Cloudflare Inc (NYSE:NET) stock is trading upwards Thursday after Goldman Sachs analyst Gabriela Borges upgraded the stock from Sell to Buy and raised its price target from $77 to $140.

Security stock performance in 2024 can almost entirely be explained by the extent to which the market believed each company was a platform rather than a point product, as per the analyst.

Borges flagged two catalysts for Cloudflare stock in 2025, including an improving sales and marketing productivity cycle after two years of evolution to better address platform sales in the enterprise and traction with Act III products for developer services as Cloudflare applies its core edge network architecture advantages to new AI inferencing use cases.

The price target boost reflects a jump in the multiple from 11x to 20x (Q5-Q8 revenue), raising the analyst's 2026 revenue estimates by 2%, given his views on sales productivity and Act III.

The price target boost reflects a jump in the multiple from 11x to 20x (Q5-Q8 revenue), raising the analyst's 2026 revenue estimates by 2%, given his views on sales productivity and Act III.

Borges changed his 2024, 2025, and 2026 EPS estimates to $0.75, $0.90, and $1.32 from $0.75, $0.86, and $1.12, driven by slightly more margin expansion, marking the highest target multiple in his coverage.

Borges downgraded Check Point Software Technologies (NASDAQ:CHKP) from Buy to Neutral and raised the price target from $204 to $207.

The analyst highlighted 2025 as a year of incremental investment for Check Point as its new CEO evaluates growth priorities and the company ramps up its new SASE products. Taken together, the analyst noted that EPS growth will be under pressure in 2025, and the stock typically tracks EPS growth. He noted an opportunity to become more positive into 2026, as the path to 10%+ revenue growth and 20%+ EPS growth comes back into focus if Check Point successfully converts incremental investments into incremental revenue growth.

Borges compared Check Point to Software companies with less than 10% revenue growth and enough EPS to be valued using a P/E methodology. Relative to this peer group (median 2025 P/E of 17x), Check Point offers similar revenue growth (6% on Street estimates versus 6% for peers in 2025) but better Rule of 40 (~47 versus 35).

The analyst also used the S&P 500 as a point of comparison: The S&P 500 is trading at 22x 2025 EPS while offering ~10% EPS growth; relative to the S&P 500, Check Point provides similar cross-cycle earnings growth.

Borges revised 2024, 2025, and 2026 EPS from $9.10, $9.75, and $10.95 to $9.10, $9.45, and $10.65 to reflect an operating expenditure trend consistent with recent history and introduced 2027 EPS of $12.25.

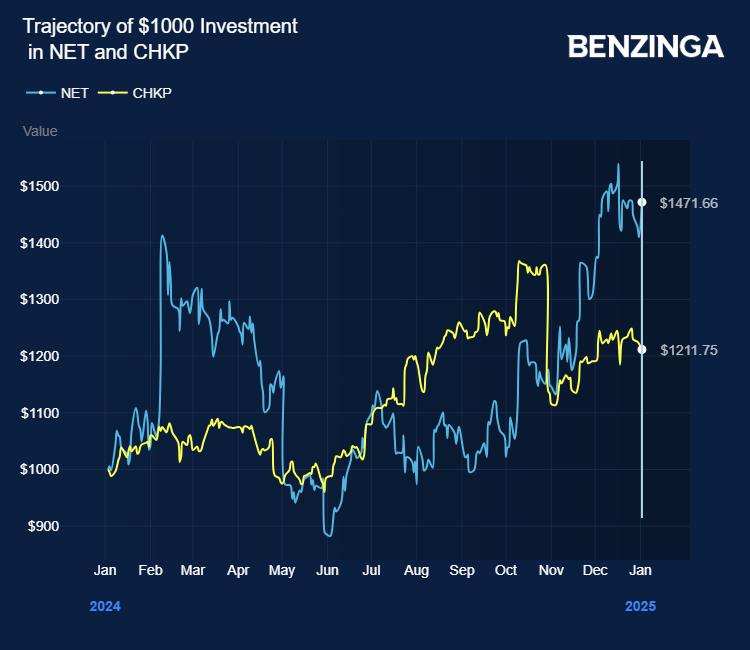

Price Actions: NET stock is up 4.59% at $112.62 at last check Thursday. CHKP is down 0.80%.

Cloudflare Inc(纽约证券交易所代码:NET)股票周四上涨,此前高盛分析师加布里埃拉·博尔赫斯将该股从卖出上调至买入,并将目标股价从77美元上调至140美元。

分析师认为,2024年的证券股表现几乎完全可以用市场在多大程度上认为每家公司是平台而不是积分产品来解释。

博尔赫斯指出了2025年Cloudflare股票的两个催化剂,包括在经过两年的演变后改善了销售和营销生产力周期,以更好地解决企业平台销售问题,以及Cloudflare将其核心边缘网络架构优势应用于新的人工智能推理用例时,第三号法案开发者服务产品的吸引力。

鉴于分析师对销售生产率和第三号法案的看法,目标股价的上涨反映了倍数从11倍跃升至20倍(Q5-Q8 收入),将分析师2026年的收入预期提高了2%。

鉴于分析师对销售生产率和第三号法案的看法,目标股价的上涨反映了倍数从11倍跃升至20倍(Q5-Q8 收入),将分析师2026年的收入预期提高了2%。

博尔赫斯将2024年、2025年和2026年的每股收益预期从0.75美元、0.86美元和1.12美元上调至0.75美元、0.90美元和1.32美元,这得益于利润率略有扩大,创下了其覆盖范围中最高的目标倍数。

博尔赫斯将Check Point Software Technologies(纳斯达克股票代码:CHKP)的评级从买入下调至中性,并将目标股价从204美元上调至207美元。

这位分析师强调2025年是Check Point增量投资的一年,因为其新任首席执行官正在评估增长优先事项,该公司正在加大其新的SASE产品力度。总而言之,该分析师指出,到2025年,每股收益的增长将面临压力,该股通常会追踪每股收益的增长。他指出,如果Check Point成功地将增量投资转化为增量收入增长,则10%以上的收入增长和20%以上的每股收益增长之路将重新成为人们关注的焦点,从而有机会在2026年变得更加乐观。

博尔赫斯将Check Point与收入增长低于10%、每股收益足以使用市盈率方法估值的软件公司进行了比较。相对于该同行群体(2025年市盈率中位数为17倍),Check Point的收入增长相似(华尔街估计为6%,而2025年同行为6%),但40法则更好(约47比35)。

该分析师还使用标准普尔500指数作为比较点:标准普尔500指数的交易价格为2025年每股收益的22倍,同时每股收益增长约10%;与标准普尔500指数相比,Check Point提供了类似的跨周期收益增长。

博尔赫斯将2024年、2025年和2026年的每股收益从9.10美元、9.75美元和10.95美元修订为9.10美元、9.45美元和10.65美元,以反映与近期历史一致的运营支出趋势,并推出了2027年每股收益12.25美元。

价格走势:周四最后一次检查时,NET价上涨4.59%,至112.62美元。CHKP 下跌了 0.80%。

鉴于分析师对销售生产率和第三号法案的看法,目标股价的上涨反映了倍数从11倍跃升至20倍(Q5-Q8 收入),将分析师2026年的收入预期提高了2%。

鉴于分析师对销售生产率和第三号法案的看法,目标股价的上涨反映了倍数从11倍跃升至20倍(Q5-Q8 收入),将分析师2026年的收入预期提高了2%。

The price target boost reflects a jump in the multiple from 11x to 20x (Q5-Q8 revenue), raising the analyst's 2026 revenue estimates by 2%, given his views on sales productivity and Act III.

The price target boost reflects a jump in the multiple from 11x to 20x (Q5-Q8 revenue), raising the analyst's 2026 revenue estimates by 2%, given his views on sales productivity and Act III.