Spotlight on IonQ: Analyzing the Surge in Options Activity

Spotlight on IonQ: Analyzing the Surge in Options Activity

Whales with a lot of money to spend have taken a noticeably bullish stance on IonQ.

大量资金投入的鲸鱼对于IonQ持有明显的看好态度。

Looking at options history for IonQ (NYSE:IONQ) we detected 36 trades.

查看IonQ(纽交所:IONQ)的期权历史,我们发现36笔交易。

If we consider the specifics of each trade, it is accurate to state that 44% of the investors opened trades with bullish expectations and 33% with bearish.

如果我们考虑每笔交易的具体情况,可以准确地说,44%的投资者以看好预期开仓,33%以看淡预期开仓。

From the overall spotted trades, 17 are puts, for a total amount of $1,659,766 and 19, calls, for a total amount of $1,159,912.

从总体发现的交易中,17笔是看跌期权,总金额为1,659,766美元,19笔是看涨期权,总金额为1,159,912美元。

Expected Price Movements

预期价格变动

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $10.0 to $75.0 for IonQ over the recent three months.

根据交易活动,看来大投资者在过去三个月内将IonQ的价格目标定位在10.0美元到75.0美元的价格范围。

Insights into Volume & Open Interest

成交量和持仓量分析

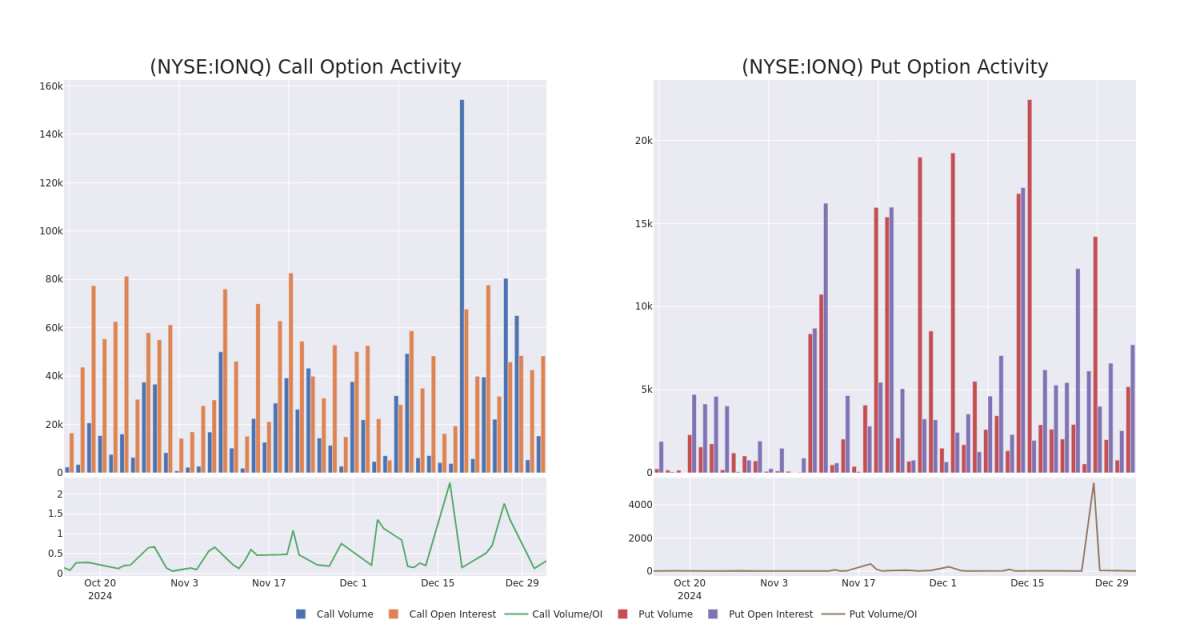

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in IonQ's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to IonQ's substantial trades, within a strike price spectrum from $10.0 to $75.0 over the preceding 30 days.

评估成交量和未平仓合约是期权交易中的一个战略步骤。这些指标揭示了在指定行权价格下IonQ期权的流动性和投资者兴趣。以下数据可视化了在过去30天内,与IonQ大宗交易相关的看涨和看跌期权的成交量和未平仓合约的波动,行权价格范围从10.0美元到75.0美元。

IonQ 30-Day Option Volume & Interest Snapshot

IonQ 30天期权成交量及兴趣快照

Largest Options Trades Observed:

观察到的最大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| IONQ | PUT | SWEEP | BEARISH | 11/21/25 | $21.0 | $18.7 | $19.7 | $50.00 | $392.0K | 0 | 199 |

| IONQ | CALL | TRADE | BULLISH | 04/17/25 | $15.0 | $14.55 | $15.0 | $50.00 | $300.0K | 5.7K | 240 |

| IONQ | PUT | SWEEP | BULLISH | 02/21/25 | $10.8 | $10.65 | $10.8 | $55.00 | $221.4K | 72 | 206 |

| IONQ | PUT | SWEEP | BEARISH | 08/15/25 | $21.65 | $19.7 | $21.65 | $55.00 | $216.5K | 0 | 200 |

| IONQ | PUT | SWEEP | BULLISH | 08/15/25 | $21.95 | $21.0 | $21.11 | $55.00 | $211.6K | 0 | 100 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 行权价 | 总交易价格 | 未平仓合约 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| IONQ | 看跌 | 扫单 | 看淡 | 11/21/25 | $21.0 | $18.7 | $19.7 | $50.00 | $392.0K | 0 | 199 |

| IONQ | 看涨 | 交易 | 看好 | 04/17/25 | $15.0 | $14.55 | $15.0 | $50.00 | $300,000 | 5.7K | 240 |

| IONQ | 看跌 | 扫单 | 看好 | 02/21/25 | $10.8 | $10.65 | $10.8 | $55.00 | $22.14万 | 72 | 206 |

| IONQ | 看跌 | 扫单 | 看淡 | 08/15/25 | $21.65 | $19.7 | $21.65 | $55.00 | 216.5K美元 | 0 | 200 |

| IONQ | 看跌 | 扫单 | 看好 | 08/15/25 | $21.95 | $21.0 | $21.11 | $55.00 | 21.16万美元 | 0 | 100 |

About IonQ

关于IonQ

IonQ Inc sells access to several quantum computers of various qubit capacities and is in the process of researching and developing technologies for quantum computers with increasing computational capabilities. The company currently makes access to its quantum computers available via cloud platforms and also to select customers via its own cloud service. This cloud-based approach enables the broad availability of quantum-computing-as-a-service (QCaaS). The company derives its revenue from its quantum-computing-as-a-service arrangements, consulting services related to co-developing algorithms on company's quantum computing systems, and contracts associated with the design, development, and construction of specialized quantum computing systems together with related services.

IonQ公司销售多种量子计算机的访问权限,具有不同的量子比特容量,并正在研究和开发计算能力不断增强的量子计算机技术。该公司目前通过云平台提供量子计算机的访问权限,同时也通过自己的云服务向部分客户提供。这种基于云的方式使量子计算即服务(QCaaS)广泛可用。该公司的营业收入来自于量子计算即服务的安排、与在公司量子计算系统上共同开发算法相关的咨询服务,以及与专门量子计算系统的设计、开发和施工及相关服务的合同。

IonQ's Current Market Status

IonQ当前的市场状态

- Trading volume stands at 8,186,097, with IONQ's price up by 0.24%, positioned at $51.2.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 50 days.

- 成交量为8,186,097,IONQ的价格上涨0.24%,现报51.2美元。

- 相对强弱指数(RSI)因子显示该股票可能接近超买状态。

- 预计在50天后发布财报。

What The Experts Say On IonQ

专家对IonQ的看法

A total of 2 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $47.5.

在过去30天内,共有2位专业分析师对这只股票进行了点评,设定了平均目标价为47.5美元。

Unusual Options Activity Detected: Smart Money on the Move

检测到期权异动:聪明资金正在行动

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* An analyst from DA Davidson has revised its rating downward to Buy, adjusting the price target to $50. * Consistent in their evaluation, an analyst from Craig-Hallum keeps a Buy rating on IonQ with a target price of $45.

Benzinga Edge的期权异动板块在市场动向出现之前识别潜在的市场推动者。看看大资金在你喜欢的股票上采取了什么头寸。点击这里获取访问权限。* DA Davidson的一位分析师已将评级下调至买入,并将目标价调整为50美元。* 一位来自Craig-Hallum的分析师在对IonQ的评估中保持买入评级,目标价为45美元。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

与仅仅交易股票相比,期权是一种风险较高的资产,但它们具有更高的盈利潜力。严肃的期权交易者通过日常学习、逐步进出交易、关注多个因子以及密切关注市场来管理这种风险。

From the overall spotted trades, 17 are puts, for a total amount of $1,659,766 and 19, calls, for a total amount of $1,159,912.

From the overall spotted trades, 17 are puts, for a total amount of $1,659,766 and 19, calls, for a total amount of $1,159,912.