Unpacking the Latest Options Trading Trends in Walt Disney

Unpacking the Latest Options Trading Trends in Walt Disney

Whales with a lot of money to spend have taken a noticeably bearish stance on Walt Disney.

有很多钱可以花的鲸鱼对沃尔特·迪斯尼采取了明显的看跌立场。

Looking at options history for Walt Disney (NYSE:DIS) we detected 12 trades.

查看沃尔特·迪斯尼(纽约证券交易所代码:DIS)的期权历史记录,我们发现了12笔交易。

If we consider the specifics of each trade, it is accurate to state that 33% of the investors opened trades with bullish expectations and 58% with bearish.

如果我们考虑每笔交易的具体情况,可以准确地说,33%的投资者以看涨的预期开盘,58%的投资者持看跌预期。

From the overall spotted trades, 4 are puts, for a total amount of $350,399 and 8, calls, for a total amount of $3,409,810.

在已发现的全部交易中,有4笔是看跌期权,总额为350,399美元,8笔是看涨期权,总额为3,409,810美元。

Predicted Price Range

预测的价格区间

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $50.0 to $140.0 for Walt Disney over the last 3 months.

考虑到这些合约的交易量和未平仓合约,在过去的3个月中,鲸鱼似乎一直将沃尔特·迪斯尼的价格定在50.0美元至140.0美元之间。

Insights into Volume & Open Interest

对交易量和未平仓合约的见解

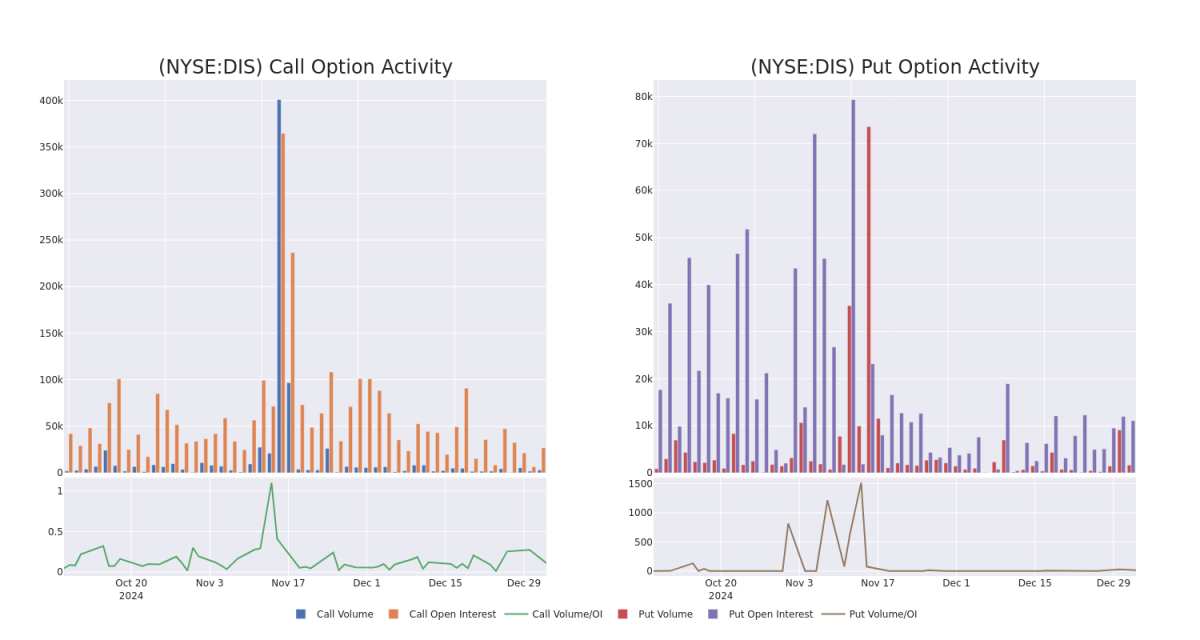

In today's trading context, the average open interest for options of Walt Disney stands at 2270.45, with a total volume reaching 2,111.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Walt Disney, situated within the strike price corridor from $50.0 to $140.0, throughout the last 30 days.

在今天的交易背景下,华特迪士尼期权的平均未平仓合约为2270.45,总成交量达到2,111.00。随附的图表描绘了沃尔特·迪斯尼高价值交易的看涨期权和看跌期权交易量以及未平仓合约在过去30天中的变化,行使价走势从50.0美元到140.0美元不等。

Walt Disney Option Activity Analysis: Last 30 Days

华特迪士尼期权活动分析:过去 30 天

Largest Options Trades Observed:

观察到的最大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DIS | CALL | SWEEP | BEARISH | 12/19/25 | $62.9 | $62.35 | $62.4 | $50.00 | $3.1M | 688 | 499 |

| DIS | PUT | SWEEP | BULLISH | 06/20/25 | $8.75 | $8.7 | $8.7 | $115.00 | $256.6K | 2.1K | 341 |

| DIS | CALL | TRADE | BULLISH | 01/16/26 | $35.6 | $35.3 | $35.6 | $80.00 | $56.9K | 877 | 17 |

| DIS | CALL | SWEEP | BEARISH | 01/10/25 | $0.77 | $0.75 | $0.77 | $112.00 | $55.6K | 3.5K | 962 |

| DIS | CALL | TRADE | BEARISH | 01/16/26 | $21.0 | $20.0 | $20.0 | $100.00 | $50.0K | 2.6K | 25 |

| 符号 | 看跌/看涨 | 交易类型 | 情绪 | Exp。日期 | 问 | 出价 | 价格 | 行使价 | 总交易价格 | 未平仓合约 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DISS | 打电话 | 扫 | 粗鲁的 | 12/19/25 | 62.9 美元 | 62.35 美元 | 62.4 美元 | 50.00 美元 | 310 万美元 | 688 | 499 |

| DISS | 放 | 扫 | 看涨 | 06/20/25 | 8.75 美元 | 8.7 美元 | 8.7 美元 | 115.00 美元 | 256.6 万美元 | 2.1K | 341 |

| DISS | 打电话 | 贸易 | 看涨 | 01/16/26 | 35.6 美元 | 35.3 美元 | 35.6 美元 | 80.00 美元 | 56.9 万美元 | 877 | 17 |

| DISS | 打电话 | 扫 | 粗鲁的 | 01/10/25 | 0.77 美元 | 0.75 美元 | 0.77 美元 | 112.00 美元 | 55.6 万美元 | 3.5K | 962 |

| DISS | 打电话 | 贸易 | 粗鲁的 | 01/16/26 | 21.0 美元 | 20.0 美元 | 20.0 美元 | 100.00 美元 | 50.0 万美元 | 2.6K | 25 |

About Walt Disney

华特迪士尼简介

Disney operates in three global business segments: entertainment, sports, and experiences. Entertainment and experiences both benefit from the firm's ownership of iconic franchises and characters. Entertainment includes the ABC broadcast network, several cable television networks, and the Disney+ and Hulu streaming services. Within the segment, Disney also engages in movie and television production and distribution, with content licensed to movie theaters, other content providers, or, increasingly, kept in-house for use on Disney's own streaming platform and television networks. The sports segment houses ESPN and the ESPN+ streaming service. Experiences contains Disney's theme parks and vacation destinations, and also benefits from merchandise licensing.

迪士尼在三个全球业务领域开展业务:娱乐、体育和体验。娱乐和体验都受益于该公司对标志性特许经营权和角色的所有权。娱乐包括美国广播公司广播网络、多个有线电视网络以及迪士尼+和Hulu流媒体服务。在该细分市场中,迪士尼还从事电影和电视制作和发行,内容授权给电影院和其他内容提供商,或者越来越多地将其保留在内部供迪士尼自己的流媒体平台和电视网络上使用。体育板块包含ESPN和ESPN+流媒体服务。体验包括迪士尼的主题公园和度假胜地,还受益于商品许可。

After a thorough review of the options trading surrounding Walt Disney, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

在全面审查了围绕沃尔特·迪斯尼的期权交易之后,我们将对该公司进行更详细的审查。这包括评估其当前的市场状况和表现。

Where Is Walt Disney Standing Right Now?

沃尔特·迪斯尼现在站在哪里?

- With a volume of 2,143,378, the price of DIS is up 0.28% at $111.13.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 33 days.

- DIS的价格上涨了0.28%,至111.13美元,交易量为2,143,378美元。

- RSI指标表明,标的股票目前在超买和超卖之间处于中性。

- 下一份财报预计将在33天后公布。

What The Experts Say On Walt Disney

专家对沃尔特·迪斯尼的看法

A total of 1 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $135.0.

在过去的30天中,共有1位专业分析师对该股发表了看法,将平均目标股价定为135.0美元。

Unusual Options Activity Detected: Smart Money on the Move

检测到不寻常的期权活动:智能货币在移动

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* Consistent in their evaluation, an analyst from Rosenblatt keeps a Buy rating on Walt Disney with a target price of $135.

Benzinga Edge的不寻常期权委员会在潜在的市场推动者发生之前就发现了它们。看看大笔资金对你最喜欢的股票持有哪些头寸。点击此处查看。* 罗森布拉特的一位分析师维持沃尔特·迪斯尼的买入评级,目标价为135美元,这与他们的评估一致。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Walt Disney options trades with real-time alerts from Benzinga Pro.

期权交易具有更高的风险和潜在的回报。精明的交易者通过不断自我教育、调整策略、监控多个指标以及密切关注市场走势来管理这些风险。借助Benzinga Pro的实时提醒,随时了解最新的华特迪士尼期权交易。

From the overall spotted trades, 4 are puts, for a total amount of $350,399 and 8, calls, for a total amount of $3,409,810.

From the overall spotted trades, 4 are puts, for a total amount of $350,399 and 8, calls, for a total amount of $3,409,810.