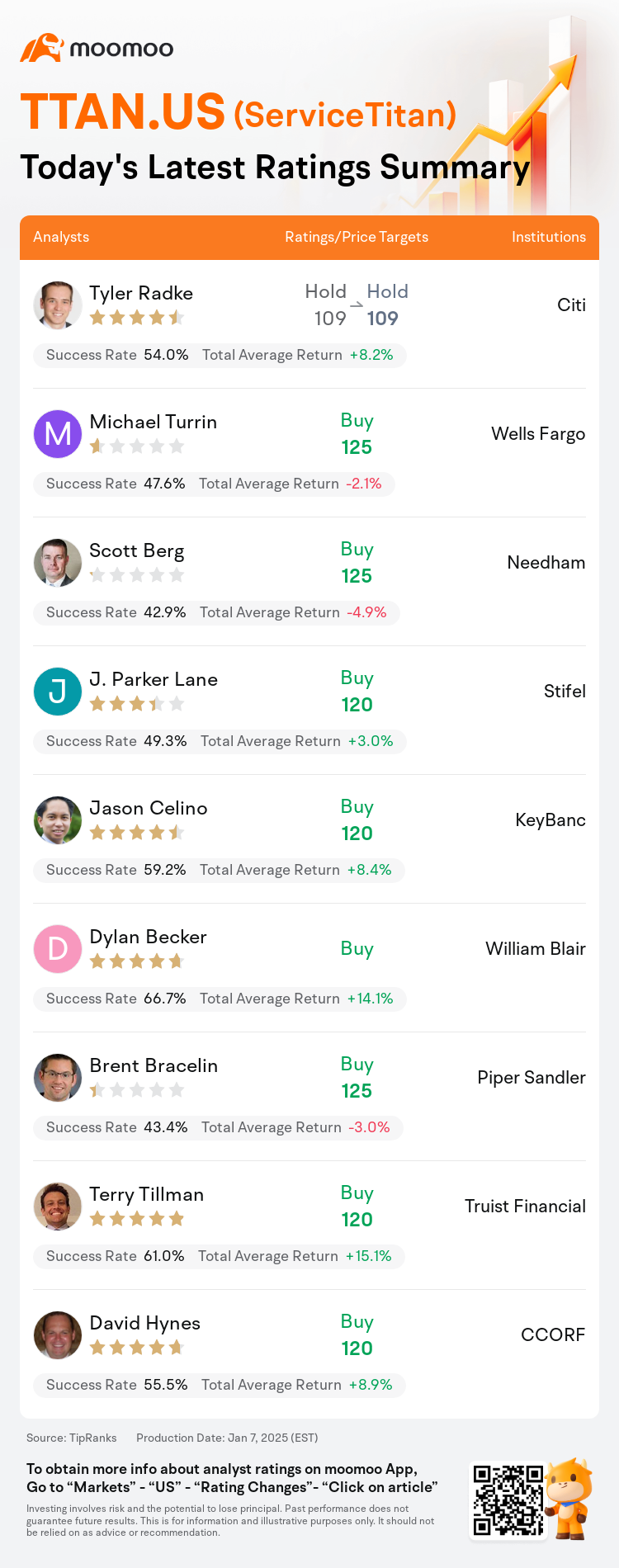

On Jan 07, major Wall Street analysts update their ratings for $ServiceTitan (TTAN.US)$, with price targets ranging from $109 to $125.

Citi analyst Tyler Radke maintains with a hold rating, and maintains the target price at $109.

Wells Fargo analyst Michael Turrin initiates coverage with a buy rating, and sets the target price at $125.

Needham analyst Scott Berg initiates coverage with a buy rating, and sets the target price at $125.

Needham analyst Scott Berg initiates coverage with a buy rating, and sets the target price at $125.

Stifel analyst J. Parker Lane initiates coverage with a buy rating, and sets the target price at $120.

KeyBanc analyst Jason Celino initiates coverage with a buy rating, and sets the target price at $120.

Furthermore, according to the comprehensive report, the opinions of $ServiceTitan (TTAN.US)$'s main analysts recently are as follows:

ServiceTitan, a vertical software-as-a-service company, is recognized for its specialized software offerings targeted at the trades industry. Although viewed positively for its business model, the observation suggests waiting for a more favorable entry point into the shares, citing the company's steep valuation premium compared to peers. Concerns also linger regarding the rate of profitability improvements given its less than impressive Rule-of-40 standing.

ServiceTitan operates within large and expanding markets, possessing strong competitive differentiation and market leadership. The company has established a track record of innovation and has powerful growth vectors. However, the shares are viewed as fairly valued at current levels.

ServiceTitan is described as a cloud-based, comprehensive platform designed to digitalize and enhance business operations for field services, including plumbing and electrical sectors. Analysts view the company as having the capacity to evolve into a robust vertical software-as-a-service entity with possible revenue generation of $4B-$5B. Nonetheless, these advantages are currently recognized by investors, suggesting a cautious approach towards the stock's future risk/reward balance.

ServiceTitan is positioned to potentially become the definitive platform standard for automating business operations across various trades like plumbing, HVAC, and electrical. These sectors are currently experiencing a significant transformation, bolstering the demand for modern, software-based solutions. However, amidst the evolving demand dynamics and market consolidation trends, there are discernible near-term execution risks. Revenue growth in the teen percentage range is conservatively projected for the next couple of years.

ServiceTitan is viewed as possessing a unique set of characteristics that are expected to drive its value both in the short-term and long-term. These characteristics include a leading vertical SaaS solution in an expansive and still growing market, consistent customer growth, and beneficial unit economics. In the near-term, enhancements in the Electrical trade and expansion into the Commercial sector are anticipated to contribute to earnings per share growth.

Here are the latest investment ratings and price targets for $ServiceTitan (TTAN.US)$ from 9 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

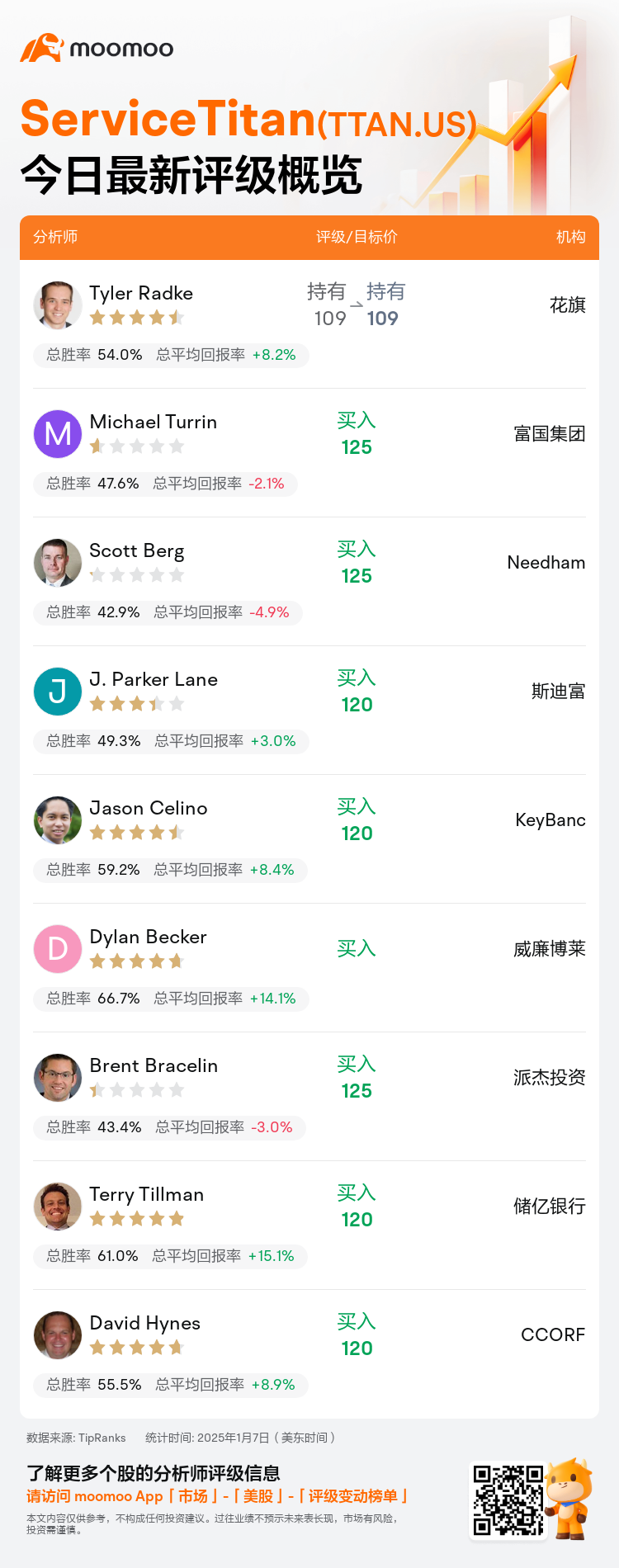

美东时间1月7日,多家华尔街大行更新了$ServiceTitan (TTAN.US)$的评级,目标价介于109美元至125美元。

花旗分析师Tyler Radke维持持有评级,维持目标价109美元。

富国集团分析师Michael Turrin首予买入评级,目标价125美元。

Needham分析师Scott Berg首予买入评级,目标价125美元。

Needham分析师Scott Berg首予买入评级,目标价125美元。

斯迪富分析师J. Parker Lane首予买入评级,目标价120美元。

KeyBanc分析师Jason Celino首予买入评级,目标价120美元。

此外,综合报道,$ServiceTitan (TTAN.US)$近期主要分析师观点如下:

ServiceTitan是一家专注于行业板块的SaaS-云计算公司,以其针对交易行业的专业软件产品而闻名。尽管其商业模式受到积极评价,但观察者建议等待一个更有利的入场时机,理由是该公司的估值相较于同行过高。鉴于其40法则的表现不尽如人意,盈利改善的速度也引发了担忧。

ServiceTitan运作于广阔且不断扩展的市场,具备强大的竞争差异化和市场领导地位。该公司建立了创新的成功记录,并拥有强大的增长动力。然而,当前股价被视为公允价值。

ServiceTitan被描述为一个基于云的综合平台,旨在数字化和提升现场服务(包括管道和电气行业)的业务运营。分析师认为,该公司有能力发展成为一家强大的垂直SaaS-云计算实体,可能带来40亿到50亿的营业收入。然而,这些优势目前被投资者所认可,因此对该股票未来的风险/收益平衡采取谨慎态度。

ServiceTitan有潜力成为自动化各类交易(如管道、暖通空调和电气)的业务操作的最终平台标准。这些行业目前正经历重大变革,推动了对现代、软件基础解决方案的需求。然而,在不断变化的需求动态和市场整合趋势中,近期内存在明显的执行风险。预计未来几年营业收入将以青少年百分比区间的幅度增长。

ServiceTitan被视为拥有一套独特的特征,预计将在短期和长期内推动其价值增长。这些特征包括在一个广阔且仍在增长的市场中领先的垂直SaaS-云计算解决方案,持续的客户增长,以及有利的单位经济学。近期,电气行业的改进和向商业板块的扩展预计将有助于每股收益的增长。

以下为今日9位分析师对$ServiceTitan (TTAN.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

Needham分析师Scott Berg首予买入评级,目标价125美元。

Needham分析师Scott Berg首予买入评级,目标价125美元。

Needham analyst Scott Berg initiates coverage with a buy rating, and sets the target price at $125.

Needham analyst Scott Berg initiates coverage with a buy rating, and sets the target price at $125.