Market Whales and Their Recent Bets on WFC Options

Market Whales and Their Recent Bets on WFC Options

Whales with a lot of money to spend have taken a noticeably bullish stance on Wells Fargo.

资金充裕的投资者对富国银行采取了明显的看好态度。

Looking at options history for Wells Fargo (NYSE:WFC) we detected 26 trades.

查看富国银行(纽交所代码:WFC)的期权历史,我们发现了26笔交易。

If we consider the specifics of each trade, it is accurate to state that 50% of the investors opened trades with bullish expectations and 46% with bearish.

如果我们考虑每笔交易的具体情况,可以准确地说,50%的投资者以看涨的预期开盘,46%则是看跌。

From the overall spotted trades, 7 are puts, for a total amount of $453,046 and 19, calls, for a total amount of $1,184,099.

从整体发现的交易中,7笔为看跌期权,总金额为453,046美元,19笔为看涨期权,总金额为1,184,099美元。

Expected Price Movements

预期价格变动

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $40.0 and $80.0 for Wells Fargo, spanning the last three months.

在评估了交易成交量和未平仓合约后,显然主要市场参与者集中在富国银行40.0美元至80.0美元的价格区间,持续了三个月。

Analyzing Volume & Open Interest

分析成交量和未平仓合约

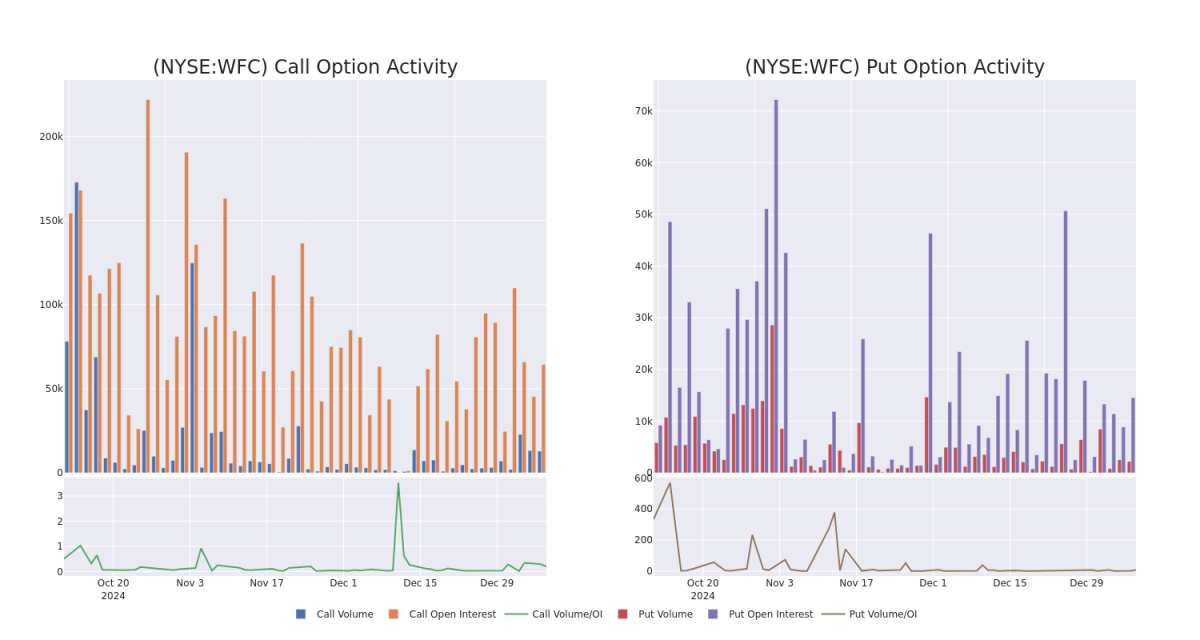

In today's trading context, the average open interest for options of Wells Fargo stands at 3752.86, with a total volume reaching 15,130.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Wells Fargo, situated within the strike price corridor from $40.0 to $80.0, throughout the last 30 days.

在今天的交易环境中,富国银行期权的平均未平仓合约为3752.86,总代成交量达15,130.00。附带的图表描绘了过去30天富国银行高价值交易的看涨和看跌期权的成交量及未平仓合约的变化。

Wells Fargo 30-Day Option Volume & Interest Snapshot

富国银行30天期权成交量和利润快照

Biggest Options Spotted:

最大的期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| WFC | CALL | TRADE | BULLISH | 02/21/25 | $3.05 | $2.98 | $3.04 | $72.50 | $304.0K | 2.1K | 1.2K |

| WFC | CALL | TRADE | BEARISH | 01/16/26 | $12.2 | $12.1 | $12.1 | $67.50 | $130.6K | 2.4K | 108 |

| WFC | PUT | SWEEP | BULLISH | 01/17/25 | $2.31 | $2.3 | $2.3 | $73.00 | $99.3K | 77 | 469 |

| WFC | PUT | SWEEP | BULLISH | 06/20/25 | $1.36 | $1.32 | $1.32 | $60.00 | $92.9K | 1.4K | 920 |

| WFC | PUT | SWEEP | BULLISH | 01/17/25 | $1.98 | $1.87 | $1.98 | $72.50 | $84.5K | 5.0K | 500 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 行权价 | 总交易价格 | 未平仓合约 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| WFC | 看涨 | 交易 | 看好 | 02/21/25 | $3.05 | $2.98 | $3.04 | $72.50 | $304.0K | 2.1K | 1.2K |

| WFC | 看涨 | 交易 | 看淡 | 01/16/26 | $12.2 | $12.1 | $12.1 | $67.50 | 130.6K美元 | 2.4K | 108 |

| WFC | 看跌 | 扫单 | 看好 | 01/17/25 | $2.31 | $2.3 | $2.3 | $73.00 | 99.3K美元 | 77 | 469 |

| WFC | 看跌 | 扫单 | 看好 | 06/20/25 | $1.36 | $1.32 | $1.32 | $60.00 | 92.9K美元 | 1.4K | 920 |

| WFC | 看跌 | 扫单 | 看好 | 01/17/25 | $1.98 | $1.87 | $1.98 | $72.50 | $84.5K | 5.0K | 500 |

About Wells Fargo

关于富国银行

Wells Fargo is one of the largest banks in the United States, with approximately $1.9 trillion in balance sheet assets. The company has four primary segments: consumer banking, commercial banking, corporate and investment banking, and wealth and investment management. It is almost entirely focused on the U.S.

富国银行是美国最大的银行之一,资产负债表资产约为1.9万亿美元。该公司有四个主要部门:消费银行、商业银行、企业及投资银行,以及财富与投资管理。它几乎完全专注于美国市场。

In light of the recent options history for Wells Fargo, it's now appropriate to focus on the company itself. We aim to explore its current performance.

考虑到富国银行近期的期权历史,现在有必要关注公司本身。我们旨在探索其当前的表现。

Current Position of Wells Fargo

富国银行的当前状态

- With a volume of 7,518,106, the price of WFC is up 0.09% at $72.09.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 8 days.

- 成交量为7,518,106,WFC的价格上涨了0.09%,现在为72.09美元。

- RSI因子提示相关股票可能接近超买。

- 下次财报预计将在8天后发布。

Professional Analyst Ratings for Wells Fargo

富国银行的专业分析师评级

Over the past month, 4 industry analysts have shared their insights on this stock, proposing an average target price of $85.0.

在过去一个月中,4名行业分析师对该股票分享了他们的见解,提出的平均目标价为85.0美元。

Unusual Options Activity Detected: Smart Money on the Move

检测到期权异动:聪明资金正在行动

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* Consistent in their evaluation, an analyst from UBS keeps a Buy rating on Wells Fargo with a target price of $85. * Maintaining their stance, an analyst from Compass Point continues to hold a Neutral rating for Wells Fargo, targeting a price of $83. * Reflecting concerns, an analyst from Truist Securities lowers its rating to Buy with a new price target of $82.* Consistent in their evaluation, an analyst from Barclays keeps a Overweight rating on Wells Fargo with a target price of $90.

Benzinga Edge的期权异动板块可以在市场移动前发现潜在的市场驱动因素。查看大资金在你最喜欢的股票上采取了哪些仓位。点击这里获取访问权限。* 在评估中保持一致,瑞银的分析师对富国银行维持买入评级,目标价为85美元。* 维持他们的立场,Compass Point的分析师对富国银行继续保持中立评级,目标价为83美元。* 反映出担忧,Truist证券的分析师将评级下调至买入,并设定新的目标价为82美元。* 在评估中保持一致,巴克莱银行的分析师对富国银行维持超配评级,目标价为90美元。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Wells Fargo with Benzinga Pro for real-time alerts.

交易期权涉及更大的风险,但也提供了更高利润的潜力。精明的交易者通过持续教育、战略交易调整、利用各种因子,并密切关注市场动态来减少这些风险。通过Benzinga Pro跟踪富国银行的最新期权交易,获取实时警报。

From the overall spotted trades, 7 are puts, for a total amount of $453,046 and 19, calls, for a total amount of $1,184,099.

From the overall spotted trades, 7 are puts, for a total amount of $453,046 and 19, calls, for a total amount of $1,184,099.