Morgan Stanley's Options Frenzy: What You Need to Know

Morgan Stanley's Options Frenzy: What You Need to Know

Investors with a lot of money to spend have taken a bearish stance on Morgan Stanley (NYSE:MS).

大量资金投入的投资者对摩根士丹利(纽交所:MS)采取了看淡的态度。

And retail traders should know.

零售交易者应该了解这一点。

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

我们今天注意到这一点,当交易出现在我们在Benzinga跟踪的公共可用期权历史记录中时。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with MS, it often means somebody knows something is about to happen.

我们不知道这些投资者是机构还是富有的个人。但当摩根士丹利出现如此大的情况时,通常意味着有人知道一些即将发生的事情。

So how do we know what these investors just did?

那么我们怎么知道这些投资者刚刚做了什么呢?

Today, Benzinga's options scanner spotted 17 uncommon options trades for Morgan Stanley.

今天,Benzinga的期权扫描仪发现了摩根士丹利的17笔不寻常的期权交易。

This isn't normal.

这并不正常。

The overall sentiment of these big-money traders is split between 41% bullish and 47%, bearish.

这些大额交易者的整体情绪在41%看好与47%看淡之间分裂。

Out of all of the special options we uncovered, 4 are puts, for a total amount of $178,394, and 13 are calls, for a total amount of $905,631.

在我们发现的所有特殊期权中,4个是看跌期权,总金额为$178,394,13个是看涨期权,总金额为$905,631。

What's The Price Target?

价格目标是什么?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $70.0 to $160.0 for Morgan Stanley over the last 3 months.

考虑到这些合约的成交量和未平仓合约,似乎鲸鱼们在过去3个月内一直在将摩根士丹利的目标价格区间设定在$70.0到$160.0之间。

Analyzing Volume & Open Interest

分析成交量和未平仓合约

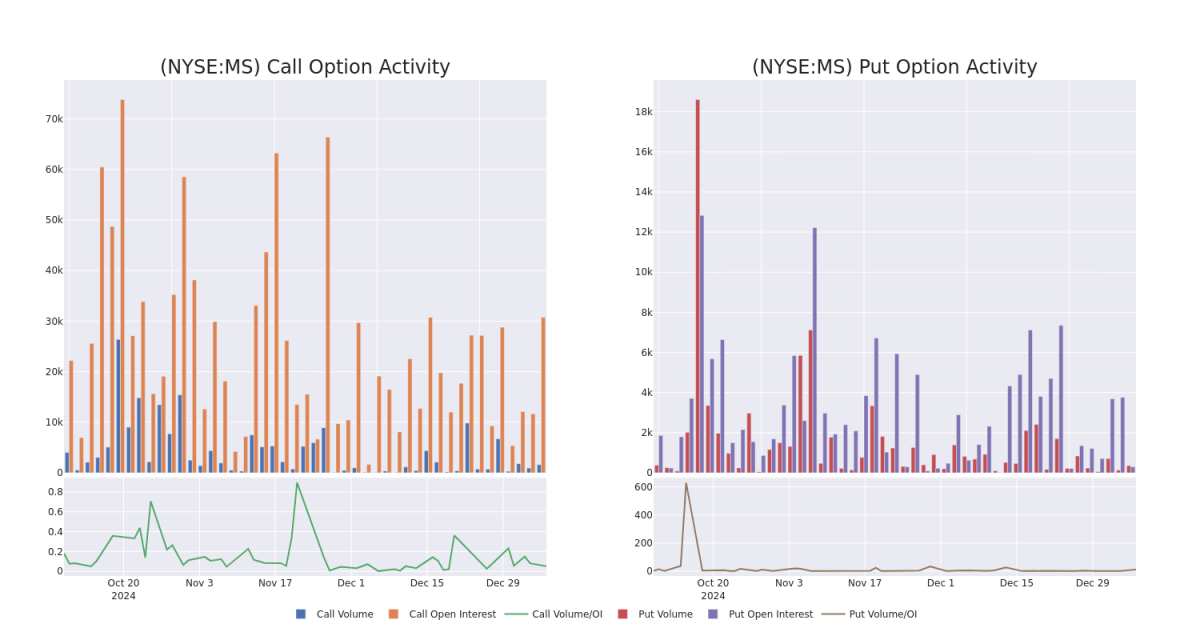

In today's trading context, the average open interest for options of Morgan Stanley stands at 2388.92, with a total volume reaching 1,966.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Morgan Stanley, situated within the strike price corridor from $70.0 to $160.0, throughout the last 30 days.

在今天的交易环境中,摩根士丹利期权的平均未平仓合约为2388.92,总成交量达到1,966.00。附图描绘了过去30天中摩根士丹利高价值交易的看涨期权和看跌期权的成交量及未平仓合约的变化。

Morgan Stanley Call and Put Volume: 30-Day Overview

摩根士丹利看涨期权和看跌期权成交量:30天概览

Significant Options Trades Detected:

检测到重大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MS | CALL | SWEEP | BULLISH | 01/17/25 | $29.95 | $29.35 | $29.95 | $100.00 | $299.5K | 14.1K | 102 |

| MS | CALL | TRADE | BULLISH | 01/17/25 | $4.25 | $3.6 | $4.25 | $127.00 | $174.2K | 281 | 410 |

| MS | CALL | TRADE | BEARISH | 02/21/25 | $7.0 | $6.75 | $6.75 | $125.00 | $60.0K | 1.4K | 12 |

| MS | PUT | SWEEP | BEARISH | 06/20/25 | $9.75 | $9.65 | $9.75 | $130.00 | $53.6K | 299 | 0 |

| MS | CALL | SWEEP | BEARISH | 02/21/25 | $2.68 | $2.67 | $2.67 | $135.00 | $50.1K | 1.6K | 502 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 行权价 | 总交易价格 | 未平仓合约 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MS | 看涨 | 扫单 | 看好 | 01/17/25 | $29.95 | $29.35 | $29.95 | $100.00 | $299.5K | 14.1K | 102 |

| MS | 看涨 | 交易 | 看好 | 01/17/25 | $4.25 | $3.6 | $4.25 | $127.00 | $174.2K | 281 | 410 |

| MS | 看涨 | 交易 | 看淡 | 02/21/25 | $7.0 | $6.75 | $6.75 | $125.00 | 60,000美元 | 1.4K | 12 |

| MS | 看跌 | 扫单 | 看淡 | 06/20/25 | $9.75 | $9.65 | $9.75 | $130.00 | $53.6K | 299 | 0 |

| MS | 看涨 | 扫单 | 看淡 | 02/21/25 | $2.68 | $2.67 | $2.67 | $135.00 | ¥50.1K | 1.6K | 502 |

About Morgan Stanley

关于摩根士丹利

Morgan Stanley is a global investment bank whose history, through its legacy firms, can be traced back to 1924. The company has institutional securities, wealth management, and investment management segments with approximately 45% of net revenue from its institutional securities business, 45% from wealth management, and 10% from investment management. About 30% of its total revenue is from outside the Americas. The company had over $5 trillion of client assets as well as around 80,000 employees at the end of 2023.

摩根士丹利是一家全球投资银行,其历史可以追溯到1924年。公司拥有机构证券、财富管理和投资管理三个业务板块,约45%的营业收入来自其机构证券业务,45%来自财富管理,10%来自投资管理。大约30%的总营业收入来自美洲以外。到2023年底,公司拥有超过5万亿的客户资产和约80,000名员工。

Current Position of Morgan Stanley

摩根士丹利当前位置

- With a trading volume of 2,824,929, the price of MS is up by 1.94%, reaching $128.38.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 10 days from now.

- 在成交量为2,824,929的情况下,MS的价格上涨了1.94%,达到$128.38。

- 当前的RSI值表明该股票可能已接近超买。

- 下一个财报计划在10天后发布。

What The Experts Say On Morgan Stanley

关于摩根士丹利的专家意见

In the last month, 1 experts released ratings on this stock with an average target price of $155.0.

在过去一个月内,1位专家对该股票发布了评级,平均目标价为$155.0。

Unusual Options Activity Detected: Smart Money on the Move

检测到期权异动:聪明资金正在行动

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* Maintaining their stance, an analyst from Barclays continues to hold a Overweight rating for Morgan Stanley, targeting a price of $155.

Benzinga Edge的期权异动板块在市场动向发生之前发现潜在的市场推动者。查看大资金在您喜欢的股票上采取了哪些持仓。点击此处以获取访问权限。* 一位来自巴克莱银行的分析师维持了对摩根士丹利的超配评级,目标价为155美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Morgan Stanley options trades with real-time alerts from Benzinga Pro.

期权交易存在更高的风险和潜在的回报。精明的交易者通过不断学习、调整策略、监控多个因子以及密切关注市场动态来管理这些风险。通过 Benzinga Pro 的实时警报,随时了解摩根士丹利的最新期权交易。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with MS, it often means somebody knows something is about to happen.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with MS, it often means somebody knows something is about to happen.