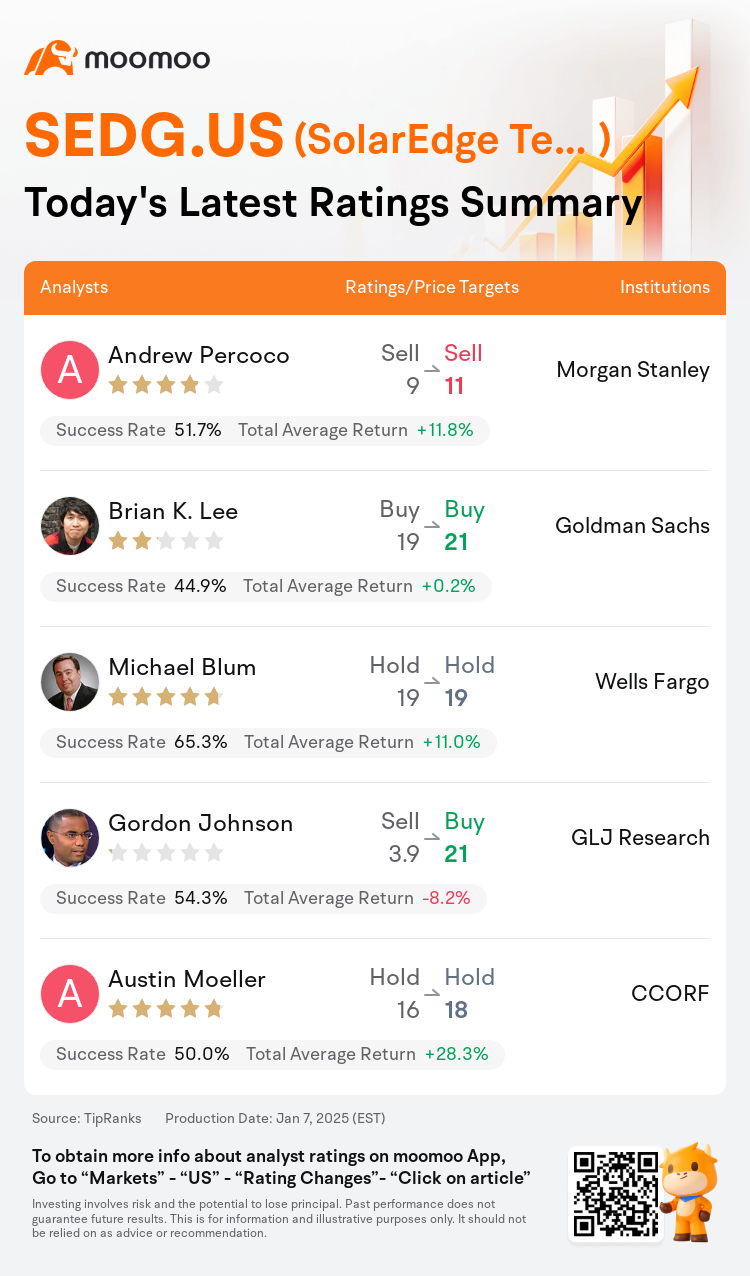

On Jan 07, major Wall Street analysts update their ratings for $SolarEdge Technologies (SEDG.US)$, with price targets ranging from $11 to $21.

Morgan Stanley analyst Andrew Percoco maintains with a sell rating, and adjusts the target price from $9 to $11.

Goldman Sachs analyst Brian K. Lee maintains with a buy rating, and adjusts the target price from $19 to $21.

Wells Fargo analyst Michael Blum maintains with a hold rating, and maintains the target price at $19.

Wells Fargo analyst Michael Blum maintains with a hold rating, and maintains the target price at $19.

GLJ Research analyst Gordon Johnson upgrades to a buy rating, and adjusts the target price from $3.9 to $21.

CCORF analyst Austin Moeller maintains with a hold rating, and adjusts the target price from $16 to $18.

Furthermore, according to the comprehensive report, the opinions of $SolarEdge Technologies (SEDG.US)$'s main analysts recently are as follows:

A reduction in workforce and several key strategic agreements have slightly improved the outlook for the shares, though risks to the company's revival persist. Recent strategic initiatives by the company are viewed as positive moves towards its goals.

SolarEdge has launched several initiatives that enhance its future prospects. These include safe harbor agreements to help two notable residential solar financiers secure the domestic content bonus, the sale of 45X tax credits, and a restructuring plan aimed at reducing operating expenses. These positive developments are anticipated to become a central point of interest for investors starting in 2025.

The company's recent restructuring and cost-cutting actions have been highlighted. However, stagnation in demand and uncertainty surrounding the IRA continue to be concerns.

Here are the latest investment ratings and price targets for $SolarEdge Technologies (SEDG.US)$ from 5 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

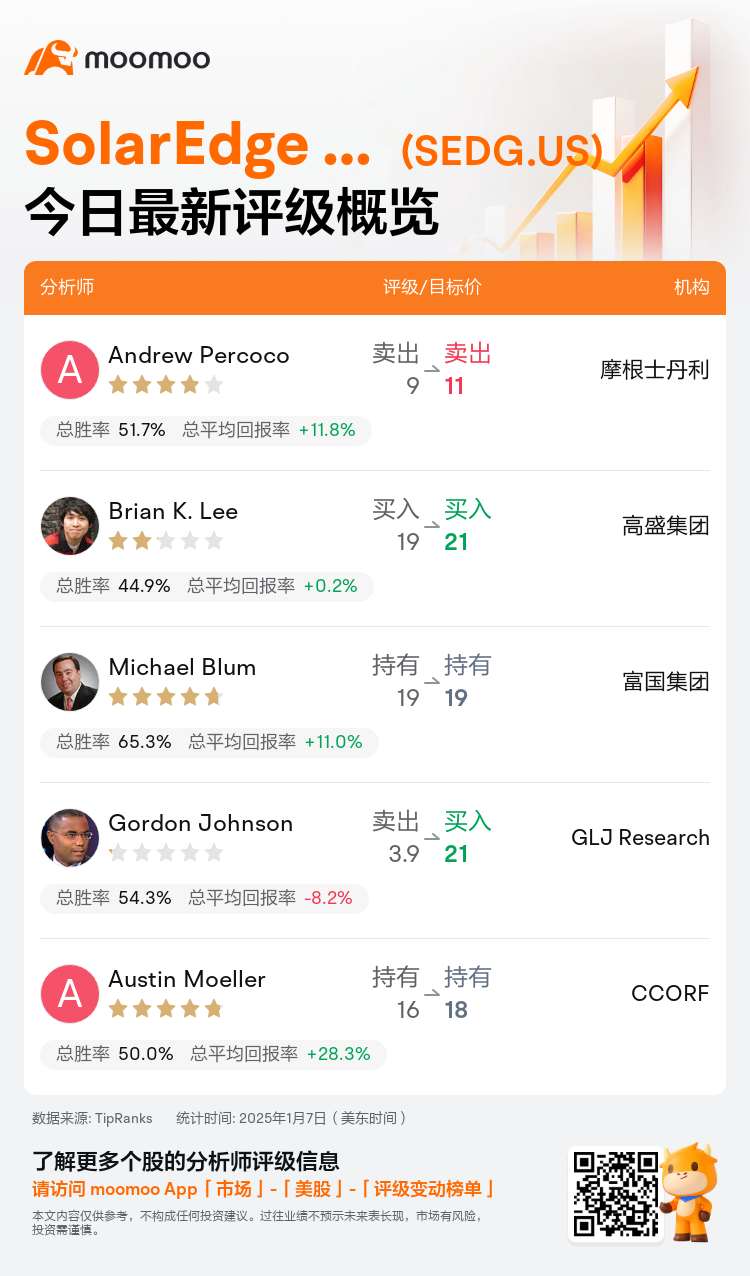

美东时间1月7日,多家华尔街大行更新了$SolarEdge Technologies (SEDG.US)$的评级,目标价介于11美元至21美元。

摩根士丹利分析师Andrew Percoco维持卖出评级,并将目标价从9美元上调至11美元。

高盛集团分析师Brian K. Lee维持买入评级,并将目标价从19美元上调至21美元。

富国集团分析师Michael Blum维持持有评级,维持目标价19美元。

富国集团分析师Michael Blum维持持有评级,维持目标价19美元。

GLJ Research分析师Gordon Johnson上调至买入评级,并将目标价从3.9美元上调至21美元。

CCORF分析师Austin Moeller维持持有评级,并将目标价从16美元上调至18美元。

此外,综合报道,$SolarEdge Technologies (SEDG.US)$近期主要分析师观点如下:

员工减少和几项关键战略协议略微改善了股票的前景,但公司复兴的风险仍然存在。公司最近的战略举措被视为朝着其目标迈出的积极步伐。

太阳能公司SolarEdge推出了几个增强其未来前景的举措。这些举措包括安全港协议,以帮助两家知名的住宅太阳能融资方获得国内内容奖金,出售45X税收抵免,以及旨在减少营业费用的重组计划。这些积极的发展预计将在2025年开始成为投资者的关注焦点。

该公司最近的重组和削减成本的措施已经得到了强调。然而,需求停滞和有关IRA的不确定性仍然是令人担忧的问题。

以下为今日5位分析师对$SolarEdge Technologies (SEDG.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

富国集团分析师Michael Blum维持持有评级,维持目标价19美元。

富国集团分析师Michael Blum维持持有评级,维持目标价19美元。

Wells Fargo analyst Michael Blum maintains with a hold rating, and maintains the target price at $19.

Wells Fargo analyst Michael Blum maintains with a hold rating, and maintains the target price at $19.