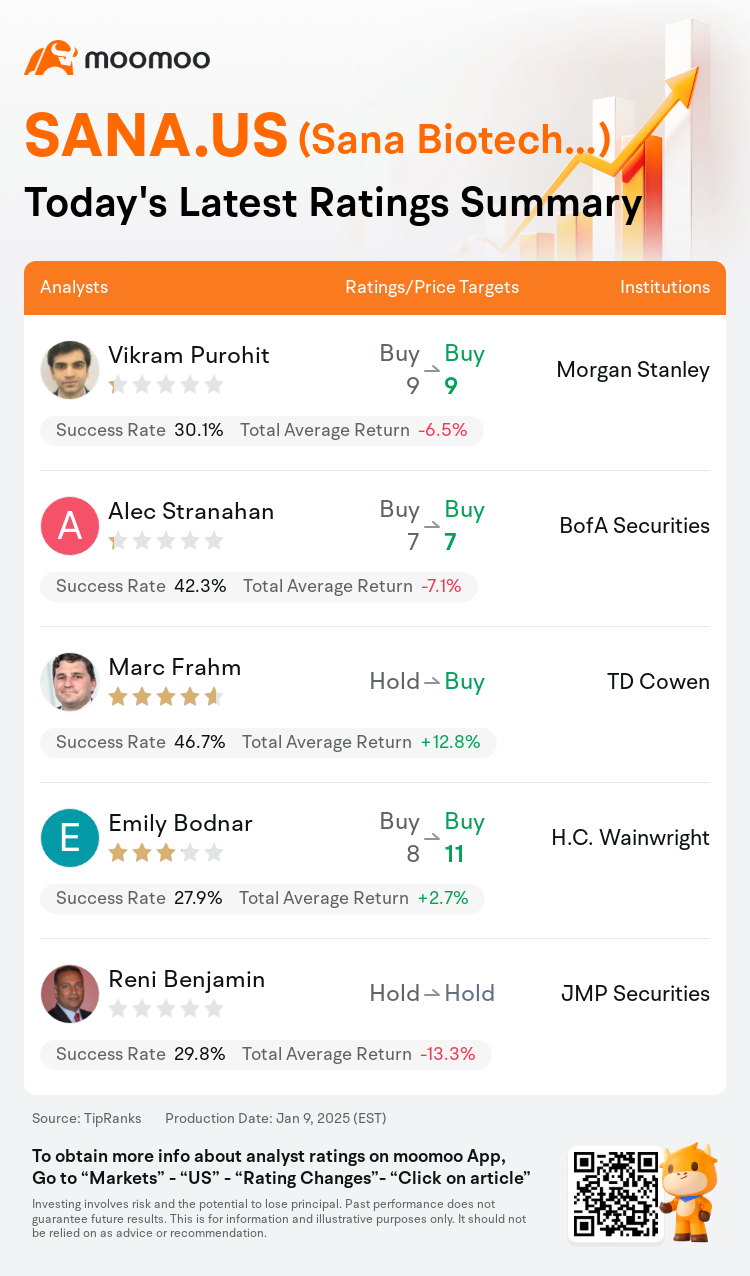

On Jan 09, major Wall Street analysts update their ratings for $Sana Biotechnology (SANA.US)$, with price targets ranging from $7 to $11.

Morgan Stanley analyst Vikram Purohit maintains with a buy rating, and maintains the target price at $9.

BofA Securities analyst Alec Stranahan maintains with a buy rating, and maintains the target price at $7.

TD Cowen analyst Marc Frahm upgrades to a buy rating.

TD Cowen analyst Marc Frahm upgrades to a buy rating.

H.C. Wainwright analyst Emily Bodnar maintains with a buy rating, and adjusts the target price from $8 to $11.

JMP Securities analyst Reni Benjamin maintains with a hold rating.

Furthermore, according to the comprehensive report, the opinions of $Sana Biotechnology (SANA.US)$'s main analysts recently are as follows:

Political and rate uncertainty remains a concern, yet the health of the Biopharma sector is perceived as significantly better than its 2022 lows. Analysts continue to favor stories about late-stage clinical trials or early product launches. Additionally, Phase 1 clinical programs that offer derisking data and near-term catalysts are becoming increasingly important focal points for investors.

Positive data from Sana Biotechnology indicate that Hypoimmune modified cadaver islet cells sustained immune evasion and C-peptide production in a type 1 diabetes patient without immunosuppression. This data establishes a proof of concept for Hypoimmune's immune evasion properties and significantly derisks applications in type 1 diabetes and other fields. Although considerable work remains in terms of commercialization, the company is considered to have a notably changed risk profile.

Here are the latest investment ratings and price targets for $Sana Biotechnology (SANA.US)$ from 5 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美东时间1月9日,多家华尔街大行更新了$Sana Biotechnology (SANA.US)$的评级,目标价介于7美元至11美元。

摩根士丹利分析师Vikram Purohit维持买入评级,维持目标价9美元。

美银证券分析师Alec Stranahan维持买入评级,维持目标价7美元。

TD Cowen分析师Marc Frahm上调至买入评级。

TD Cowen分析师Marc Frahm上调至买入评级。

H.C. Wainwright分析师Emily Bodnar维持买入评级,并将目标价从8美元上调至11美元。

JMP Securities分析师Reni Benjamin维持持有评级。

此外,综合报道,$Sana Biotechnology (SANA.US)$近期主要分析师观点如下:

政治和利率的不确定性仍然令人担忧,但生物制药板块的健康状况被认为显著好于2022年的低谷。分析师们继续青睐关于晚期临床试验或早期产品发布的故事。此外,提供去风险数据和近期催化剂的第一阶段临床项目正变得越来越重要,成为投资者关注的焦点。

来自Sana生物技术的正面数据表明,低免疫修改后的尸体胰岛细胞在一名未经免疫抑制的1型糖尿病患者中维持了免疫逃逸和C肽的产生。该数据为低免疫的免疫逃逸属性确立了概念证明,并显著降低了在1型糖尿病和其他领域应用的风险。尽管在商业化方面仍需大量工作,但该公司的风险配置被认为有显著变化。

以下为今日5位分析师对$Sana Biotechnology (SANA.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

TD Cowen分析师Marc Frahm上调至买入评级。

TD Cowen分析师Marc Frahm上调至买入评级。

TD Cowen analyst Marc Frahm upgrades to a buy rating.

TD Cowen analyst Marc Frahm upgrades to a buy rating.