SoFi Tech Downgraded Over Valuation Concerns: Stock Priced Three Times Its Peers

SoFi Tech Downgraded Over Valuation Concerns: Stock Priced Three Times Its Peers

SoFi Technologies (NASDAQ:SOFI) has faced recent downgrades from analysts citing concerns over the company's high valuation. However, technical analysis, particularly moving averages, suggests potential support for the stock.

SoFi科技公司(纳斯达克:SOFI)近期遭遇分析师下调评级,原因是对公司高估值的担忧。然而,技术面分析,特别是移动平均线,表明股票可能存在支持位。

What Happened: SoFi was downgraded to 'underperform' by Keefe, Bruyette, and Woods (KBW), despite a recent rally driven by investor optimism and lower interest rates. While KBW slightly increased its price target, it expressed concerns about SOFI's lofty valuation, deeming its long-term earnings potential insufficient to justify the current stock price.

发生了什么:SoFi被Keefe, Bruyette和Woods(KBW)下调至‘表现不佳’,尽管最近由于投资者乐观情绪和利率下降,股价出现反弹。虽然KBW略微上调了其目标价,但对此时SOFI的高估值表示担忧,认为其长期盈利潜力不足以证明目前的股票价格。

The brokerage emphasized the challenges of achieving ambitious earnings targets, citing the need for significant revenue growth and margin improvement. KBW concluded that the current risk-reward profile for SOFI investors leans heavily toward potential losses.

该券商强调了实现雄心勃勃的盈利目标所面临的挑战,指出需要显著的营业收入增长和利润率改善。KBW总结认为,SOFI投资者当前的风险回报比例则严重倾向于潜在损失。

According to Benzinga Pro, the stock was nearly three times more expensive than its peers. The forward price-to-earnings for SoFi was 76.923, whereas the average of its peers stood at 26.384.

根据Benzinga Pro,SoFi的股票几乎比其同行贵三倍。SoFi的前瞻市盈率为76.923,而其同行的平均市盈率为26.384。

| Stocks | Market Cap | Forward P/E |

| American Express (NYSE: AXP) | 209.453B | 19.531 |

| Capital One Financial (NYSE:COF) | 67.880B | 11.696 |

| Discover Financial (NYSE:DFS) | 43.322B | 14.065 |

| Synchrony Financial (NYSE:SYF) | 25.327B | 9.709 |

| SoFi Technologies (NASDAQ:SOFI) | 16.711B | 76.923 |

| Average: 26.3848 |

| 股票 | 市值 | 前瞻市盈率 |

| 美国运通(纽交所:AXP) | 2094.53亿 | 19.531 |

| 第一资本信贷 (纽交所:COF) | 678.80亿 | 11.696 |

| 发现金融 (纽交所:DFS) | 433.22亿 | 14.065 |

| synchrony financial (纽交所:SYF) | 253.27亿 | 9.709 |

| SoFi科技(纳斯达克:SOFI) | 167.11亿 | 76.923 |

| 平均: 26.3848 |

Why It Matters: In December, BofA Securities downgraded SoFi, citing overvaluation. They believed SoFi's current stock price was ahead of its financial performance, trading at a significant premium to its peers.

重要性:在12月份,BofA证券下调了SoFi的评级,理由是估值过高。他们认为SoFi当前的股价超出了其财务表现,且交易价格显著高于同行。

Conversely, Jefferies maintained its "Buy" rating on SoFi and increased its price target, expressing optimism about the company's future

另一方面,杰弗里维持了对SoFi的“买入”评级,并提高了其目标价,对公司的未来表示乐观。

From a technical perspective, the analysis of daily moving averages shows strong support for the SoFi Tech stock.

从技术面分析来看,日均移动平均线显示SoFi科技股票有强劲的压力位。

SoFi's shares closed at $15.4 apiece on Tuesday, this was above its 50, and 200-day simple moving averages, suggesting a largely bullish trend. The 20-day moving average price was $15.86 apiece.

周二,SoFi的股票收于每股15.4美元,超过了其50日和200日简单移动平均线,表明整体看好趋势。20日移动平均价格为每股15.86美元。

These simple moving averages represent the average price of the security over the specified number of days. While 50 and 200-day averages represent longer-term prices, the eight and 20-day moving averages are for shorter periods.

这些简单移动平均线表示证券在指定天数内的平均价格。50日和200日平均数代表长期价格,而8日和20日移动平均数则用于短期。

On the other hand, the relative strength index of 50.75 suggested that the stock is in the neutral zone.

另一方面,相对强弱指数为50.75,表明该股票处于中立区间。

Price Action: The company shares rose 59.59% in 2024, outperforming the Invesco QQQ Trust ETF (NASDAQ:QQQ), which rose by 26.99%, according to Benzinga Pro data.

价格行动:根据Benzinga Pro的数据,该公司的股票在2024年上涨了59.59%,表现优于纳指100ETF-Invesco QQQ Trust(NASDAQ:QQQ),后者上涨了26.99%。

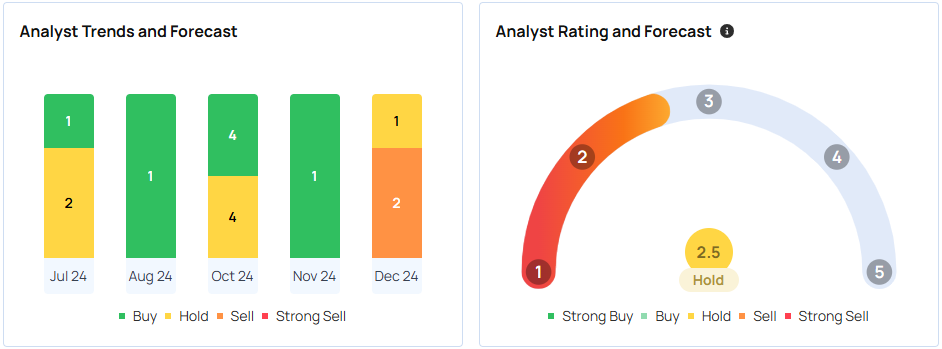

According to Benzinga, SoFi has a consensus price target of $9.98 per share based on the ratings of 26 analysts. The highest price target out of all the analysts tracked by Benzinga is $16 apiece issued by JPMorgan as of Dec. 2, 2024. The lowest target price is $3 per share issued by Wedbush on April 30, 2024.

根据Benzinga的数据,SoFi的共识目标价为每股9.98美元,基于26名分析师的评级。根据Benzinga跟踪的所有分析师中,摩根大通在2024年12月2日发布的每股目标价为16美元,是最高的目标价。最低目标价为2024年4月30日由Wedbush发布的每股3美元。

The average price target of $13.67 apiece between Morgan Stanley, B of A Securities, and JPMorgan implies an 11.14% downside for SoFi.

摩根士丹利和摩根大通之间平均目标价为每股13.67美元,这意味着SoFi的下行空间为11.14%。

- S&P 500 Scaled A Record 57 All-Time Highs In 2024: Here's What Analysts Think Is In Store This Year

- S&P 500在2024年创下了57个历史新高:以下是分析师对今年的看法。

Photo courtesy: Shutterstock

照片提供:shutterstock

According to Benzinga Pro, the stock was nearly three times more expensive than its peers. The forward price-to-earnings for SoFi was 76.923, whereas the average of its peers stood at 26.384.

According to Benzinga Pro, the stock was nearly three times more expensive than its peers. The forward price-to-earnings for SoFi was 76.923, whereas the average of its peers stood at 26.384.