Puyang Refractories Group Co., Ltd.'s (SZSE:002225) 13% Gain Last Week Benefited Both Retail Investors Who Own 51% as Well as Insiders

Puyang Refractories Group Co., Ltd.'s (SZSE:002225) 13% Gain Last Week Benefited Both Retail Investors Who Own 51% as Well as Insiders

Key Insights

关键洞察

- The considerable ownership by retail investors in Puyang Refractories Group indicates that they collectively have a greater say in management and business strategy

- 49% of the business is held by the top 25 shareholders

- Insiders own 40% of Puyang Refractories Group

- 濮耐股份中零售投资者的持有比例高,表明他们在管理和业务策略方面共同拥有更大的发言权。

- 业务的49%由前25名股东持有。

- 内部人士持有濮耐股份40%的股份。

If you want to know who really controls Puyang Refractories Group Co., Ltd. (SZSE:002225), then you'll have to look at the makeup of its share registry. And the group that holds the biggest piece of the pie are retail investors with 51% ownership. In other words, the group stands to gain the most (or lose the most) from their investment into the company.

如果你想知道谁真正控制了濮耐股份有限公司(SZSE:002225),那么你必须查看其股东名册的构成。持有最大部分股份的群体是零售投资者,他们的持股比例为51%。换句话说,这个群体将从他们对公司的投资中获得最大收益(或承受最大损失)。

While retail investors were the group that benefitted the most from last week's CN¥654m market cap gain, insiders too had a 40% share in those profits.

虽然散户投资者是上周市值增加65400万人民币中受益最多的群体,但内部人士也获得了40%的利润。

Let's delve deeper into each type of owner of Puyang Refractories Group, beginning with the chart below.

让我们深入了解濮耐股份的每种所有者类型,从下面的图表开始。

What Does The Institutional Ownership Tell Us About Puyang Refractories Group?

机构持股对濮耐股份有什么启示?

Many institutions measure their performance against an index that approximates the local market. So they usually pay more attention to companies that are included in major indices.

许多机构的表现与近似当地市场的指数进行比较。因此,他们通常更加关注那些被纳入主要指数的公司。

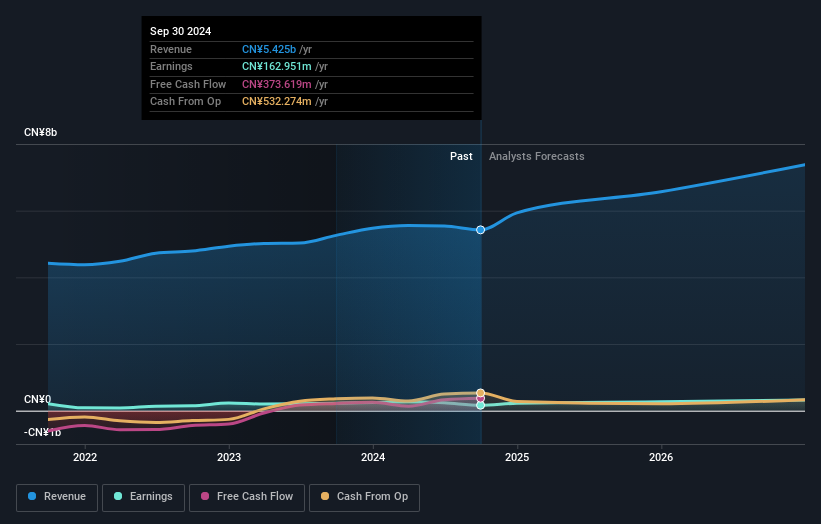

As you can see, institutional investors have a fair amount of stake in Puyang Refractories Group. This implies the analysts working for those institutions have looked at the stock and they like it. But just like anyone else, they could be wrong. When multiple institutions own a stock, there's always a risk that they are in a 'crowded trade'. When such a trade goes wrong, multiple parties may compete to sell stock fast. This risk is higher in a company without a history of growth. You can see Puyang Refractories Group's historic earnings and revenue below, but keep in mind there's always more to the story.

如您所见,机构投资者在濮耐股份中拥有相当数量的股份。这意味着为这些机构工作的分析师对这只股票进行了研究,并且他们看好它。但就像其他人一样,他们也可能会出错。当多家机构持有一只股票时,始终存在他们处于“拥挤交易”的风险。当这种交易出现问题时,多个参与方可能会竞争快速出售股票。在没有增长历史的公司中,这种风险更高。您可以在下面看到濮耐股份的历史收益和营业收入,但请记住,事情总是有更多的故事。

Puyang Refractories Group is not owned by hedge funds. Looking at our data, we can see that the largest shareholder is Baikuan Liu with 13% of shares outstanding. For context, the second largest shareholder holds about 10% of the shares outstanding, followed by an ownership of 8.6% by the third-largest shareholder. Zhiyan Guo, who is the third-largest shareholder, also happens to hold the title of Chairman of Corporate Board.

濮耐股份并不被对冲基金持有。根据我们的数据,最大股东是刘百宽,持有13%的流通股。作为对比,第二大股东持有约10%的流通股,第三大股东则持有8.6%的股份。第三大股东郭志燕恰好还是公司董事会主席。

On studying our ownership data, we found that 25 of the top shareholders collectively own less than 50% of the share register, implying that no single individual has a majority interest.

通过研究我们的持股数据,我们发现前25大股东共同持有的股份少于50%,这意味着没有任何个人拥有多数股权。

While it makes sense to study institutional ownership data for a company, it also makes sense to study analyst sentiments to know which way the wind is blowing. There are plenty of analysts covering the stock, so it might be worth seeing what they are forecasting, too.

虽然研究一家公司机构的所有权数据是有意义的,但研究分析师的看法也同样重要,以了解市场的动态。很多分析师关注这只股票,因此查看他们的预测也可能是值得的。

Insider Ownership Of Puyang Refractories Group

濮耐股份的内部股权

The definition of company insiders can be subjective and does vary between jurisdictions. Our data reflects individual insiders, capturing board members at the very least. Company management run the business, but the CEO will answer to the board, even if he or she is a member of it.

公司内部人员的定义可能是主观的,并且在不同的司法管辖区有所不同。我们的数据反映了个人内部人员,至少包括董事会成员。公司管理层负责业务的运行,但CEO需要对董事会负责,即使他或她是董事会成员。

Most consider insider ownership a positive because it can indicate the board is well aligned with other shareholders. However, on some occasions too much power is concentrated within this group.

大多数人认为内部持股是积极的,因为这表明董事会与其他股东保持良好的一致性。然而,在某些情况下,权力在这个群体中过于集中。

Our information suggests that insiders maintain a significant holding in Puyang Refractories Group Co., Ltd.. Insiders have a CN¥2.2b stake in this CN¥5.6b business. It is great to see insiders so invested in the business. It might be worth checking if those insiders have been buying recently.

我们的信息表明,内部人士在濮耐股份有限公司中持有相当大的股份。内部人士在这家价值56亿人民币的企业中拥有22亿人民币的股份。看到内部人士如此投资于业务令人欣慰。值得检查一下这些内部人士最近是否有买入。

General Public Ownership

公众持股

The general public, who are usually individual investors, hold a substantial 51% stake in Puyang Refractories Group, suggesting it is a fairly popular stock. This size of ownership gives investors from the general public some collective power. They can and probably do influence decisions on executive compensation, dividend policies and proposed business acquisitions.

公众,通常是个体投资者,在濮耐股份中持有51%的 substantial 股份,这表明它是一只相当受欢迎的股票。这种股份的规模赋予了普通投资者一些集体权力。他们可以,并且很可能真的会影响高管薪酬、股息政策和拟议的业务收购的决策。

Next Steps:

下一步:

While it is well worth considering the different groups that own a company, there are other factors that are even more important. To that end, you should be aware of the 3 warning signs we've spotted with Puyang Refractories Group .

虽然考虑拥有一家公司不同团体是非常重要的,但还有其他更加重要的因素。为此,你应该注意到我们发现的关于濮耐股份的3个警告信号。

If you are like me, you may want to think about whether this company will grow or shrink. Luckily, you can check this free report showing analyst forecasts for its future.

如果你像我一样,你可能想考虑这家公司是会增长还是缩小。幸运的是,你可以查看这份免费的报告,了解分析师对其未来的预测。

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

注意:本文中的数字是根据过去十二个月的数据计算得出的,指的是截至财务报表日期的月份最后一天的12个月期间。这可能与完整年度的年报数字不一致。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对本文有反馈?对内容有疑虑?请直接与我们联系。或者,发送电子邮件至 editorial-team (at) simplywallst.com。

这篇来自Simply Wall St的文章是一般性的。我们根据历史数据和分析师预测提供评论,采用无偏见的方法,我们的文章并不旨在提供财务建议。它不构成对任何股票的买入或卖出建议,也未考虑到您的目标或财务状况。我们旨在为您提供以基本数据驱动的长期分析。请注意,我们的分析可能未考虑最新的价格敏感公司公告或定性材料。Simply Wall St在提到的任何股票中均没有持仓。

Many institutions measure their performance against an index that approximates the local market. So they usually pay more attention to companies that are included in major indices.

Many institutions measure their performance against an index that approximates the local market. So they usually pay more attention to companies that are included in major indices.