Deep-pocketed investors have adopted a bearish approach towards Boeing (NYSE:BA), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in BA usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 31 extraordinary options activities for Boeing. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 29% leaning bullish and 38% bearish. Among these notable options, 6 are puts, totaling $506,680, and 25 are calls, amounting to $1,198,077.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $140.0 to $240.0 for Boeing over the recent three months.

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $140.0 to $240.0 for Boeing over the recent three months.

Insights into Volume & Open Interest

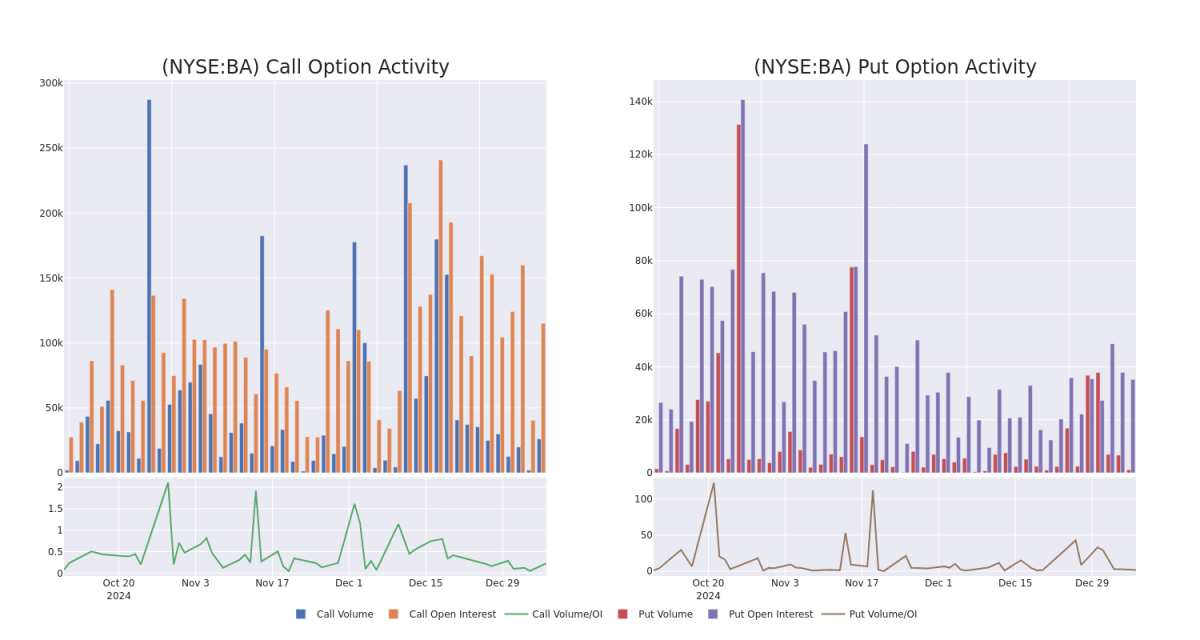

In today's trading context, the average open interest for options of Boeing stands at 3195.0, with a total volume reaching 7,945.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Boeing, situated within the strike price corridor from $140.0 to $240.0, throughout the last 30 days.

Boeing 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|

| BA | CALL | SWEEP | BEARISH | 04/17/25 | $13.4 | $13.05 | $13.05 | $175.00 | $150.0K | 949 | 153 |

| BA | PUT | TRADE | BEARISH | 01/15/27 | $28.75 | $26.85 | $28.23 | $175.00 | $141.1K | 99 | 50 |

| BA | PUT | TRADE | BULLISH | 02/21/25 | $23.5 | $23.05 | $23.05 | $195.00 | $133.6K | 40 | 250 |

| BA | CALL | SWEEP | BEARISH | 04/17/25 | $13.55 | $13.3 | $13.39 | $175.00 | $106.5K | 949 | 123 |

| BA | PUT | TRADE | NEUTRAL | 08/15/25 | $66.85 | $66.0 | $66.5 | $240.00 | $93.1K | 0 | 14 |

About Boeing

Boeing is a major aerospace and defense firm. It operates in three segments: commercial airplanes; defense, space, and security; and Global services. Boeing's commercial airplanes segment competes with Airbus in the production of aircraft that can carry more than 130 passengers. Boeing's defense, space, and security segment competes with Lockheed, Northrop, and several other firms to create military aircraft, satellites, and weaponry. Global services provides aftermarket support to airlines.

In light of the recent options history for Boeing, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Boeing's Current Market Status

- With a trading volume of 1,516,950, the price of BA is up by 1.79%, reaching $173.83.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 22 days from now.

Professional Analyst Ratings for Boeing

2 market experts have recently issued ratings for this stock, with a consensus target price of $212.5.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* An analyst from Deutsche Bank has decided to maintain their Buy rating on Boeing, which currently sits at a price target of $215. * In a positive move, an analyst from Barclays has upgraded their rating to Overweight and adjusted the price target to $210.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Boeing options trades with real-time alerts from Benzinga Pro.

财力雄厚的投资者对波音(纽约证券交易所代码:BA)采取了看跌态度,这是市场参与者不容忽视的。我们对本辛加公开期权记录的追踪今天揭示了这一重大举措。这些投资者的身份仍然未知,但是广管局如此重大的变动通常表明大事即将发生。

我们今天从观察中收集了这些信息,当时Benzinga的期权扫描仪重点介绍了波音的31项非同寻常的期权活动。这种活动水平与众不同。

这些重量级投资者的总体情绪存在分歧,29%的人倾向于看涨,38%的人倾向于看跌。在这些值得注意的期权中,有6个是看跌期权,总额为506,680美元,25个是看涨期权,总额为1,198,077美元。

预计的目标价格

根据交易活动,看来主要投资者的目标是波音在最近三个月的价格区间内从140.0美元到240.0美元不等。

根据交易活动,看来主要投资者的目标是波音在最近三个月的价格区间内从140.0美元到240.0美元不等。

对交易量和未平仓合约的见解

在今天的交易背景下,波音期权的平均未平仓合约为3195.0,总交易量达到7,945.00。随附的图表描绘了过去30天波音高价值交易的看涨期权和看跌期权交易量以及未平仓合约的变化,行使价走势从140.0美元到240.0美元不等。

波音30天期权交易量和利息快照

观察到的最大期权交易:

| 符号 | 看跌/看涨 | 交易类型 | 情绪 | Exp。日期 | 问 | 出价 | 价格 | 行使价 | 总交易价格 | 未平仓合约 | 音量 |

|---|

| BA | 打电话 | 扫 | 粗鲁的 | 04/17/25 | 13.4 美元 | 13.05 美元 | 13.05 美元 | 175.00 美元 | 150.0 万美元 | 949 | 153 |

| BA | 放 | 贸易 | 粗鲁的 | 01/15/27 | 28.75 美元 | 26.85 美元 | 28.23 美元 | 175.00 美元 | 141.1 万美元 | 99 | 50 |

| BA | 放 | 贸易 | 看涨 | 02/21/25 | 23.5 美元 | 23.05 美元 | 23.05 美元 | 195.00 美元 | 133.6 万美元 | 40 | 250 |

| BA | 打电话 | 扫 | 粗鲁的 | 04/17/25 | 13.55 美元 | 13.3 美元 | 13.39 美元 | 175.00 美元 | 106.5 万美元 | 949 | 123 |

| BA | 放 | 贸易 | 中立 | 08/15/25 | 66.85 美元 | 66.0 美元 | 66.5 美元 | 240.00 美元 | 93.1 万美元 | 0 | 14 |

关于波音

波音是一家大型航空航天和国防公司。它分为三个部门:商用飞机;国防、太空和安全;以及全球服务。波音的商用飞机部门在生产可运载超过130名乘客的飞机方面与空中客车公司竞争。波音的国防、太空和安全部门与洛克希德、诺斯罗普和其他几家公司竞争,以制造军用飞机、卫星和武器。全球服务为航空公司提供售后支持。

鉴于波音最近的期权历史,现在应该将重点放在公司本身上。我们的目标是探索其目前的表现。

波音的当前市场状况

- 英国航空的交易量为1,516,950美元,上涨了1.79%,达到173.83美元。

- 当前的RSI值表明该股可能接近超买。

- 下一份收益报告定于即日起22天后发布。

波音专业分析师评级

2位市场专家最近发布了该股的评级,共识目标价为212.5美元。

在短短 20 天内将 1000 美元变成 1270 美元?

20年专业期权交易员透露了他的单线图技术,该技术显示何时买入和卖出。复制他的交易,平均每20天获利27%。点击此处查看。* 德意志银行的一位分析师决定维持对波音的买入评级,目前的目标股价为215美元。* 巴克莱银行的一位分析师将其评级上调至增持,并将目标股价调整至210美元,这是一个积极的举动。

期权交易具有更高的风险和潜在的回报。精明的交易者通过不断自我教育、调整策略、监控多个指标以及密切关注市场走势来管理这些风险。借助Benzinga Pro的实时警报,随时了解最新的波音期权交易。

根据交易活动,看来主要投资者的目标是波音在最近三个月的价格区间内从140.0美元到240.0美元不等。

根据交易活动,看来主要投资者的目标是波音在最近三个月的价格区间内从140.0美元到240.0美元不等。

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $140.0 to $240.0 for Boeing over the recent three months.

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $140.0 to $240.0 for Boeing over the recent three months.