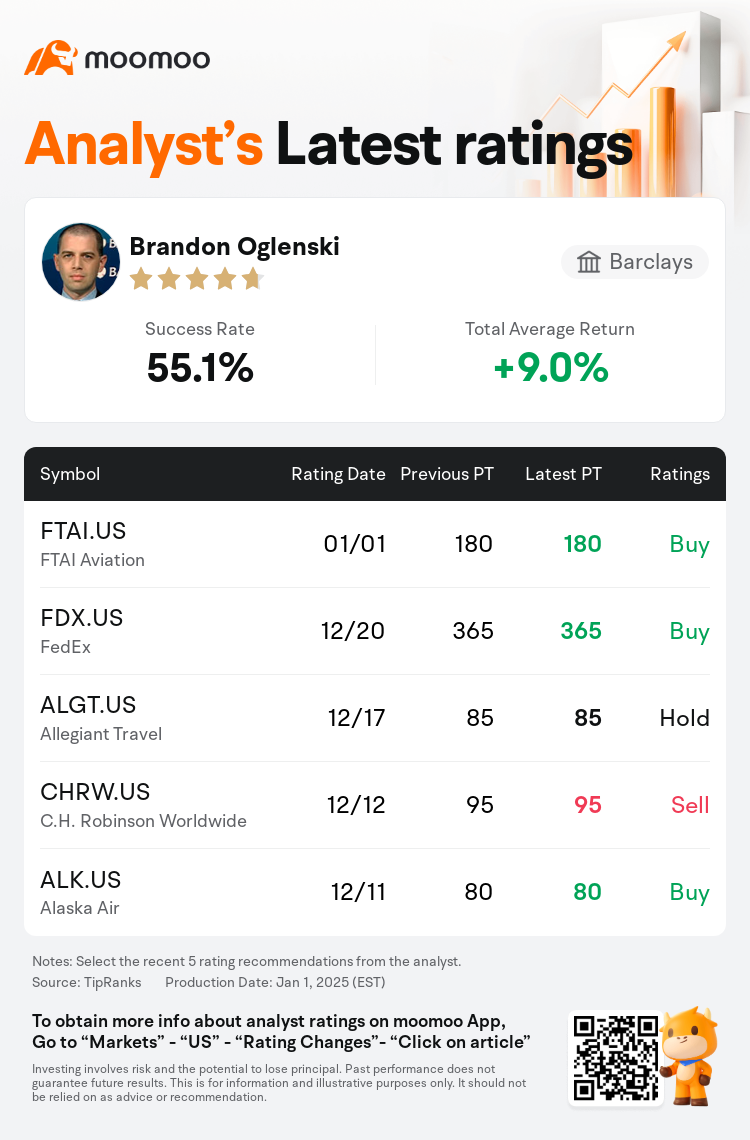

Barclays analyst Brandon Oglenski maintains $FTAI Aviation (FTAI.US)$ with a buy rating, and maintains the target price at $180.

According to TipRanks data, the analyst has a success rate of 55.1% and a total average return of 9.0% over the past year.

Furthermore, according to the comprehensive report, the opinions of $FTAI Aviation (FTAI.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $FTAI Aviation (FTAI.US)$'s main analysts recently are as follows:

FTAI Aviation has projected its 2025 adjusted EBITDA to lie between $1.1 billion and $1.15 billion, surpassing consensus estimates which hovered around $1.065 billion. This figure includes contributions of $500 million from Aviation Leasing and between $600 million and $650 million from Aerospace. Additionally, the company has revealed a Strategic Capital initiative to sell 46 on-lease narrowbody aircraft at $549 million. This strategy serves to lessen capital intensity of the business while maintaining control over the aircraft through its module factory and V2500 MRE business. Overall, the growth trajectory of the company is noted to be quicker than previously anticipated.

The company's strategic capital initiative involves collaboration with third-party institutional investors, initially targeting the acquisition of A320ceo and 737NG aircraft using the proceeds. Additionally, the company has disclosed its adjusted EBITDA projection for 2025, ranging between $1.10B-$1.15B, underscoring its strategic shift towards enhancing its Aerospace Products business.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

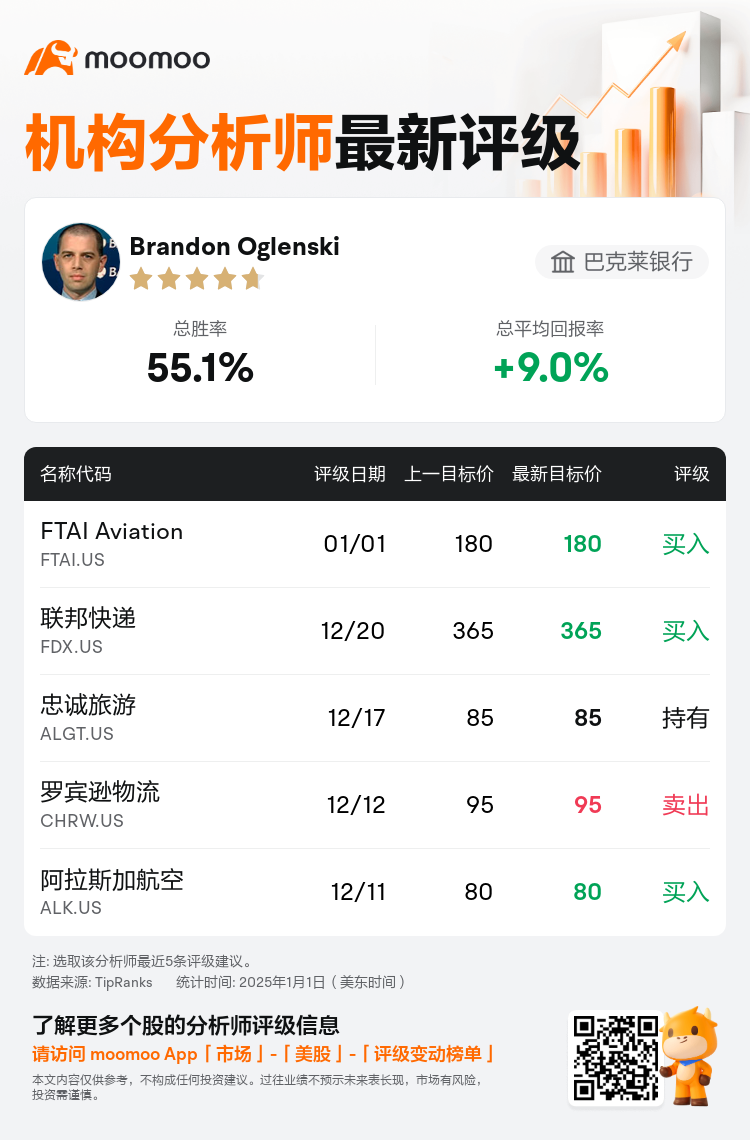

巴克莱银行分析师Brandon Oglenski维持$FTAI Aviation (FTAI.US)$买入评级,维持目标价180美元。

根据TipRanks数据显示,该分析师近一年总胜率为55.1%,总平均回报率为9.0%。

此外,综合报道,$FTAI Aviation (FTAI.US)$近期主要分析师观点如下:

此外,综合报道,$FTAI Aviation (FTAI.US)$近期主要分析师观点如下:

FTAI Aviation预计,其2025年调整后的息税折旧摊销前利润将在11亿美元至11.5亿美元之间,超过了徘徊在10.65亿美元左右的共识预期。该数字包括航空租赁的5亿美元捐款和来自航空航天公司的6亿至6.5亿美元捐款。此外,该公司还透露了一项战略资本计划,计划以5.49亿美元的价格出售46架租赁的窄体飞机。该战略旨在降低业务的资本密集度,同时通过其模块工厂和 V2500 MRE 业务保持对飞机的控制。总体而言,该公司的增长轨迹比先前的预期要快。

该公司的战略资本计划涉及与第三方机构投资者的合作,最初的目标是使用所得款项收购A320ceo和737NG飞机。此外,该公司还披露了其调整后的2025年息税折旧摊销前利润预测,介于11.0亿美元至11.5亿美元之间,这突显了其向加强航空航天产品业务的战略转移。

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

此外,综合报道,$FTAI Aviation (FTAI.US)$近期主要分析师观点如下:

此外,综合报道,$FTAI Aviation (FTAI.US)$近期主要分析师观点如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of