Here's Why Shanghai Dazhong Public Utilities(Group)Ltd (SHSE:600635) Can Manage Its Debt Responsibly

Here's Why Shanghai Dazhong Public Utilities(Group)Ltd (SHSE:600635) Can Manage Its Debt Responsibly

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies Shanghai Dazhong Public Utilities(Group) Co.,Ltd. (SHSE:600635) makes use of debt. But is this debt a concern to shareholders?

沃伦·巴菲特曾 famously 说过,‘波动性并不等同于风险。’当我们考虑一个公司的风险时,我们总是喜欢看它的债务使用情况,因为债务过重可能导致破产。与许多其他公司一样,大众公用(集团)有限公司(SHSE:600635)也在使用债务。但是,这对股东来说是个问题吗?

Why Does Debt Bring Risk?

为什么债务带来风险?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

债务在企业面临偿还困难时,会造成问题,不论是通过新资本还是自由现金流。在最坏的情况下,如果公司无法偿还债权人,可能会破产。然而,较为常见(但仍然代价高昂)的情况是,公司必须以较低的股价稀释股东,仅仅是为了控制债务。当然,债务的好处在于它通常代表了便宜的资本,尤其是当它替代了可以以高回报率再投资的公司中的稀释时。考虑一家公司的债务水平时,第一步是将其现金和债务一起考虑。

What Is Shanghai Dazhong Public Utilities(Group)Ltd's Debt?

上海大众公用(集团)有限公司的债务是什么?

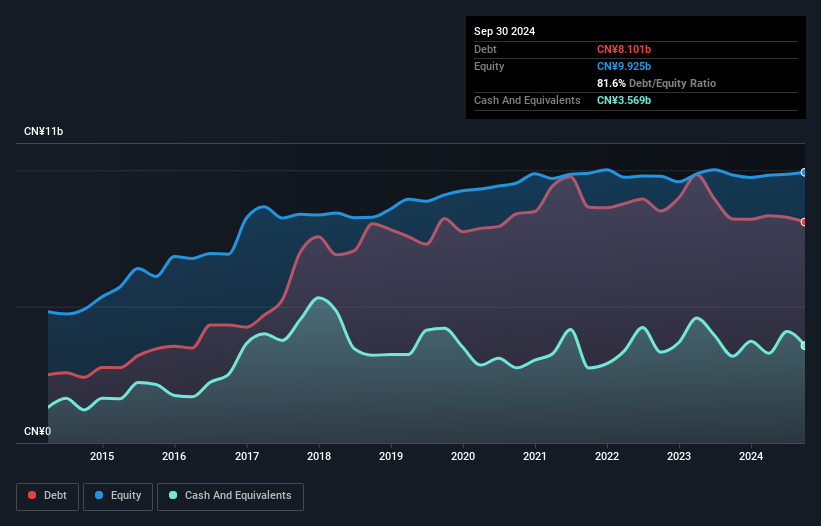

As you can see below, Shanghai Dazhong Public Utilities(Group)Ltd had CN¥8.10b of debt, at September 2024, which is about the same as the year before. You can click the chart for greater detail. However, it also had CN¥3.57b in cash, and so its net debt is CN¥4.53b.

如您所见,到2024年9月,大众公用(集团)有限公司的债务为81亿人民币,和去年差不多。您可以点击图表查看更详细的信息。然而,它也拥有35.7亿人民币的现金,因此,其净债务为45.3亿人民币。

How Strong Is Shanghai Dazhong Public Utilities(Group)Ltd's Balance Sheet?

上海大众公用(集团)有限公司的资产负债表有多强?

According to the last reported balance sheet, Shanghai Dazhong Public Utilities(Group)Ltd had liabilities of CN¥8.44b due within 12 months, and liabilities of CN¥4.31b due beyond 12 months. On the other hand, it had cash of CN¥3.57b and CN¥486.1m worth of receivables due within a year. So it has liabilities totalling CN¥8.69b more than its cash and near-term receivables, combined.

根据最近报告的资产负债表,上海大众公用(集团)有限公司在12个月内的负债为84.4亿人民币,12个月后的负债为43.1亿人民币。另一方面,它的现金为35.7亿人民币,未来一年到期的应收账款为48610万人民币。因此,它的负债总额为86.9亿人民币,远远超过其现金和短期应收款的总和。

This deficit is considerable relative to its market capitalization of CN¥10.0b, so it does suggest shareholders should keep an eye on Shanghai Dazhong Public Utilities(Group)Ltd's use of debt. Should its lenders demand that it shore up the balance sheet, shareholders would likely face severe dilution.

相对于其100亿人民币的市值,这一赤字是相当可观的,因此这确实表明股东应关注上海大众公用(集团)有限公司的债务使用。如果其贷方要求其增强资产负债表,股东可能将面临严重的稀释。

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

为了评估一家公司的债务与其收益的关系,我们计算其净债务与息税折旧摊销前利润(EBITDA)的比率,以及息税前利润(EBIT)与利息费用的比率(即利息覆盖率)。通过这种方式,我们考虑了债务的绝对数量和所支付的利率。

As it happens Shanghai Dazhong Public Utilities(Group)Ltd has a fairly concerning net debt to EBITDA ratio of 6.4 but very strong interest coverage of 1k. So either it has access to very cheap long term debt or that interest expense is going to grow! It is well worth noting that Shanghai Dazhong Public Utilities(Group)Ltd's EBIT shot up like bamboo after rain, gaining 41% in the last twelve months. That'll make it easier to manage its debt. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Shanghai Dazhong Public Utilities(Group)Ltd will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

实际上,上海大众公用(集团)有限公司的净债务与EBITDA比率为6.4,令人担忧,但利息保障极其强大,达到0.1万。因此,它要么能够获得非常廉价的长期债务,要么利息支出将会增长!值得注意的是,上海大众公用(集团)有限公司的EBIT在过去12个月中像雨后竹笋一般猛增41%。这将使其更容易管理债务。当分析债务水平时,资产负债表显然是最好的起点。但你不能将债务完全孤立看待;因为上海大众公用(集团)有限公司需要盈利来偿还这笔债务。因此,在考虑债务时,查看盈利趋势绝对是值得的。点击这里获取互动快照。

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. In the last three years, Shanghai Dazhong Public Utilities(Group)Ltd's free cash flow amounted to 38% of its EBIT, less than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

最后,企业需要自由现金流来偿还债务;会计利润是不能满足这个要求的。因此,我们显然需要查看该EBIT是否导致相应的自由现金流。在过去三年中,上海大众公用(集团)有限公司的自由现金流占其EBIT的38%,低于我们的预期。这种现金转化能力不足使得处理债务更加困难。

Our View

我们的观点

Shanghai Dazhong Public Utilities(Group)Ltd's net debt to EBITDA was a real negative on this analysis, although the other factors we considered were considerably better. There's no doubt that its ability to to cover its interest expense with its EBIT is pretty flash. It's also worth noting that Shanghai Dazhong Public Utilities(Group)Ltd is in the Gas Utilities industry, which is often considered to be quite defensive. When we consider all the factors mentioned above, we do feel a bit cautious about Shanghai Dazhong Public Utilities(Group)Ltd's use of debt. While debt does have its upside in higher potential returns, we think shareholders should definitely consider how debt levels might make the stock more risky. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. Case in point: We've spotted 4 warning signs for Shanghai Dazhong Public Utilities(Group)Ltd you should be aware of, and 3 of them are significant.

大众公用(集团)有限公司的净债务与EBITDA比例在这项分析中表现得相当糟糕,尽管我们考虑的其他因素要好得多。毫无疑问,它用EBIT覆盖利息支出的能力相当出色。值得一提的是,大众公用(集团)有限公司位于燃气公用事业行业,这通常被认为是相当防御性的。考虑到上述所有因素,我们对大众公用(集团)有限公司的债务使用确实感到有些谨慎。虽然债务在提高潜在回报方面确实有其好处,但我们认为股东们应该考虑债务水平如何使得股票风险增加。在分析债务水平时,资产负债表显然是一个起点。但归根结底,每家公司都可能存在资产负债表外的风险。举个例子:我们发现了大众公用(集团)有限公司的4个警告信号,你应该对此有所了解,其中3个是重要的。

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对本文有反馈?对内容有疑虑?请直接与我们联系。或者,发送电子邮件至 editorial-team (at) simplywallst.com。

这篇来自Simply Wall St的文章是一般性的。我们根据历史数据和分析师预测提供评论,采用无偏见的方法,我们的文章并不旨在提供财务建议。它不构成对任何股票的买入或卖出建议,也未考虑到您的目标或财务状况。我们旨在为您提供以基本数据驱动的长期分析。请注意,我们的分析可能未考虑最新的价格敏感公司公告或定性材料。Simply Wall St在提到的任何股票中均没有持仓。

According to the last reported balance sheet, Shanghai Dazhong Public Utilities(Group)Ltd had liabilities of CN¥8.44b due within 12 months, and liabilities of CN¥4.31b due beyond 12 months. On the other hand, it had cash of CN¥3.57b and CN¥486.1m worth of receivables due within a year. So it has liabilities totalling CN¥8.69b more than its cash and near-term receivables, combined.

According to the last reported balance sheet, Shanghai Dazhong Public Utilities(Group)Ltd had liabilities of CN¥8.44b due within 12 months, and liabilities of CN¥4.31b due beyond 12 months. On the other hand, it had cash of CN¥3.57b and CN¥486.1m worth of receivables due within a year. So it has liabilities totalling CN¥8.69b more than its cash and near-term receivables, combined.