Bitcoin ETFs Quadruple SPY Returns, Magnificent 7 Plays Catch-Up

Bitcoin ETFs Quadruple SPY Returns, Magnificent 7 Plays Catch-Up

Bitcoin (CRYPTO: BTC) ETFs delivered over 100% gains in 2024. That's four times the returns of the S&P 500 index. The Roundhill Magnificent Seven ETF (NASDAQ:MAGS), meanwhile, lagged at 65%, proving the tech elite can't always keep up with crypto.

比特币(CRYPTO: BTC)ETF在2024年实现了超过100%的收益。这是标普500指数回报的四倍。与此同时,Roundhill 科技七巨头ETF(纳斯达克:MAGS)表现不佳,仅为65%,证明了科技精英并不总能追赶上加密货币。

The SPDR S&P 500 ETF Trust (NYSE:SPY), a reliable proxy for the S&P 500, posted a respectable 24.4% gain over the past year.

SPDR 标普500指数ETF Trust(纽交所:SPY)作为标普500的可靠代理,过去一年收益达24.4%。

It has faltered recently, dropping 2.51% over the last month.

近期它的表现下滑,上个月下跌了2.51%。

Chart created using Benzinga Pro

图表使用Benzinga Pro创建

With the stock price below its eight-, 20- and 50-day simple moving averages, SPY's technical outlook remains strongly bearish.

由于股价低于其八日、20日和50日简单移动平均线,SPY的技术前景仍然非常看淡。

That said, a glimmer of hope lies in its 200-day SMA (simple moving average), which signals a bullish undertone at $555.48 compared to SPY's current $589.49 price. Short-term pain may precede long-term gains, as buying pressure hints at future bullish movement.

也就是说,其200日简单移动平均线(SMA)散发出一丝希望,在$555.48的情况下,相较于SPY当前$589.49的价格,暗示出看好的基调。短期的痛苦可能在长期收益之前,因为购买压力暗示未来的看好走势。

Read Also: Is SPY Losing Its Spark? The S&P 500's Risk Conundrum

相关阅读:SPY正在失去活力吗?标普500的风险难题

Bitcoin ETFs Shine Despite Headwinds

比特币ETF在逆风中依然光芒四射

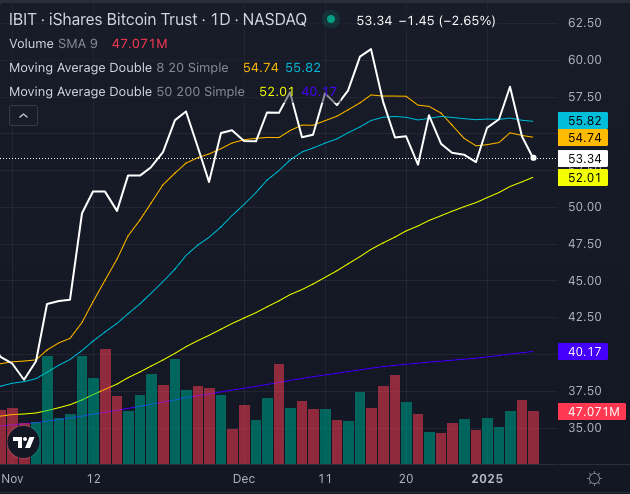

The iShares Bitcoin Trust ETF (NASDAQ:IBIT), a proxy of Bitcoin performance, crushed benchmarks with a 100.3% return in 2024.

iShares比特币信托可交易ETF(纳斯达克:IBIT),作为比特币表现的指标,2024年以100.3%的回报率超越 benchmark

Chart created using Benzinga Pro

图表使用Benzinga Pro创建

Despite a slight 2.54% dip last month, IBIT's long-term technicals remain robust, trading well above its 200-day SMA at $40.17. However, recent selling pressure and a price of $53.34 below its eight and 20-day SMAs indicate a short-term bearish trend.

尽管上个月小幅下跌2.54%,但IBIT的长期技术指标仍然强劲,价格在40.17美元,远高于其200日均线。然而,近期的抛售压力以及53.34美元的价格低于其八日和20日均线,表明短期内有看淡趋势。

With Bitcoin ETFs delivering unmatched growth, even slight headwinds haven't dampened their shine.

由于比特币ETF展现出无与伦比的增长,即使是轻微的逆风也未能减弱其光芒。

MAGS: Tech Titans In Neutral

MAGS:科技巨头保持中立

The Roundhill Magnificent Seven ETF (NASDAQ:MAGS), a barometer for the magnificent seven tech giants, climbed 64.89% last year, a commendable performance but still lagging Bitcoin ETFs.

Roundhill科技七巨头ETF(纳斯达克:MAGS)去年上涨了64.89%,尽管表现令人称道,但仍然落后于比特币ETF。

The MAGS ETF offers equal-weight exposure to the Magnificent Seven stocks:

MAGS ETF提供等权重的科技七巨头股票敞口:

- Alphabet Inc (NASDAQ:GOOGL) (NASDAQ:GOOG)

- Amazon.com Inc (NASDAQ:AMZN)

- Apple Inc (NASDAQ:AAPL)

- Meta Platforms Inc (NASDAQ:META)

- Microsoft Corp (NASDAQ:MSFT)

- Nvidia Corp (NASDAQ:NVDA)

- Tesla Inc (NASDAQ:TSLA).

- Alphabet Inc (纳斯达克: GOOGL) (纳斯达克: GOOG)

- 亚马逊公司(纳斯达克:AMZN)

- 苹果公司(纳斯达克:AAPL)

- Meta Platforms Inc(纳斯达克:META)

- 微软-T(纳斯达克:MSFT)

- 英伟达公司 (纳斯达克: NVDA)

- 特斯拉公司 (纳斯达克: TSLA)。

Chart created using Benzinga Pro

图表使用Benzinga Pro创建

MAGS has mostly stalled in recent months, with a 0.24% gain over the past month and signs of short-term selling pressure.

MAGS在最近几个月基本停滞,过去一个月增长了0.24%,并出现了短期的卖压迹象。

Its price of $55.04 sits below its eight and 20-day SMAs but above the 50 and 200-day SMAs, reflecting a mix of caution and resilience. As tech struggles to regain momentum, investors may seek opportunities elsewhere.

其价格为55.04美元,位于其八日和二十日简单移动平均线(SMA)之下,但高于其五十日和二百日SMA,反映出一种谨慎和韧性兼具的状态。随着科技股努力恢复动能,投资者可能会寻找其他机会。

Crypto steals the spotlight as SPY and MAGS navigate choppy waters. Can Bitcoin ETFs keep their lead in 2025?

在SPY和MAGS在波动水域中航行时,加密货币吸引了目光。比特币ETF能否在2025年保持领先?

- Bitcoin ETFs' First Year Delivers Massive Returns As 2025 Brings Questions

- 比特币ETF的第一年带来了巨大的回报,2025年引发了许多疑问。

Image: Shutterstock

图片:shutterstock