Market Whales and Their Recent Bets on VRT Options

Market Whales and Their Recent Bets on VRT Options

Financial giants have made a conspicuous bearish move on Vertiv Hldgs. Our analysis of options history for Vertiv Hldgs (NYSE:VRT) revealed 61 unusual trades.

金融巨头对Vertiv Hldgs采取了明显的看跌举动。我们对维谛控股(纽约证券交易所代码:VRT)期权历史的分析显示了61笔不寻常的交易。

Delving into the details, we found 36% of traders were bullish, while 54% showed bearish tendencies. Out of all the trades we spotted, 26 were puts, with a value of $1,606,218, and 35 were calls, valued at $2,676,908.

深入研究细节,我们发现36%的交易者看涨,而54%的交易者表现出看跌倾向。在我们发现的所有交易中,有26笔是看跌期权,价值为1,606,218美元,35笔是看涨期权,价值2676,908美元。

Projected Price Targets

预计的目标价格

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $60.0 to $180.0 for Vertiv Hldgs over the recent three months.

根据交易活动,看来重要投资者的目标是在最近三个月中将Vertiv Hldgs的价格区间定在60.0美元至180.0美元之间。

Analyzing Volume & Open Interest

分析交易量和未平仓合约

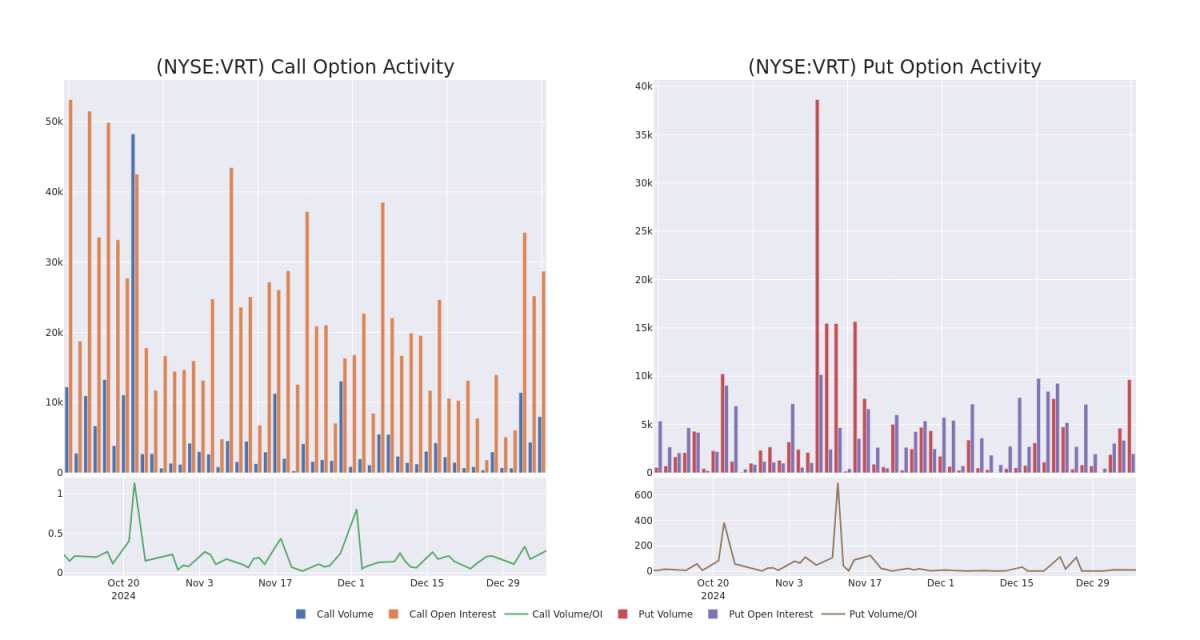

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

查看交易量和未平仓合约是对股票进行尽职调查的一种有见地的方式。

This data can help you track the liquidity and interest for Vertiv Hldgs's options for a given strike price.

这些数据可以帮助您跟踪给定行使价下Vertiv Hldgs期权的流动性和利息。

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Vertiv Hldgs's whale activity within a strike price range from $60.0 to $180.0 in the last 30 days.

下面,我们可以分别观察过去30天在60.0美元至180.0美元的行使价区间内,Vertiv Hldgs所有鲸鱼活动的看涨和看跌期权交易量和未平仓合约的变化。

Vertiv Hldgs Option Activity Analysis: Last 30 Days

Vertiv Hldgs 期权活动分析:过去 30 天

Significant Options Trades Detected:

检测到的重大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| VRT | CALL | TRADE | BULLISH | 01/17/25 | $6.6 | $6.4 | $6.6 | $130.00 | $141.2K | 5.8K | 499 |

| VRT | CALL | TRADE | BEARISH | 01/17/25 | $7.15 | $6.6 | $6.6 | $130.00 | $134.6K | 5.8K | 703 |

| VRT | PUT | SWEEP | BEARISH | 01/16/26 | $37.25 | $35.75 | $37.25 | $150.00 | $111.7K | 1.8K | 168 |

| VRT | CALL | TRADE | BEARISH | 01/17/25 | $8.25 | $7.45 | $7.65 | $128.00 | $111.6K | 744 | 65 |

| VRT | CALL | TRADE | BEARISH | 01/17/25 | $6.5 | $6.05 | $6.2 | $130.00 | $106.6K | 5.8K | 1.2K |

| 符号 | 看跌/看涨 | 交易类型 | 情绪 | Exp。日期 | 问 | 出价 | 价格 | 行使价 | 总交易价格 | 未平仓合约 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| VRT | 打电话 | 贸易 | 看涨 | 01/17/25 | 6.6 美元 | 6.4 美元 | 6.6 美元 | 130.00 美元 | 141.2 万美元 | 5.8K | 499 |

| VRT | 打电话 | 贸易 | 粗鲁的 | 01/17/25 | 7.15 美元 | 6.6 美元 | 6.6 美元 | 130.00 美元 | 134.6 万美元 | 5.8K | 703 |

| VRT | 放 | 扫 | 粗鲁的 | 01/16/26 | 37.25 美元 | 35.75 美元 | 37.25 美元 | 150.00 美元 | 111.7 万美元 | 1.8K | 168 |

| VRT | 打电话 | 贸易 | 粗鲁的 | 01/17/25 | 8.25 美元 | 7.45 美元 | 7.65 美元 | 128.00 美元 | 111.6 万美元 | 744 | 65 |

| VRT | 打电话 | 贸易 | 粗鲁的 | 01/17/25 | 6.5 美元 | 6.05 美元 | 6.2 美元 | 130.00 美元 | 106.6 万美元 | 5.8K | 1.2K |

About Vertiv Hldgs

关于 Vertiv Hldgs

Vertiv Holdings Co brings together hardware, software, analytics and ongoing services to ensure its customers vital applications run continuously, perform optimally and grow with their business needs. The company solves the important challenges faced by data centers, communication networks and commercial and industrial facilities with a portfolio of power, cooling and IT infrastructure solutions and services that extends from the cloud to the edge of the network. Its services include critical power, thermal management, racks and enclosures, monitoring and management, and other services. Its three business segments include the Americas, Asia Pacific; and Europe, Middle East & Africa.

Vertiv Holdings Co 将硬件、软件、分析和持续服务相结合,以确保其客户的重要应用程序持续运行、以最佳性能运行并随着其业务需求而增长。该公司通过从云端延伸到网络边缘的电力、冷却和IT基础设施解决方案和服务组合,解决了数据中心、通信网络以及商业和工业设施面临的重要挑战。其服务包括关键电源、散热管理、机架和机柜、监控和管理以及其他服务。其三个业务部门包括美洲、亚太地区以及欧洲、中东和非洲。

After a thorough review of the options trading surrounding Vertiv Hldgs, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

在对围绕Vertiv Hldgs的期权交易进行了全面审查之后,我们将对该公司进行更详细的审查。这包括评估其当前的市场状况和表现。

Present Market Standing of Vertiv Hldgs

Vertiv Hldgs目前的市场地位

- With a trading volume of 1,543,891, the price of VRT is up by 4.62%, reaching $131.48.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 44 days from now.

- vRT的交易量为1,543,891美元,上涨了4.62%,达到131.48美元。

- 当前的RSI值表明该股可能接近超买。

- 下一份收益报告定于即日起44天后发布。

What The Experts Say On Vertiv Hldgs

专家对Vertiv Hldgs的看法

2 market experts have recently issued ratings for this stock, with a consensus target price of $148.5.

2位市场专家最近发布了该股的评级,共识目标价为148.5美元。

Turn $1000 into $1270 in just 20 days?

在短短 20 天内将 1000 美元变成 1270 美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* An analyst from Barclays downgraded its action to Equal-Weight with a price target of $142. * An analyst from Citigroup persists with their Buy rating on Vertiv Hldgs, maintaining a target price of $155.

20年专业期权交易员透露了他的单线图技术,该技术显示何时买入和卖出。复制他的交易,平均每20天获利27%。点击此处查看。* 巴克莱银行的一位分析师将其股票评级下调至同等权重,目标股价为142美元。*花旗集团的一位分析师维持对Vertiv Hldgs的买入评级,维持155美元的目标价。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

与仅交易股票相比,期权是一种风险更高的资产,但它们具有更高的盈利潜力。严肃的期权交易者通过每天进行自我教育、扩大交易规模、遵循多个指标以及密切关注市场来管理这种风险。

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.