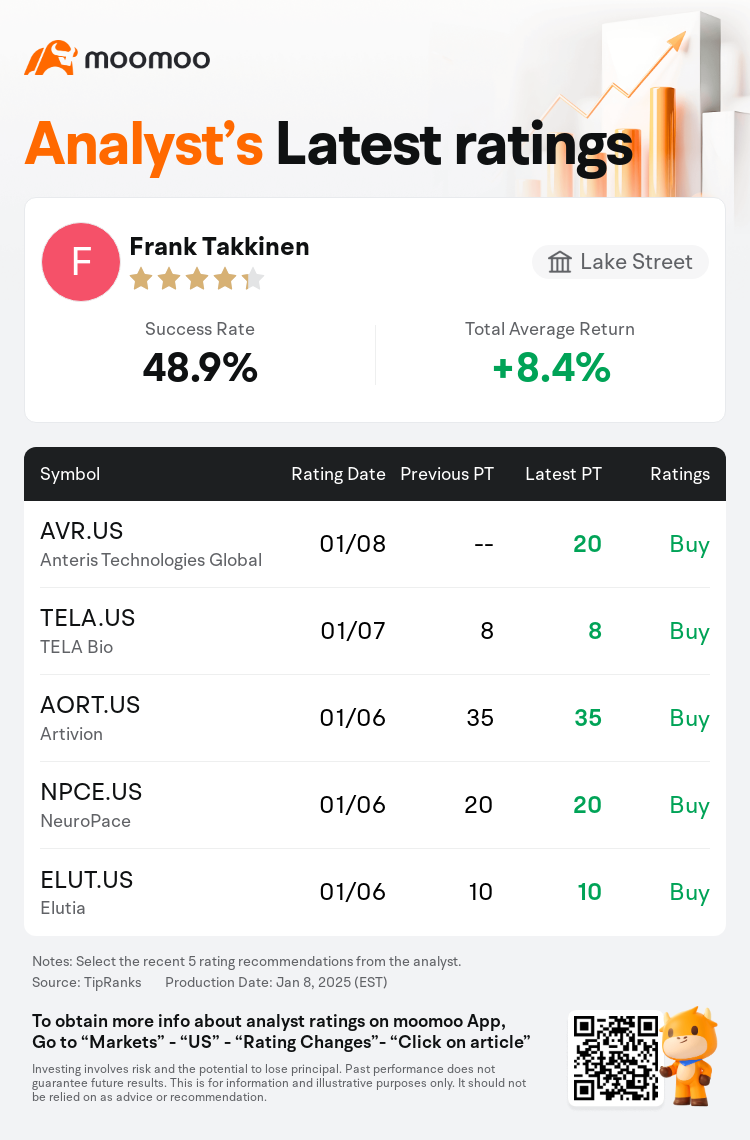

Lake Street analyst Frank Takkinen initiates coverage on $Anteris Technologies Global (AVR.US)$ with a buy rating, and sets the target price at $20.

According to TipRanks data, the analyst has a success rate of 48.9% and a total average return of 8.4% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Anteris Technologies Global (AVR.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Anteris Technologies Global (AVR.US)$'s main analysts recently are as follows:

The timing for Anteris Technologies' entry into the transcatheter aortic valve replacement market appears optimal. The market clearly shows a persistent conflict between preferences for balloon-expandable valves and the requirements for superior hemodynamics in smaller valve sizes. Anteris' DurAVR could potentially cater to this demand by providing balloon-expandable valve delivery across all valve sizes, addressing the increasing needs for valve replacement.

Anteris Technologies has developed DurAVR, a first-in-class biomimetic transcatheter aortic valve replacement platform described as having 'disruptive potential.' The hemodynamic outcomes observed in its clinical development program set it apart and may enable Anteris to secure a significant market share in the $10B TAVR market if these results are replicated in subsequent trials.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

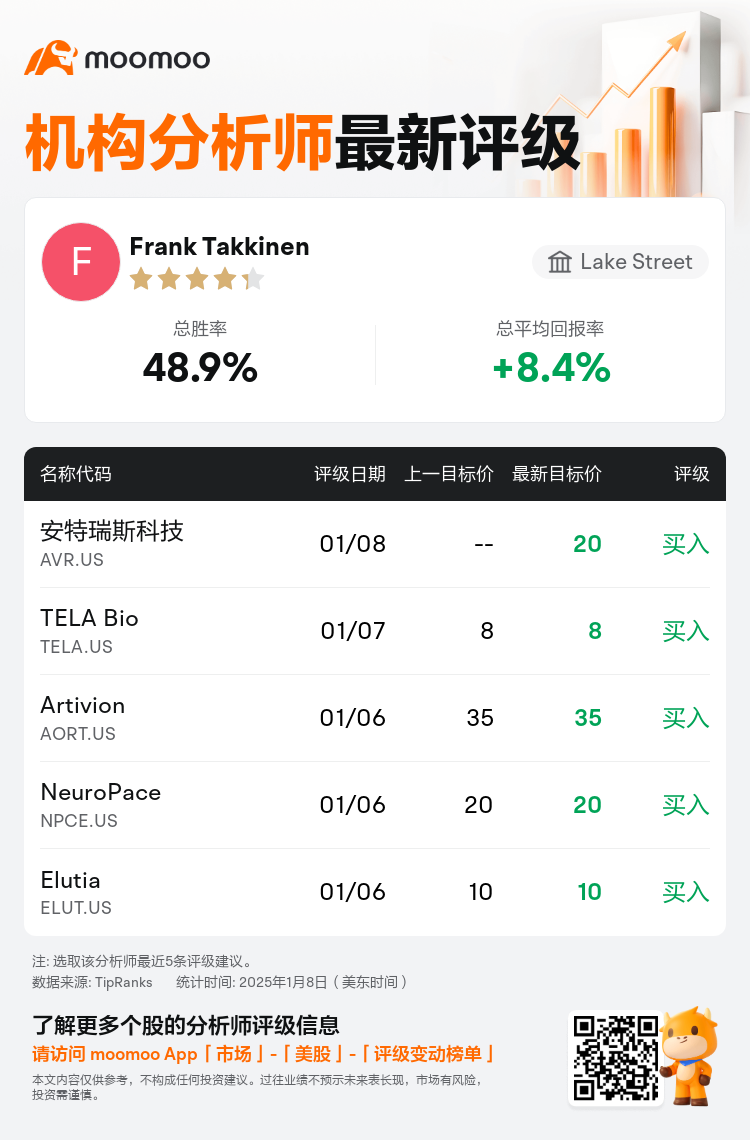

Lake Street分析师Frank Takkinen首予$安特瑞斯科技 (AVR.US)$买入评级,目标价20美元。

根据TipRanks数据显示,该分析师近一年总胜率为48.9%,总平均回报率为8.4%。

此外,综合报道,$安特瑞斯科技 (AVR.US)$近期主要分析师观点如下:

此外,综合报道,$安特瑞斯科技 (AVR.US)$近期主要分析师观点如下:

安特瑞斯科技公司进入经导管主动脉瓣置换市场的时机似乎非常合适。该市场明显显示出对气囊膨胀瓣的偏好与对较小瓣尺寸的优越血流动力学要求之间的持续冲突。安特瑞斯的DurAVR潜在地能够满足这一需求,通过在所有瓣尺寸上提供气囊膨胀瓣的输送,满足日益增长的瓣置换需求。

安特瑞斯科技公司开发了DurAVR,这是一种首创的仿生经导管主动脉瓣置换平台,被形容为具有“颠覆性潜力”。其临床开发计划中观察到的血流动力学结果使其与众不同,并可能促使安特瑞斯在100亿TAVR市场中获得显著的市场份额,如果这些结果在后续试验中得以重复的话。

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

此外,综合报道,$安特瑞斯科技 (AVR.US)$近期主要分析师观点如下:

此外,综合报道,$安特瑞斯科技 (AVR.US)$近期主要分析师观点如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of