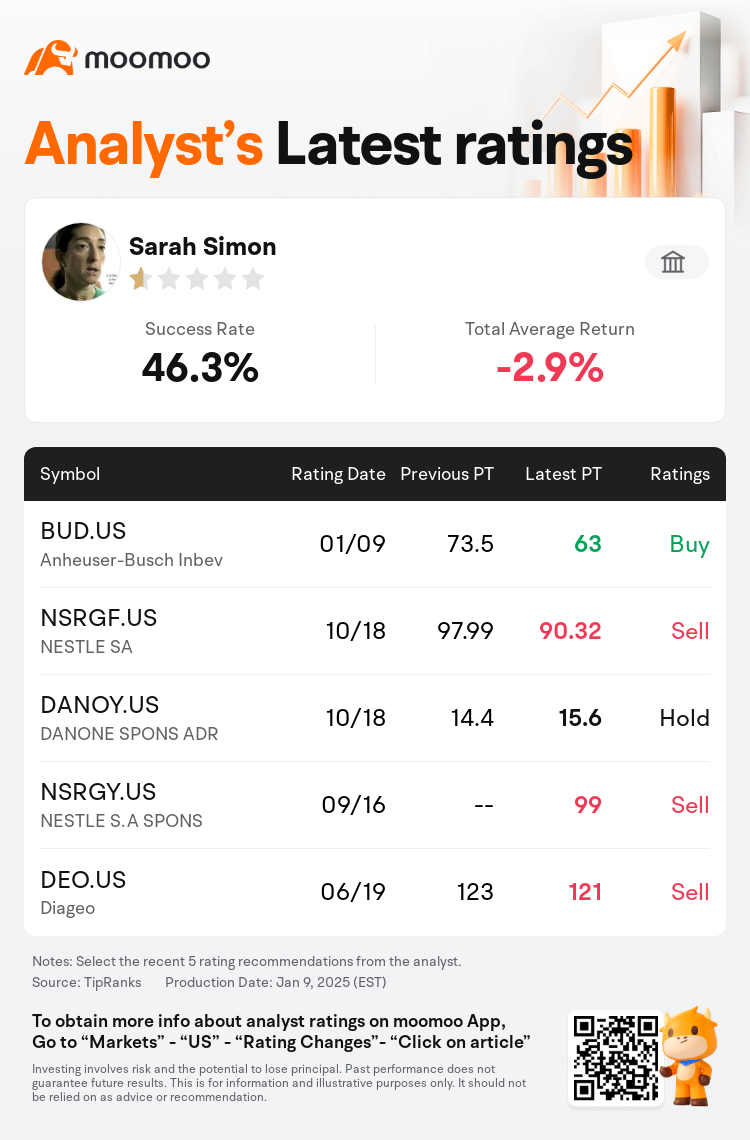

Morgan Stanley analyst Sarah Simon maintains $Anheuser-Busch Inbev (BUD.US)$ with a buy rating, and adjusts the target price from $73.5 to $63.

According to TipRanks data, the analyst has a success rate of 46.3% and a total average return of -2.9% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Anheuser-Busch Inbev (BUD.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Anheuser-Busch Inbev (BUD.US)$'s main analysts recently are as follows:

The firm is adjusting its estimates for AB InBev based on the most recent scanner data in European and U.S. markets, alongside the latest foreign exchange rates, which are noted to have both translational and transactional effects on profitability. Despite the firm envisioning that AB InBev continues to deliver 'very attractive' cash returns, it anticipates that growth and share price performance will majorly occur in the latter half of the year. Additionally, they predict there are better immediate opportunities available within the Beverages sector.

The company's volumes continue to exhibit weakness, yet it is anticipated that leverage and free cash flow will show positive trends. It is expected that the company's deleveraging and increased free cash flow will remain on course despite a quarter marked by soft volumes.

2025 appears to be challenging for the food and beverage industry, largely because the likelihood of significant changes in the regulatory environment remains minimal. Additionally, the slow adoption and high dropout rates associated with GLP-1 treatments, along with the normalization of value-seeking shopping behaviors as consumers adjust to elevated prices and experience wage inflation, are influencing the market. It is suggested that numerous food and beverage brands should consider revising their pricing and margin structures to enhance their perceived value among consumers.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

摩根士丹利分析师Sarah Simon维持$百威英博 (BUD.US)$买入评级,并将目标价从73.5美元下调至63美元。

根据TipRanks数据显示,该分析师近一年总胜率为46.3%,总平均回报率为-2.9%。

此外,综合报道,$百威英博 (BUD.US)$近期主要分析师观点如下:

此外,综合报道,$百威英博 (BUD.US)$近期主要分析师观点如下:

该公司正在根据欧洲和美国市场的最新扫描仪数据以及最新的外汇汇率,调整对百威英博的估计,这些汇率被认为对盈利能力具有折算和交易影响。尽管该公司设想百威英博继续提供 “非常有吸引力” 的现金回报,但它预计增长和股价表现将主要发生在下半年。此外,他们预测饮料行业会有更好的即时机会。

该公司的交易量继续表现疲软,但预计杠杆率和自由现金流将显示出积极的趋势。尽管本季度交易量疲软,但预计该公司的去杠杆化和自由现金流的增加仍将按计划进行。

对于食品和饮料行业来说,2025年似乎充满挑战,这主要是因为监管环境发生重大变化的可能性仍然微乎其微。此外,与 GLP-1 治疗相关的缓慢采用率和高辍学率,以及随着消费者适应价格上涨和工资上涨而出现的追求价值的购物行为的正常化,正在影响市场。有人建议,许多食品和饮料品牌应考虑修改其定价和利润结构,以提高其在消费者中的感知价值。

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

此外,综合报道,$百威英博 (BUD.US)$近期主要分析师观点如下:

此外,综合报道,$百威英博 (BUD.US)$近期主要分析师观点如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of