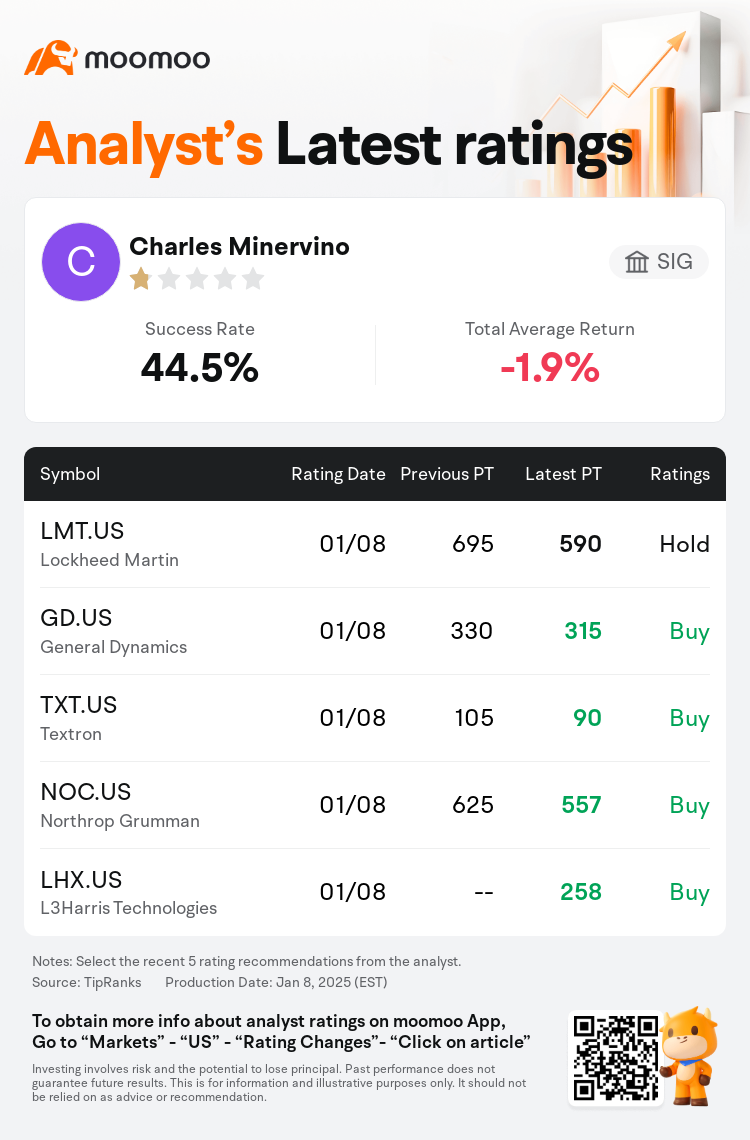

SIG analyst Charles Minervino downgrades $Lockheed Martin (LMT.US)$ to a hold rating, and adjusts the target price from $695 to $590.

According to TipRanks data, the analyst has a success rate of 44.5% and a total average return of -1.9% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Lockheed Martin (LMT.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Lockheed Martin (LMT.US)$'s main analysts recently are as follows:

Barclays notes that aerospace is likely to generate positive relative earnings growth and anticipates further outperformance in 2025, with greater benefits leaning towards original equipment rather than aftermarket. On the defense side, performance has been weaker and the situation remains challenging, largely due to increased budget risks and uncertainties associated with government fiscal policies.

The outlook for commercial aerospace remains guarded, reflecting anticipated delays in the OEM build ramp, consistent with previous assessments. Discussions late in the fourth quarter support this perspective. In the defense sector, persistent concerns over funding and DOGE risk are expected to continue overshadowing the market, with the final quarter unlikely to provide significant clarity. There is potential for Lockheed Martin to pre-fund its 2025 pension obligations and/or proceed with the remaining MFC option exercise charges; both moves could be seen favorably. However, any increases in government services guidance may be tempered by the ongoing uncertainties related to the continuing resolution extension into March.

The revenue outlook for Defense and IT services is considered even-keeled and currently without optimistic drivers, according to an analyst discussing expectations for the Aerospace and Defense Electronics sector through 2025. In comparison, the commercial aerospace segment continues to be favored going into 2024, a stance that is anticipated to remain steady, with a particular focus on names heavily linked to the 2025 aftermarket.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

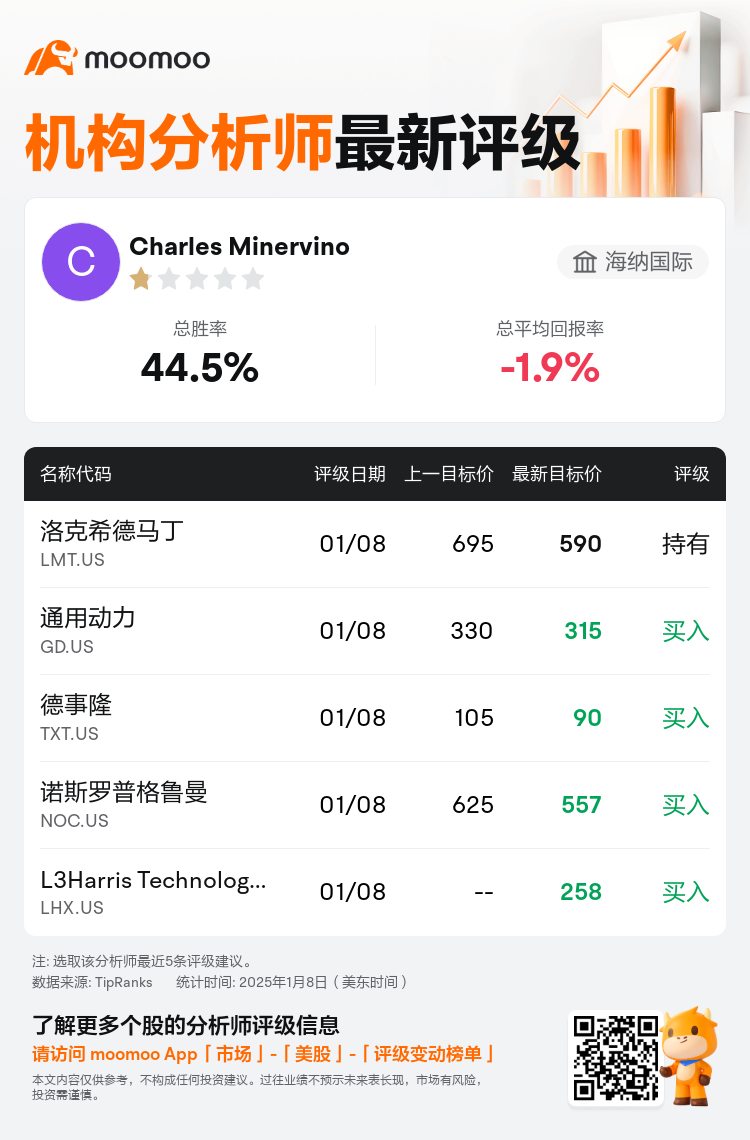

海纳国际分析师Charles Minervino下调$洛克希德马丁 (LMT.US)$至持有评级,并将目标价从695美元下调至590美元。

根据TipRanks数据显示,该分析师近一年总胜率为44.5%,总平均回报率为-1.9%。

此外,综合报道,$洛克希德马丁 (LMT.US)$近期主要分析师观点如下:

此外,综合报道,$洛克希德马丁 (LMT.US)$近期主要分析师观点如下:

巴克莱指出,航空航天可能会带来正的相对收益增长,并预计2025年将进一步跑赢大盘,更大的收益将倾向于原始设备而不是售后市场。在国防方面,表现一直疲软,形势仍然严峻,这主要是由于预算风险增加以及与政府财政政策相关的不确定性。

与先前的评估一致,商用航空航天的前景仍然保守,这反映了原始设备制造商建造阶段的预期延迟。第四季度末的讨论支持了这一观点。在国防领域,对资金和DOGE风险的持续担忧预计将继续给市场蒙上阴影,最后一个季度不太可能提供明显的明晰度。洛克希德·马丁公司有可能为其2025年的养老金义务预先注资和/或继续支付剩余的MFC期权行使费用;这两项举措都可能得到积极评价。但是,与决议持续延期至3月相关的持续不确定性可能会抑制政府服务指导方针的任何增加。

一位分析师在讨论2025年之前航空航天和国防电子行业的预期时表示,国防和信息技术服务的收入前景被认为平稳,目前没有乐观的驱动因素。相比之下,到2024年,商用航空航天领域将继续受到青睐,这一立场预计将保持稳定,特别关注与2025年售后市场密切相关的名称。

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

此外,综合报道,$洛克希德马丁 (LMT.US)$近期主要分析师观点如下:

此外,综合报道,$洛克希德马丁 (LMT.US)$近期主要分析师观点如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of