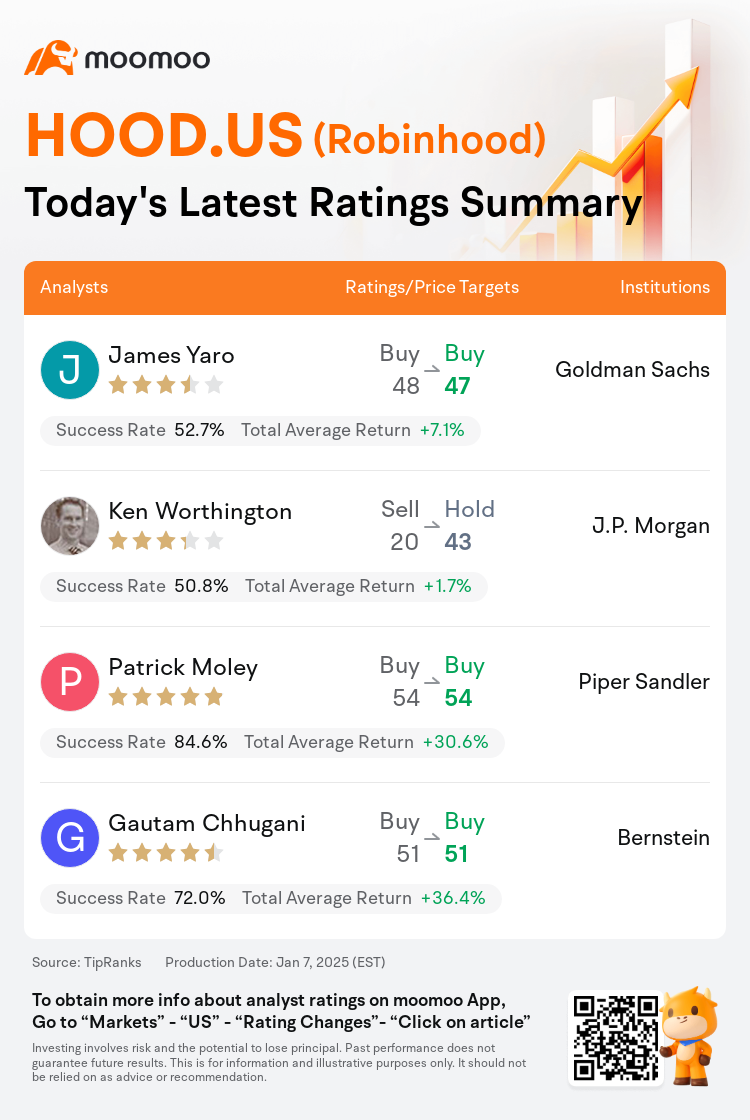

On Jan 07, major Wall Street analysts update their ratings for $Robinhood (HOOD.US)$, with price targets ranging from $43 to $54.

Goldman Sachs analyst James Yaro maintains with a buy rating, and adjusts the target price from $48 to $47.

J.P. Morgan analyst Ken Worthington upgrades to a hold rating, and adjusts the target price from $20 to $43.

Piper Sandler analyst Patrick Moley maintains with a buy rating, and maintains the target price at $54.

Piper Sandler analyst Patrick Moley maintains with a buy rating, and maintains the target price at $54.

Bernstein analyst Gautam Chhugani maintains with a buy rating, and maintains the target price at $51.

Furthermore, according to the comprehensive report, the opinions of $Robinhood (HOOD.US)$'s main analysts recently are as follows:

Alternative asset managers are experiencing significant enduring tailwinds, with emphasis placed on the retail and wealth sectors as particularly promising. Exchanges, however, appear less captivating in bullish markets, leading to a slower expansion compared to more asset sensitive sectors like asset managers and certain brokers. It is anticipated that Trump administration policies may benefit businesses involved in energy exchanges, although growth prospects appear subdued in other asset sectors. Brokers, favored to excel by 2025, are expected to benefit from more robust short-term rates enhancing margin lending and other high-margin operations. An actively trading retail customer base, deriving profits currently, may prolong an active trading environment. Analysts highlight that Robinhood has made significant strides in validating its operations beyond its initial focus on meme-stock trading.

Robinhood has successfully transitioned from being a rapidly expanding, sometimes profitable online broker primarily aimed at younger investors, to a leading example of consistent top and bottom line growth, and assets under custody accumulation. The company's growth prospects in the near to medium term are bolstered by increasing wallet share among highly-profitable active traders, with a long-term opportunity to broaden its total addressable market both domestically and internationally.

Here are the latest investment ratings and price targets for $Robinhood (HOOD.US)$ from 4 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美东时间1月7日,多家华尔街大行更新了$Robinhood (HOOD.US)$的评级,目标价介于43美元至54美元。

高盛集团分析师James Yaro维持买入评级,并将目标价从48美元下调至47美元。

摩根大通分析师Ken Worthington上调至持有评级,并将目标价从20美元上调至43美元。

派杰投资分析师Patrick Moley维持买入评级,维持目标价54美元。

派杰投资分析师Patrick Moley维持买入评级,维持目标价54美元。

联博集团分析师Gautam Chhugani维持买入评级,维持目标价51美元。

此外,综合报道,$Robinhood (HOOD.US)$近期主要分析师观点如下:

另类资产管理公司正经历显著的持续顺风,特别是在零售和财富领域受到的重视被认为尤其有前景。然而,在看好的市场中,交易所似乎不那么吸引,导致相较于更敏感于资产的领域如资产管理公司和某些经纪商,扩张速度较慢。预计特朗普政府的政策可能会对参与能源交易的公司带来好处,尽管在其他资产领域的增长前景似乎受限。预计到2025年,受到青睐的经纪商将在更强劲的短期利率下受益,增强保证金贷款和其他高利润业务。一个主动交易的零售客户群体,当前获得利润,可能会延长活跃的交易环境。分析师们指出,Robinhood在验证其运营方面取得了显著进展,超越了最初对meme股票交易的专注。

Robinhood已经成功转型,从原本快速扩张、偶尔盈利的在线经纪商,主要面向年轻投资者,成为一个 consistent top and bottom line growth 的领先案例,并不断积累托管资产。公司在近期到中期内的增长前景受到高度盈利的主动交易者增加的支持,同时在国内外拓展其可服务市场的长期机会。

以下为今日4位分析师对$Robinhood (HOOD.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

派杰投资分析师Patrick Moley维持买入评级,维持目标价54美元。

派杰投资分析师Patrick Moley维持买入评级,维持目标价54美元。

Piper Sandler analyst Patrick Moley maintains with a buy rating, and maintains the target price at $54.

Piper Sandler analyst Patrick Moley maintains with a buy rating, and maintains the target price at $54.