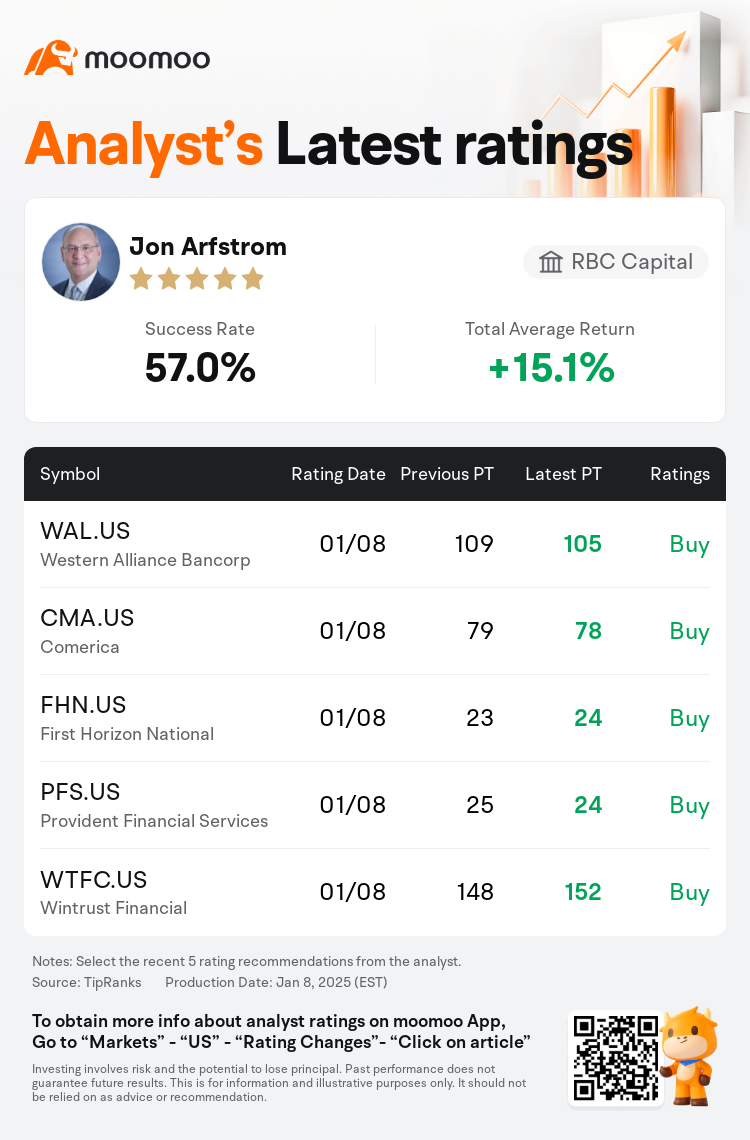

RBC Capital analyst Jon Arfstrom maintains $Western Alliance Bancorp (WAL.US)$ with a buy rating, and adjusts the target price from $109 to $105.

According to TipRanks data, the analyst has a success rate of 57.0% and a total average return of 15.1% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Western Alliance Bancorp (WAL.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Western Alliance Bancorp (WAL.US)$'s main analysts recently are as follows:

Heading into the Q4 earnings season for regional banks, fundamental trends for the quarter are anticipated to be underscored by minimal growth in loans and deposits, a slight decline in net intercessor margins, and stable credit trends overall. Looking beyond the results, it is believed that focus areas alongside bank earnings will include outlooks for 2025, which will likely reflect adjustments to the persistent 'higher for a bit longer' interest rate scenario. There remains a positive stance on regional bank stocks for 2025, albeit with moderated optimism due to a 'less aggressive rate cutting' perspective expected from the Federal Reserve.

In a broader discussion on regional banks' Q4 earnings, it was noted that changes in the rate environment and the national economic forecast, along with optimism regarding the new U.S. administration, could shift focus mostly onto projections for 2025. There's an expectation for respectable Q4 results across the sector, but the forthcoming path for deposit betas, net interest margins, and growth potentials remains crucial. These discussions primarily entail minor adjustments to margin expectations and somewhat reduced predictions for near-term loan growth.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

加皇资本市场分析师Jon Arfstrom维持$阿莱恩斯西部银行 (WAL.US)$买入评级,并将目标价从109美元下调至105美元。

根据TipRanks数据显示,该分析师近一年总胜率为57.0%,总平均回报率为15.1%。

此外,综合报道,$阿莱恩斯西部银行 (WAL.US)$近期主要分析师观点如下:

此外,综合报道,$阿莱恩斯西部银行 (WAL.US)$近期主要分析师观点如下:

区域银行进入第四季度财报季时,贷款和存款的最小增长、净中介利润率略有下降以及总体信贷趋势稳定的预计将突显该季度的基本趋势。除了业绩外,据信银行收益之外的重点领域将包括2025年的展望,这可能会反映对持续 “在更长的时间内提高利率” 情景的调整。尽管美联储预计将采取 “不那么激进的降息” 观点,但乐观情绪有所缓和,但对2025年地区银行股的立场仍然持乐观态度。

在关于地区银行第四季度收益的更广泛讨论中,有人指出,利率环境和国民经济预测的变化,以及对美国新政府的乐观情绪,可能会将重点主要转移到2025年的预测上。预计该行业第四季度业绩将取得可观的业绩,但即将到来的存款测试版、净利率和增长潜力的路径仍然至关重要。这些讨论主要涉及对利润率预期的微小调整,并略微降低对短期贷款增长的预测。

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

此外,综合报道,$阿莱恩斯西部银行 (WAL.US)$近期主要分析师观点如下:

此外,综合报道,$阿莱恩斯西部银行 (WAL.US)$近期主要分析师观点如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of