Barclays analyst Terry Ma maintains $SLM Corp (SLM.US)$ with a buy rating, and adjusts the target price from $26 to $34.

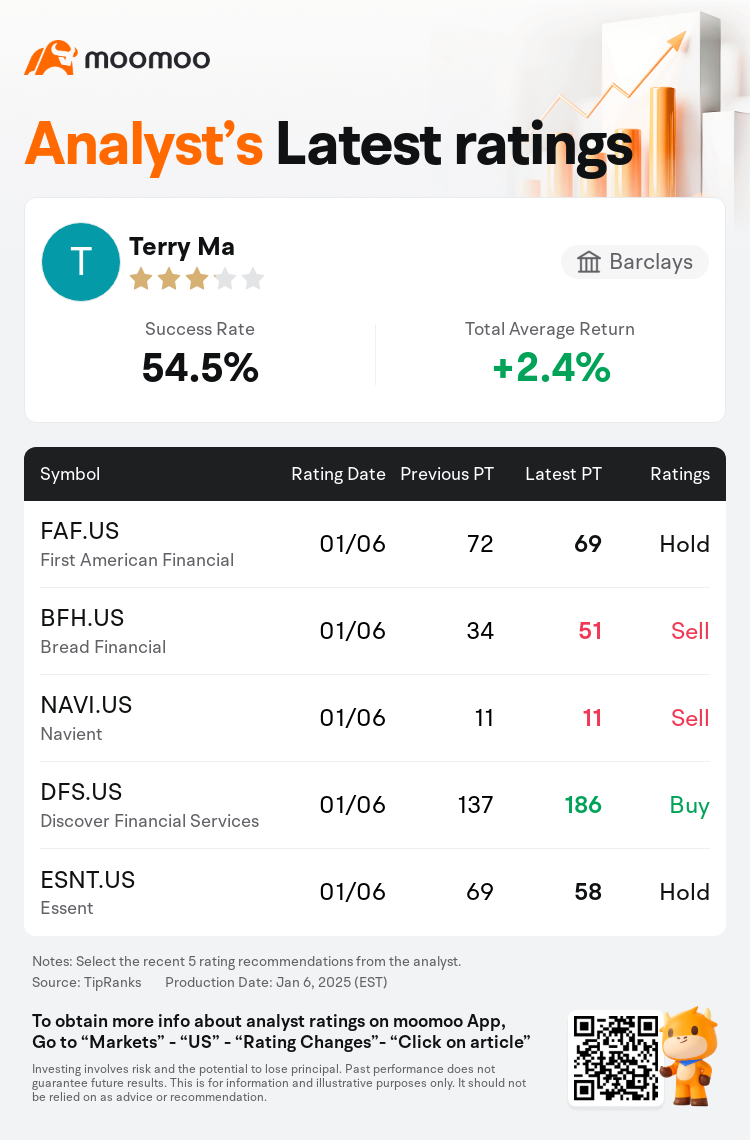

According to TipRanks data, the analyst has a success rate of 54.5% and a total average return of 2.4% over the past year.

Furthermore, according to the comprehensive report, the opinions of $SLM Corp (SLM.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $SLM Corp (SLM.US)$'s main analysts recently are as follows:

Heading into 2025, the focal points for the specialty finance sector include a stable consumer base, improved consumer credit trends particularly among prime borrowers, persistently high mortgage rates, and a more relaxed regulatory environment. Since the election, shares in the consumer lending sector have performed robustly, somewhat accelerating expected returns and complicating stock selection processes. The strategy that was effective in mortgage finance in 2024 is being carried forward to 2025, with a preference for companies having balanced business models. Analyst preference leans towards stocks that possess unacknowledged positive catalysts capable of generating further gains. Moreover, air lessors are still perceived as undervalued, while there's a suggestion of caution towards mortgage credit.

The results of the recent November election seem to have revitalized economic enthusiasm, enhancing business and consumer confidence in anticipation of a more pro-business climate. This shift has heightened expectations for the U.S. economy while diminishing prospects for further Federal Reserve easing. This scenario is viewed as favorable for companies linked to consumer credit and spending, but less so for those connected to the mortgage market, which continues to suffer from high rates and a shortage of housing supply.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

巴克莱银行分析师Terry Ma维持$学贷美 (SLM.US)$买入评级,并将目标价从26美元上调至34美元。

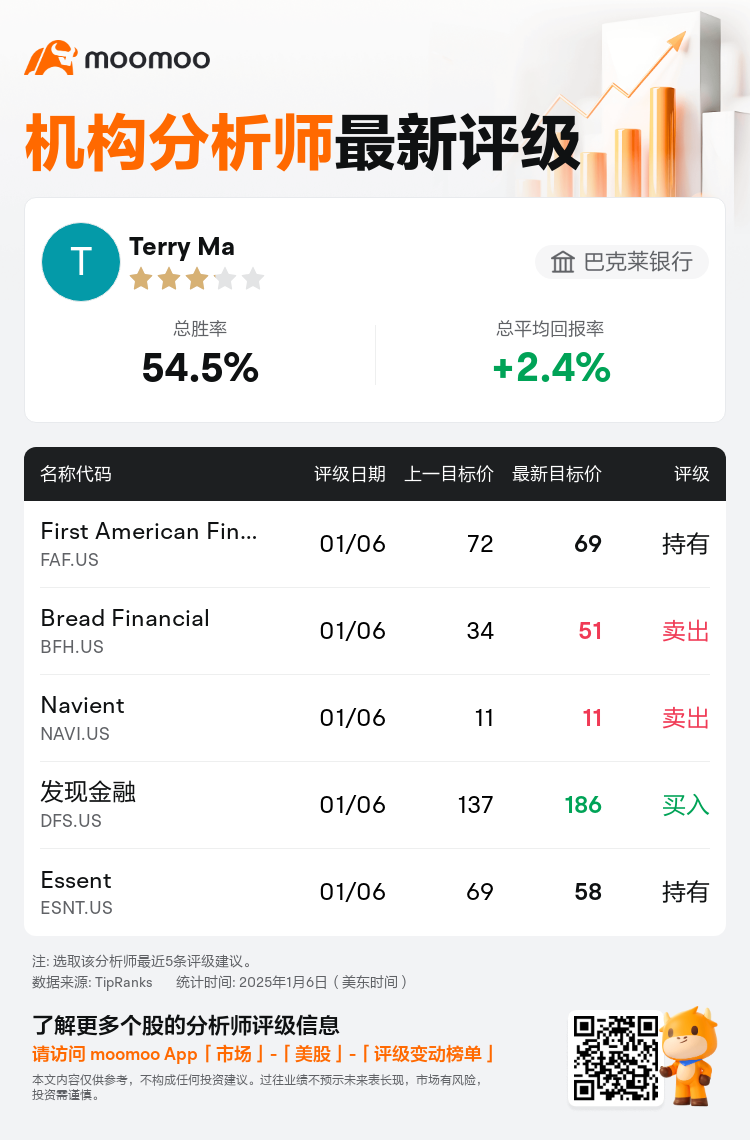

根据TipRanks数据显示,该分析师近一年总胜率为54.5%,总平均回报率为2.4%。

此外,综合报道,$学贷美 (SLM.US)$近期主要分析师观点如下:

此外,综合报道,$学贷美 (SLM.US)$近期主要分析师观点如下:

进入2025年,专业金融行业的重点包括稳定的消费者基础、消费信贷趋势的改善(尤其是主要借款人的消费信贷趋势)、持续居高不下的抵押贷款利率以及更加宽松的监管环境。自大选以来,消费贷款行业的股票表现强劲,在一定程度上加快了预期回报,使选股过程复杂化。2024年在抵押贷款融资中有效的战略将延续到2025年,优先考虑具有平衡商业模式的公司。分析师的偏好倾向于那些具有未被承认的积极催化剂、能够产生进一步收益的股票。此外,航空出租人仍被视为被低估,同时有人建议对抵押贷款持谨慎态度。

最近11月大选的结果似乎重振了经济热情,增强了企业和消费者的信心,以应对更加亲商的环境。这种转变提高了对美国经济的预期,同时也削弱了美联储进一步宽松政策的前景。这种情况被认为对与消费信贷和支出相关的公司有利,但对那些与抵押贷款市场相关的公司则不那么有利,抵押贷款市场继续遭受高利率和住房供应短缺的困扰。

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

此外,综合报道,$学贷美 (SLM.US)$近期主要分析师观点如下:

此外,综合报道,$学贷美 (SLM.US)$近期主要分析师观点如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of