据可以帮助你跟踪施贵宝在特定行权价的期权流动性和兴趣。

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Bristol-Myers Squibb's whale activity within a strike price range from $43.0 to $75.0 in the last 30 days.

下面,我们可以观察到施贵宝在过去30天内,在43.0美元至75.0美元的行权价区间内,看涨和看跌的成交量和未平仓合约的演变。

Bristol-Myers Squibb Call and Put Volume: 30-Day Overview

施贵宝看涨和看跌期权成交量:30天概览

Significant Options Trades Detected:

检测到重大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| BMY | PUT | SWEEP | BULLISH | 01/16/26 | $19.7 | $19.3 | $19.3 | $75.00 | $119.6K | 15 | 62 |

| BMY | CALL | SWEEP | BULLISH | 02/21/25 | $0.8 | $0.79 | $0.8 | $60.00 | $71.8K | 1.0K | 2.1K |

| BMY | CALL | TRADE | BEARISH | 01/17/25 | $14.05 | $13.4 | $13.47 | $43.00 | $67.3K | 2.9K | 50 |

| BMY | CALL | TRADE | BEARISH | 01/17/25 | $2.57 | $1.78 | $1.94 | $55.00 | $58.2K | 16.9K | 334 |

| BMY | CALL | SWEEP | BULLISH | 02/21/25 | $0.8 | $0.79 | $0.8 | $60.00 | $47.5K | 1.0K | 1.2K |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 行权价 | 总交易价格 | 未平仓合约 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| BMY | 看跌 | 扫单 | 看好 | 01/16/26 | $19.7 | $19.3 | $19.3 | $75.00 | 119.6K美元 | 15 | 62 |

| BMY | 看涨 | 扫单 | 看好 | 02/21/25 | $0.8 | $0.79 | $0.8 | $60.00 | $71.8K | 1.0K | 2.1K |

| BMY | 看涨 | 交易 | 看淡 | 01/17/25 | $14.05 | $13.4 | $13.47 | $43.00 | 67.3K美元 | 2.9K | 50 |

| BMY | 看涨 | 交易 | 看淡 | 01/17/25 | $2.57 | $1.78 | $1.94 | $55.00 | 58.2K美元 | 16.9K | 334 |

| BMY | 看涨 | 扫单 | 看好 | 02/21/25 | $0.8 | $0.79 | $0.8 | $60.00 | 4.75万美元 | 1.0K | 1.2K |

About Bristol-Myers Squibb

关于施贵宝

Bristol-Myers Squibb discovers, develops, and markets drugs for various therapeutic areas, such as cardiovascular, cancer, and immune disorders. A key focus for Bristol is immuno-oncology, where the firm is a leader in drug development. Bristol derives close to 70% of total sales from the US, showing a higher dependence on the US market than most of its peer group.

施贵宝发现、开发和销售各种治疗领域的药物,如心血管、癌症和免疫性疾病。施贵宝的重点是免疫肿瘤学,在这个领域公司在药物开发方面是领先者。施贵宝将近70%的总销售额来自美国,显示出比大多数同行更依赖美国市场。

In light of the recent options history for Bristol-Myers Squibb, it's now appropriate to focus on the company itself. We aim to explore its current performance.

鉴于施贵宝近期的期权历史,现在适合关注该公司本身。我们旨在探索其当前的表现。

Current Position of Bristol-Myers Squibb

施贵宝的当前状况

- With a trading volume of 3,126,940, the price of BMY is up by 0.74%, reaching $56.48.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 37 days from now.

- BMY的成交量为3,126,940,价格上涨0.74%,达到了56.48美元。

- 当前的相对强弱指标(RSI)值表明,该股票目前在超买和超卖之间处于中立状态。

- 下一个财报发布安排在37天后。

Professional Analyst Ratings for Bristol-Myers Squibb

施贵宝的专业分析师评级

A total of 2 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $66.5.

在过去的30天里,共有2名专业分析师对该股票给出了评价,设定的平均目标价为66.5美元。

Turn $1000 into $1270 in just 20 days?

在短短20天内将1000美元变成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* Showing optimism, an analyst from Jefferies upgrades its rating to Buy with a revised price target of $70. * Reflecting concerns, an analyst from B of A Securities lowers its rating to Neutral with a new price target of $63.

一位拥有20年经验的期权交易员揭示了他的单行图表技术,显示何时买入和卖出。复制他的交易,这些交易平均每20天获利27%。点击这里获取访问权限。* 显示乐观态度的是,Jefferies的一名分析师将其评级上调至买入,修订后的目标价为70美元。* 反映出担忧的是,B of A证券的一名分析师将其评级下调至中立,新的目标价为63美元。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Bristol-Myers Squibb with Benzinga Pro for real-time alerts.

交易期权涉及更大的风险,但也提供了更高利润的潜力。精明的交易者通过持续教育、战略性交易调整、利用各种因子,并密切关注市场动态以降低这些风险。通过Benzinga Pro获取施贵宝的最新期权交易和实时警报。

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.