JPMorgan Chase Unusual Options Activity For January 08

JPMorgan Chase Unusual Options Activity For January 08

Whales with a lot of money to spend have taken a noticeably bearish stance on JPMorgan Chase.

有很多钱可以花的鲸鱼对摩根大通采取了明显的看跌立场。

Looking at options history for JPMorgan Chase (NYSE:JPM) we detected 19 trades.

查看摩根大通(纽约证券交易所代码:JPM)的期权历史记录,我们发现了19笔交易。

If we consider the specifics of each trade, it is accurate to state that 31% of the investors opened trades with bullish expectations and 52% with bearish.

如果我们考虑每笔交易的具体情况,可以准确地说,31%的投资者以看涨的预期开启交易,52%的投资者持看跌预期。

From the overall spotted trades, 6 are puts, for a total amount of $248,156 and 13, calls, for a total amount of $1,029,870.

在已发现的全部交易中,有6笔是看跌期权,总额为248,156美元,13笔看涨期权,总额为1,029,870美元。

Expected Price Movements

预期的价格走势

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $205.0 to $270.0 for JPMorgan Chase over the last 3 months.

考虑到这些合约的交易量和未平仓合约,在过去的3个月中,鲸鱼似乎一直将摩根大通的价格定在205.0美元至270.0美元之间。

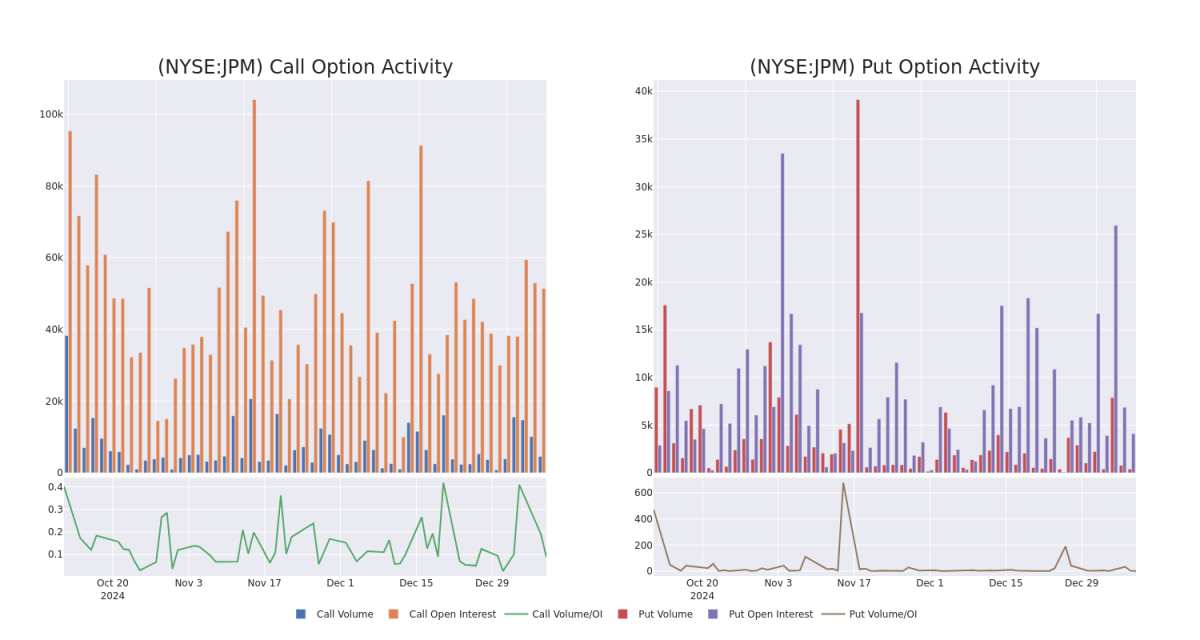

Volume & Open Interest Trends

交易量和未平仓合约趋势

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in JPMorgan Chase's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to JPMorgan Chase's substantial trades, within a strike price spectrum from $205.0 to $270.0 over the preceding 30 days.

评估交易量和未平仓合约是期权交易的战略步骤。这些指标揭示了摩根大通按指定行使价计算的期权的流动性和投资者对摩根大通期权的兴趣。即将发布的数据可视化了与摩根大通大量交易相关的看涨期权和看跌期权的交易量和未平仓合约的波动,在过去30天内,行使价范围从205.0美元到270美元不等。

JPMorgan Chase 30-Day Option Volume & Interest Snapshot

摩根大通30天期权交易量和利息快照

Significant Options Trades Detected:

检测到的重大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| JPM | CALL | TRADE | BULLISH | 03/21/25 | $3.85 | $3.75 | $3.85 | $260.00 | $365.7K | 2.0K | 1.0K |

| JPM | CALL | TRADE | BEARISH | 03/21/25 | $40.35 | $40.1 | $40.1 | $205.00 | $160.4K | 216 | 0 |

| JPM | CALL | SWEEP | BULLISH | 01/16/26 | $27.5 | $27.15 | $27.5 | $240.00 | $137.5K | 2.1K | 50 |

| JPM | CALL | SWEEP | BEARISH | 04/17/25 | $11.45 | $11.25 | $11.31 | $245.00 | $67.6K | 2.2K | 68 |

| JPM | PUT | SWEEP | BEARISH | 03/21/25 | $20.5 | $19.8 | $20.5 | $260.00 | $53.3K | 184 | 26 |

| 符号 | 看跌/看涨 | 交易类型 | 情绪 | Exp。日期 | 问 | 出价 | 价格 | 行使价 | 总交易价格 | 未平仓合约 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| JPM | 打电话 | 贸易 | 看涨 | 03/21/25 | 3.85 美元 | 3.75 美元 | 3.85 美元 | 260.00 美元 | 365.7 万美元 | 2.0K | 1.0K |

| JPM | 打电话 | 贸易 | 粗鲁的 | 03/21/25 | 40.35 美元 | 40.1 美元 | 40.1 美元 | 205.00 美元 | 160.4 万美元 | 216 | 0 |

| JPM | 打电话 | 扫 | 看涨 | 01/16/26 | 27.5 美元 | 27.15 美元 | 27.5 美元 | 240.00 美元 | 137.5 万美元 | 2.1K | 50 |

| JPM | 打电话 | 扫 | 粗鲁的 | 04/17/25 | 11.45 美元 | 11.25 美元 | 11.31 美元 | 245.00 美元 | 67.6 万美元 | 2.2K | 68 |

| JPM | 放 | 扫 | 粗鲁的 | 03/21/25 | 20.5 美元 | 19.8 美元 | 20.5 美元 | 260.00 美元 | 53.3 万美元 | 184 | 26 |

About JPMorgan Chase

摩根大通简介

JPMorgan Chase is one of the largest and most complex financial institutions in the United States, with nearly $4.1 trillion in assets. It is organized into four major segments--consumer and community banking, corporate and investment banking, commercial banking, and asset and wealth management. JPMorgan operates, and is subject to regulation, in multiple countries.

摩根大通是美国最大和最复杂的金融机构之一,拥有近4.1万亿美元的资产。它分为四个主要部分——消费者和社区银行、企业和投资银行、商业银行以及资产和财富管理。摩根大通在多个国家开展业务并受监管。

Having examined the options trading patterns of JPMorgan Chase, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在研究了摩根大通的期权交易模式之后,我们的注意力现在直接转向了该公司。这种转变使我们能够深入研究其目前的市场地位和表现

Where Is JPMorgan Chase Standing Right Now?

摩根大通现在的立场如何?

- Currently trading with a volume of 4,310,173, the JPM's price is down by -0.16%, now at $242.79.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 7 days.

- 摩根大通目前的交易量为4,310,173美元,价格下跌了-0.16%,目前为242.79美元。

- RSI读数表明,该股目前在超买和超卖之间处于中立状态。

- 预计收益将在7天后发布。

Professional Analyst Ratings for JPMorgan Chase

摩根大通的专业分析师评级

3 market experts have recently issued ratings for this stock, with a consensus target price of $281.3333333333333.

3位市场专家最近发布了该股的评级,共识目标价为281.33333333333美元。

Unusual Options Activity Detected: Smart Money on the Move

检测到不寻常的期权活动:智能货币在移动

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* Maintaining their stance, an analyst from B of A Securities continues to hold a Buy rating for JPMorgan Chase, targeting a price of $280. * An analyst from Barclays persists with their Overweight rating on JPMorgan Chase, maintaining a target price of $304. * Reflecting concerns, an analyst from Truist Securities lowers its rating to Hold with a new price target of $260.

Benzinga Edge的不寻常期权委员会在潜在的市场推动者发生之前就发现了它们。看看大笔资金对你最喜欢的股票持有哪些头寸。点击此处查看。* A证券b的一位分析师维持其立场,继续维持摩根大通的买入评级,目标价为280美元。* 巴克莱银行的一位分析师坚持对摩根大通的增持评级,维持304美元的目标价。*出于担忧,Truist Securities的一位分析师将其评级下调至持有,新的目标股价为260美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest JPMorgan Chase options trades with real-time alerts from Benzinga Pro.

期权交易具有更高的风险和潜在的回报。精明的交易者通过不断自我教育、调整策略、监控多个指标以及密切关注市场走势来管理这些风险。借助Benzinga Pro的实时提醒,随时了解最新的摩根大通期权交易。

From the overall spotted trades, 6 are puts, for a total amount of $248,156 and 13, calls, for a total amount of $1,029,870.

From the overall spotted trades, 6 are puts, for a total amount of $248,156 and 13, calls, for a total amount of $1,029,870.