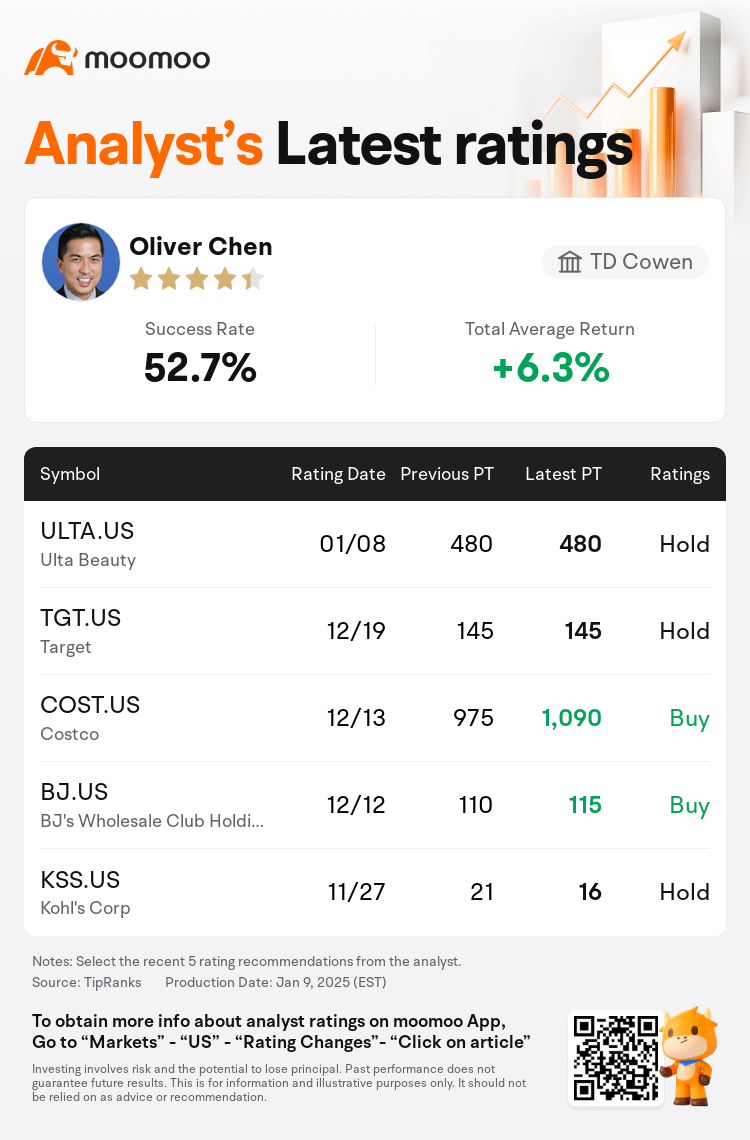

TD Cowen analyst Oliver Chen maintains $Ulta Beauty (ULTA.US)$ with a hold rating, and maintains the target price at $480.

According to TipRanks data, the analyst has a success rate of 52.7% and a total average return of 6.3% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Ulta Beauty (ULTA.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Ulta Beauty (ULTA.US)$'s main analysts recently are as follows:

Following the announcement of Kecia Steelman as CEO, succeeding Dave Kimbell, and a promising holiday season report, it is forecasted that Q4 comparable store sales will be modestly up and operating margins will surpass the earlier high-end guidance. The expectation for Q4 EPS has been revised upward, reflecting a favorable preannouncement. However, it should be noted that margins are anticipated to decrease by 200 basis points year-over-year in Q4, and by 180 points for FY24.

After four years at the helm, Ulta Beauty's CEO Dave Kimbell is set to retire, with COO Kecia Steelman stepping into the role effective immediately. The transition, though unexpected, positions Steelman as a suitable successor according to analysts. Ulta has also revised its Q4 guidance, expecting a slight increase in comparable store sales, contrary to a consensus prediction of a 1.2% decline, and anticipates an EBIT margin higher than previously forecasted. This suggests that the company managed to achieve these positive comps without heightened promotions. Analysts now view the easing of competitive pressures as a positive, suggesting a more optimistic outlook for fiscal year 2025.

Ulta Beauty's announcement that CEO Dave Kimball will retire was accompanied by positive updated guidance, which is encouraging for the company's future prospects, notably in terms of positive comparable store sales. However, concerns persist regarding the company's high valuation and ongoing competitive pressures.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

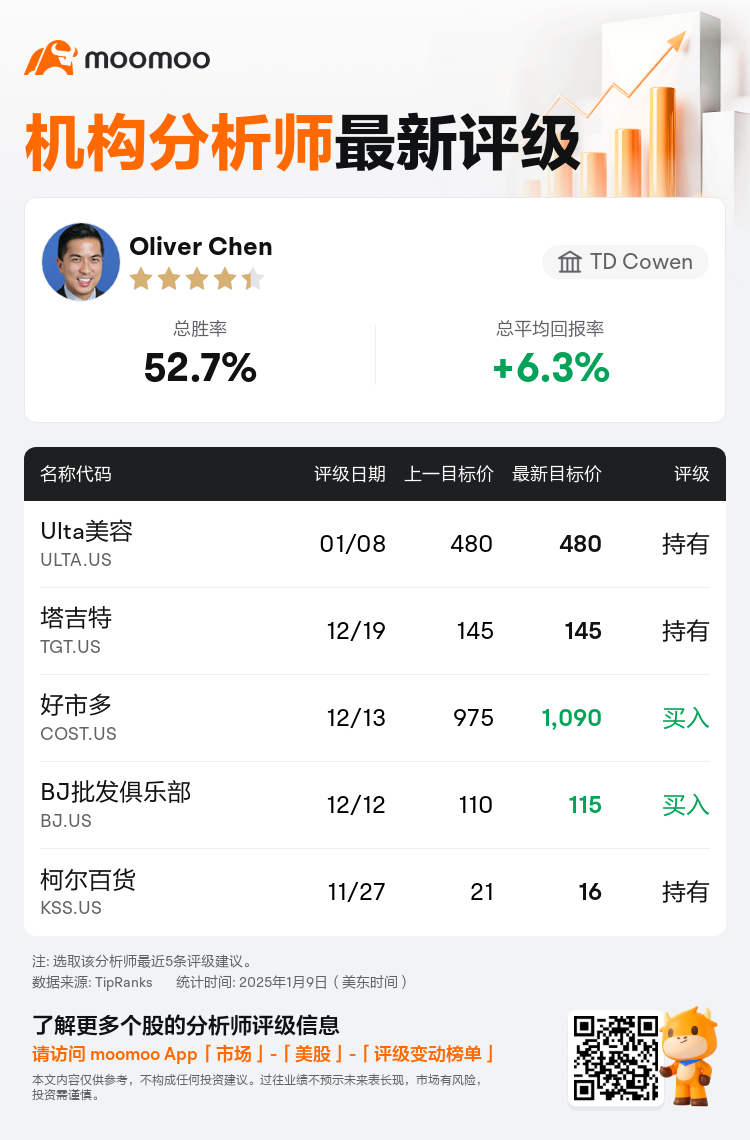

TD Cowen分析师Oliver Chen维持$Ulta美容 (ULTA.US)$持有评级,维持目标价480美元。

根据TipRanks数据显示,该分析师近一年总胜率为52.7%,总平均回报率为6.3%。

此外,综合报道,$Ulta美容 (ULTA.US)$近期主要分析师观点如下:

此外,综合报道,$Ulta美容 (ULTA.US)$近期主要分析师观点如下:

继Kecia Steelman宣布接替戴夫·金贝尔担任首席执行官以及一份令人鼓舞的假日季报告之后,预计第四季度同类门店的销售额将略有增长,营业利润率将超过先前的高端预期。对第四季度每股收益的预期已向上修正,这反映了预先公布的利好。但是,应该注意的是,预计第四季度的利润率将同比下降200个基点,24财年的利润率将下降180个基点。

掌舵四年后,Ulta Beauty的首席执行官戴夫·金贝尔即将退休,首席运营官凯西亚·斯蒂尔曼的上任立即生效。分析师认为,这一转变虽然出乎意料,但使Steelman成为合适的继任者。Ulta还修订了其第四季度指引,预计同类门店销售额将略有增长,这与市场普遍预测的下降1.2%相反,并预计息税前利润率将高于先前的预测。这表明该公司在没有加强晋升的情况下设法实现了这些积极的业绩。分析师现在认为竞争压力的缓解是积极的,这表明2025财年的前景更加乐观。

Ulta Beauty宣布首席执行官戴夫·金博尔将退休,同时发布了积极的最新指导方针,这对公司的未来前景感到鼓舞,尤其是在同类门店的正销售额方面。但是,对公司的高估值和持续的竞争压力的担忧仍然存在。

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

此外,综合报道,$Ulta美容 (ULTA.US)$近期主要分析师观点如下:

此外,综合报道,$Ulta美容 (ULTA.US)$近期主要分析师观点如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of