Markets Weekly Update (January 3) Tesla's Q4 Delivery Data Missed Expectations, Stock Price Drops by Over 6%

Markets Weekly Update (January 3) Tesla's Q4 Delivery Data Missed Expectations, Stock Price Drops by Over 6%

Welcome to the Markets Weekly Update, the column committed to delivering essential investing insights for the week and key events that could move markets in the week ahead.

欢迎来到市场每周更新,本栏目致力于提供本周的重要投资见解以及可能在未来一周影响市场的关键事件。

Macro Matters

宏观问题

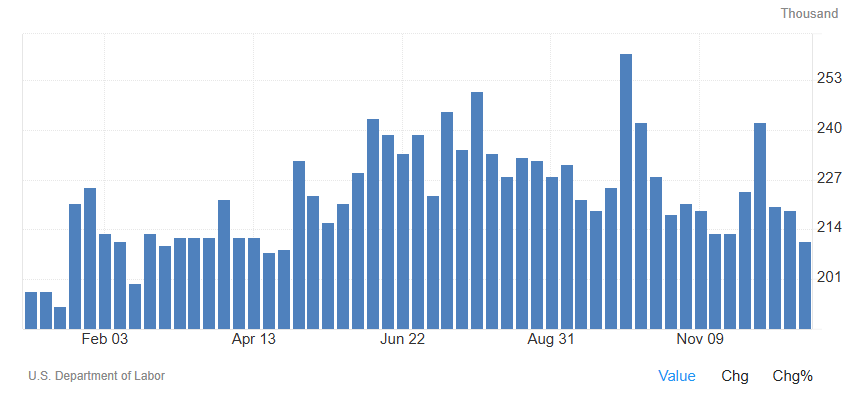

US Initial Jobless Claims Fall to 8-Month Low

美国初请失业金人数降至8个月低点

In the final week of 2024, the number of first-time unemployment claims in the US dropped unexpectedly by 9,000 to 211,000, which is a significant decrease from the anticipated rise to 222,000, and represents the fewest initial claims seen in eight months. This is according to data from the U.S. Department of Labor. The week before, continuing claims for unemployment benefits decreased by 52,000 to 1,844,000, which was lower than the expected 1,890,000. These figures suggest that the US job market is still very competitive compared to historical norms. This situation could give the Federal Reserve the flexibility to maintain higher interest rates if inflation doesn't slow down at the rate they want.

在2024年的最后一周,美国首次申请失业救济的人数意外减少了9,000,降至211,000,这是预计将上升至222,000的显著下降,并且是八个月以来最低的初始申请数量。这是根据美国劳工部的数据。前一周,继续申请失业救济的人数减少了52,000,降至1,844,000,低于预期的1,890,000。这些数字表明,尽管与历史标准相比,美国的就业市场仍然非常具有竞争力。这种情况可能使美联储在通胀没有按照他们希望的速度放缓的情况下保持较高利率的灵活性。

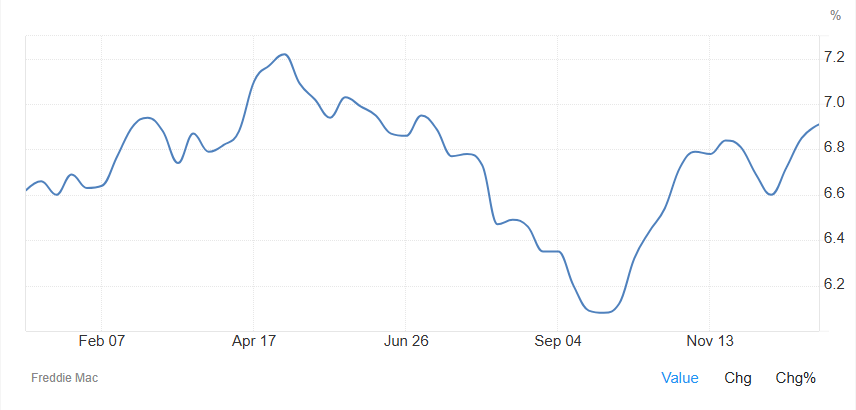

US Mortgage Rate Approaches 7%

美国抵押贷款利率接近7%

As of January 2, the average interest rate for 30-year fixed mortgages backed by Freddie Mac rose to 6.91%, the highest level since July. This increase aligns with the surge in long-term Treasury yields, driven by the Federal Reserve's hawkish signals and strong economic data. Freddie Mac's Chief Economist, Sam Khater, stated, "Mortgage rates have slightly increased to just below 7%, reaching their highest point in nearly six months. Compared to the same period last year, rates have risen, and the headwind of affordability persists. However, with the rise in pending home sales, it appears that buyers are more inclined to wait and see".

截至1月2日,由Freddie Mac支持的30年期固定抵押贷款的平均利率上升至6.91%,是自7月以来的最高水平。这一上涨与长期国债收益率的飙升相一致,主要是由于美联储的鹰派信号和强劲的经济数据。Freddie Mac的首席经济学家Sam Khater表示:"抵押贷款利率轻微上升,刚好低于7%,达到了近六个月以来的最高点。与去年同一时期相比,利率上升,购房的负担依然存在。然而,随着待售新屋的增加,买家似乎更倾向于观望。"

Dollar Holds Near 2-Year Highs Amid Strong US Outlook

美元在强劲的美国前景中保持在2年高位附近

The US dollar index remained above 109 on Friday, hovering near its highest level in two years as investors are placing bets on a strengthening US economy and anticipating fewer interest rate cuts by the Federal Reserve this year. The American economy continues to demonstrate resilience, which is setting it up to outperform other economies worldwide in the short term. The Federal Reserve has signaled that it will adopt a more cautious approach to easing monetary policy in 2025, in light of persistent inflation. The latest forecasts suggest that there will be just two interest rate cuts of 0.25 percentage points each this year, marking a significant decrease from the 1 percentage point (four 0.25 percentage point cuts) that was expected back in September.

美国美元指数周五保持在109以上,徘徊在两年来的最高水平附近,因为投资者在押注美国经济增强,并期待美联储今年减少利率的次数会减少。美国经济继续表现出韧性,这使其在短期内有望超过全球其他经济体。美联储已表示,将在2025年采取更谨慎的货币政策放松措施,原因是通胀持续。最新的预测表明,今年将只会有两次每次0.25个百分点的降息,较9月份预计的1个百分点(四次0.25个百分点的降息)大幅减少。

Furthermore, uncertainties surrounding the policies of the incoming Trump administration have driven investors to seek the safety of the US dollar. As a result, the dollar is currently trading at multi-year highs against the euro, the Australian dollar, and the New Zealand dollar, and at multi-month highs against the Japanese yen and the British pound.

此外,关于特朗普新政府政策的不确定性使得投资者寻求美元的安全。因此,美元目前兑欧元、澳币和纽元的汇率达到了多年高点,兑日币和英镑的汇率也达到了数月来的高点。

Smart Money Flow

智能资金流动

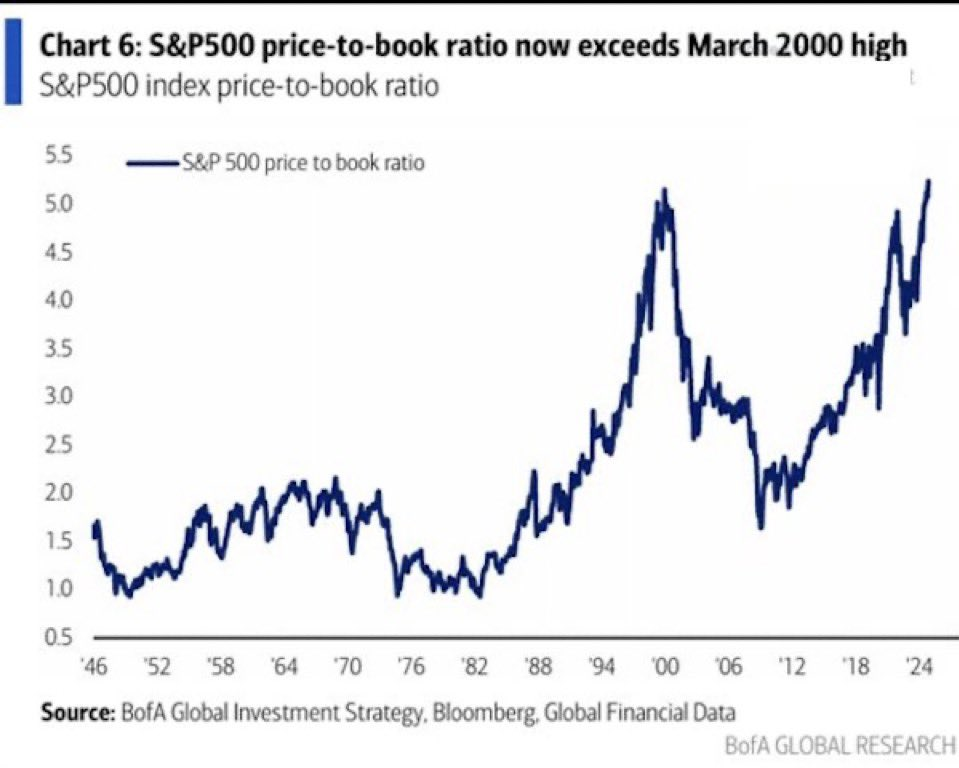

The price-to-book ratio of the S&P 500 Index has now surpassed its peak during the dot-com bubble era.

标普500指数的市净率现在已经超过了互联网泡沫时期的峰值。

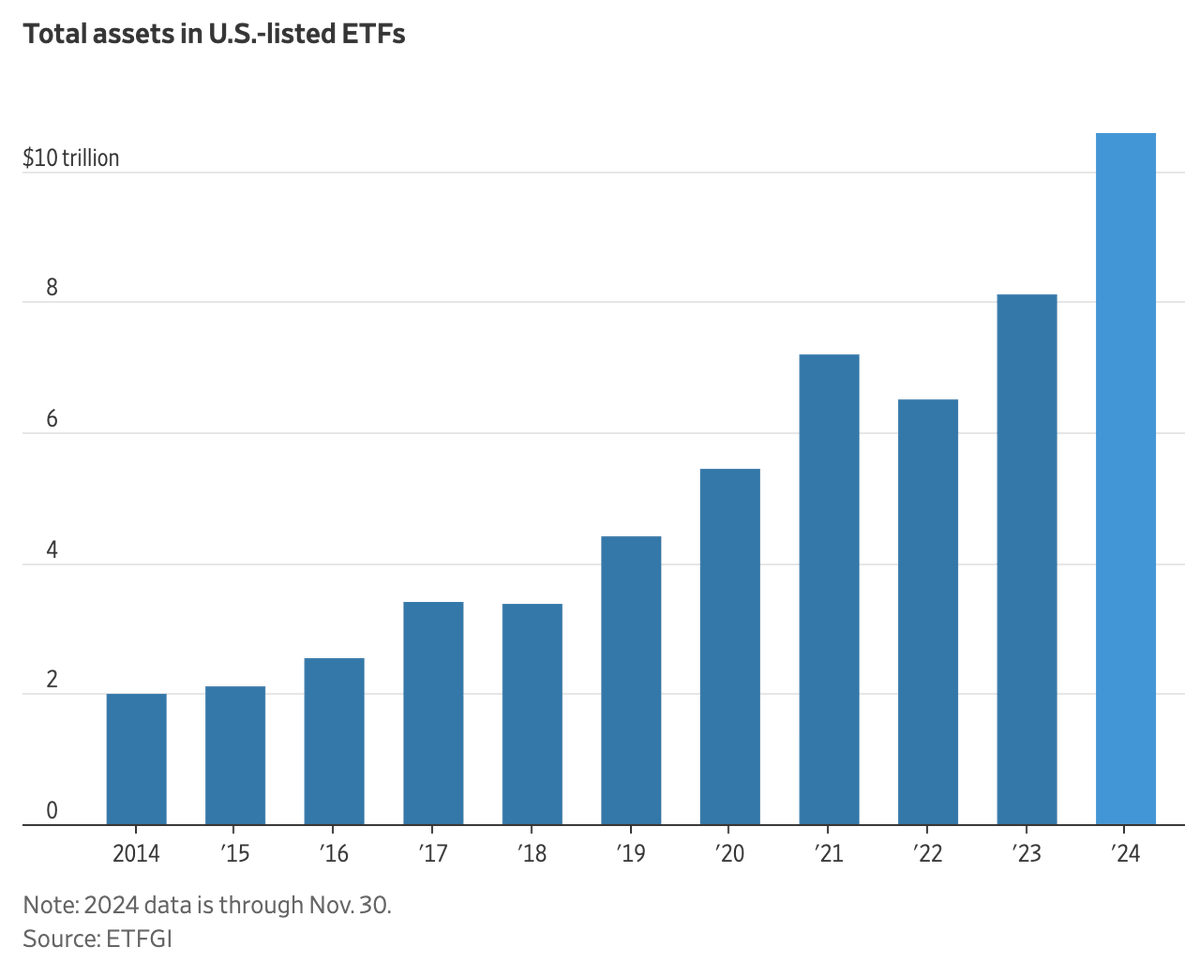

By the end of November, the total assets of Exchange Traded Funds (ETFs) in the United States had reached a record high of $10.6 trillion, marking an increase of over 30% since the beginning of 2024.

到11月底,美国交易所交易基金(ETF)的总资产达到了创纪录的10.6万亿,较2024年初增长了超过30%。

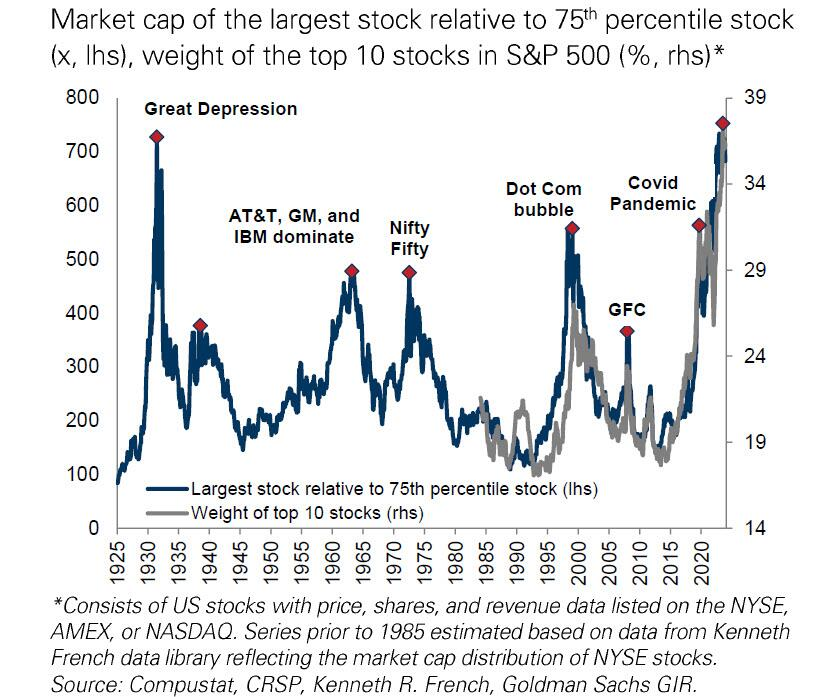

The concentration bubble in the U.S. stock market is rarely bigger

美国股市的集中泡沫几乎前所未见。

The market concentration at the start of 2025 has reached its highest level since the Great Depression. The top 10 U.S. stocks account for 38% of the total market capitalization.

到2025年初,市场集中度达到了自大萧条以来的最高水平。美国前10只股票占市场总市值的38%。

Top Corporate News

头条公司新闻

Tesla's Q4 delivery data missed expectations, Stock price drops by over 6%

特斯拉第四季度交付数据低于预期,股票价格下跌超过6%。

On Thursday, January 2nd, Eastern Time, Tesla released its vehicle delivery data for the full year and fourth quarter of 2024. Subsequently, its stock price fell by more than 6% during the day's trading. Tesla said that 1.79 million vehicles were delivered in 2024, less than the 1.8 million vehicles delivered in 2023 and lower than the analysts' general forecast of 1.8 million. This marks the first annual sales decline since Tesla went public in 2011.

在2024年1月2日,东部时间,特斯拉发布了2024年全年的车辆交付数据和第四季度的数据。随后,该股票在当天的交易中下跌了超过6%。特斯拉表示,2024年交付了179万辆汽车,低于2023年的180万辆,也低于分析师普遍预测的180万辆。这标志着自2011年特斯拉上市以来首次出现年度销售下滑。

Despite the annual sales decline, Tesla still achieved strong growth in the fourth quarter. In the fourth quarter ending December 31st, Tesla delivered 495,570 vehicles, setting a new quarterly delivery record but falling short of the analysts' average expectations. Although the sales of electric vehicles hardly grew, Tesla's stock price rose by more than 60% in 2024. Almost all of the increase occurred after the presidential election on November 5th.

尽管年度销售出现下滑,特斯拉在第四季度仍实现了强劲增长。在截至12月31日的第四季度,特斯拉交付了495,570辆汽车,创造了新的季度交付记录,但未达到分析师的平均预期。尽管新能源汽车的销量几乎没有增长,特斯拉的股价在2024年上涨了超过60%。几乎所有的增长都发生在11月5日的总统选举之后。

Investors are certainly concerned about quarterly delivery volumes, but currently, they are more focused on the future development in 2025 and how Elon Musk's close relationship with Trump will help the electric vehicle manufacturer.

投资者肯定对季度交付量表示关切,但目前,他们更关注2025年的未来发展,以及埃隆·马斯克与特朗普的密切关系将如何帮助这家新能源汽车制造商。

Carvana Slips as Hindenburg Alleges 'Related-Party Accounting Games'

Carvana下滑,因亨登堡指控其存在“关联方财务游戏”

Hindenburg Research has announced that it is shorting Carvana, a used car dealer. It claims that the recent turnaround of this online used car retailer is propped up by shaky loans and accounting manipulations. Carvana's share price dropped approximately 3% on Thursday.

兴登堡研究公司宣布对二手车经销商Carvana开空。他们声称,这家在线二手车零售商最近的转变是由不稳定的贷款和会计操控所支撑的。Carvana的股价在周四下跌了大约3%。

Nathan Anderson, the founder of Hindenburg, said that after conducting extensive document reviews and interviewing 49 industry experts, former Carvana employees, competitors, and relevant parties, the institution firmly believes that Carvana's "transformation is an illusion".

兴登堡的创始人内森·安德森表示,在进行了广泛的文件审查和采访49位行业专家、前Carvana员工、竞争对手及相关方后,该机构坚信Carvana的“转型是一个幻影”。

The institution wrote in its report, "Our research has found that the company sold $800 million in loans to suspected undisclosed related parties. Meanwhile, it has utilized accounting manipulations and loose loan approval processes to drive temporary revenue growth, while insiders have taken the opportunity to cash out billions of dollars' worth of stocks."

该机构在报告中写道:“我们的研究发现,该公司向涉嫌未披露的关联方出售了80000万美元的贷款。同时,它利用会计操控和宽松的贷款审批流程来推动临时营业收入增长,而内部人士则借此机会套现了数十亿美元的股票。”

Disclaimer: This presentation is for informational and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors’ financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information having regard to your relevant personal circumstances before making any investment decisions. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal.

免责声明:本演示材料仅供信息和教育用途,并不构成对任何特定投资或投资策略的推荐或认可。本内容提供的投资信息具有一般性,仅供参考,可能不适用于所有投资者。信息提供时未考虑个人投资者的财务能力、财务状况、投资目标、投资时间框架或风险承受能力。在做出任何投资决定之前,您应考虑根据自己相关的个人情况,该信息的适当性。过去的投资表现并不表明或保证未来的成功。收益会有所不同,所有投资都存在风险,包括本金损失。

Moomoo is a financial information and trading app offered by Moomoo Technologies Inc. In the U.S., investment products and services on Moomoo are offered by Moomoo Financial Inc., Member FINRA/SIPC.

moomoo是由moomoo科技公司提供的金融信息和交易应用。在美国,moomoo提供的投资产品和服务由moomoo金融公司提供,成员为FINRA/SIPC。