Are Shenzhen Jufei Optoelectronics Co., Ltd.'s (SZSE:300303) Mixed Financials The Reason For Its Gloomy Performance on The Stock Market?

Are Shenzhen Jufei Optoelectronics Co., Ltd.'s (SZSE:300303) Mixed Financials The Reason For Its Gloomy Performance on The Stock Market?

It is hard to get excited after looking at Shenzhen Jufei Optoelectronics' (SZSE:300303) recent performance, when its stock has declined 5.1% over the past month. We, however decided to study the company's financials to determine if they have got anything to do with the price decline. Long-term fundamentals are usually what drive market outcomes, so it's worth paying close attention. In this article, we decided to focus on Shenzhen Jufei Optoelectronics' ROE.

在看到聚飞光电(SZSE:300303)最近的表现后,很难激动,因为其股票在过去一个月下跌了5.1%。然而,我们决定研究公司的财务状况,以判断这是否与股价下跌有关。长期基本面通常是推动市场结果的因素,因此值得仔细关注。在本文中,我们决定专注于聚飞光电的ROE。

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors' money. In simpler terms, it measures the profitability of a company in relation to shareholder's equity.

股本回报率(ROE)是衡量公司如何有效地增长其价值和管理投资者资金的指标。简单来说,它衡量公司的盈利能力相对于股东权益的情况。

How To Calculate Return On Equity?

如何计算股东权益回报率?

ROE can be calculated by using the formula:

ROE可以通过以下公式计算:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

股东权益回报率 = 净利润(来自持续运营)÷ 股东权益

So, based on the above formula, the ROE for Shenzhen Jufei Optoelectronics is:

因此,根据上述公式,深圳聚飞光电的roe为:

8.6% = CN¥277m ÷ CN¥3.2b (Based on the trailing twelve months to September 2024).

8.6% = CN¥27700万 ÷ CN¥32亿(基于截至2024年9月的过去十二个月)。

The 'return' refers to a company's earnings over the last year. Another way to think of that is that for every CN¥1 worth of equity, the company was able to earn CN¥0.09 in profit.

“回报”是指公司在过去一年中的 earnings。换句话说,公司的每1元权益,能够赚取0.09元的利润。

What Has ROE Got To Do With Earnings Growth?

roe与盈利增长有何关系?

So far, we've learned that ROE is a measure of a company's profitability. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

到目前为止,我们了解到ROE是衡量公司盈利能力的一种指标。基于公司选择再投资或“保留”的利润,我们能够评估公司未来产生利润的能力。在其他条件相等的情况下,具有更高股本回报率和更高利润留存的公司通常相比那些没有相同特征的公司拥有更高的增长率。

Shenzhen Jufei Optoelectronics' Earnings Growth And 8.6% ROE

聚飞光电的盈利增长和8.6%的ROE

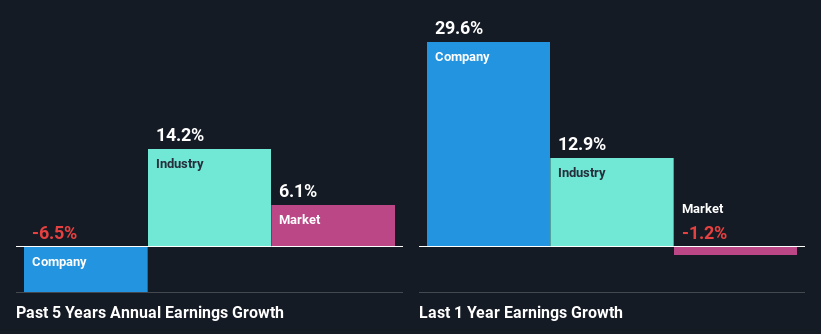

When you first look at it, Shenzhen Jufei Optoelectronics' ROE doesn't look that attractive. Although a closer study shows that the company's ROE is higher than the industry average of 6.4% which we definitely can't overlook. But seeing Shenzhen Jufei Optoelectronics' five year net income decline of 6.5% over the past five years, we might rethink that. Remember, the company's ROE is a bit low to begin with, just that it is higher than the industry average. Hence, this goes some way in explaining the shrinking earnings.

乍一看,聚飞光电的ROE并不是那么吸引人。尽管更深入的研究显示,该公司的ROE高于行业平均水平6.4%,这是我们绝对无法忽视的。但是,看到聚飞光电在过去五年净利润下降了6.5%,我们可能需要重新考虑这一点。请记住,该公司的ROE起初就有点低,只不过高于行业平均水平。因此,这在一定程度上解释了盈利的缩减。

That being said, we compared Shenzhen Jufei Optoelectronics' performance with the industry and were concerned when we found that while the company has shrunk its earnings, the industry has grown its earnings at a rate of 14% in the same 5-year period.

话虽如此,我们将聚飞光电的表现与行业进行了对比,并对公司在盈利缩水的同时,行业在同五年期间的盈利增长率高达14%这一点感到担忧。

Earnings growth is a huge factor in stock valuation. It's important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). Doing so will help them establish if the stock's future looks promising or ominous. Is Shenzhen Jufei Optoelectronics fairly valued compared to other companies? These 3 valuation measures might help you decide.

盈利增长是股票估值的一个重要因素。投资者了解市场是否已经考虑到公司预期的盈利增长(或下降)非常重要。这样做将帮助他们判断股票的未来是看起来有前景还是不妙。聚飞光电与其他公司相比,估值是否合理?这三种估值指标可能会帮助您做出判断。

Is Shenzhen Jufei Optoelectronics Efficiently Re-investing Its Profits?

聚飞光电是否有效地再投资其利润?

Shenzhen Jufei Optoelectronics has a high three-year median payout ratio of 55% (that is, it is retaining 45% of its profits). This suggests that the company is paying most of its profits as dividends to its shareholders. This goes some way in explaining why its earnings have been shrinking. With only very little left to reinvest into the business, growth in earnings is far from likely. You can see the 5 risks we have identified for Shenzhen Jufei Optoelectronics by visiting our risks dashboard for free on our platform here.

聚飞光电的三年中位支付比率为55%(即,其保留了45%的利润),这表明该公司将大部分利润作为分红派息支付给股东。这在一定程度上解释了其盈利为何持续下降。在很少有剩余用于再投资于业务的情况下,盈利增长几乎是不可能的。您可以通过访问我们平台这里的风险仪表板免费查看我们为聚飞光电确定的5个风险。

Moreover, Shenzhen Jufei Optoelectronics has been paying dividends for at least ten years or more suggesting that management must have perceived that the shareholders prefer dividends over earnings growth.

此外,聚飞光电至少已支付分红派息十年或更长时间,这表明管理层可能察觉到股东更喜欢分红派息而不是盈利增长。

Conclusion

结论

Overall, we have mixed feelings about Shenzhen Jufei Optoelectronics. Primarily, we are disappointed to see a lack of growth in earnings even in spite of a moderate ROE. Bear in mind, the company reinvests a small portion of its profits, which explains the lack of growth. Up till now, we've only made a short study of the company's growth data. You can do your own research on Shenzhen Jufei Optoelectronics and see how it has performed in the past by looking at this FREE detailed graph of past earnings, revenue and cash flows.

总体而言,我们对聚飞光电的看法是复杂的。主要是,我们对其盈利没有增长感到失望,即使在适度的ROE下也是如此。请注意,该公司将小部分利润进行再投资,这解释了增长的缺乏。迄今为止,我们对该公司的增长数据仅进行了短期研究。您可以对聚飞光电进行自己的研究,查看它在过去的表现,方法是查看这张免费详细图表,了解过去的盈利、营业收入和现金流情况。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对本文有反馈?对内容有疑虑?请直接与我们联系。或者,发送电子邮件至 editorial-team (at) simplywallst.com。

这篇来自Simply Wall St的文章是一般性的。我们根据历史数据和分析师预测提供评论,采用无偏见的方法,我们的文章并不旨在提供财务建议。它不构成对任何股票的买入或卖出建议,也未考虑到您的目标或财务状况。我们旨在为您提供以基本数据驱动的长期分析。请注意,我们的分析可能未考虑最新的价格敏感公司公告或定性材料。Simply Wall St在提到的任何股票中均没有持仓。

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity