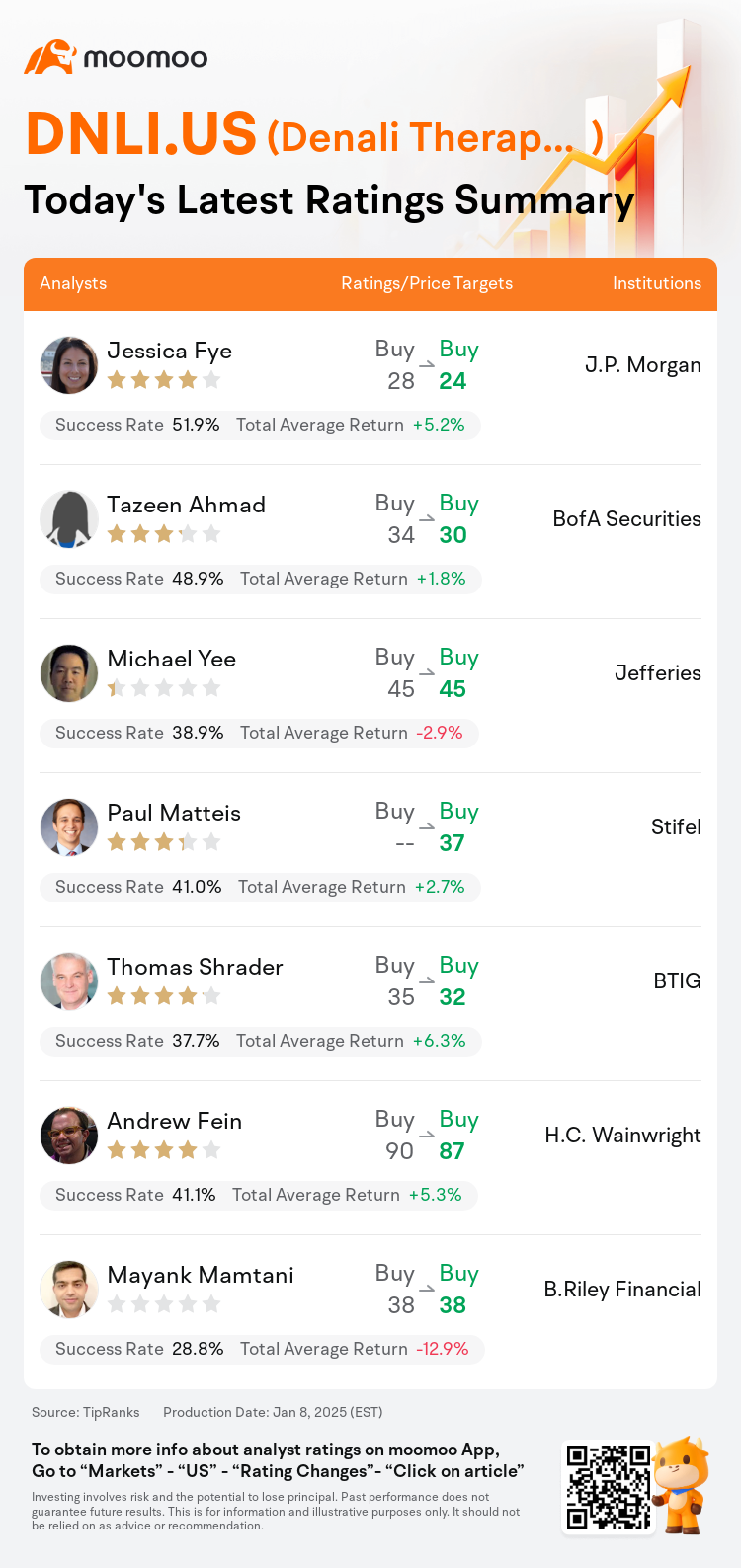

On Jan 08, major Wall Street analysts update their ratings for $Denali Therapeutics (DNLI.US)$, with price targets ranging from $24 to $87.

J.P. Morgan analyst Jessica Fye maintains with a buy rating, and adjusts the target price from $28 to $24.

BofA Securities analyst Tazeen Ahmad maintains with a buy rating, and adjusts the target price from $34 to $30.

Jefferies analyst Michael Yee maintains with a buy rating, and maintains the target price at $45.

Jefferies analyst Michael Yee maintains with a buy rating, and maintains the target price at $45.

Stifel analyst Paul Matteis maintains with a buy rating, and sets the target price at $37.

BTIG analyst Thomas Shrader maintains with a buy rating, and adjusts the target price from $35 to $32.

Furthermore, according to the comprehensive report, the opinions of $Denali Therapeutics (DNLI.US)$'s main analysts recently are as follows:

The recent disclosure regarding the Phase 2/3 HEALEY trial outcomes, which assessed an agonist of eIF2B in treating amyotrophic lateral sclerosis, led to some disappointment due to the DNL343's lack of success. This is particularly disheartening given the strong pre-clinical indications that suggested a reduction in the aggregation of significant ALS pathology drivers such as TDP-43. It has also been noted that this was among the final legacy projects for Denali, as the company's management is steering its development focus increasingly towards Television (TV) related projects.

Denali Therapeutics is anticipated to evolve into a commercial entity around late 2025 to early 2026, propelled by the potential accelerated FDA endorsement of tividenofusp alfa, an enzyme replacement treatment for Hunter syndrome. Thanks to its ability to penetrate the brain, DNL310 is expected to rapidly secure a substantial portion of the market share, currently held by Elaprase's $700M in annual sales. Additionally, Denali's preclinical 'Peak 2' initiatives aimed at Alzheimer's and Parkinson's diseases are considered promising prospects for the long term.

Here are the latest investment ratings and price targets for $Denali Therapeutics (DNLI.US)$ from 7 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美东时间1月8日,多家华尔街大行更新了$Denali Therapeutics (DNLI.US)$的评级,目标价介于24美元至87美元。

摩根大通分析师Jessica Fye维持买入评级,并将目标价从28美元下调至24美元。

美银证券分析师Tazeen Ahmad维持买入评级,并将目标价从34美元下调至30美元。

富瑞集团分析师Michael Yee维持买入评级,维持目标价45美元。

富瑞集团分析师Michael Yee维持买入评级,维持目标价45美元。

斯迪富分析师Paul Matteis维持买入评级,目标价37美元。

BTIG分析师Thomas Shrader维持买入评级,并将目标价从35美元下调至32美元。

此外,综合报道,$Denali Therapeutics (DNLI.US)$近期主要分析师观点如下:

关于评估eIF20亿激动剂在治疗肌萎缩侧索硬化症方面的第二/第三阶段 HEALEY 试验结果的最新披露,引起了一些失望,因为DNL343未能成功。这尤其令人沮丧,因为强有力的临床前迹象表明减少了许多ALS病理驱动因子如TDP-43的聚集。此外,这被认为是Denali的最后几个遗留项目之一,因为公司的管理层越来越多地将其开发重点转向与电视相关的项目。

Denali Therapeutics预计将在2025年底至2026年初转变为一家商业实体,这主要得益于FDA对tividenofusp alfa的潜在加速批准,该药物是用于亨特综合征的酶替代治疗。由于其能够穿透大脑,DNL310预期将迅速占据市场份额,目前该市场由Elaprase的70000万美元年销量所占。此外,Denali针对阿尔茨海默病和帕金森病的临床前“Peak 2”计划被认为是长期内的有希望前景。

以下为今日7位分析师对$Denali Therapeutics (DNLI.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

富瑞集团分析师Michael Yee维持买入评级,维持目标价45美元。

富瑞集团分析师Michael Yee维持买入评级,维持目标价45美元。

Jefferies analyst Michael Yee maintains with a buy rating, and maintains the target price at $45.

Jefferies analyst Michael Yee maintains with a buy rating, and maintains the target price at $45.