Looking At Caterpillar's Recent Unusual Options Activity

Looking At Caterpillar's Recent Unusual Options Activity

Financial giants have made a conspicuous bullish move on Caterpillar. Our analysis of options history for Caterpillar (NYSE:CAT) revealed 23 unusual trades.

金融巨头对卡特彼勒采取了明显的看好举措。我们对卡特彼勒(纽交所:CAT)的期权历史分析显示有23笔飞凡交易。

Delving into the details, we found 39% of traders were bullish, while 34% showed bearish tendencies. Out of all the trades we spotted, 8 were puts, with a value of $611,787, and 15 were calls, valued at $959,845.

深入细节,我们发现39%的交易者看好,而34%显示出看淡的倾向。在我们发现的所有交易中,有8笔是看跌,价值$611,787,15笔是看涨,价值$959,845。

Predicted Price Range

预测价格区间

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $185.0 to $460.0 for Caterpillar during the past quarter.

分析这些合约的成交量和未平仓合约,看来大玩家们在过去一个季度内关注卡特彼勒的价格区间为$185.0到$460.0。

Volume & Open Interest Development

成交量和持仓量的评估是期权交易中的一个关键步骤。这些指标揭示了阿里巴巴集团(Alibaba Gr Hldgs)特定执行价格期权的流动性和投资者兴趣。下面的数据可视化了在过去30天内,阿里巴巴集团(Alibaba Gr Hldgs)在执行价格在74.0美元到120.0美元区间内的看涨看跌期权中,成交量和持仓量的波动情况。

In terms of liquidity and interest, the mean open interest for Caterpillar options trades today is 417.5 with a total volume of 688.00.

就流动性和兴趣而言,卡特彼勒期权交易今天的平均未平仓合约为417.5,成交总量为688.00。

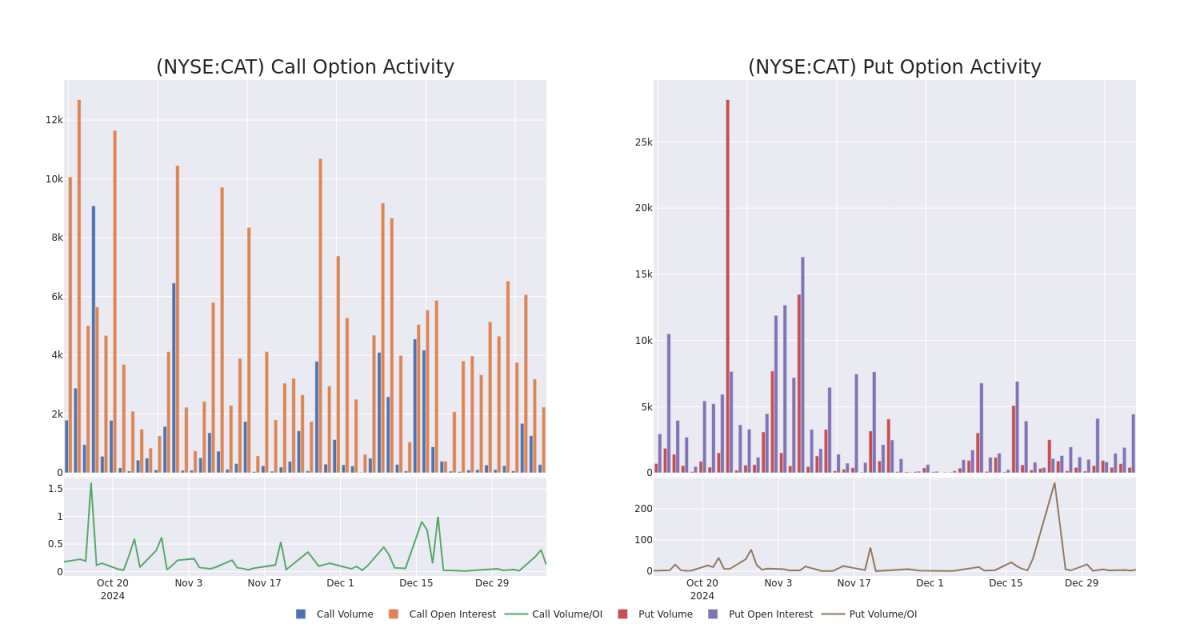

In the following chart, we are able to follow the development of volume and open interest of call and put options for Caterpillar's big money trades within a strike price range of $185.0 to $460.0 over the last 30 days.

在下方的图表中,我们可以跟踪卡特彼勒在过去30天内的看涨和看跌期权的大额交易的成交量和未平仓合约的发展,行权价区间为$185.0到$460.0。

Caterpillar Option Activity Analysis: Last 30 Days

卡特彼勒期权活动分析:最近30天

Significant Options Trades Detected:

检测到重大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CAT | PUT | SWEEP | BEARISH | 09/19/25 | $21.35 | $20.95 | $20.95 | $340.00 | $180.3K | 87 | 138 |

| CAT | CALL | SWEEP | NEUTRAL | 09/19/25 | $171.85 | $170.75 | $171.85 | $190.00 | $137.5K | 2 | 16 |

| CAT | CALL | SWEEP | BULLISH | 09/19/25 | $31.35 | $30.65 | $31.07 | $370.00 | $134.3K | 25 | 68 |

| CAT | PUT | SWEEP | BULLISH | 09/19/25 | $21.0 | $20.9 | $21.0 | $340.00 | $109.4K | 87 | 210 |

| CAT | CALL | SWEEP | NEUTRAL | 09/19/25 | $152.6 | $152.55 | $152.6 | $210.00 | $106.9K | 2 | 7 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 行权价 | 总交易价格 | 未平仓合约 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 卡特彼勒 | 看跌 | 扫单 | 看淡 | 09/19/25 | $21.35 | $20.95 | $20.95 | $340.00 | 18万美元 | 87 | 138 |

| 卡特彼勒 | 看涨 | 扫单 | 中立 | 09/19/25 | $171.85 | $170.75 | $171.85 | $190.00 | $137.5K | 2 | 16 |

| 卡特彼勒 | 看涨 | 扫单 | 看好 | 09/19/25 | $31.35 | $30.65 | $31.07 | $370.00 | $134.3K | 25 | 68 |

| 卡特彼勒 | 看跌 | 扫单 | 看好 | 09/19/25 | $21.0 | $20.9 | $21.0 | $340.00 | 109.4K美元 | 87 | 210 |

| 卡特彼勒 | 看涨 | 扫单 | 中立 | 09/19/25 | $152.6 | $152.55 | $152.6 | $210.00 | $106.9K | 2 | 7 |

About Caterpillar

关于卡特彼勒

Caterpillar is the world's leading manufacturer of construction and mining equipment, off-highway diesel and natural gas engines, industrial gas turbines and diesel-electric locomotives. Its reporting segments are: construction industries (40% sales/47% operating profit, or OP), resource industries (20% sales/19% OP), and energy & transportation (40% sales/34% OP). Market share approaches 20% across many products. Caterpillar operates a captive finance subsidiary to facilitate sales. The firm has global reach (46% US sales/54% ex-US). Construction skews more domestic, while the other divisions are more geographically diversified. An independent network of 156 dealers operates approximately 2,800 facilities, giving Caterpillar reach into about 190 countries for sales and support services.

卡特彼勒是全球领先的施工和矿业设备、越野柴油和天然气发动机、工业气体涡轮机及柴油电力机车的制造商。其报告部门包括:施工行业(销售占比40%/营业利润占比47%),资源行业(销售占比20%/营业利润占比19%),以及能源和运输(销售占比40%/营业利润占比34%)。各类产品的市场份额接近20%。卡特彼勒运营着一家专属融资子公司,以促进销售。该公司具有全球影响力(美国销售占比46%/美国以外销售占比54%)。施工业务以国内市场为主,而其他部门的地理多样性更高。一独立的经销商网络由156家经销商运营,约有2,800个设施,使卡特彼勒的销售和支持服务覆盖大约190个国家。

Having examined the options trading patterns of Caterpillar, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在分析了卡特彼勒的期权交易模式后,我们的注意力现在直接转向这家公司。这一转变使我们能够深入了解其当前的市场地位和表现。

Present Market Standing of Caterpillar

卡特彼勒的当前市场地位

- With a volume of 816,083, the price of CAT is down -1.29% at $358.32.

- RSI indicators hint that the underlying stock may be oversold.

- Next earnings are expected to be released in 26 days.

- CAT的成交量为816,083,价格下跌了1.29%,现为358.32美元。

- RSI因子暗示标的股票可能被超卖。

- 下次财报预计在26天内发布。

Expert Opinions on Caterpillar

关于卡特彼勒的专家意见

In the last month, 1 experts released ratings on this stock with an average target price of $471.0.

在过去一个月里,有1位专家对该股票进行了评级,平均目标价为471.0美元。

Turn $1000 into $1270 in just 20 days?

在短短20天内将1000美元变成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* An analyst from Truist Securities has decided to maintain their Buy rating on Caterpillar, which currently sits at a price target of $471.

一位拥有20年经验的期权交易员透露了他的单行图技术,显示何时买入和卖出。复制他的交易,这些交易每20天平均获利27%。点击这里获取访问权限。*一位来自Truist证券的分析师决定维持对卡特彼勒的买入评级,目前的目标价为471美元。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

与仅仅交易股票相比,期权是一种风险较高的资产,但它们具有更高的盈利潜力。严肃的期权交易者通过日常学习、逐步进出交易、关注多个因子以及密切关注市场来管理这种风险。

In terms of liquidity and interest, the mean open interest for Caterpillar options trades today is 417.5 with a total volume of 688.00.

In terms of liquidity and interest, the mean open interest for Caterpillar options trades today is 417.5 with a total volume of 688.00.