J.P. Morgan analyst Anthony Elian maintains $Columbia Banking System (COLB.US)$ with a hold rating, and adjusts the target price from $32 to $30.

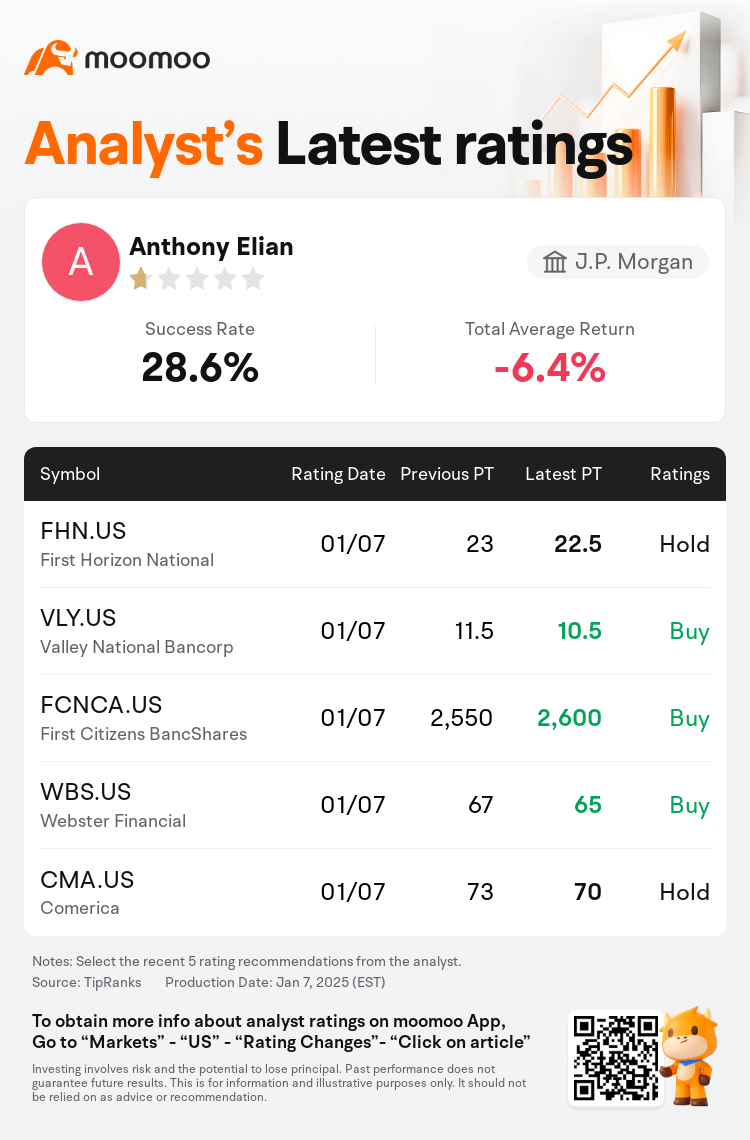

According to TipRanks data, the analyst has a success rate of 28.6% and a total average return of -6.4% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Columbia Banking System (COLB.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Columbia Banking System (COLB.US)$'s main analysts recently are as follows:

As the Q4 earnings season for regional banks approaches, expected trends include minimal growth in loans and deposits, slightly lower net intercessor margins, and stable credit trends. Beyond the immediate results, the focus is expected to shift towards the 2025 outlooks which might reflect the persistent high-interest rate environment. While optimistic about the prospects of regional bank stocks into 2025, this optimism is moderated by expectations of a less aggressive rate-cutting stance by the Federal Reserve.

In recent discussions, anticipation shifts towards the 2025 financial outlooks, influenced by recent economic conditions and an optimistic perspective on the U.S. political landscape. Analysts predict a firm outcome for Q4 in the regional banking sector. However, the primary focus remains on deposit betas, net interest margins, and potential growth prospects. Adjustments in financial models often involve minor revisions to margin forecasts and a tempering of short-term loan growth expectations.

The optimism toward Columbia Banking has increased due to expectations of a notable net interest income rise post Q1 2025, a steeper yield curve, favorable early deposit betas, and regulatory relief. Additionally, the deposit franchise, often undervalued, alongside $8B of high-cost funding repricing by Q1 2025, contributes to this positive outlook.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

摩根大通分析师Anthony Elian维持$哥伦比亚银行系统 (COLB.US)$持有评级,并将目标价从32美元下调至30美元。

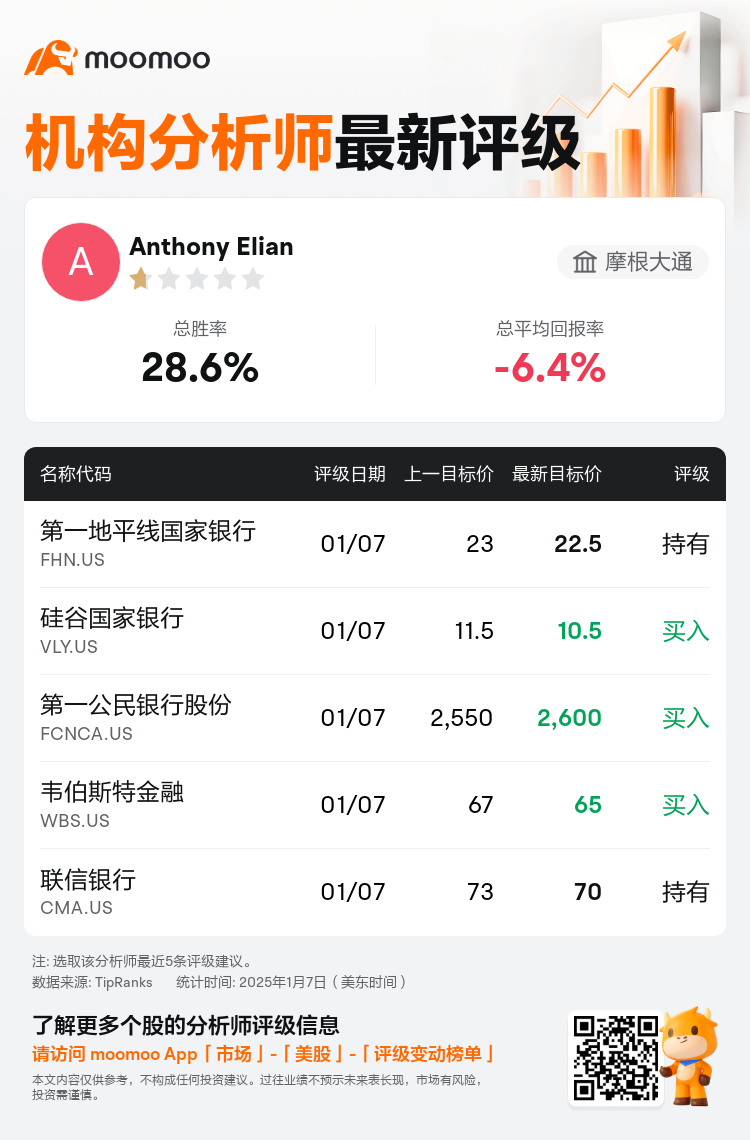

根据TipRanks数据显示,该分析师近一年总胜率为28.6%,总平均回报率为-6.4%。

此外,综合报道,$哥伦比亚银行系统 (COLB.US)$近期主要分析师观点如下:

此外,综合报道,$哥伦比亚银行系统 (COLB.US)$近期主要分析师观点如下:

随着区域银行第四季度财报季的临近,预期的趋势包括贷款和存款增长最小,净中介利润率略有下降以及信贷趋势稳定。除了眼前的结果外,预计重点将转移到2025年的展望上,这可能反映出持续的高利率环境。尽管对2025年地区银行股的前景持乐观态度,但由于对美联储不那么激进的降息立场的预期,这种乐观情绪有所缓和。

在最近的讨论中,受近期经济状况和对美国政治格局的乐观前景的影响,人们的预期转向了2025年的金融前景。分析师预测,地区银行业第四季度业绩良好。但是,主要重点仍然是存款测试版、净利率和潜在的增长前景。财务模型的调整通常涉及对利润率预测的微调和短期贷款增长预期的缓和。

由于预计2025年第一季度后净利息收入将显著增加、收益率曲线更陡峭、早期存款beta优惠以及监管救济,人们对哥伦比亚银行的乐观情绪有所增加。此外,存款特许经营权的估值经常被低估,再加上到2025年第一季度80亿美元的高成本融资重新定价,为这一乐观前景做出了贡献。

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

此外,综合报道,$哥伦比亚银行系统 (COLB.US)$近期主要分析师观点如下:

此外,综合报道,$哥伦比亚银行系统 (COLB.US)$近期主要分析师观点如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of